Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Northwest Pipe (NASDAQ: NWPX) and the best and worst performers in the hvac and water systems industry.

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 9 hvac and water systems stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady as they are up 4.7% on average since the latest earnings results.

Northwest Pipe (NASDAQ: NWPX)

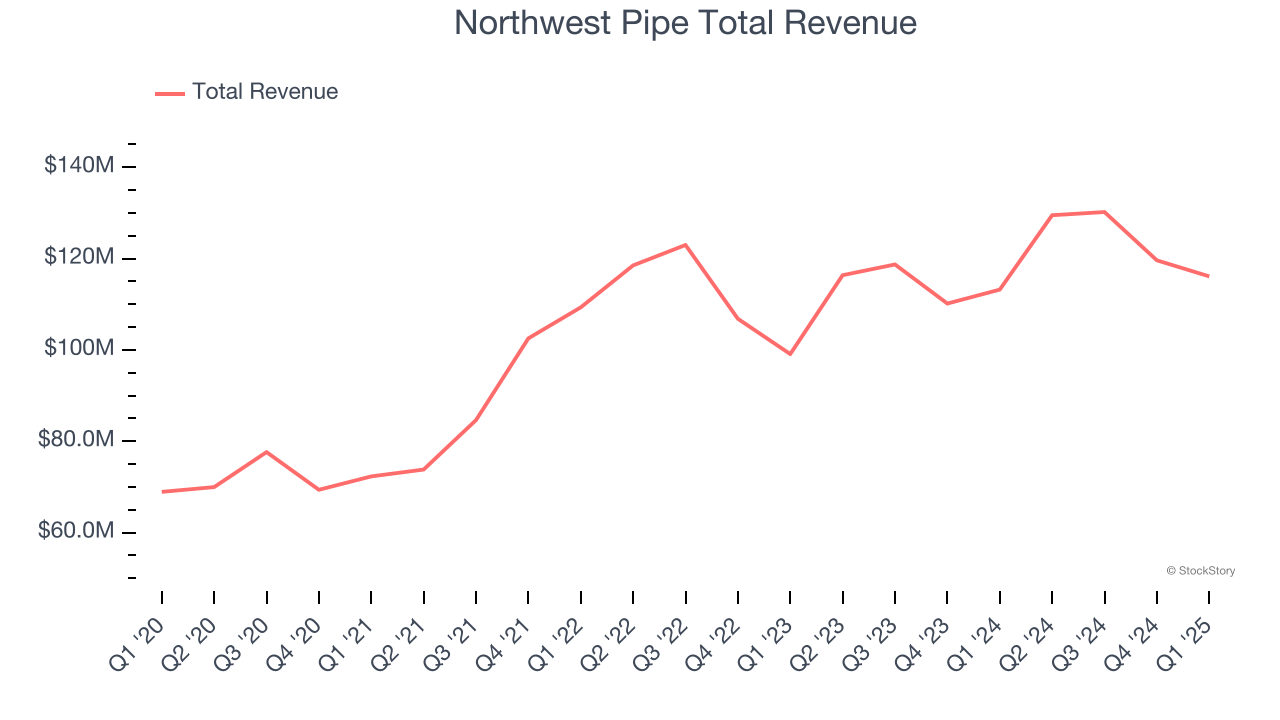

Playing a large role in the Integrated Pipeline (IPL) project in Texas to deliver ~350 million gallons of water per day, Northwest Pipe (NASDAQ: NWPX) is a manufacturer of pipeline systems for water infrastructure.

Northwest Pipe reported revenues of $116.1 million, up 2.6% year on year. This print exceeded analysts’ expectations by 3.7%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

"In the first quarter of 2025, we encountered a mix of external challenges ranging from weather disruptions across multiple facilities to the uncertainty brought on by new trade policies from the incoming administration," said Scott Montross, President and Chief Executive Officer of Northwest Pipe Company.

The stock is down 5.8% since reporting and currently trades at $39.82.

Read our full report on Northwest Pipe here, it’s free.

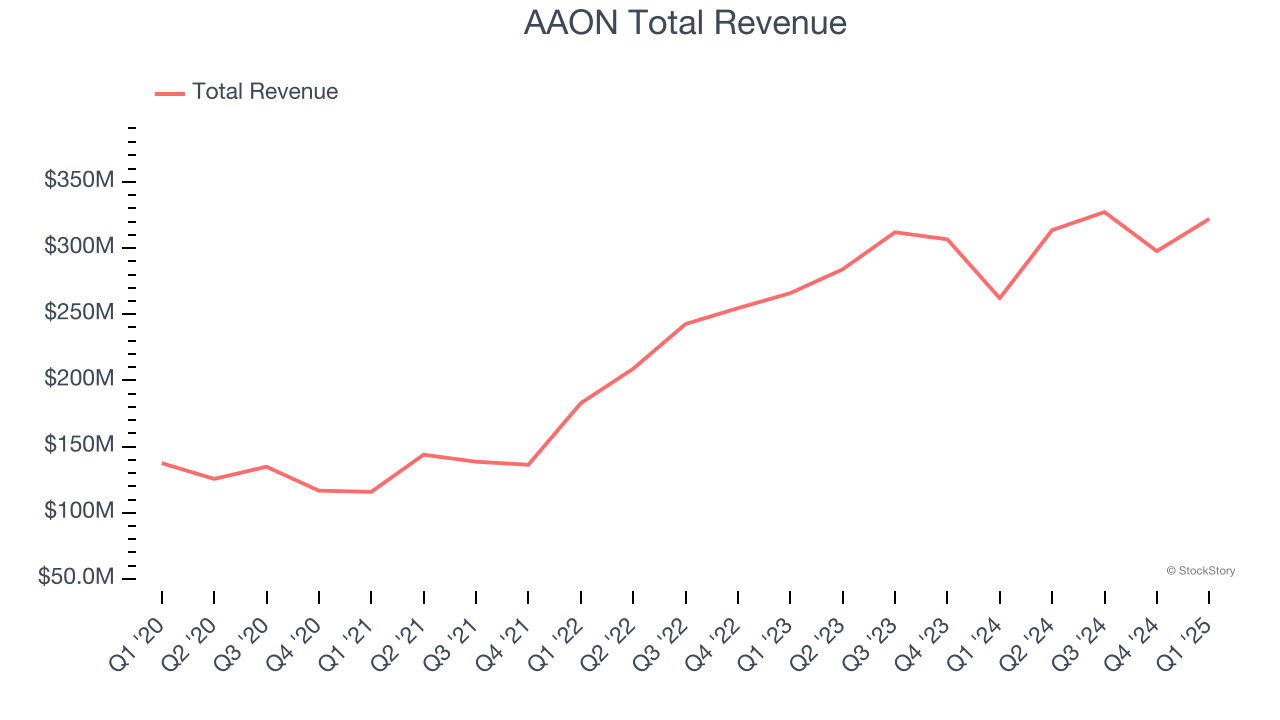

Best Q1: AAON (NASDAQ: AAON)

Backed by two million square feet of lab testing space, AAON (NASDAQ: AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

AAON reported revenues of $322.1 million, up 22.9% year on year, outperforming analysts’ expectations by 10.9%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

AAON delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 5.4% since reporting. It currently trades at $96.04.

Is now the time to buy AAON? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Advanced Drainage (NYSE: WMS)

Originally started as a farm water drainage company, Advanced Drainage Systems (NYSE: WMS) provides clean water management solutions to communities across America.

Advanced Drainage reported revenues of $615.8 million, down 5.8% year on year, falling short of analysts’ expectations by 6.8%. It was a disappointing quarter as it posted a miss of analysts’ Infiltrators revenue estimates and full-year revenue guidance missing analysts’ expectations.

Advanced Drainage delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 7% since the results and currently trades at $113.15.

Read our full analysis of Advanced Drainage’s results here.

Zurn Elkay (NYSE: ZWS)

Claiming to have saved more than 30 billion gallons of water, Zurn Elkay (NYSE: ZWS) provides water management solutions to various industries.

Zurn Elkay reported revenues of $388.8 million, up 4% year on year. This print topped analysts’ expectations by 1.4%. Taking a step back, it was a mixed quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ organic revenue estimates.

The stock is up 16.2% since reporting and currently trades at $36.16.

Read our full, actionable report on Zurn Elkay here, it’s free.

CSW (NASDAQ: CSWI)

With over two centuries of combined operations manufacturing and supplying, CSW (NASDAQ: CSWI) offers special chemicals, coatings, sealants, and lubricants for various industries.

CSW reported revenues of $230.5 million, up 9.3% year on year. This result missed analysts’ expectations by 1%. It was a slower quarter as it also produced a slight miss of analysts’ EBITDA estimates.

The stock is down 3.3% since reporting and currently trades at $304.19.

Read our full, actionable report on CSW here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.