Looking back on gas and liquid handling stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Chart (NYSE: GTLS) and its peers.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 12 gas and liquid handling stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

Luckily, gas and liquid handling stocks have performed well with share prices up 12.6% on average since the latest earnings results.

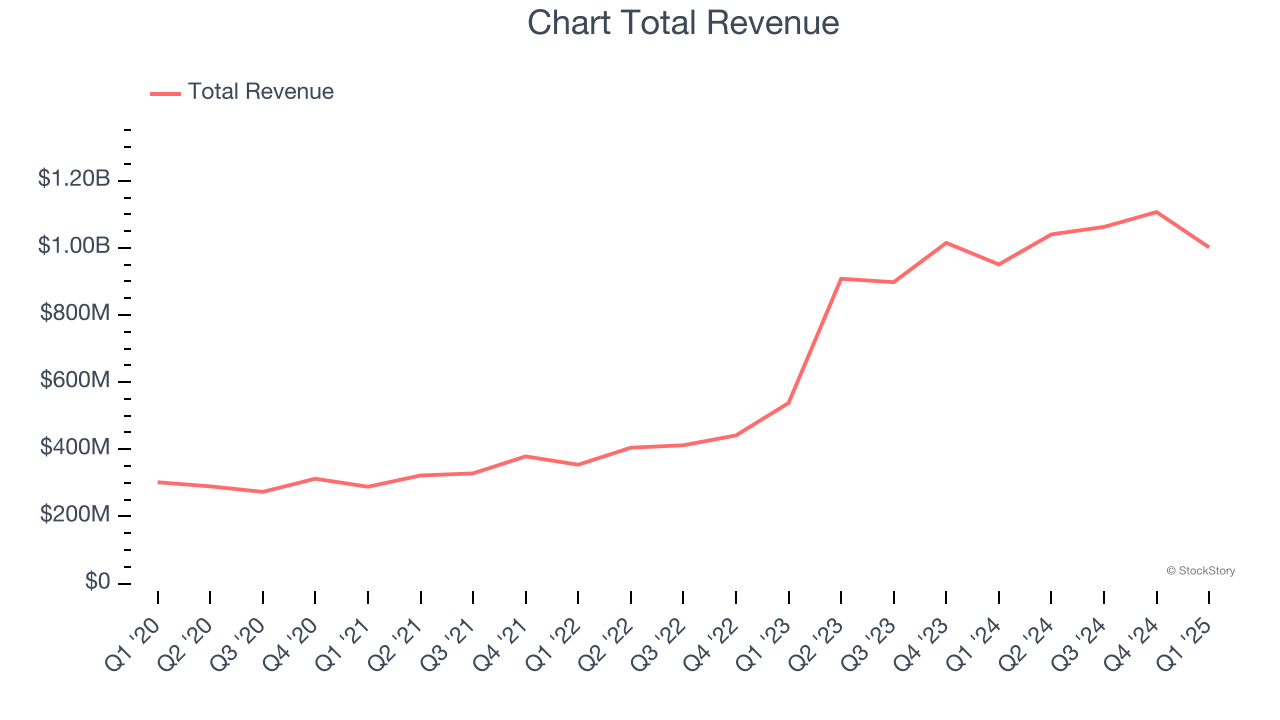

Chart (NYSE: GTLS)

Installing the first bulk Co2 tank for McDonalds’s sodas, Chart (NYSE: GTLS) provides equipment to store and transport gasses.

Chart reported revenues of $1.00 billion, up 5.3% year on year. This print was in line with analysts’ expectations, and overall, it was a very strong quarter for the company with an impressive beat of analysts’ adjusted operating income estimates and full-year EBITDA guidance exceeding analysts’ expectations.

“We delivered strong order and organic sales growth of 17.3% and 6.6% in the first quarter of 2025. This marks our fourth consecutive quarter of reported gross profit margin above 33%, which contributed to a 190 basis points expansion in adjusted operating income margin,” stated Jill Evanko, Chart Industries’ CEO and President.

Chart delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 22.2% since reporting and currently trades at $164.65.

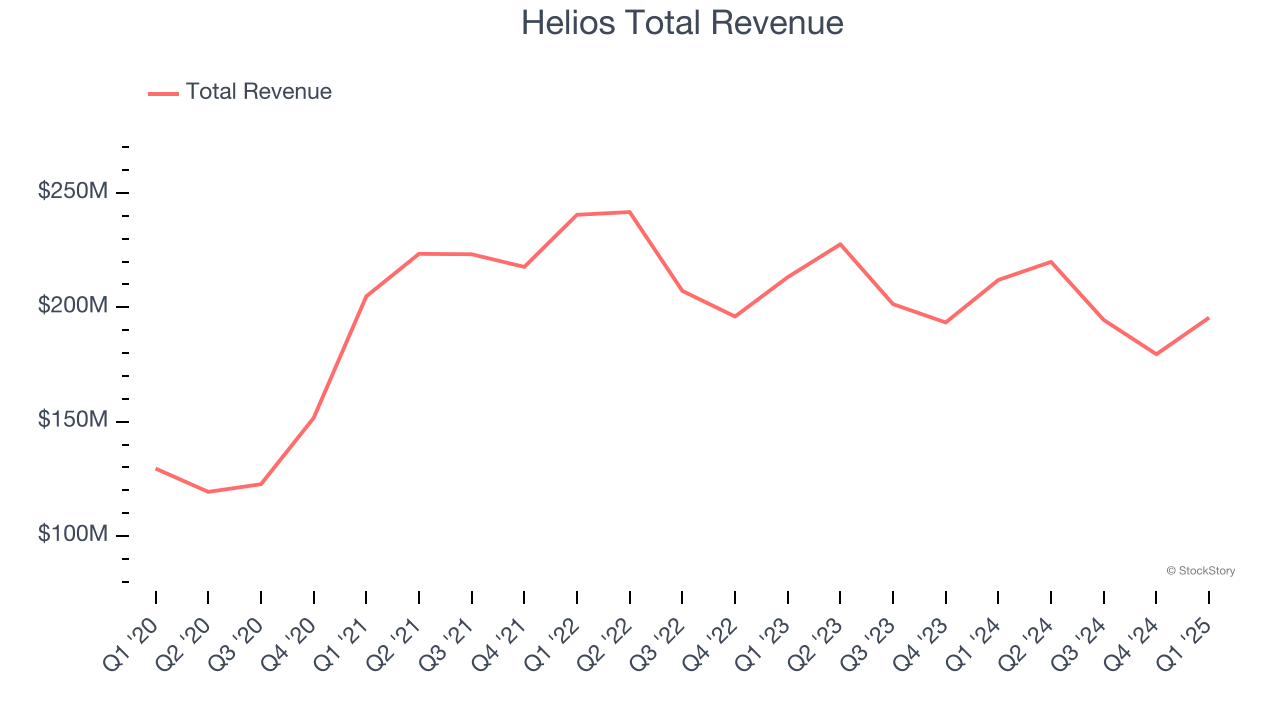

Best Q1: Helios (NYSE: HLIO)

Founded on the principle of treating others as one wants to be treated, Helios (NYSE: HLIO) designs, manufactures, and sells motion and electronic control components for various sectors.

Helios reported revenues of $195.5 million, down 7.8% year on year, outperforming analysts’ expectations by 3.8%. The business had an exceptional quarter with an impressive beat of analysts’ organic revenue and EBITDA estimates.

Helios achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 23% since reporting. It currently trades at $33.37.

Is now the time to buy Helios? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Parker-Hannifin (NYSE: PH)

Founded in 1917, Parker Hannifin (NYSE: PH) is a manufacturer of motion and control systems for a wide variety of mobile, industrial and aerospace markets.

Parker-Hannifin reported revenues of $4.96 billion, down 2.2% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ adjusted operating income and organic revenue estimates.

Interestingly, the stock is up 15.7% since the results and currently trades at $698.47.

Read our full analysis of Parker-Hannifin’s results here.

SPX Technologies (NYSE: SPXC)

SPX Technologies (NYSE: SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

SPX Technologies reported revenues of $482.6 million, up 3.7% year on year. This print was in line with analysts’ expectations. Overall, it was an exceptional quarter as it also put up an impressive beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

SPX Technologies achieved the highest full-year guidance raise among its peers. The stock is up 22.9% since reporting and currently trades at $167.68.

Read our full, actionable report on SPX Technologies here, it’s free.

IDEX (NYSE: IEX)

Founded in 1988, IDEX (NYSE: IEX) is a global manufacturer specializing in highly engineered products such as pumps, flow meters, and fluidics systems for various industries.

IDEX reported revenues of $814.3 million, up 1.7% year on year. This number beat analysts’ expectations by 1.1%. It was a very strong quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 1.1% since reporting and currently trades at $175.57.

Read our full, actionable report on IDEX here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.