Allstate has been treading water for the past six months, recording a small return of 3.5% while holding steady at $193.33.

Is now the time to buy Allstate, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Allstate Not Exciting?

We're swiping left on Allstate for now. Here are three reasons why there are better opportunities than ALL and a stock we'd rather own.

1. Deteriorating Combined Ratio

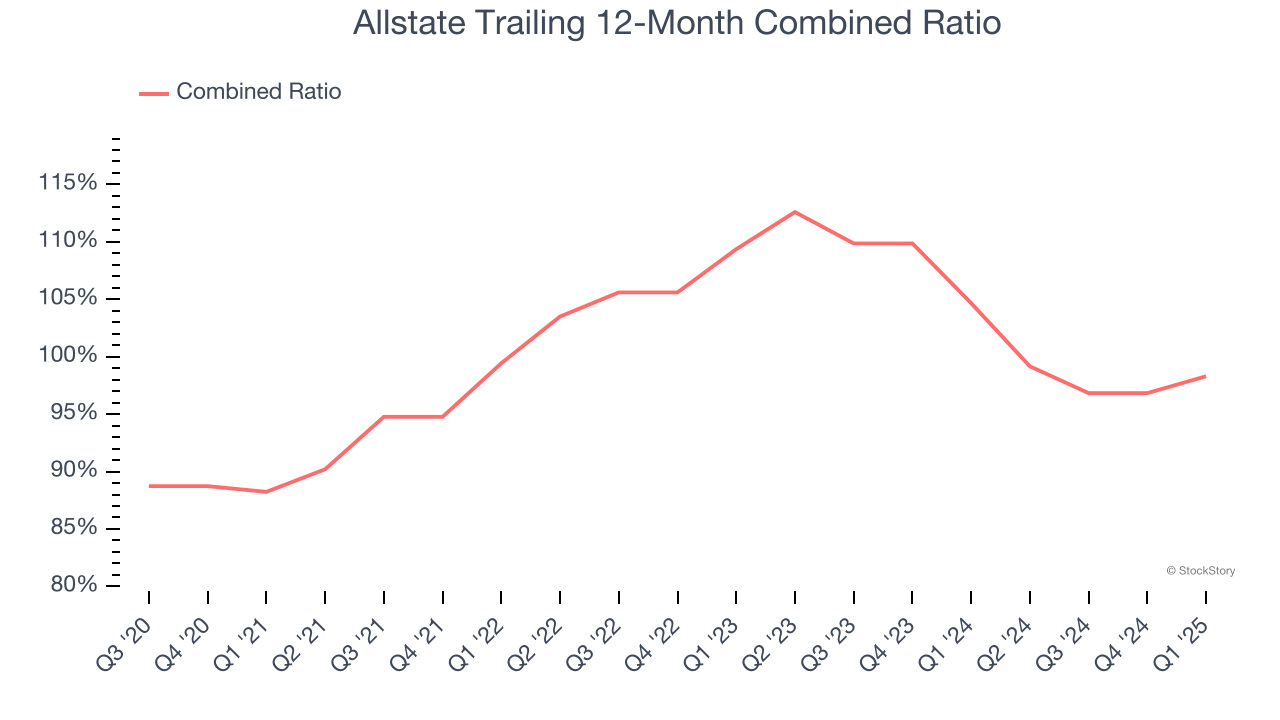

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

Combined ratio = (costs of underwriting + what an insurer pays out in claims) / net premiums earned. If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations.

Over the last four years, Allstate’s combined ratio has swelled by 10.1 percentage points, hitting 98.3% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually raises questions in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

2. BVPS Growth Demonstrates Strong Asset Foundation

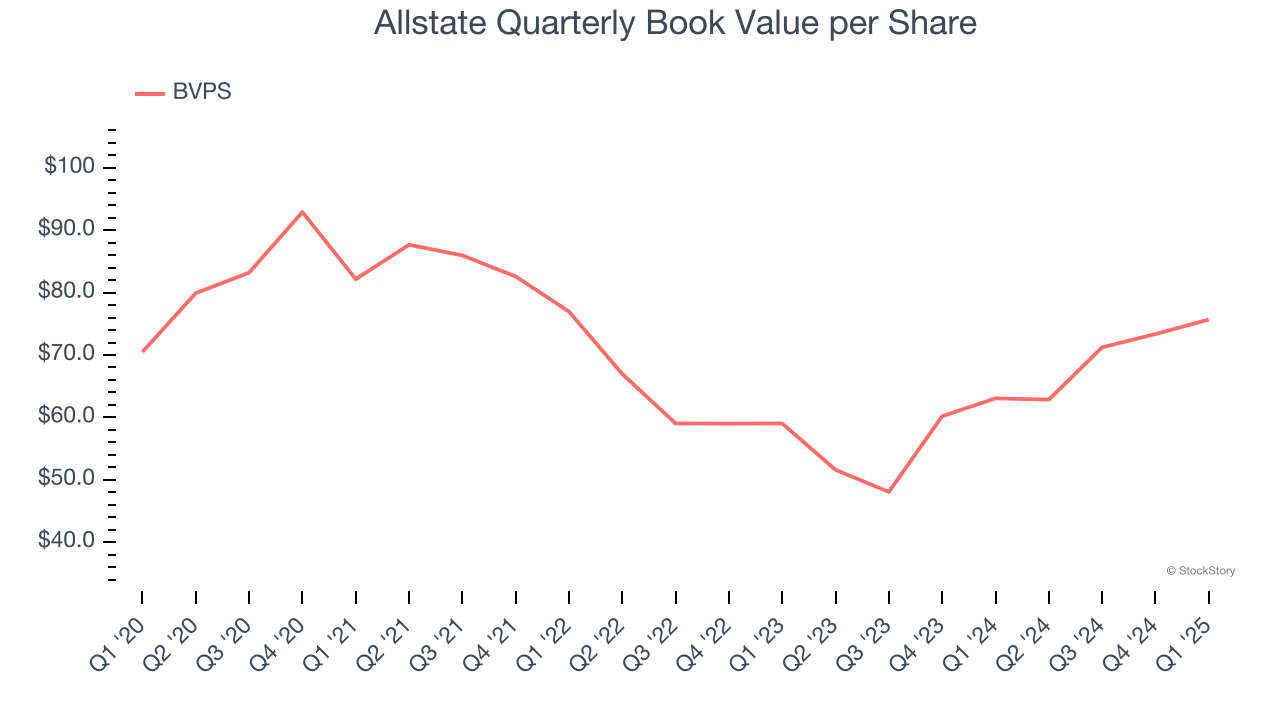

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

Although Allstate’s BVPS increased by a meager 1.4% annually over the last five years, the good news is that its growth has recently accelerated as BVPS grew at a decent 13.2% annual clip over the past two years (from $59.03 to $75.68 per share).

3. Previous Growth Initiatives Haven’t Impressed

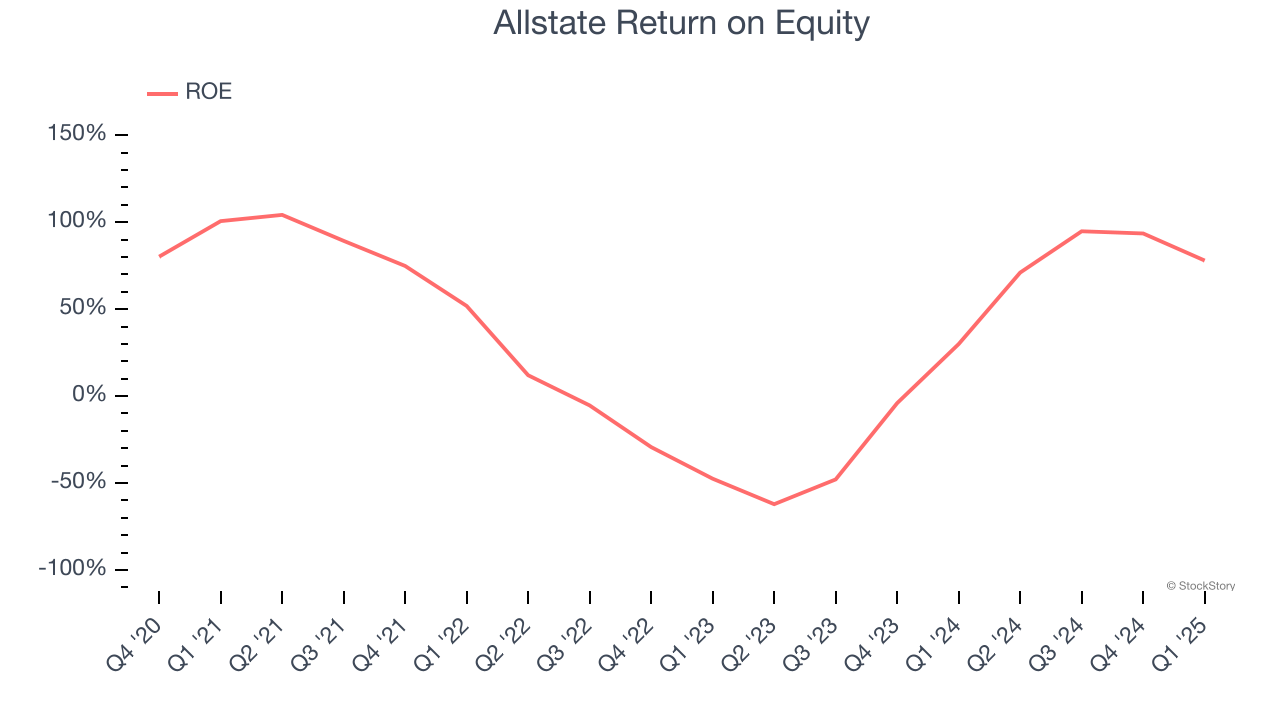

Return on equity (ROE) is a crucial yardstick for insurance companies, measuring their ability to generate returns on the capital provided by shareholders. Insurers that consistently deliver superior ROE tend to create more value for their investors over time through strategic capital allocation and shareholder-friendly policies.

Over the last five years, Allstate has averaged an ROE of 10.6%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

Allstate isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 2.2× forward P/B (or $193.33 per share). This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere. We’d suggest looking at the most dominant software business in the world.

Stocks We Like More Than Allstate

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.