The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Park-Ohio (NASDAQ: PKOH) and the rest of the engineered components and systems stocks fared in Q1.

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 engineered components and systems stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.4% below.

Luckily, engineered components and systems stocks have performed well with share prices up 16.8% on average since the latest earnings results.

Weakest Q1: Park-Ohio (NASDAQ: PKOH)

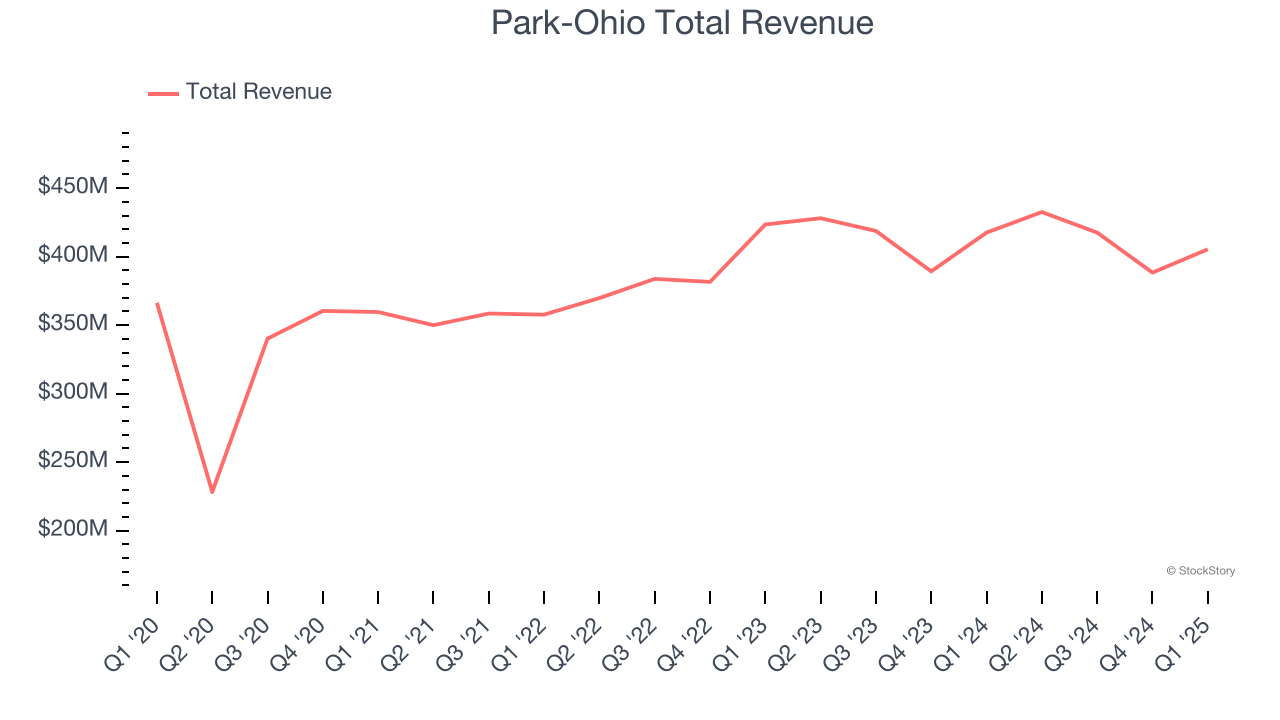

Based in Cleveland, Park-Ohio (NASDAQ: PKOH) provides supply chain management services, capital equipment, and manufactured components.

Park-Ohio reported revenues of $405.4 million, down 2.9% year on year. This print fell short of analysts’ expectations by 4.7%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

Park-Ohio delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 14.1% since reporting and currently trades at $18.33.

Read our full report on Park-Ohio here, it’s free.

Best Q1: Regal Rexnord (NYSE: RRX)

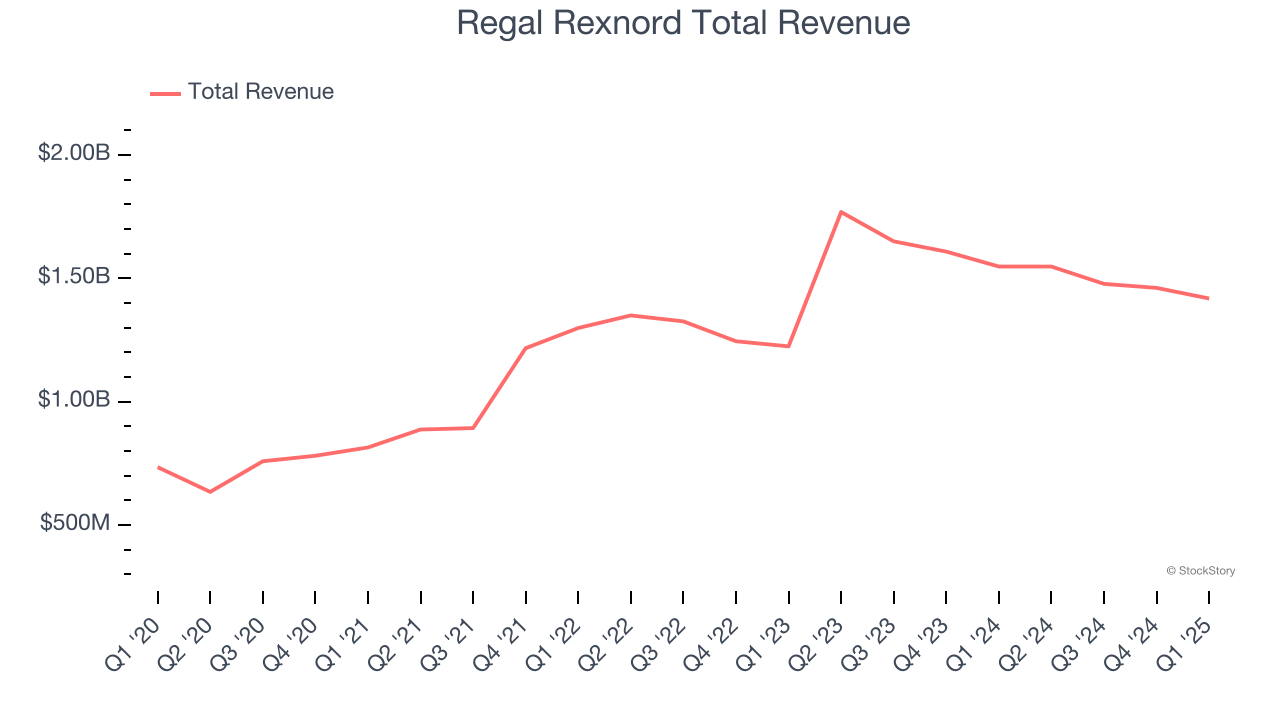

Headquartered in Milwaukee, Regal Rexnord (NYSE: RRX) provides power transmission and industrial automation products.

Regal Rexnord reported revenues of $1.42 billion, down 8.4% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with an impressive beat of analysts’ organic revenue and EBITDA estimates.

The market seems happy with the results as the stock is up 37.9% since reporting. It currently trades at $151.89.

Is now the time to buy Regal Rexnord? Access our full analysis of the earnings results here, it’s free.

Timken (NYSE: TKR)

Established after the founder noticed the difficulty freight wagons had making sharp turns, Timken (NYSE: TKR) is a provider of industrial parts used across various sectors.

Timken reported revenues of $1.14 billion, down 4.2% year on year, exceeding analysts’ expectations by 1.1%. Still, it was a slower quarter as it posted a significant miss of analysts’ adjusted operating income estimates and full-year EPS guidance missing analysts’ expectations.

Interestingly, the stock is up 19.6% since the results and currently trades at $78.07.

Read our full analysis of Timken’s results here.

Arrow Electronics (NYSE: ARW)

Founded as a single retail store, Arrow Electronics (NYSE: ARW) provides electronic components and enterprise computing solutions to businesses globally.

Arrow Electronics reported revenues of $6.81 billion, down 1.6% year on year. This result beat analysts’ expectations by 7.2%. It was an exceptional quarter as it also recorded a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Arrow Electronics pulled off the biggest analyst estimates beat among its peers. The stock is up 18.9% since reporting and currently trades at $132.16.

Read our full, actionable report on Arrow Electronics here, it’s free.

Enpro (NYSE: NPO)

Holding a Guinness World Record for creating the world's largest gasket, Enpro (NYSE: NPO) designs, manufactures, and sells products used for machinery in various industries.

Enpro reported revenues of $273.2 million, up 6.1% year on year. This print surpassed analysts’ expectations by 2.6%. Zooming out, it was a satisfactory quarter as it also logged a solid beat of analysts’ EBITDA estimates but full-year revenue guidance missing analysts’ expectations.

Enpro had the weakest full-year guidance update among its peers. The stock is up 31.6% since reporting and currently trades at $204.36.

Read our full, actionable report on Enpro here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.