The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Microchip Technology (NASDAQ: MCHP) and the rest of the analog semiconductors stocks fared in Q1.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 0.8% above.

Luckily, analog semiconductors stocks have performed well with share prices up 23.8% on average since the latest earnings results.

Microchip Technology (NASDAQ: MCHP)

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

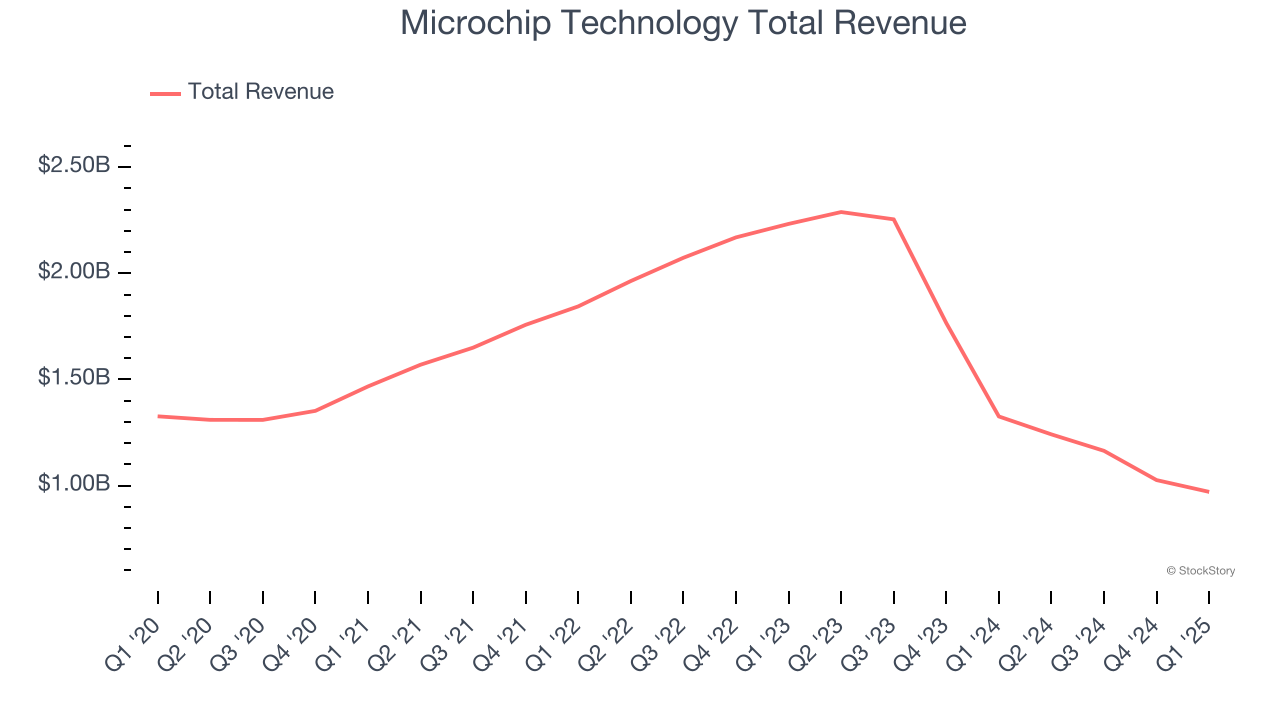

Microchip Technology reported revenues of $970.5 million, down 26.8% year on year. This print exceeded analysts’ expectations by 1%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ EPS estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

Steve Sanghi, Microchip’s CEO and President commented that "Our March quarter revenue of $970.5 million exceeded the midpoint of our guidance, and we believe marks the bottom of this prolonged industry down cycle for Microchip. The decisive actions we have taken under our nine-point-plan are enhancing our operational capabilities through more efficient manufacturing, improving inventory management, and a renewed strategic focus. As we move forward from a challenging fiscal year, we believe Microchip is better positioned to capitalize on growth opportunities as market conditions evolve."

Microchip Technology delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 50.3% since reporting and currently trades at $73.80.

Is now the time to buy Microchip Technology? Access our full analysis of the earnings results here, it’s free.

Best Q1: Himax (NASDAQ: HIMX)

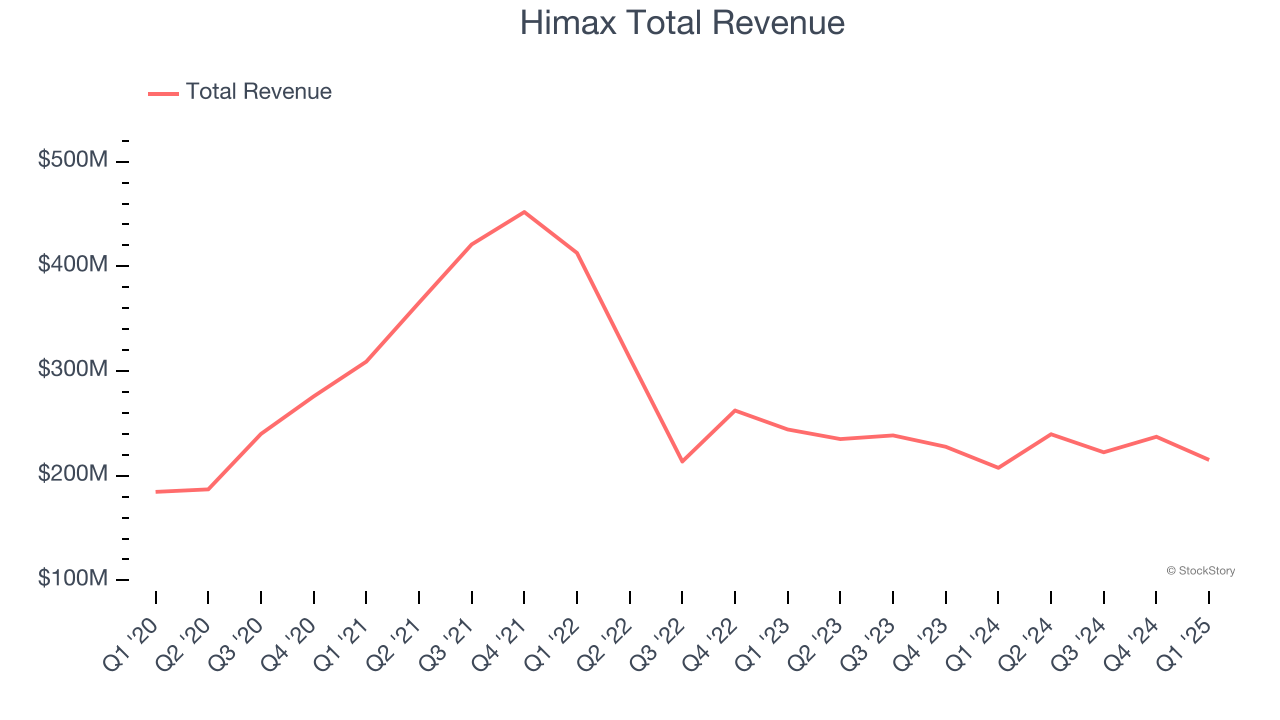

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $215.1 million, up 3.7% year on year, outperforming analysts’ expectations by 2.4%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 27.6% since reporting. It currently trades at $9.52.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Vishay Intertechnology (NYSE: VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $715.2 million, down 4.2% year on year, falling short of analysts’ expectations by 0.6%. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and revenue guidance for next quarter meeting analysts’ expectations.

Vishay Intertechnology delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 26.5% since the results and currently trades at $16.99.

Read our full analysis of Vishay Intertechnology’s results here.

Analog Devices (NASDAQ: ADI)

Founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965, Analog Devices (NASDAQ: ADI) is one of the largest providers of high performance analog integrated circuits used mainly in industrial end markets, along with communications, autos, and consumer devices.

Analog Devices reported revenues of $2.64 billion, up 22.3% year on year. This print beat analysts’ expectations by 5.2%. It was a very strong quarter as it also recorded a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 8.1% since reporting and currently trades at $240.02.

Read our full, actionable report on Analog Devices here, it’s free.

Sensata Technologies (NYSE: ST)

Originally a temperature sensor control maker and a subsidiary of Texas Instruments for 60 years, Sensata Technology Holdings (NYSE: ST) is a leading supplier of analog sensors used in industrial and transportation applications, best known for its dominant position in the tire pressure monitoring systems in cars.

Sensata Technologies reported revenues of $911.3 million, down 9.5% year on year. This result surpassed analysts’ expectations by 3.5%. Zooming out, it was a satisfactory quarter as it also produced a solid beat of analysts’ EPS estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

The stock is up 38.3% since reporting and currently trades at $31.07.

Read our full, actionable report on Sensata Technologies here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.