Since January 2025, Allstate has been in a holding pattern, posting a small return of 2.3% while floating around $194.08.

Is now the time to buy Allstate, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Allstate Not Exciting?

We're sitting this one out for now. Here are three reasons why we avoid ALL and a stock we'd rather own.

1. Deteriorating Combined Ratio

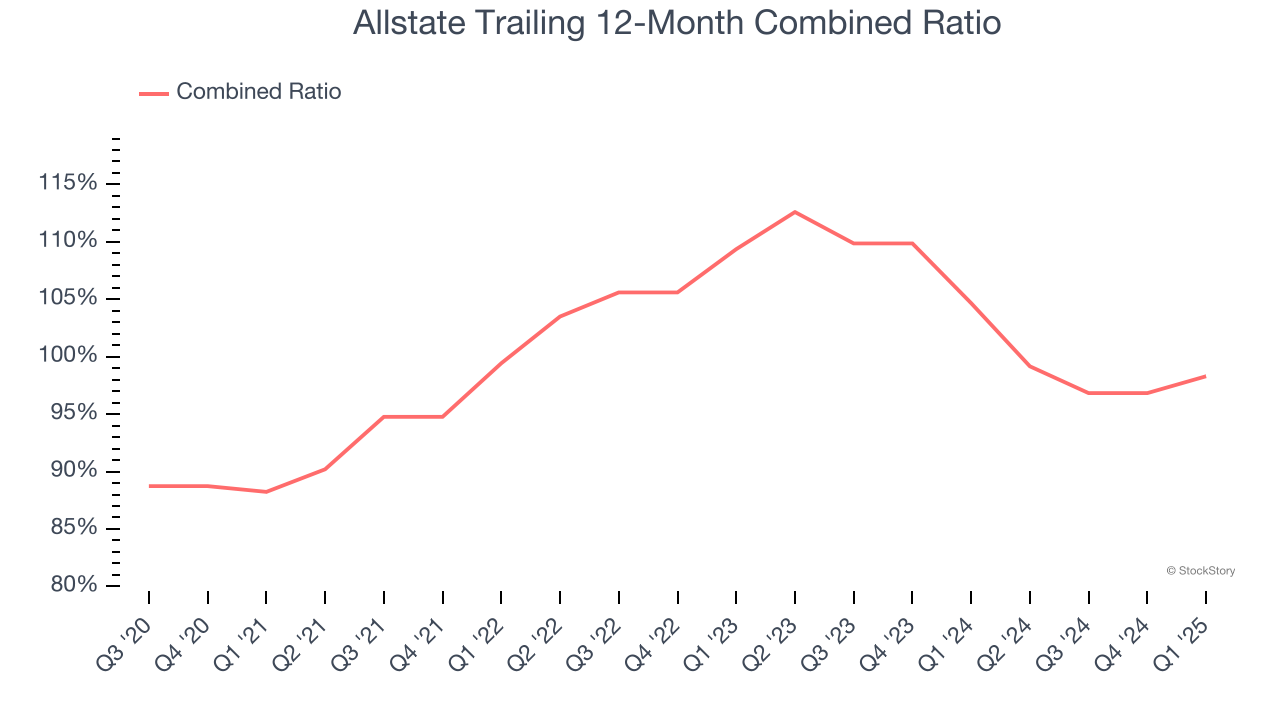

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

The combined ratio sums the costs of underwriting (salaries, commissions, overhead) as well as what an insurer pays out in claims (losses) and divides it by net premiums earned. If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations of selling insurance policies.

Over the last four years, Allstate’s combined ratio has swelled by 10.1 percentage points, hitting 98.3% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually raises questions in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

2. BVPS Growth Demonstrates Strong Asset Foundation

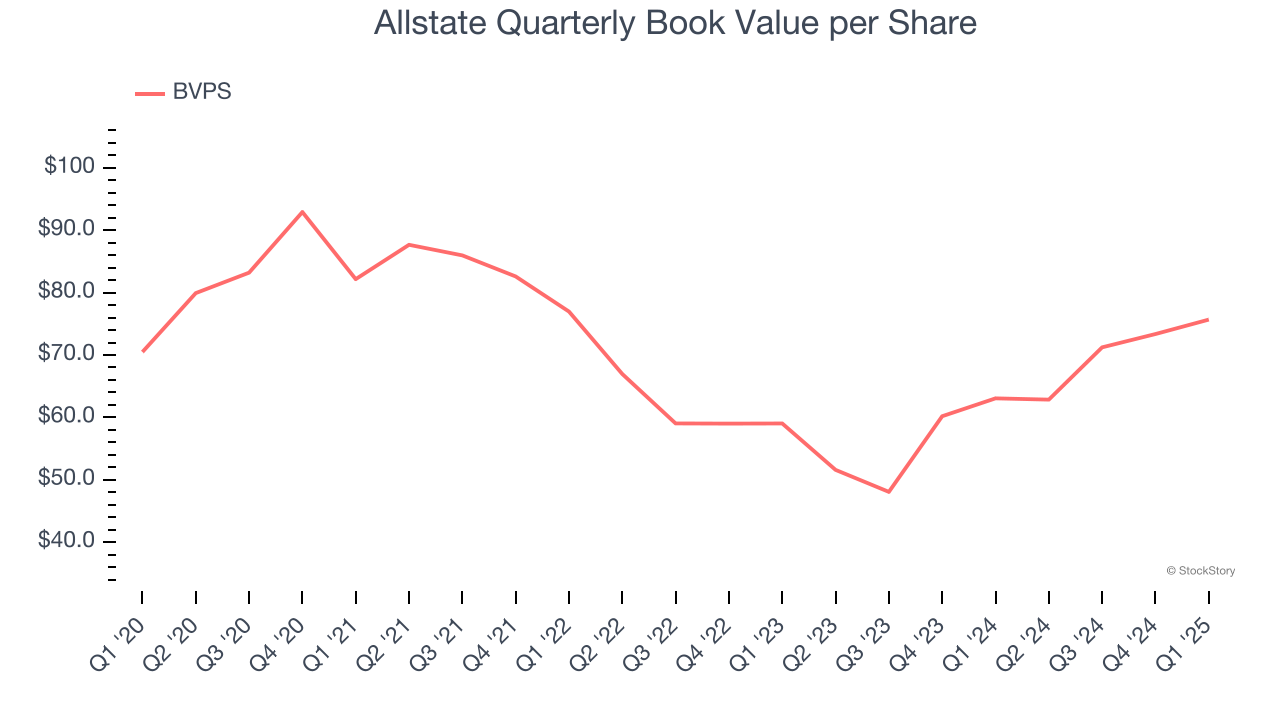

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Although Allstate’s BVPS increased by a meager 1.4% annually over the last five years, the good news is that its growth has recently accelerated as BVPS grew at a decent 13.2% annual clip over the past two years (from $59.03 to $75.68 per share).

3. Previous Growth Initiatives Haven’t Impressed

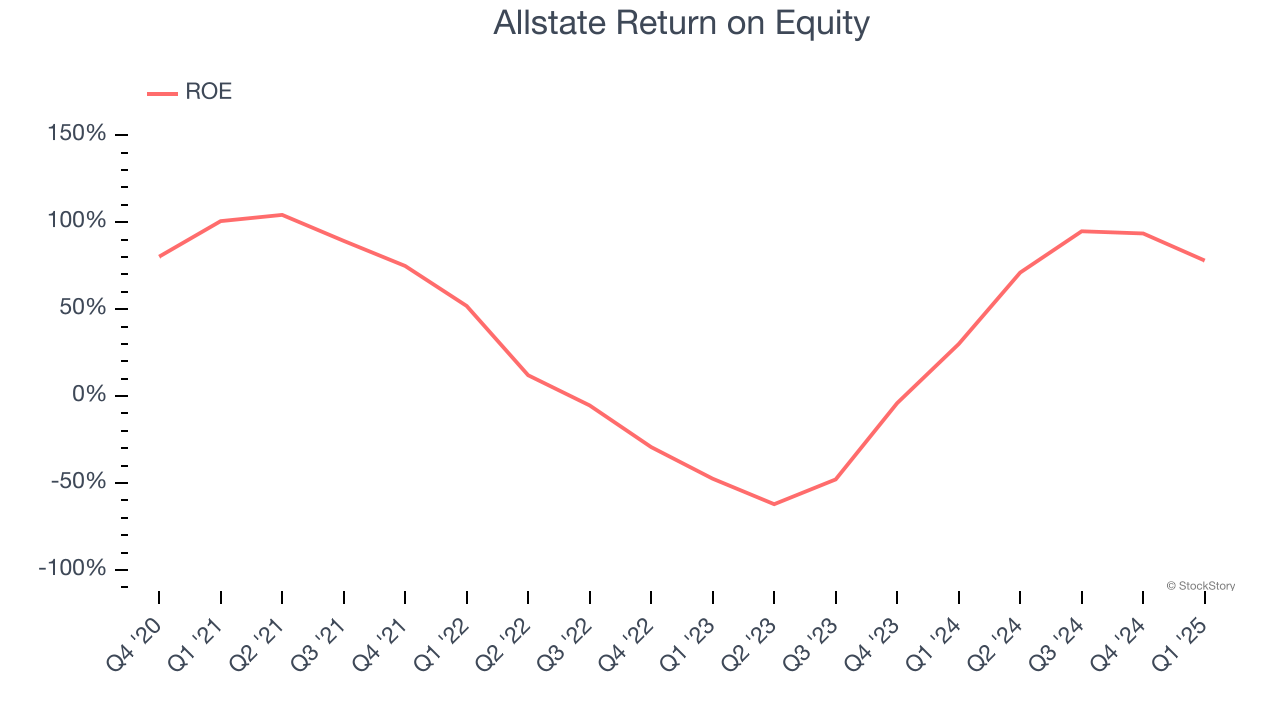

Return on Equity, or ROE, ties everything together and is a vital metric. It tells us how much profit the insurer generates for each dollar of shareholder equity entrusted to management. Over a long period, insurers with higher ROEs tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Allstate has averaged an ROE of 10.6%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

Allstate isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 2.2× forward P/B (or $194.08 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Allstate

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.