Regional bank Banc of California (NYSE: BANC) fell short of the market’s revenue expectations in Q2 CY2025, but sales rose 5.2% year on year to $272.8 million. Its GAAP profit of $0.12 per share was 54.7% below analysts’ consensus estimates.

Is now the time to buy Banc of California? Find out by accessing our full research report, it’s free.

Banc of California (BANC) Q2 CY2025 Highlights:

- Net Interest Income: $240.2 million vs analyst estimates of $243.5 million (4.7% year-on-year growth, 1.4% miss)

- Net Interest Margin: 3.1% vs analyst estimates of 3.1% (30 basis point year-on-year increase, 3.8 bps miss)

- Revenue: $272.8 million vs analyst estimates of $276.1 million (5.2% year-on-year growth, 1.2% miss)

- Efficiency Ratio: 9.9% vs analyst estimates of 68.8% (58.9 percentage point beat)

- EPS (GAAP): $0.12 vs analyst expectations of $0.26 (54.7% miss)

- Market Capitalization: $2.37 billion

Jared Wolff, President & CEO of Banc of California, commented, “Our second quarter results reflect the strength of our core earnings engine and our disciplined execution. We delivered double digit growth in adjusted earnings per share, our third consecutive quarter of strong loan growth, expanded net interest income, and grew pre-tax pre-provision profitability, all while proactively managing credit risk. The decisive actions we took to reposition a portion of our balance sheet—through the opportunistic sale of select CRE loans—have enhanced our credit profile and strengthened our balance sheet, positioning us to continue generating consistent and high quality earnings. We have increased tangible book value per share for five straight quarters. With a healthy capital base, improving credit metrics, and a robust pipeline of high-quality loan originations, we are confident in our ability to drive long-term value for our shareholders.”

Company Overview

Originally established in 1941 and now operating with a tech-forward approach that includes its SmartStreet platform for homeowner associations, Banc of California (NYSE: BANC) is a California-based bank holding company that provides banking services to small and middle-market businesses, entrepreneurs, and individuals.

Sales Growth

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

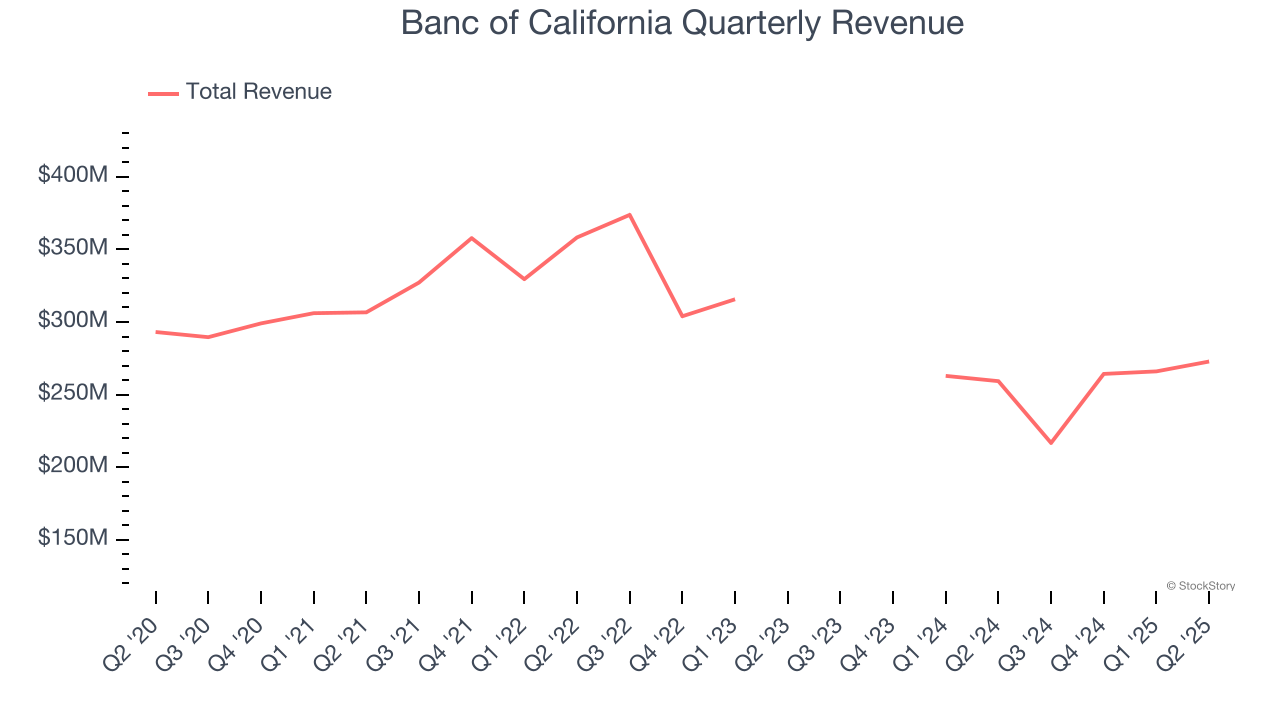

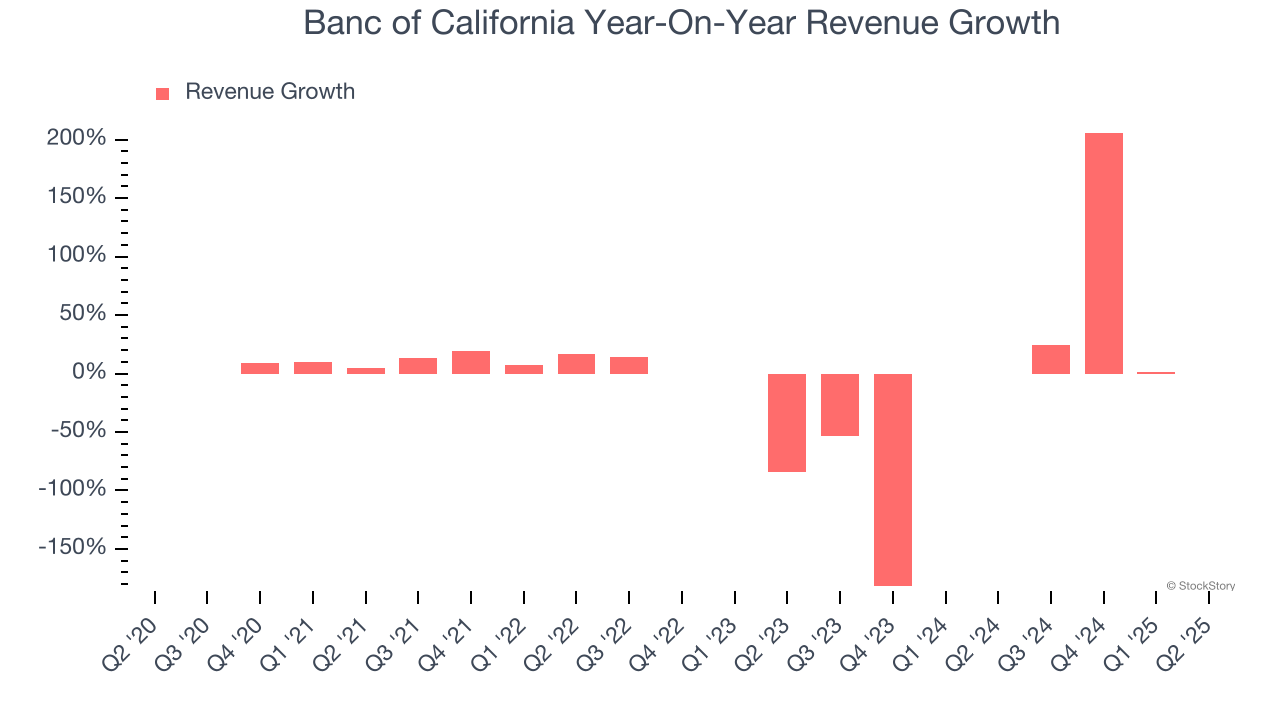

Over the last five years, Banc of California’s demand was weak and its revenue declined by 2.1% per year. This was below our standards and is a sign of lacking business quality.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Banc of California’s annualized revenue declines of 1.5% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Banc of California’s revenue grew by 5.2% year on year to $272.8 million, missing Wall Street’s estimates.

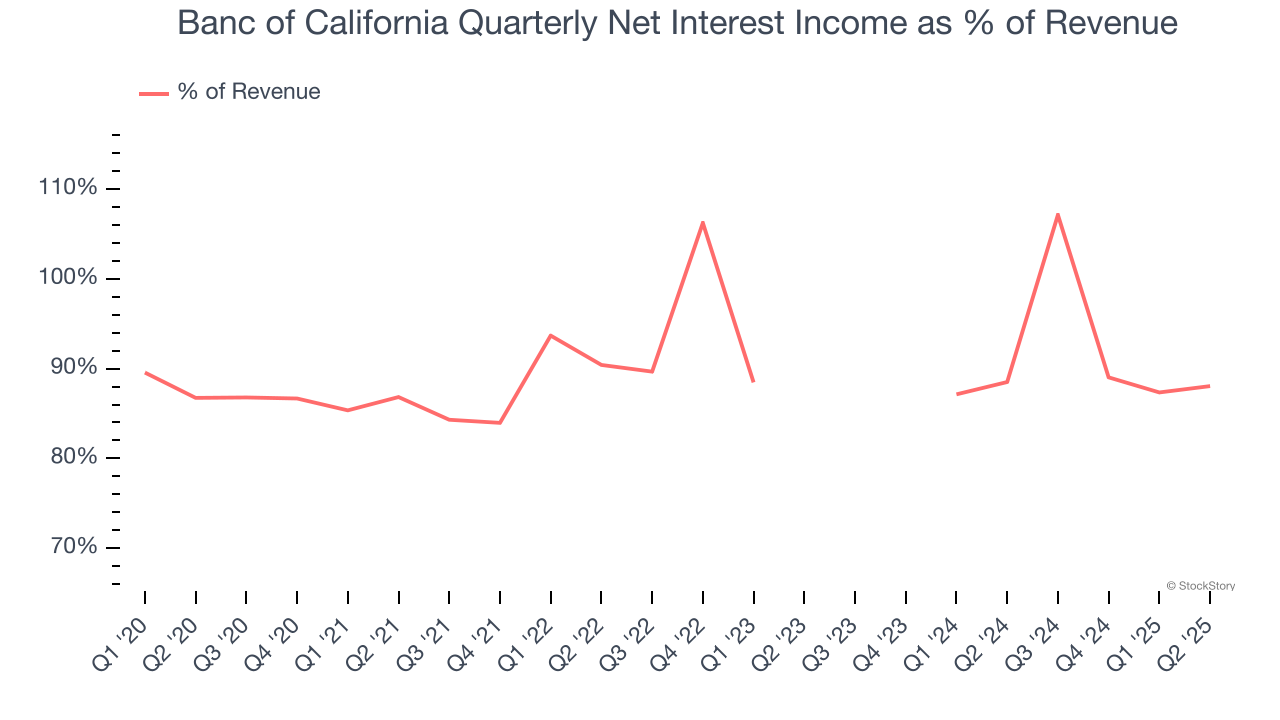

Net interest income made up 93.2% of the company’s total revenue during the last five years, meaning Banc of California lives and dies by its lending activities because non-interest income barely moves the needle.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

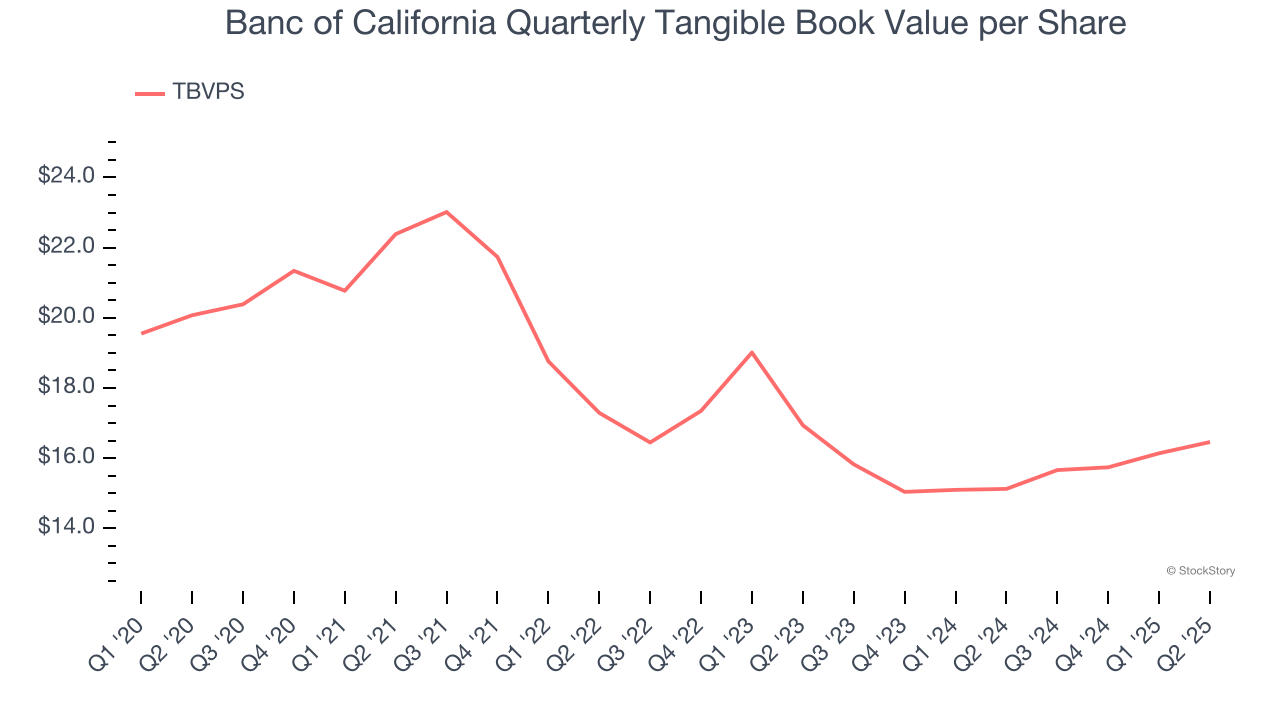

Tangible Book Value Per Share (TBVPS)

The balance sheet drives banking profitability since earnings flow from the spread between borrowing and lending rates. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark. By excluding intangible assets with uncertain liquidation values, this metric captures real, liquid net worth per share. EPS can become murky due to acquisition impacts or accounting flexibility around loan provisions, and TBVPS resists financial engineering manipulation.

Banc of California’s TBVPS declined at a 3.9% annual clip over the last five years. On a two-year basis, TBVPS fell at a slower pace, dropping by 1.4% annually from $16.94 to $16.46 per share.

Over the next 12 months, Consensus estimates call for Banc of California’s TBVPS to grow by 8.2% to $17.81, decent growth rate.

Key Takeaways from Banc of California’s Q2 Results

We struggled to find many positives in these results as its revenue, EPS, and net interest income fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.2% to $15.10 immediately after reporting.

Banc of California’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.