The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Varonis (NASDAQ: VRNS) and the rest of the cybersecurity stocks fared in Q1.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

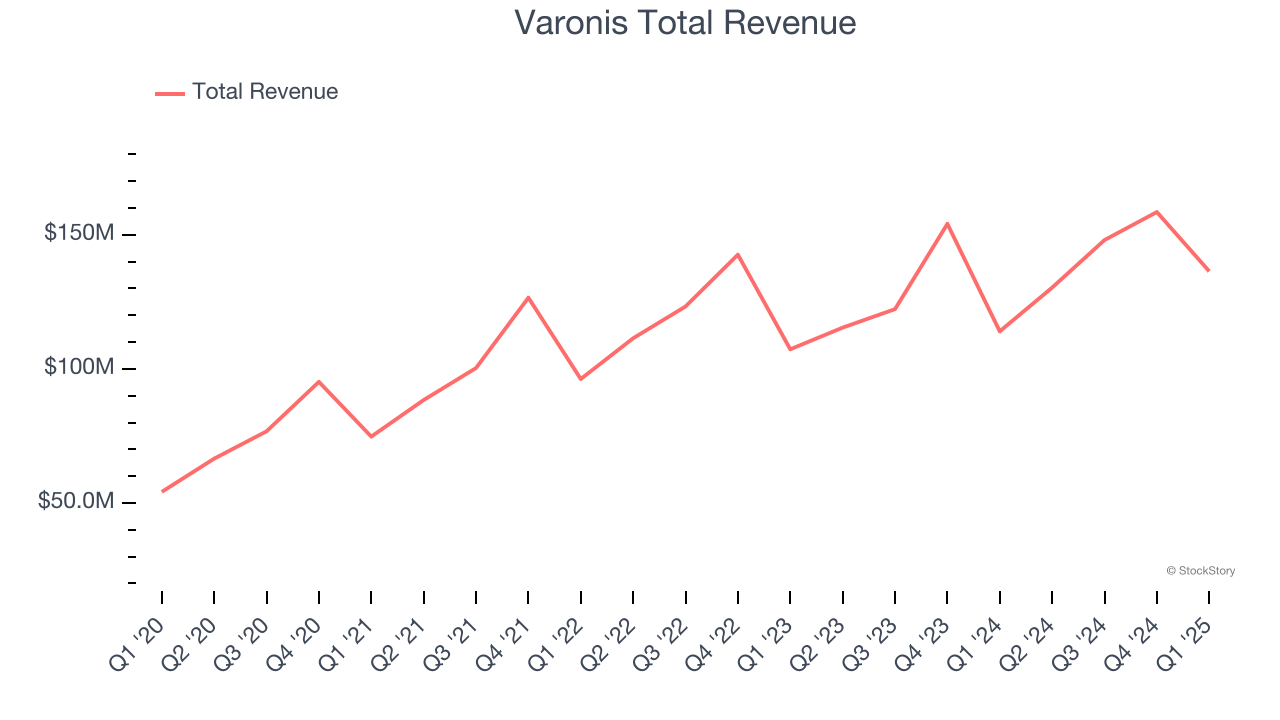

Varonis (NASDAQ: VRNS)

Founded by a duo of former Israeli Defense Forces cyber warfare engineers, Varonis (NASDAQ: VRNS) offers software-as-service that helps customers protect data from cyber threats and gain visibility into how enterprise data is being used.

Varonis reported revenues of $136.4 million, up 19.6% year on year. This print exceeded analysts’ expectations by 2.3%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

Yaki Faitelson, Varonis CEO, said, "Our first quarter results reflect the momentum of our SaaS platform as well as the many tailwinds that are contributing to the growth in our business, including MDDR and Generative AI. Our solution has never been more relevant, and we look forward to completing our SaaS transition this year which will unlock many more benefits for our customers and our company as we execute on our significant market opportunity.”

Interestingly, the stock is up 17.3% since reporting and currently trades at $51.94.

Read our full report on Varonis here, it’s free.

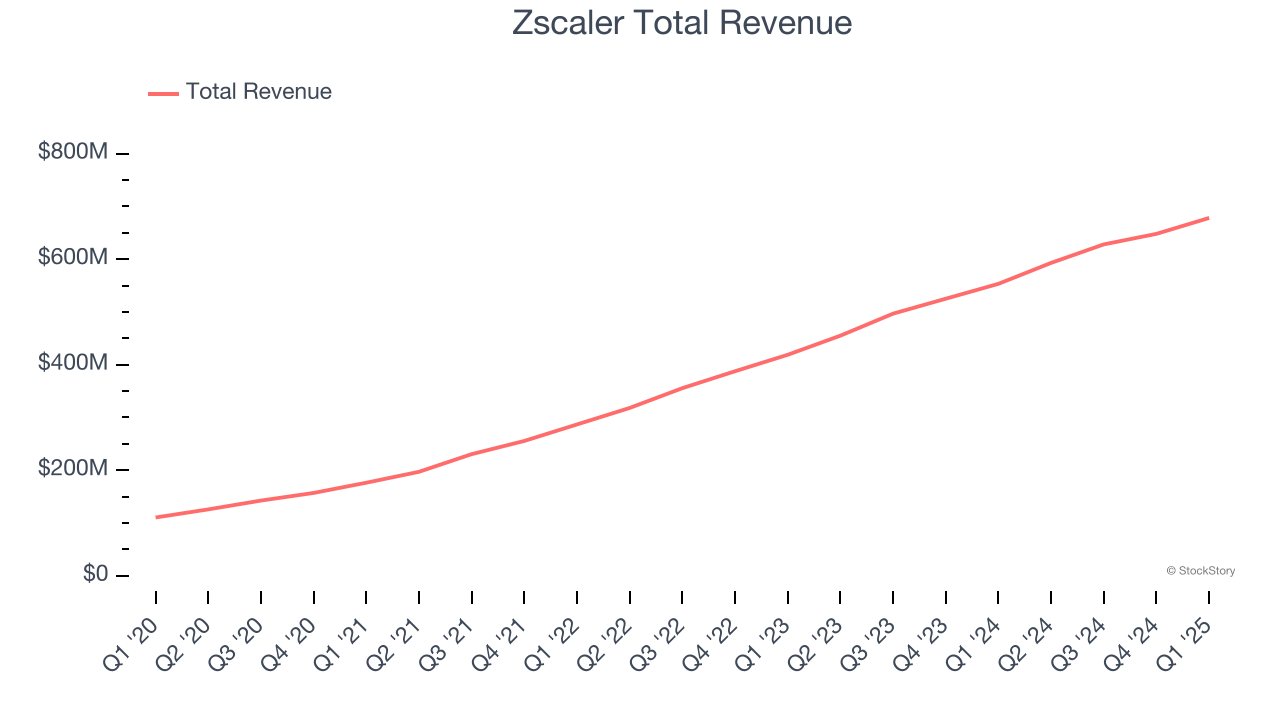

Best Q1: Zscaler (NASDAQ: ZS)

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ: ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Zscaler reported revenues of $678 million, up 22.6% year on year, outperforming analysts’ expectations by 1.6%. The business had a very strong quarter with full-year EPS guidance exceeding analysts’ expectations and an impressive beat of analysts’ annual recurring revenue estimates.

Zscaler scored the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 14% since reporting. It currently trades at $286.02.

Is now the time to buy Zscaler? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SentinelOne (NYSE: S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE: S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $229 million, up 22.9% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a solid beat of analysts’ EBITDA estimates but a miss of analysts’ billings estimates.

As expected, the stock is down 1.2% since the results and currently trades at $19.44.

Read our full analysis of SentinelOne’s results here.

Qualys (NASDAQ: QLYS)

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ: QLYS) provides organizations with software to assess their exposure to cyber-attacks.

Qualys reported revenues of $159.9 million, up 9.7% year on year. This result surpassed analysts’ expectations by 1.8%. It was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

The stock is up 11.4% since reporting and currently trades at $141.06.

Read our full, actionable report on Qualys here, it’s free.

CrowdStrike (NASDAQ: CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ: CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $1.10 billion, up 19.8% year on year. This print met analysts’ expectations. Taking a step back, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter meeting analysts’ expectations.

CrowdStrike had the weakest performance against analyst estimates among its peers. The stock is down 3.5% since reporting and currently trades at $471.50.

Read our full, actionable report on CrowdStrike here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.