Over the past six months, Yelp’s shares (currently trading at $34.97) have posted a disappointing 13.6% loss, well below the S&P 500’s 5% gain. This might have investors contemplating their next move.

Following the drawdown, is this a buying opportunity for YELP? Find out in our full research report, it’s free.

Why Does YELP Stock Spark Debate?

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE: YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Two Positive Attributes:

1. Elite Gross Margin Powers Best-In-Class Business Model

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For social network businesses like Yelp, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center, and other infrastructure expenses.

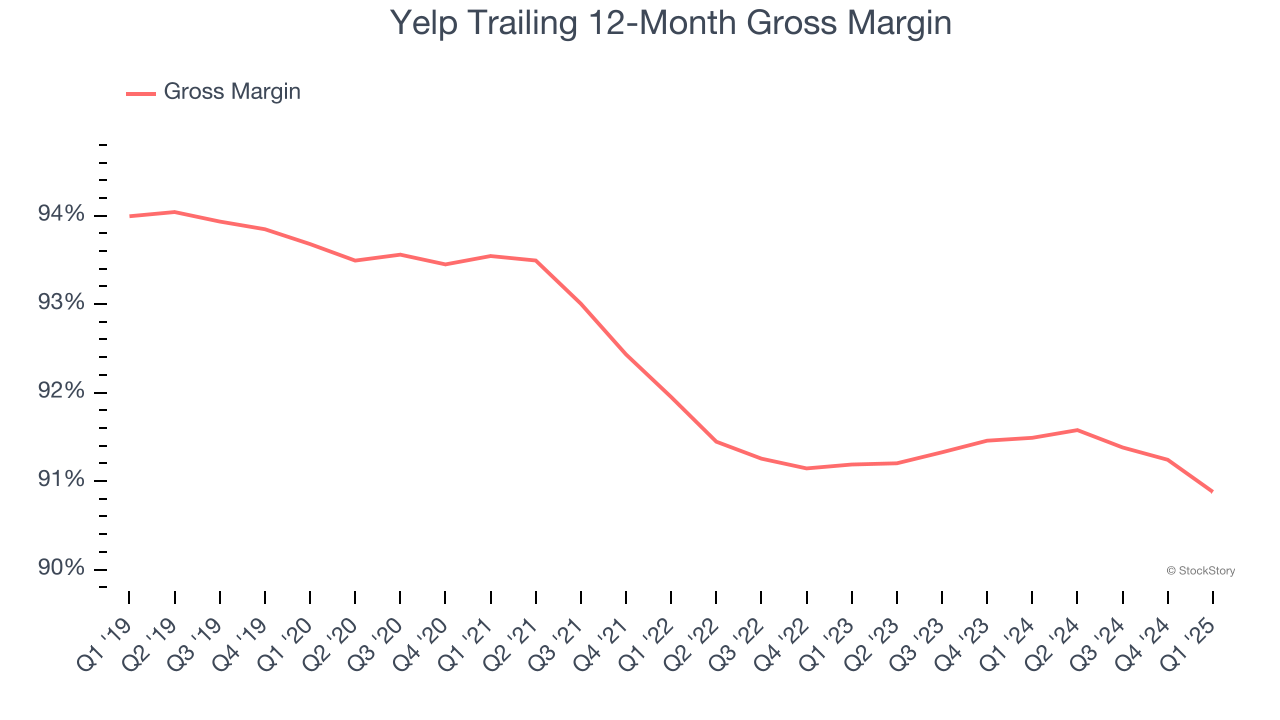

Yelp’s gross margin is one of the highest in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in product and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 91.2% gross margin over the last two years. Said differently, roughly $91.17 was left to spend on selling, marketing, and R&D for every $100 in revenue.

2. EBITDA Margin Reveals a Well-Run Organization

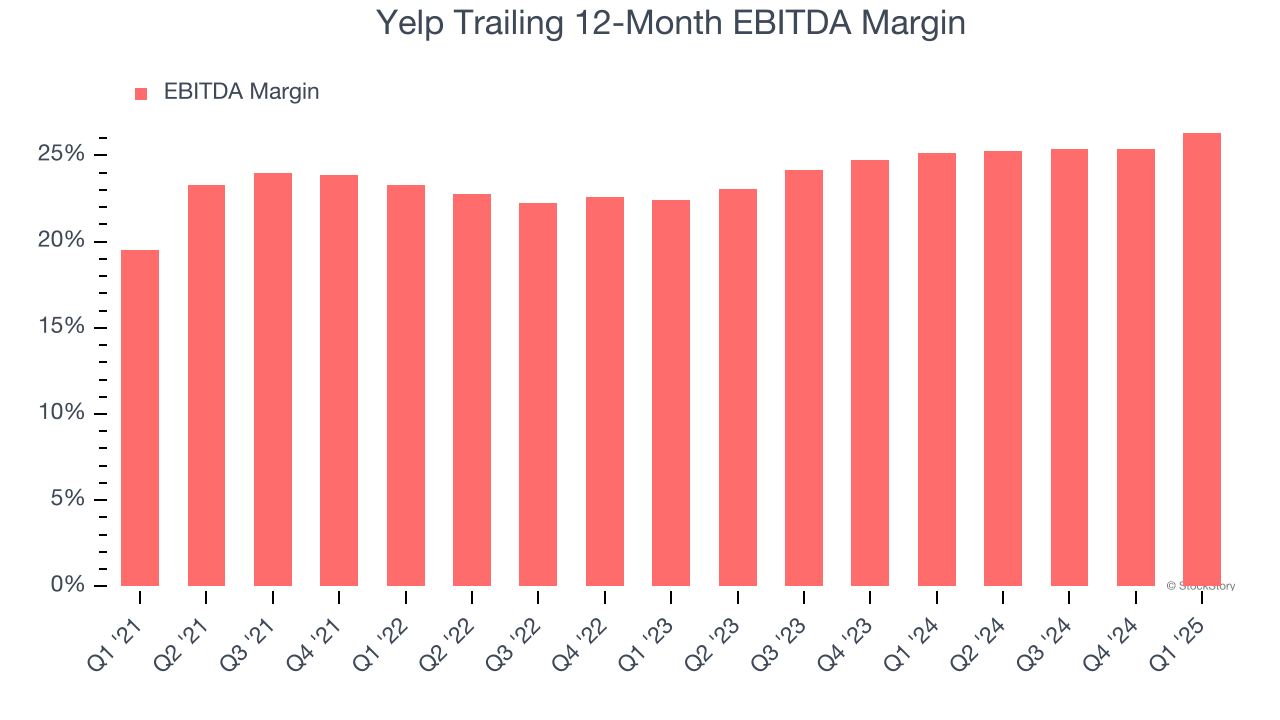

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Yelp has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 25.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

Growth in Customer Spending Lags Peers

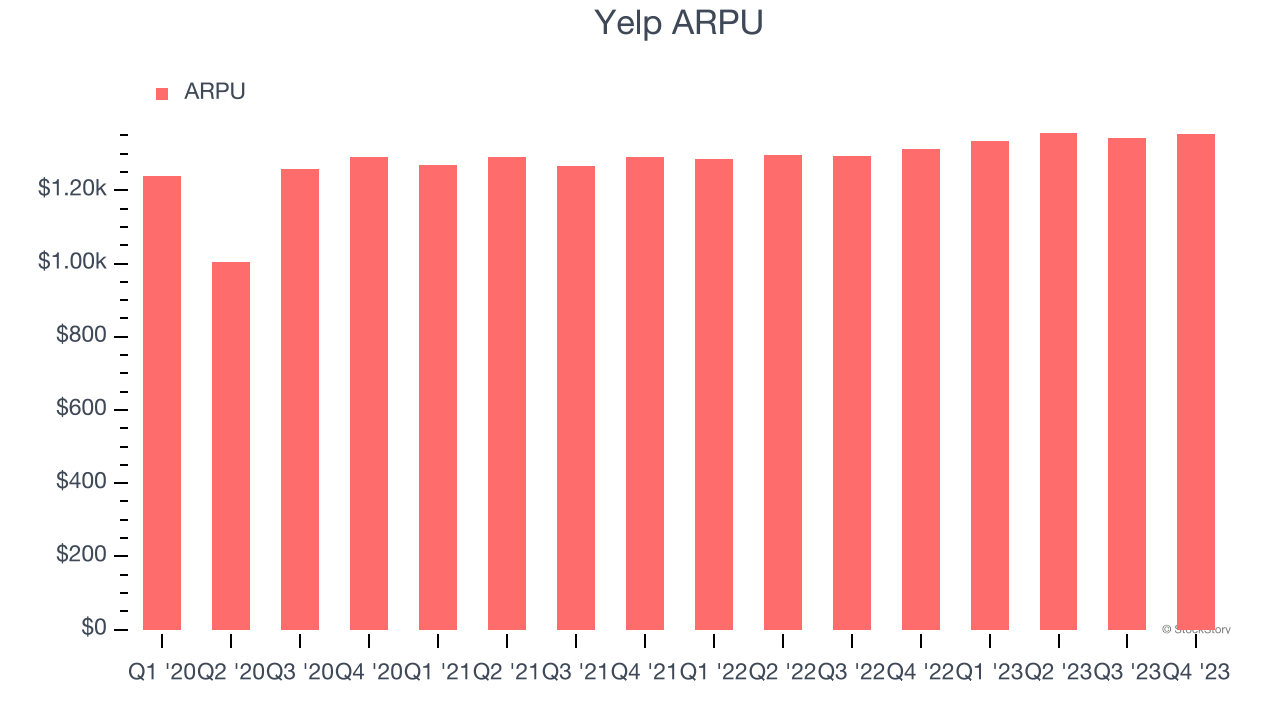

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Yelp’s audience and its ad-targeting capabilities.

Yelp’s ARPU growth has been mediocre over the last two years, averaging 3.9%. This raises questions about its platform’s health and ability to engage its users effectively.

Final Judgment

Yelp’s merits more than compensate for its flaws. With the recent decline, the stock trades at 6.5× forward EV/EBITDA (or $34.97 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.