Wrapping up Q1 earnings, we look at the numbers and key takeaways for the vertical software stocks, including Guidewire (NYSE: GWRE) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 4 vertical software stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Luckily, vertical software stocks have performed well with share prices up 14.9% on average since the latest earnings results.

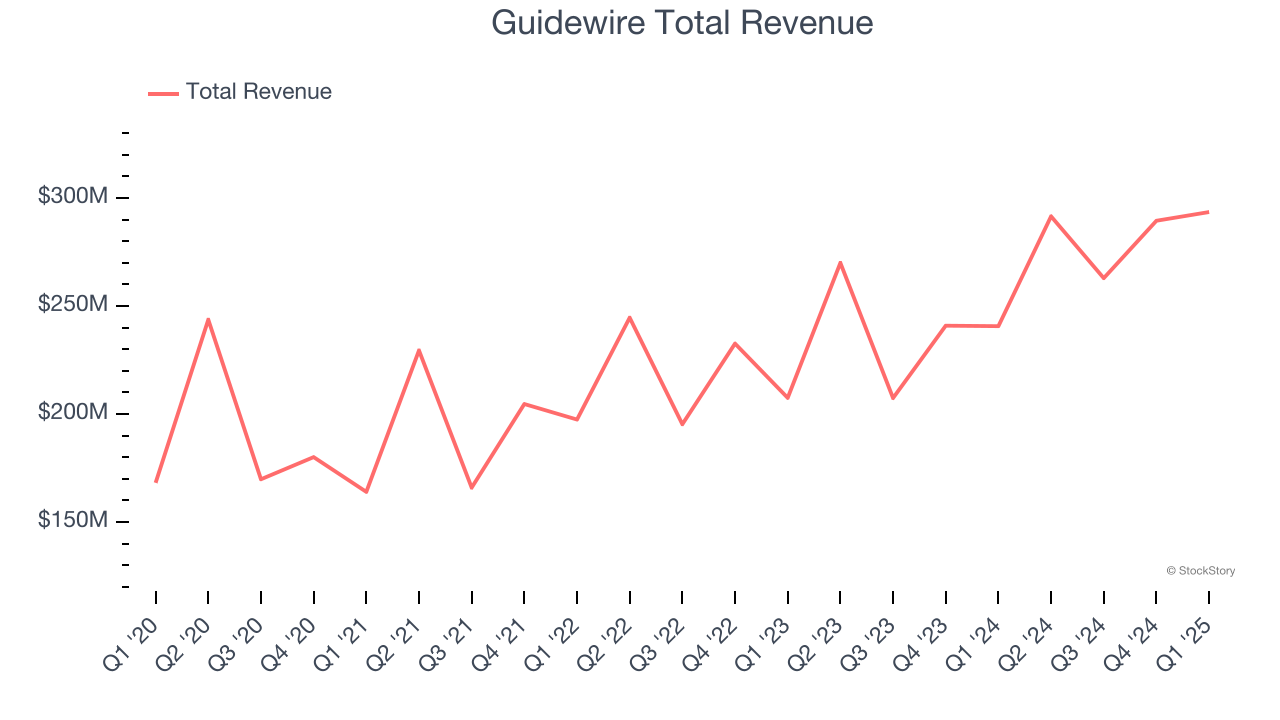

Guidewire (NYSE: GWRE)

Founded by two individuals involved in the development of leading procurement software Ariba, Guidewire (NYSE: GWRE) offers insurance companies a software-as-a-service platform to help sell their products and manage their workflows.

Guidewire reported revenues of $293.5 million, up 22% year on year. This print exceeded analysts’ expectations by 2.4%. Overall, it was a strong quarter for the company with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Guidewire achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 5.6% since reporting and currently trades at $230.38.

Is now the time to buy Guidewire? Access our full analysis of the earnings results here, it’s free.

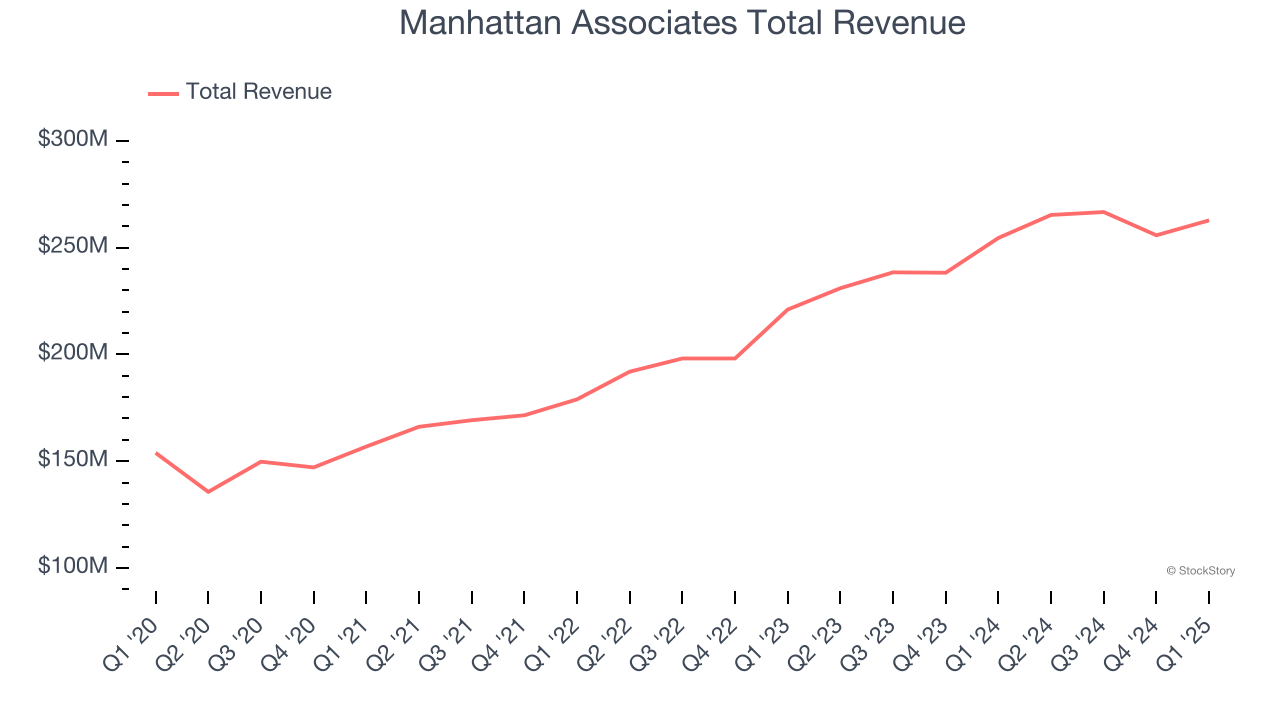

Best Q1: Manhattan Associates (NASDAQ: MANH)

Boasting major consumer staples and pharmaceutical companies as clients, Manhattan Associates (NASDAQ: MANH) offers a software-as-service platform that helps customers manage their supply chains.

Manhattan Associates reported revenues of $262.8 million, up 3.2% year on year, outperforming analysts’ expectations by 2.3%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance beating analysts’ expectations.

The market seems happy with the results as the stock is up 23.2% since reporting. It currently trades at $199.93.

Is now the time to buy Manhattan Associates? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Alarm.com (NASDAQ: ALRM)

Founded in 2000 as a business unit within MicroStrategy, Alarm.com (NASDAQ: ALRM) is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

Alarm.com reported revenues of $238.8 million, up 7% year on year, exceeding analysts’ expectations by 1.9%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

Alarm.com delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 4.3% since the results and currently trades at $57.69.

Read our full analysis of Alarm.com’s results here.

Bentley (NASDAQ: BSY)

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ: BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Bentley reported revenues of $370.5 million, up 9.7% year on year. This number topped analysts’ expectations by 1.4%. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

Bentley had the weakest performance against analyst estimates among its peers. The stock is up 26.5% since reporting and currently trades at $55.35.

Read our full, actionable report on Bentley here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.