Over the last six months, Intuitive Surgical’s shares have sunk to $480, producing a disappointing 18.9% loss - a stark contrast to the S&P 500’s 6.4% gain. This may have investors wondering how to approach the situation.

Following the drawdown, is now a good time to buy ISRG? Find out in our full research report, it’s free.

Why Does ISRG Stock Spark Debate?

Pioneering minimally invasive surgery since its first da Vinci system was FDA-cleared in 2000, Intuitive Surgical (NASDAQ: ISRG) develops and manufactures robotic-assisted surgical systems that enable minimally invasive procedures across various medical specialties.

Two Positive Attributes:

1. Elevated Demand Drives Higher Sales Volumes

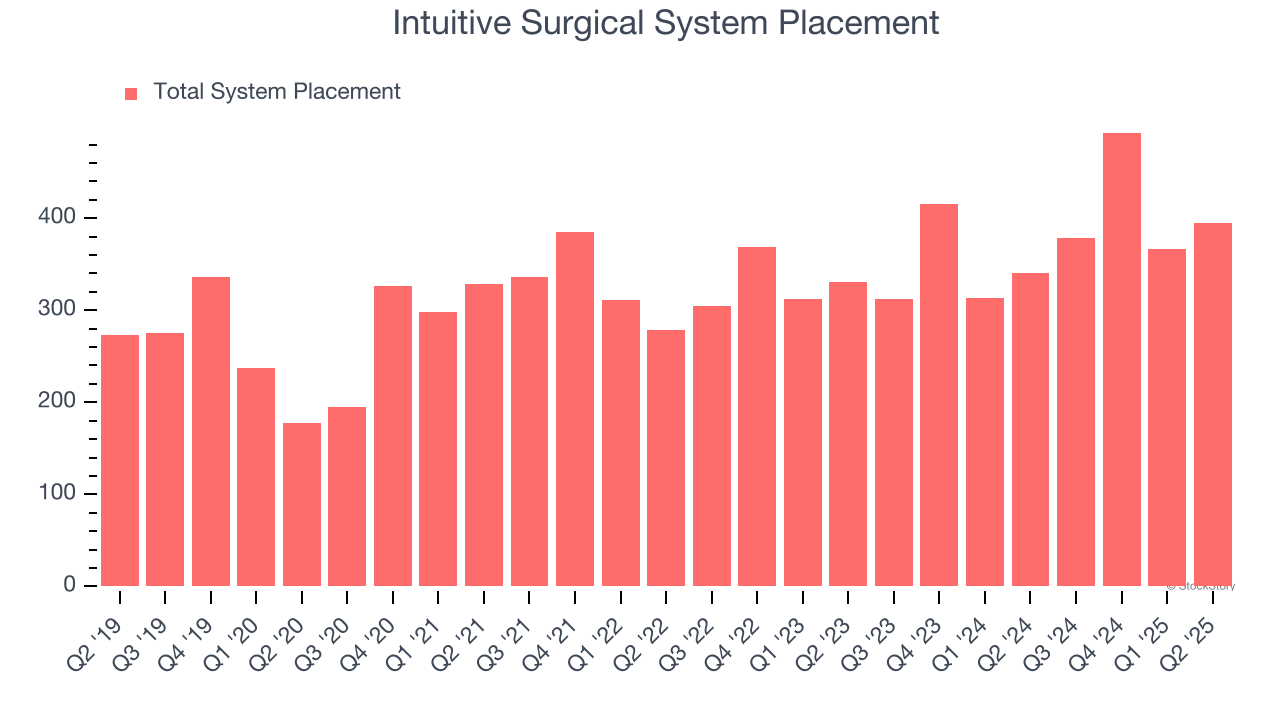

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Surgical Equipment & Consumables - Specialty company because there’s a ceiling to what customers will pay.

Intuitive Surgical’s system placement punched in at 395 in the latest quarter, and over the last two years, averaged 11.4% year-on-year growth. This performance was impressive and shows its offerings have a unique value proposition (and perhaps some degree of customer loyalty).

2. Outstanding Long-Term EPS Growth

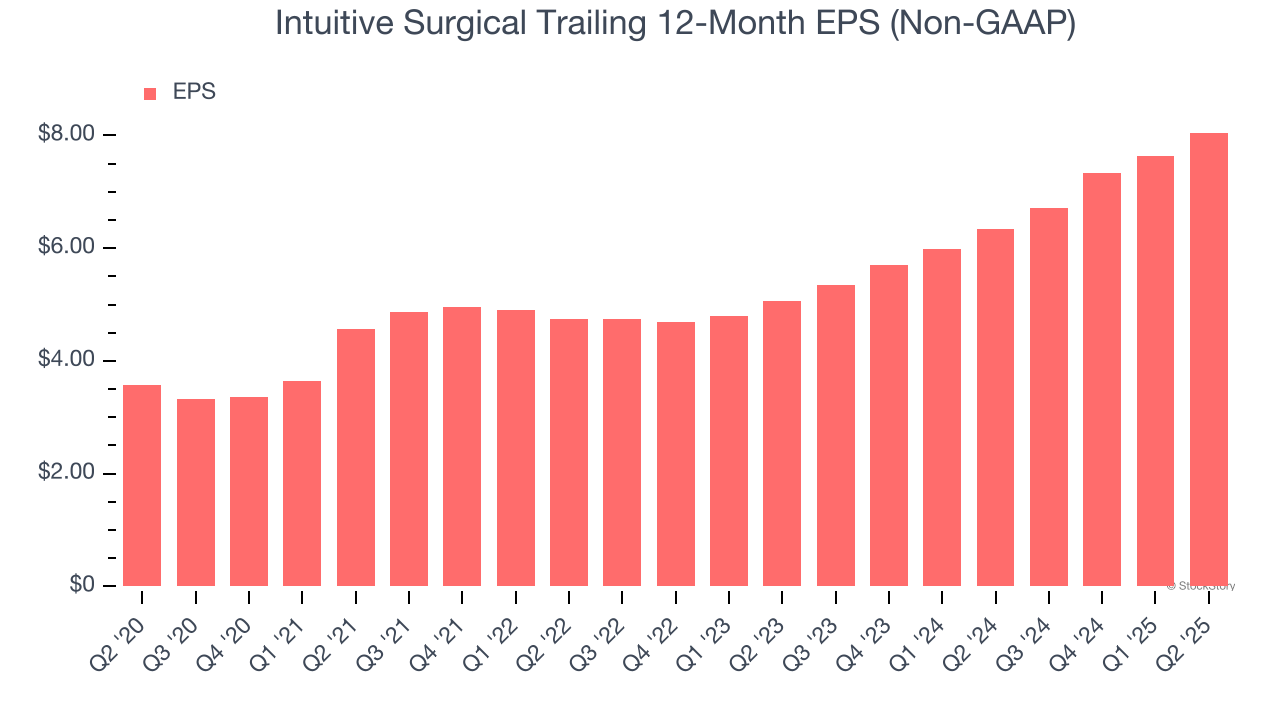

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Intuitive Surgical’s astounding 17.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

One Reason to be Careful:

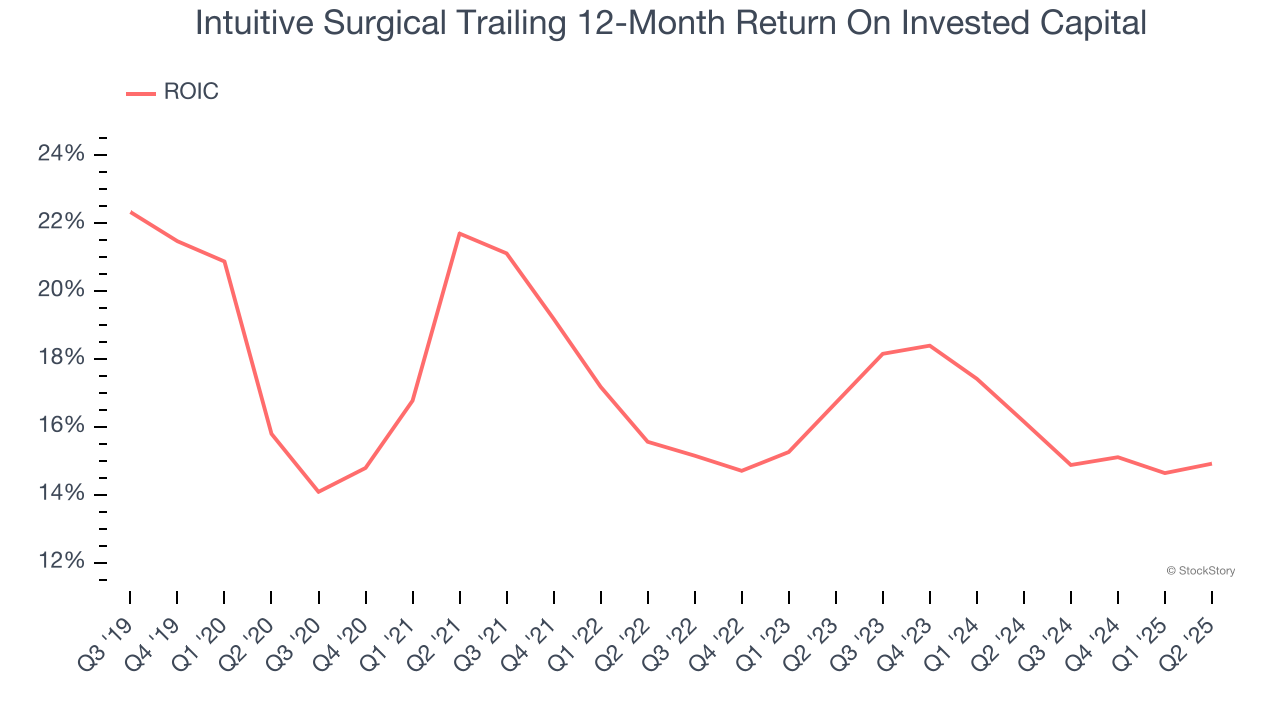

New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Intuitive Surgical’s ROIC decreased by 3.1 percentage points annually over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

Final Judgment

Intuitive Surgical has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 57.4× forward P/E (or $480 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.