Fashion conglomerate PVH (NYSE: PVH) reported Q2 CY2025 results beating Wall Street’s revenue expectations, with sales up 4.5% year on year to $2.17 billion. Its non-GAAP profit of $2.52 per share was 25.9% above analysts’ consensus estimates.

Is now the time to buy PVH? Find out by accessing our full research report, it’s free.

PVH (PVH) Q2 CY2025 Highlights:

- Revenue: $2.17 billion vs analyst estimates of $2.12 billion (4.5% year-on-year growth, 2.3% beat)

- Adjusted EPS: $2.52 vs analyst estimates of $2.00 (25.9% beat)

- Management reiterated its full-year Adjusted EPS guidance of $10.88 at the midpoint

- Operating Margin: 6.1%, down from 8.4% in the same quarter last year

- Constant Currency Revenue rose 1% year on year (-4.9% in the same quarter last year)

- Market Capitalization: $3.92 billion

Company Overview

Founded in 1881 by a husband and wife duo, PVH (NYSE: PVH) is a global fashion conglomerate with iconic brands like Calvin Klein and Tommy Hilfiger.

Revenue Growth

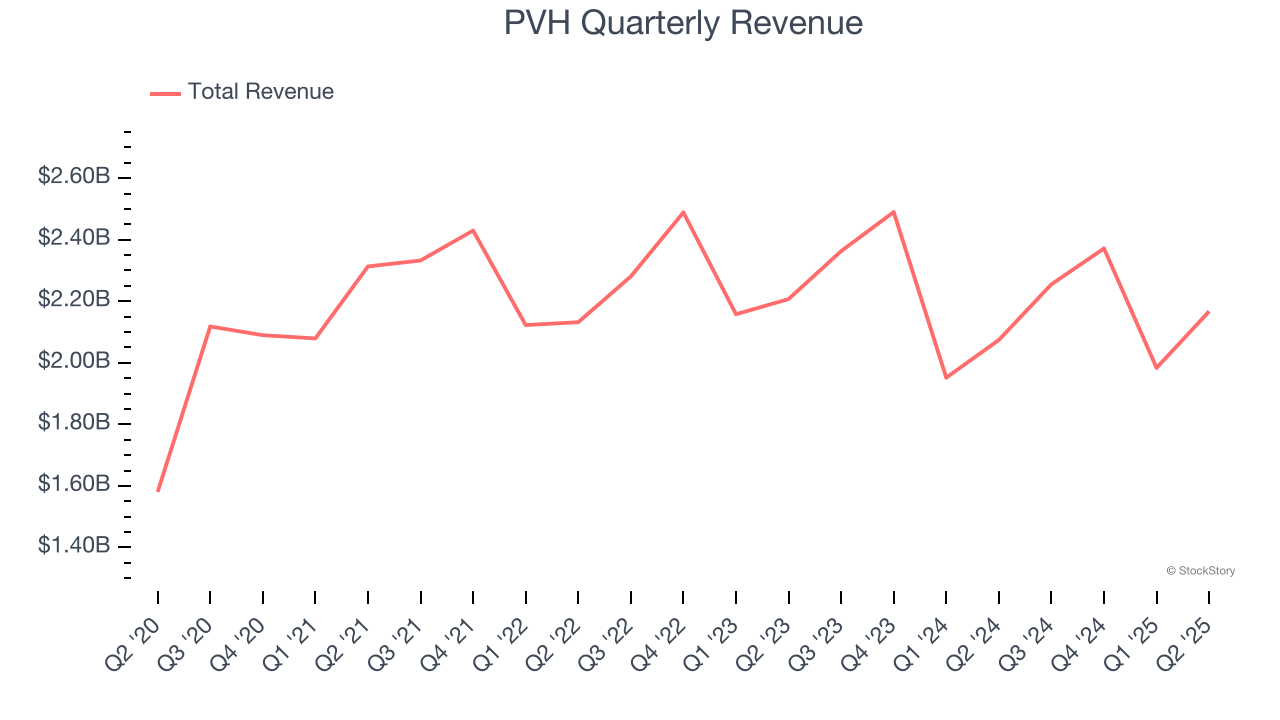

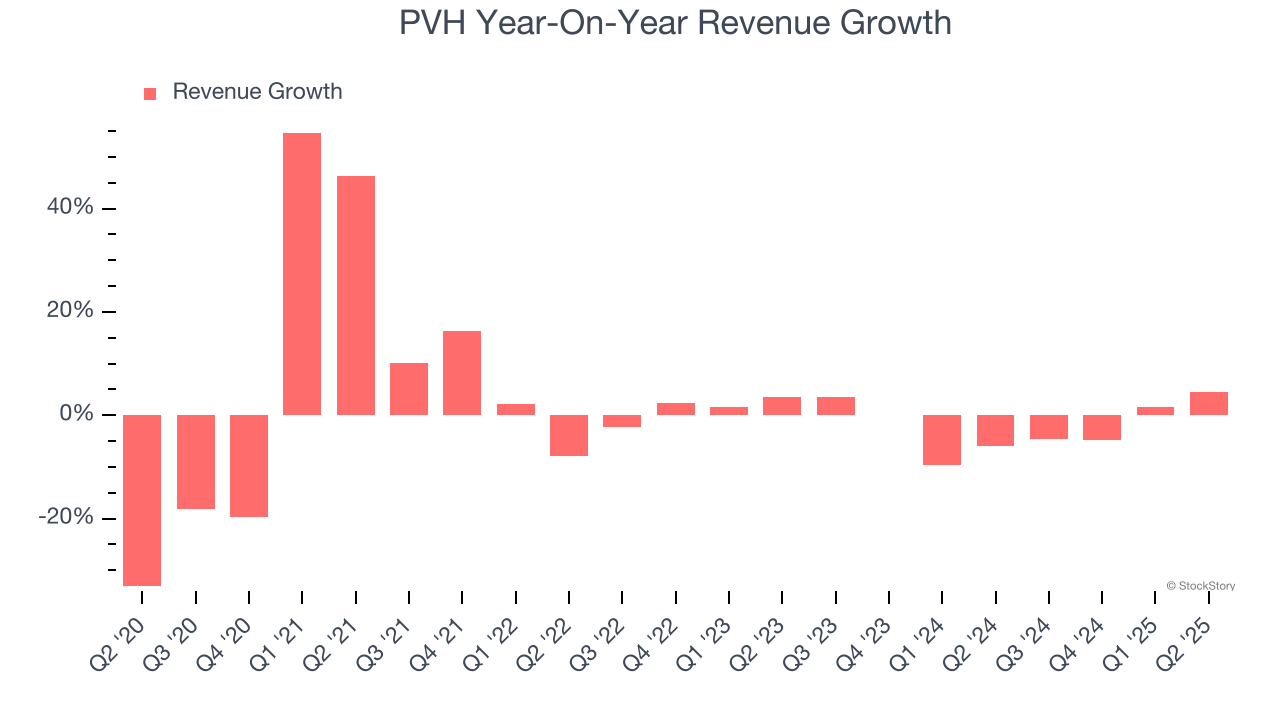

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, PVH’s sales grew at a weak 1.6% compounded annual growth rate over the last five years. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. PVH’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2% annually.

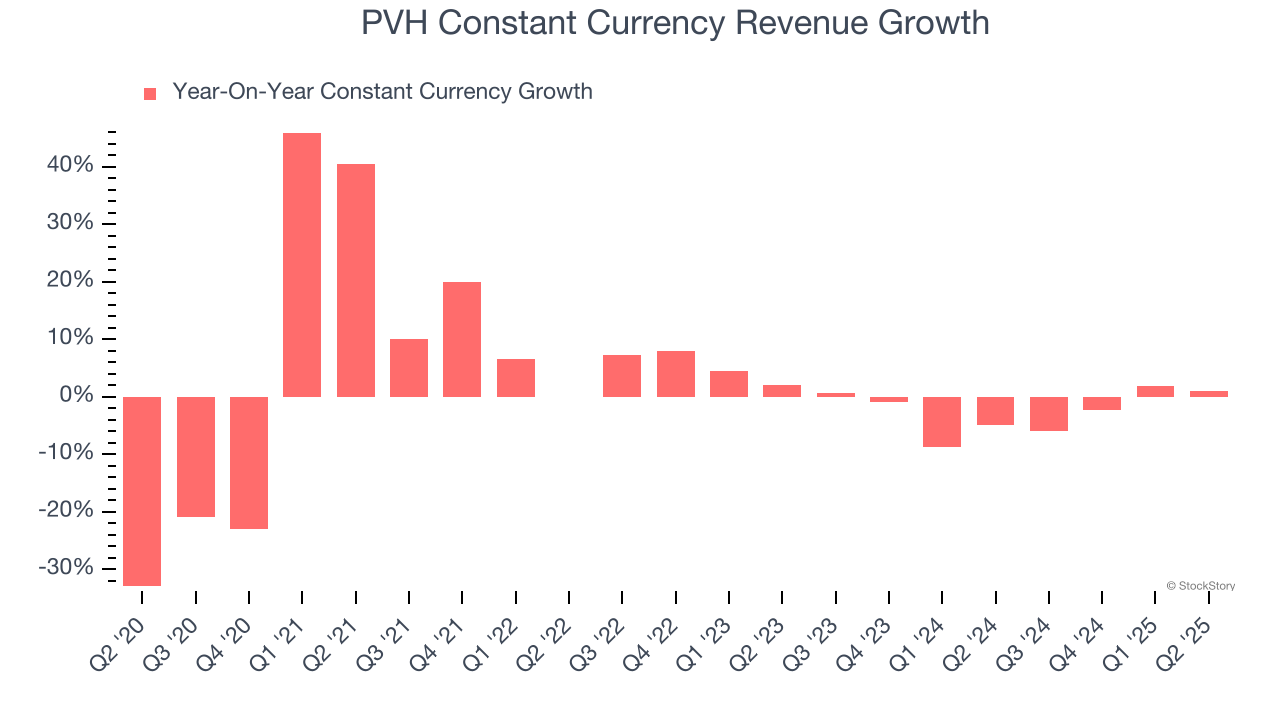

PVH also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 2.4% year-on-year declines. Because this number aligns with its normal revenue growth, we can see that PVH has properly hedged its foreign currency exposure.

This quarter, PVH reported modest year-on-year revenue growth of 4.5% but beat Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

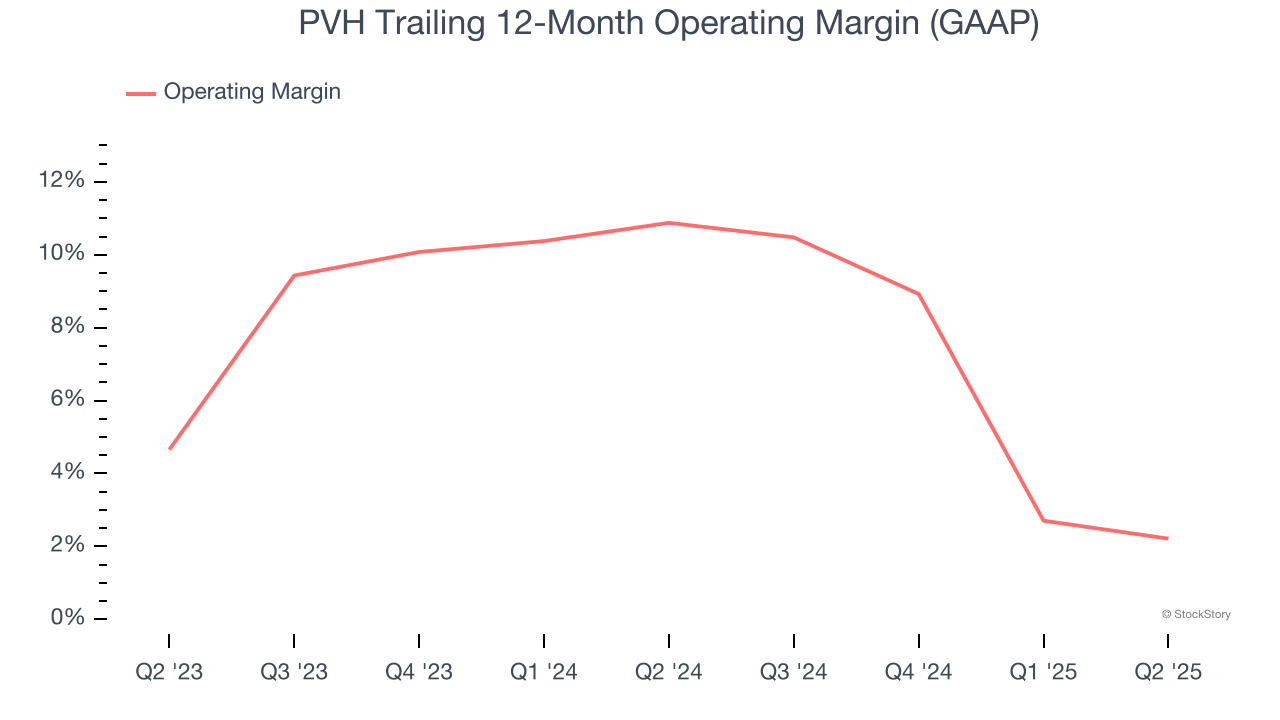

PVH’s operating margin has shrunk over the last 12 months and averaged 6.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q2, PVH generated an operating margin profit margin of 6.1%, down 2.2 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

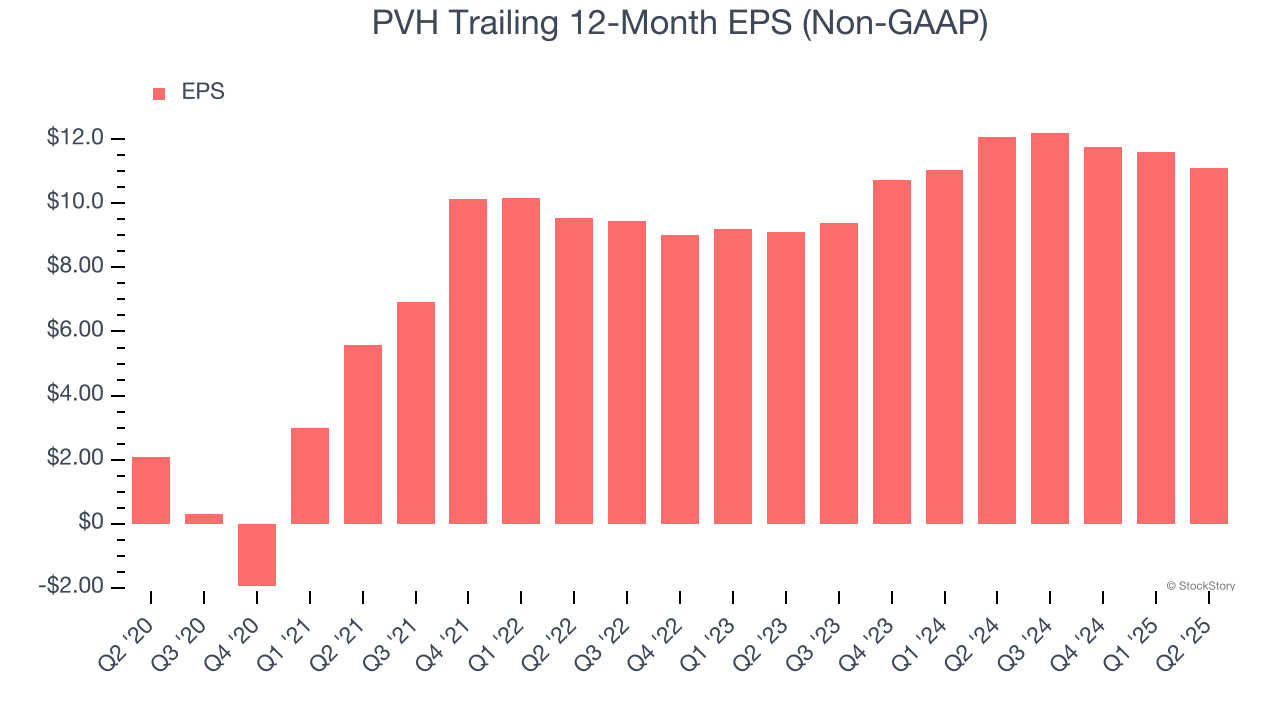

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

PVH’s EPS grew at an astounding 39.8% compounded annual growth rate over the last five years, higher than its 1.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q2, PVH reported adjusted EPS of $2.52, down from $3.01 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects PVH’s full-year EPS of $11.12 to grow 6.7%.

Key Takeaways from PVH’s Q2 Results

It was good to see PVH beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 5.2% to $86.75 immediately after reporting.

Sure, PVH had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.