Financial automation platform BILL (NYSE: BILL) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 11.5% year on year to $383.3 million. On the other hand, next quarter’s revenue guidance of $390 million was less impressive, coming in 1.1% below analysts’ estimates. Its non-GAAP profit of $0.53 per share was 30.4% above analysts’ consensus estimates.

Is now the time to buy BILL? Find out by accessing our full research report, it’s free.

BILL (BILL) Q2 CY2025 Highlights:

- Revenue: $383.3 million vs analyst estimates of $375.9 million (11.5% year-on-year growth, 2% beat)

- Adjusted EPS: $0.53 vs analyst estimates of $0.41 (30.4% beat)

- Adjusted Operating Income: $56.35 million vs analyst estimates of $46.03 million (14.7% margin, 22.4% beat)

- Revenue Guidance for Q3 CY2025 is $390 million at the midpoint, below analyst estimates of $394.4 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.10 at the midpoint, missing analyst estimates by 3.6%

- Operating Margin: -5.8%, in line with the same quarter last year

- Free Cash Flow Margin: 17.9%, down from 25.4% in the previous quarter

- Customers: 493,800, up from 488,600 in the previous quarter

- Market Capitalization: $4.19 billion

Company Overview

Transforming the messy back-office financial operations that plague small business owners, BILL (NYSE: BILL) provides a cloud-based platform that automates accounts payable, accounts receivable, and expense management for small and midsize businesses.

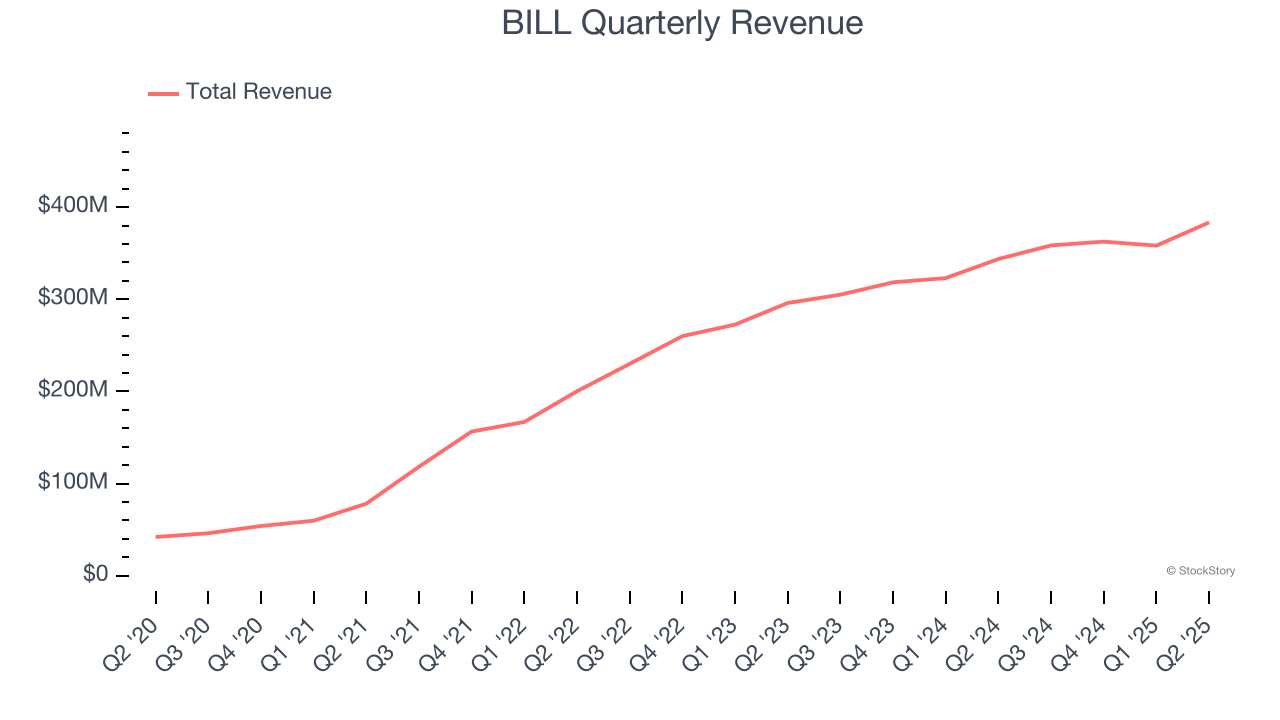

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, BILL’s 31.6% annualized revenue growth over the last three years was impressive. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, BILL reported year-on-year revenue growth of 11.5%, and its $383.3 million of revenue exceeded Wall Street’s estimates by 2%. Company management is currently guiding for a 8.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.9% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is above average for the sector and implies the market is baking in some success for its newer products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

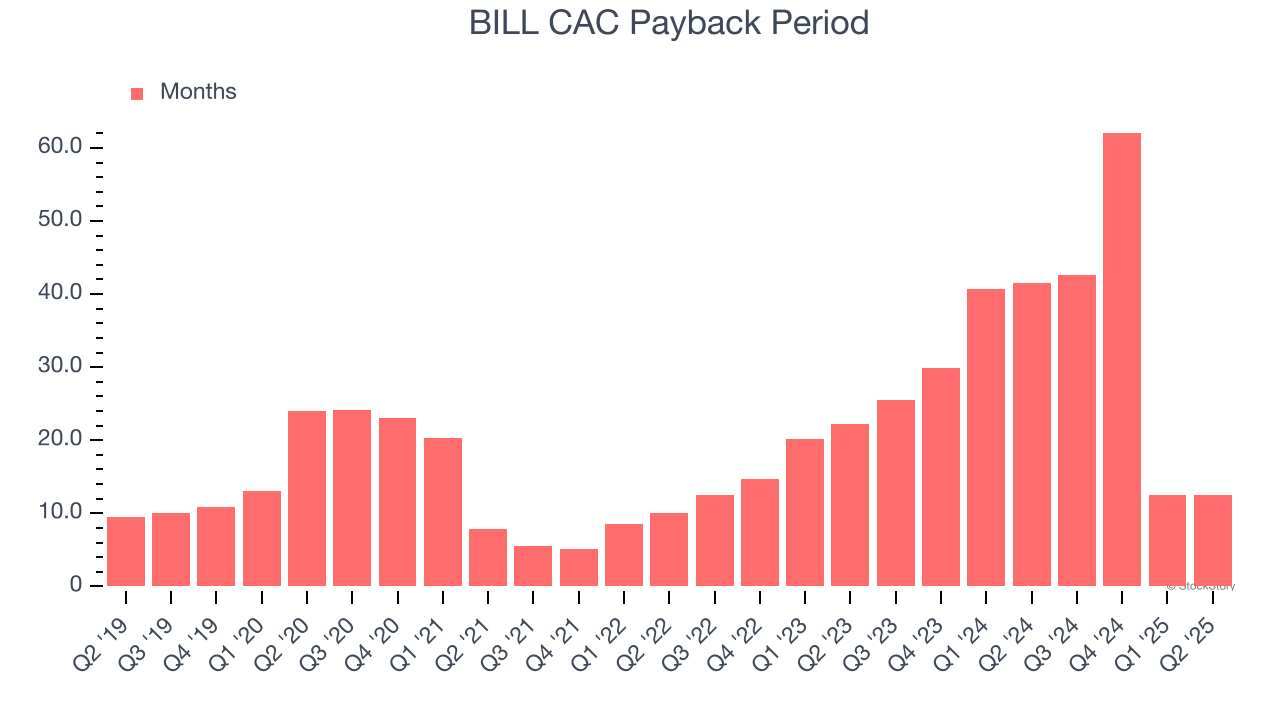

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

BILL is extremely efficient at acquiring new customers, and its CAC payback period checked in at 12.5 months this quarter. The company’s rapid sales cycles stem from its strong brand reputation and self-serve model, where it can onboard many small customers with little to no oversight. These dynamics give BILL more resources to pursue new product initiatives so it can potentially move up market and serve enterprise clients, which can provide a second leg of growth.

Key Takeaways from BILL’s Q2 Results

It was encouraging to see BILL beat analysts’ revenue expectations this quarter. On the other hand, its full-year revenue guidance slightly missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $41.50 immediately following the results.

BILL underperformed this quarter, but does that create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.