The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how therapeutics stocks fared in Q2, starting with Biogen (NASDAQ: BIIB).

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 9 therapeutics stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 5.1%.

Luckily, therapeutics stocks have performed well with share prices up 12.2% on average since the latest earnings results.

Best Q2: Biogen (NASDAQ: BIIB)

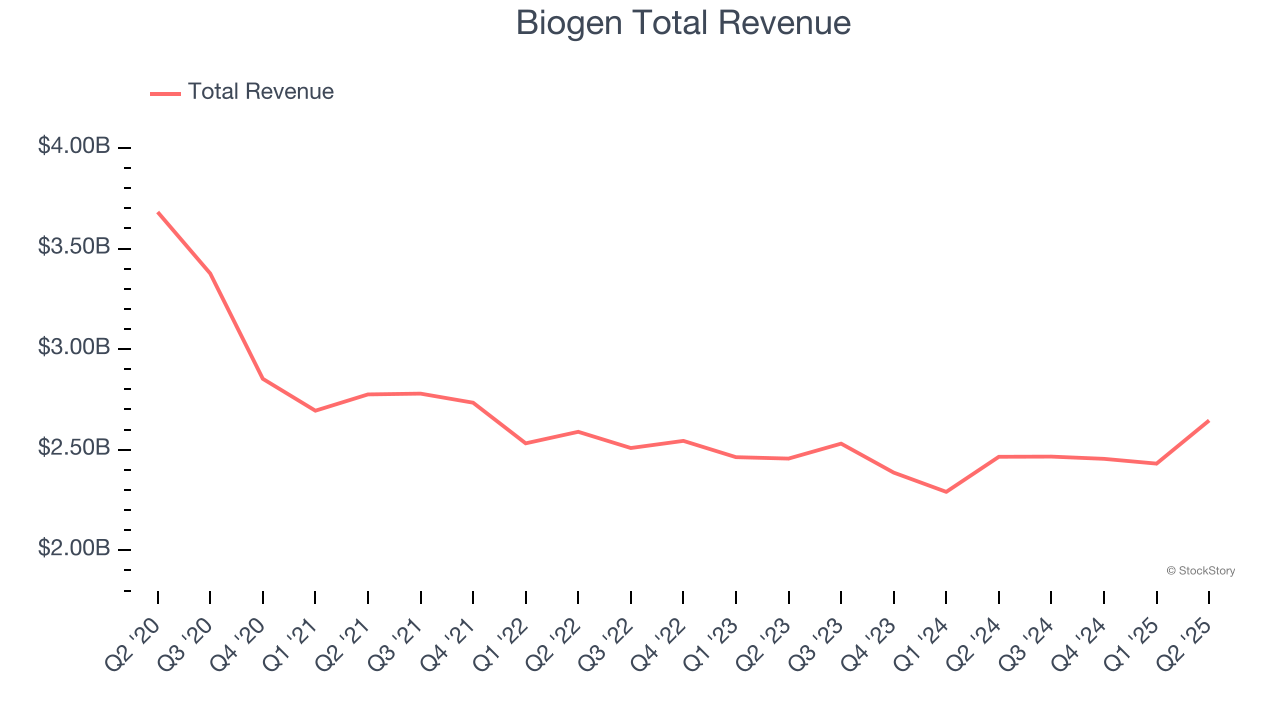

Founded in 1978 and pioneering treatments for some of medicine's most complex challenges, Biogen (NASDAQ: BIIB) develops and markets therapies for neurological conditions, including multiple sclerosis, Alzheimer's disease, spinal muscular atrophy, and rare diseases.

Biogen reported revenues of $2.65 billion, up 7.3% year on year. This print exceeded analysts’ expectations by 13.7%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

Biogen pulled off the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 14.1% since reporting and currently trades at $144.81.

Is now the time to buy Biogen? Access our full analysis of the earnings results here, it’s free.

Myriad Genetics (NASDAQ: MYGN)

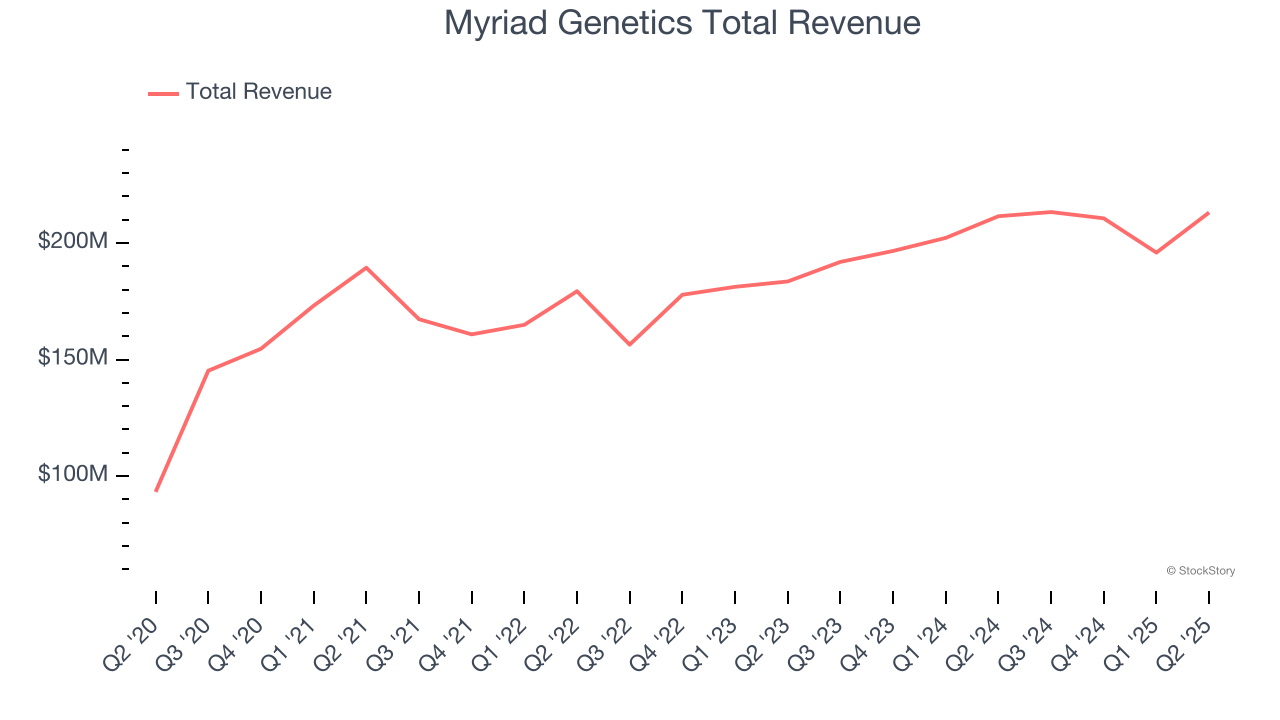

Founded in 1991 as one of the pioneers in translating genetic discoveries into clinical applications, Myriad Genetics (NASDAQ: MYGN) develops genetic tests that assess disease risk, guide treatment decisions, and provide insights across oncology, women's health, and mental health.

Myriad Genetics reported revenues of $213.1 million, flat year on year, outperforming analysts’ expectations by 5.5%. The business had a stunning quarter with a beat of analysts’ EPS estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Myriad Genetics delivered the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 98.2% since reporting. It currently trades at $7.65.

Is now the time to buy Myriad Genetics? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: United Therapeutics (NASDAQ: UTHR)

Founded by a mother seeking treatment for her daughter's pulmonary arterial hypertension, United Therapeutics (NASDAQ: UTHR) develops and commercializes medications for chronic lung diseases and other life-threatening conditions, with a focus on pulmonary hypertension treatments.

United Therapeutics reported revenues of $798.6 million, up 11.7% year on year, falling short of analysts’ expectations by 0.5%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

United Therapeutics delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 33.9% since the results and currently trades at $397.80.

Read our full analysis of United Therapeutics’s results here.

BioMarin Pharmaceutical (NASDAQ: BMRN)

Pioneering treatments for conditions that often had no previous therapeutic options, BioMarin Pharmaceutical (NASDAQ: BMRN) develops and commercializes therapies that address the root causes of rare genetic disorders, particularly those affecting children.

BioMarin Pharmaceutical reported revenues of $825.4 million, up 15.9% year on year. This number topped analysts’ expectations by 8.4%. It was an exceptional quarter as it also recorded a beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

BioMarin Pharmaceutical achieved the fastest revenue growth among its peers. The stock is down 10.6% since reporting and currently trades at $53.94.

Read our full, actionable report on BioMarin Pharmaceutical here, it’s free.

AbbVie (NYSE: ABBV)

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie (NYSE: ABBV) is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

AbbVie reported revenues of $15.42 billion, up 6.6% year on year. This print surpassed analysts’ expectations by 2.6%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ constant currency revenue and EPS estimates.

The stock is up 14.1% since reporting and currently trades at $216.14.

Read our full, actionable report on AbbVie here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.