Over the past six months, The Marzetti Company’s shares (currently trading at $181.52) have posted a disappointing 5.3% loss, well below the S&P 500’s 9.7% gain. This may have investors wondering how to approach the situation.

Is now the time to buy The Marzetti Company, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is The Marzetti Company Not Exciting?

Even with the cheaper entry price, we don't have much confidence in The Marzetti Company. Here are three reasons we avoid MZTI and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

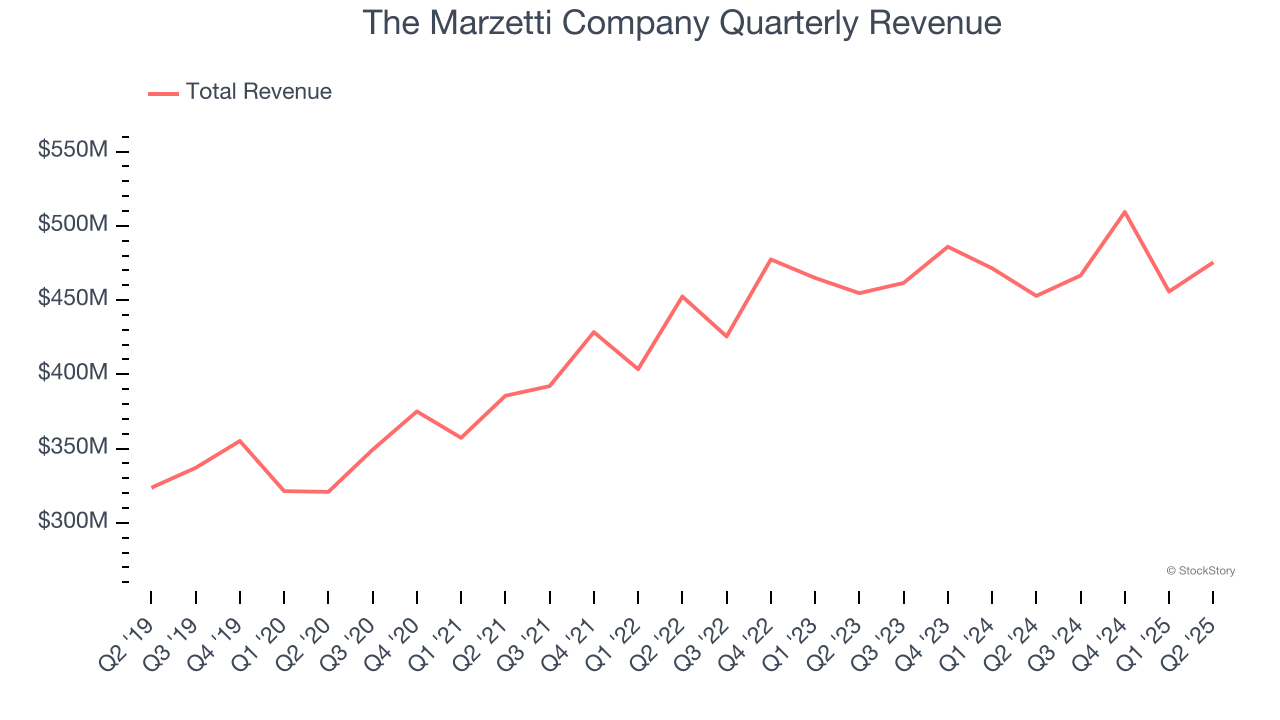

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, The Marzetti Company grew its sales at a tepid 4.4% compounded annual growth rate. This fell short of our benchmark for the consumer staples sector.

2. Fewer Distribution Channels Limit its Ceiling

With $1.91 billion in revenue over the past 12 months, The Marzetti Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect The Marzetti Company’s revenue to rise by 1.6%, a slight deceleration versus This projection doesn't excite us and suggests its products will face some demand challenges.

Final Judgment

The Marzetti Company’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 25.3× forward P/E (or $181.52 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than The Marzetti Company

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.