As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the wireless, cable and satellite industry, including WideOpenWest (NYSE:WOW) and its peers.

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

The 8 wireless, cable and satellite stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates.

While some wireless, cable and satellite stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.8% since the latest earnings results.

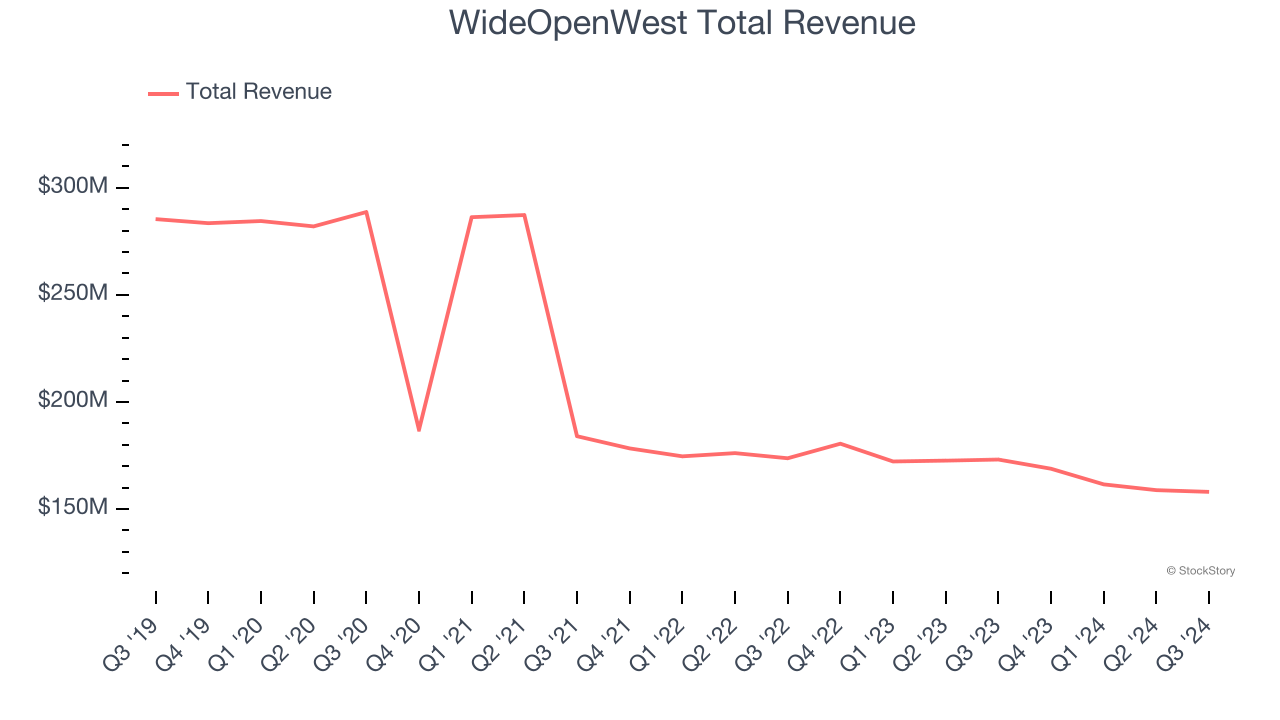

WideOpenWest (NYSE:WOW)

Initially started in Denver as a cable television provider, WideOpenWest (NYSE:WOW) provides high-speed internet, cable, and telephone services to the Midwest and Southeast regions of the U.S.

WideOpenWest reported revenues of $158 million, down 8.7% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ adjusted operating income and EPS estimates.

"During the third quarter we demonstrated the strength of our strategy in our expansion markets where we increased penetration rates to higher levels and grew ARPU," said Teresa Elder, WOW!'s CEO.

WideOpenWest achieved the highest full-year guidance raise but had the slowest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 6.4% since reporting and currently trades at $4.73.

Read our full report on WideOpenWest here, it’s free.

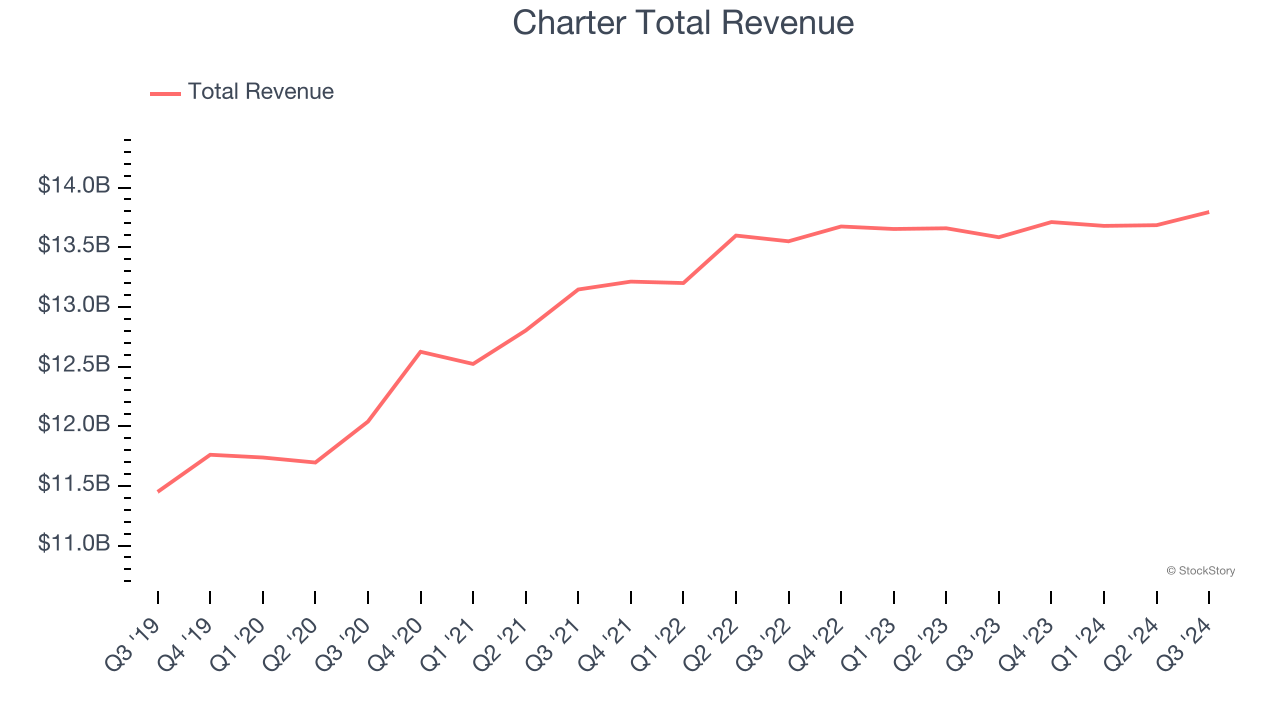

Best Q3: Charter (NASDAQ:CHTR)

Operating as Spectrum, Charter (NASDAQ:CHTR) is a leading telecommunications company offering cable television, high-speed internet, and voice services across the United States.

Charter reported revenues of $13.8 billion, up 1.6% year on year, outperforming analysts’ expectations by 1%. The business had a satisfactory quarter with a decent beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 6.4% since reporting. It currently trades at $348.50.

Is now the time to buy Charter? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Sirius XM (NASDAQ:SIRI)

Known for its commercial-free music channels, Sirius XM (NASDAQ:SIRI) is a broadcasting company that provides satellite radio and online radio services across North America.

Sirius XM reported revenues of $2.17 billion, down 4.4% year on year, falling short of analysts’ expectations by 0.8%. It was a slower quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Sirius XM delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. The company reported 39.07 million users, down 2.5% year on year. As expected, the stock is down 14.4% since the results and currently trades at $23.45.

Read our full analysis of Sirius XM’s results here.

Cable One (NYSE:CABO)

Founded in 1986, Cable One (NYSE:CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

Cable One reported revenues of $393.6 million, down 6.4% year on year. This number topped analysts’ expectations by 0.6%. However, it was a slower quarter as it produced a significant miss of analysts’ EPS and adjusted operating income estimates.

The stock is down 3.5% since reporting and currently trades at $373.30.

Read our full, actionable report on Cable One here, it’s free.

Comcast (NASDAQ:CMCSA)

Formerly known as American Cable Systems, Comcast (NASDAQ:CMCSA) is a multinational telecommunications company offering a wide range of services.

Comcast reported revenues of $32.07 billion, up 6.5% year on year. This number beat analysts’ expectations by 1.1%. Aside from that, it was a mixed quarter as it also produced a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

Comcast delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 9.2% since reporting and currently trades at $38.38.

Read our full, actionable report on Comcast here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.