Television broadcasting and media company Sinclair (NASDAQ: SBGI) will be reporting results tomorrow after market close. Here’s what investors should know.

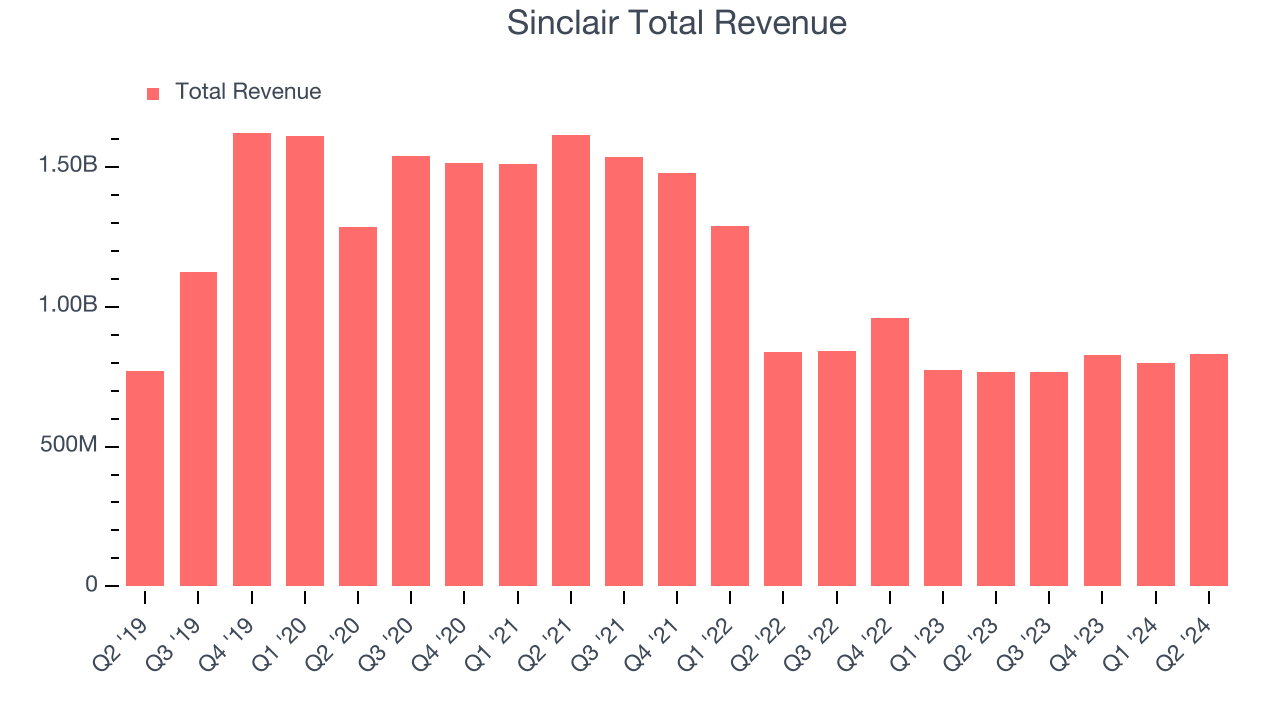

Sinclair missed analysts’ revenue expectations by 1.1% last quarter, reporting revenues of $829 million, up 7.9% year on year. It was a mixed quarter for the company, with an impressive beat of analysts’ earnings estimates but a miss of analysts’ Distribution revenue estimates.

Is Sinclair a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Sinclair’s revenue to grow 20.5% year on year to $924.6 million, a reversal from the 9% decrease it recorded in the same quarter last year. Adjusted earnings are expected to come in at $1.05 per share.

The majority of analysts covering the company have reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Sinclair has missed Wall Street’s revenue estimates six times over the last two years.

Looking at Sinclair’s peers in the consumer discretionary segment, some have already reported their Q3 results, giving us a hint as to what we can expect. FOX delivered year-on-year revenue growth of 11.1%, beating analysts’ expectations by 5.7%, and E.W. Scripps reported revenues up 14.1%, topping estimates by 2.7%.

Read our full analysis of FOX’s results here and E.W. Scripps’s results here.

Investors in the consumer discretionary segment have had steady hands going into earnings, with share prices up 2% on average over the last month. Sinclair is up 1.3% during the same time and is heading into earnings with an average analyst price target of $16.38 (compared to the current share price of $16.72).

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.