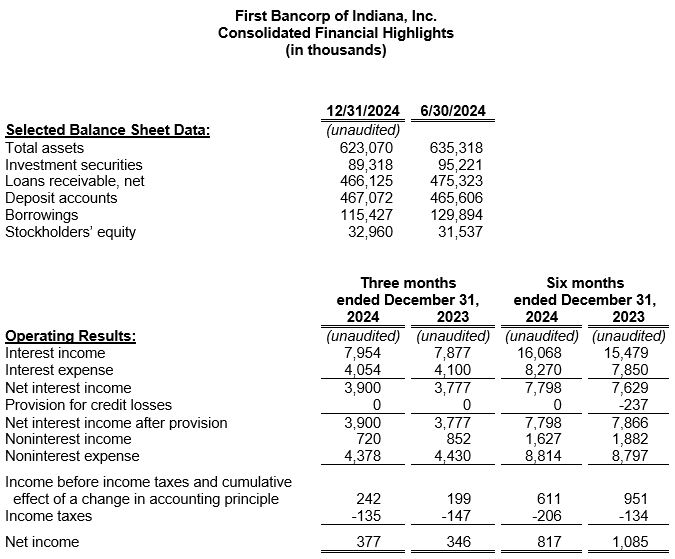

EVANSVILLE, Ind. - Feb. 7, 2025 - PRLog -- First Bancorp of Indiana, Inc. (OTCPK:FBPI), the holding company (the "Company") for First Federal Savings Bank (the "Bank"), reported earnings of $377,000 ($0.22 per diluted common share) for the second fiscal quarter ended December 31, 2024, compared to $346,000 ($0.21 per diluted common share) for the same quarter a year ago. Earnings for the first half of Fiscal 2025 totaled $817,000 ($0.48 per diluted common share), compared to $1.09 million ($0.65 per diluted common share) last fiscal year-to-date. Earnings for the six-month period equate to a return on average assets (ROA) of 0.26% and a return on average equity (ROE) of 4.92%. This compares to an annualized ROA of 0.34% and an annualized ROE of 7.52% last fiscal year.

Net interest income improved from the prior year. Increased yields on earning assets, provided by higher interest rates on newly originated loans and adjustable-rate loans that have repriced upward, outpaced elevated funding costs. The Company's Net Interest Margin (NIM), as a percentage of average interest-earning assets, was 2.66% for the six months ended December 31, 2024, an improvement from the 2.60% reported for the same timeframe last year. Gains on loan sales declined in the most recent quarter as higher loan rates slowed loan origination volume. Despite higher data processing costs and professional fees, non-interest expenses for the six month period were nearly unchanged from a year ago thanks to prudent overhead cost reductions.

The securities portfolio, which is primarily composed of investment-grade municipal bonds or obligations of US government agencies, declined to $89.3 million on December 31, 2024, following the sale of $5.3 million of securities in the first quarter.

Net loans outstanding, at $466.1 million on December 31, 2024, declined $9.2 million during the first half of the fiscal year, primarily due to the sale of a $13.3 million pool of single-family mortgage loans in December. Commercial loan production slowed to $11.9 million for the first half of the fiscal year. Single-family mortgage loan production added $21.7 million during the same timeframe, with construction lending accounting for more than one-fourth of this activity. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, totaled $7.8 million.

No provision for credit losses on loans was recorded in the six months ended December 31, 2024. Net loan chargeoffs totaled $75,800 for the first two quarters of the fiscal year. The ratio of loans 90 days or more delinquent or loans on nonaccrual status to total loans was 1.76% on December 31, 2024, compared to 0.89% a year ago. Overall, the Allowance for Credit Losses, including reserves for investment securities and unfunded commitments, stood at $5.57 million at quarter end. The portion of the allowance attributed to the loan portfolio represented 1.14% of at-risk loans. Although management believes that the allowance is adequate, a slowing economy, higher interest rates, and persistent inflation may have an adverse effect on the credit quality of the loan portfolio. Management remains in close contact with our most vulnerable borrowers and will provide to the allowance, as necessary.

Deposit accounts, totaling $467.1 million on December 31, 2024, have increased by $1.5 million since the beginning of the fiscal year. Local deposit rates have moderated in recent months and wholesale funding levels declined, reducing the cost of deposits to an annualized 2.62% for the quarter. Similarly, the Company's total cost of funds, including FHLB advances and debt of the holding company, totaled an annualized 2.76% for the same period.

As a part of the Bank's Liquidity Management Plan, contingency funding sources are available and liquidity stress tests determine adequacy. First Federal Savings Bank maintains lines of credit and additional borrowing capacity with the Federal Reserve Bank's discount window and the Federal Home Loan Bank.

Stockholders' equity totaled $33.0 million on December 31, 2024, which includes a $9.7 million fair value reduction to the available for sale securities portfolio given the rapid rise in market interest rates. This securities portfolio adjustment is not a part of the regulatory capital calculations, and gains or losses in the securities portfolio are only recognized in earnings if a security is sold. Based on the 1,699,786 outstanding common shares on December 31, 2024, the book value per share of FBPI stock was $19.39.

At December 31, 2024, the Bank's Tier 1 Leverage, Tier 1 Risk Based and Total Risk Based Capital ratios were 8.41%, 12.12% and 13.36%, respectively.

This press release may contain statements that are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors including, but not limited to: general economic conditions; prices for real estate in the Company's market areas; the interest rate environment and the impact of the interest rate environment on our business, financial condition and results of operations; our ability to successfully execute our strategy to conserve capital, enhance liquidity and earnings, and reduce higher funding costs; the Bank's ability to pay dividends to the Company to fund the payment of cash dividends on the Company's common stock, and the ability of the Bank to receive any required regulatory approval or non-objection in order to do so; changes in the demand for loans; deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the outcome of pending or threatened litigation, or of matters before regulatory agencies; changes in law, governmental policies and regulations; and rapidly changing technology affecting financial services. Accordingly, actual results may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company or any other person that results expressed therein will be achieved. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

Contact

Michael H Head

President & CEO

***@fbei.net

Photos: (Click photo to enlarge)

Source: First Bancorp of Indiana Inc (OTCPK:FBPI)

Read Full Story - First Bancorp of Indiana, Inc. Announces Financial Results - December 31, 2024 | More news from this source

Press release distribution by PRLog

First Bancorp of Indiana, Inc. Announces Financial Results - December 31, 2024

February 07, 2025 at 20:19 PM EST