Cathie Wood, founder and CEO of Ark Invest, does not usually back away from her highest‑conviction ideas, which is exactly why her steady selling of Tesla (TSLA) shares has everyone’s attention. Ark Invest has been trimming Tesla even as the stock trades near $475 and has a record free cash flow of nearly $4 billion.

Earlier in the year, the tone was very different as Ark leaned into weakness rather than backing away from the story. When Tesla sold off after its Q2 2025 earnings report, Ark stepped in and bought the post-earnings dip, scooping up 143,190 TSLA shares across three flagship exchange-traded funds (ETFs).

That makes today’s selling harder to ignore for anyone trying to read the next chapter in the TSLA story. So the real question for investors is simple. If one of Tesla’s most famous long-term bulls is taking chips off the table at these prices, should you be following her out the door, leaning into the story, or doing something in between? Let’s dive in.

Tesla’s Rally Runs Into Margins

Tesla is an American electric vehicle (EV) and clean energy manufacturer headquartered in Austin, Texas, focused on EVs, batteries, and software-driven mobility solutions.

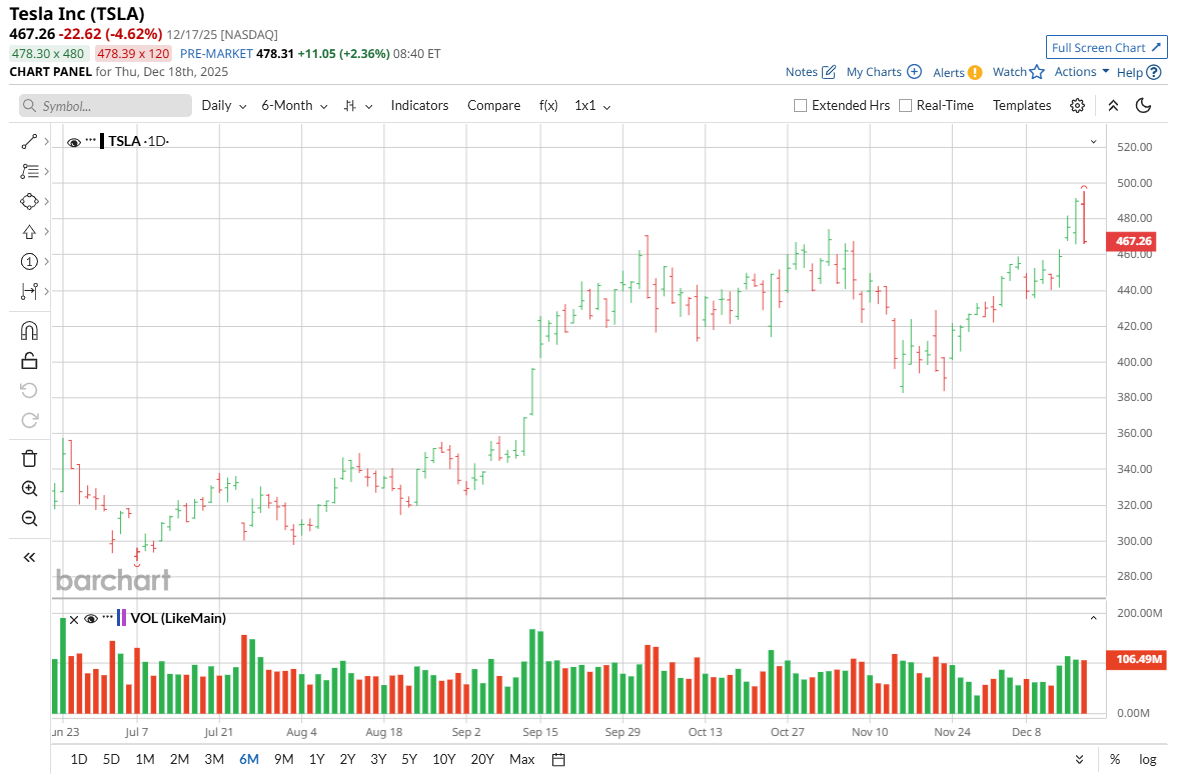

Tesla currently trades around $467, with a year-to-date gain of 15.7%.

It now carries a market capitalization of roughly $1.5 trillion, supported by a trailing price-to-earnings (P/E) ratio of 337.85x versus a sector median of 16.58x and a forward P/E of 415.72x against 17.76x. This valuation backdrop helps explain why even long-time bulls may feel compelled to trim holdings.

Tesla’s latest earnings report for the third quarter underscores that tension between lofty expectations and mixed fundamentals. TSLA delivered earnings per share (EPS) of $0.37, missing the $0.41 consensus by $0.04 and posting a negative surprise of 9.76%. This result came despite revenue of $28.10 billion, which exceeded estimates of $26.37 billion and showed that demand remains robust at the top line.

TSLA’s profitability metrics paint a more cautious picture. Tesla’s operating expenses jumped 50% year-over-year to $3.43 billion as spending ramped on robotaxis and Optimus, driving operating margins down to 5.8% from 10.8%. This left gross profit up just 1% on 12% revenue growth, showing how much investment is pressuring near-term earnings power. Tesla still generated $4.8 billion in free cash flow, a record that dwarfs the prior quarter’s $146 million.

Why Tesla’s Story Still Sells

Tesla recently locked in a supply agreement with Samsung SDI, valued at roughly $2.1 billion over three years. The agreement will help Tesla secure battery cells for its energy storage systems, including Megapack and Powerwall products. This deal directly addresses the company's production constraints in energy storage, a segment that contributed 12% of total revenue in Q3.

Beyond batteries, robotaxis remain the headline-grabbing catalyst. Elon Musk announced plans to remove safety drivers from Austin robotaxis within three weeks. He also teased a next-generation Full Self-Driving model that is “an order of magnitude bigger,” with a possible launch window in January or February 2026.

Tesla is even hiring robotaxi operators in New York City, which hints at ambitions to push into one of the toughest urban driving environments. The catch is that regulatory approval remains uncertain, full autonomy at scale is still years away, and competitors like Waymo already have more than 100 million miles logged without safety drivers.

Meanwhile, another narrative is the idea of Tesla growing into an $8.5 trillion company, tied to a proposed $1 trillion CEO pay package. This is exactly the setup that can prompt Ark Invest to sell shares into strength, because the stock becomes increasingly driven by milestones and sentiment.

Wall Street’s TSLA Reality Check

The next earnings release is slated for February, which could either validate the narrative or fuel more trimming. For the current quarter, the average EPS estimate is $0.35 versus $0.66 in the prior year.

Looking one quarter out, the average EPS estimate is $0.34, compared with $0.15 last year. In other words, expectations call for a rebound, but from a depressed base.

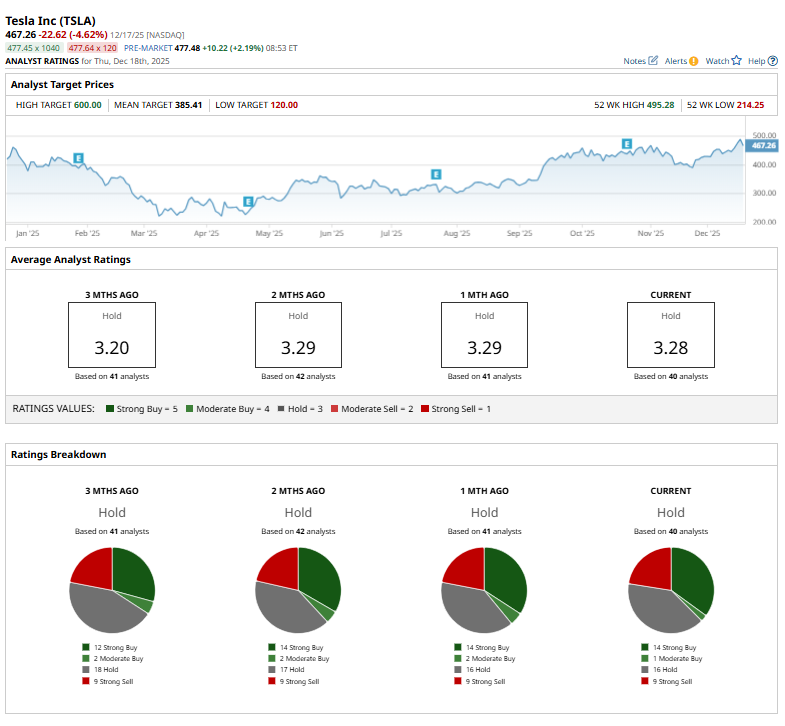

Consensus positioning stays cautious, with the consensus rating on Tesla currently a “Hold.” The average 12‑month price target comes in at $385.41, which implies roughly 19% downside from its current price.

In Conclusion

Cathie Wood is not bailing on Tesla so much as dialing back risk after a massive rerating, and that nuance matters for anyone watching her trades. Given stretched valuations, choppy near-term earnings, and neutral analyst targets, TSLA looks more likely to cool off or move sideways than rip higher from here in a straight line. Over a multi-year window, the odds still favor higher prices if robotaxis and energy storage deliver, but sizing and patience will matter.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart