Globe Life Inc. (GL), headquartered in McKinney, Texas, delivers essential life and supplemental health insurance to U.S. middle-income households. Its offerings span term life, whole life, kids’ life, final expense, and accidental death policies, plus health coverage for cancer, critical illness, hospitalization, and Medicare supplements.

The company operates through the broad segments of Life Insurance, Supplemental Health Insurance, and Investments. It has a market capitalization of $11.20 billion, which makes it a “big-cap” stock.

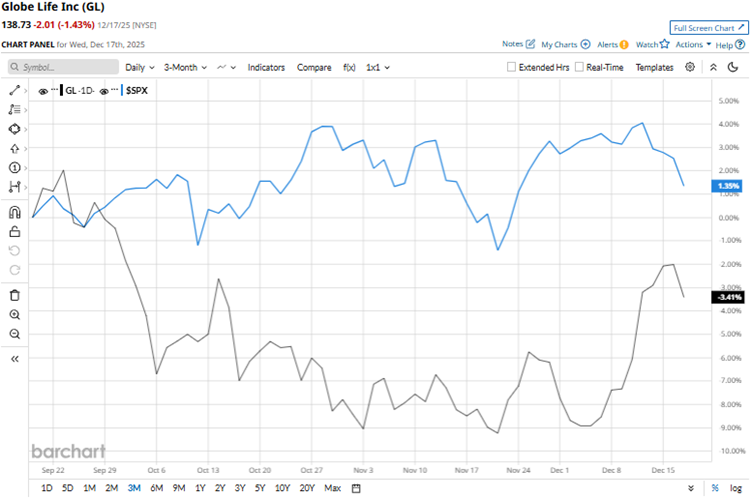

Globe Life’s shares had reached a 52-week high of $147.83 in September, but are down 6.2% from that level. Amid tepid sentiment surrounding the company following its quarterly results, the stock has declined by a modest 2.9% over the past three months. On the other hand, the broader S&P 500 Index ($SPX) has gained 1.8% over the same period.

However, over a more extended period, this underperformance fades. Globe Life’s shares have been up by 31.2% over the past 52 weeks, while they have gained 16.2% over the past six months. The S&P 500 index has increased 11.1% and 12.4% over the same periods, respectively. The stock has traded above its 200-day moving average for the past year and above its 50-day moving average since early December.

On Oct. 22, Globe Life reported its third-quarter results for fiscal 2025. The company’s total revenue increased by 4% year-over-year (YOY) to $1.51 billion. This was based on its premium revenue rising by 5% annually to $1.23 billion. Its net operating income was $4.81 per share, up 38% YOY and higher than the $4.54 per share that analysts had expected. While the stock gained marginally on Oct. 23, it dropped by 1.5% on Oct. 24.

We compare Globe Life’s performance with that of another life insurance firm, Unum Group (UNM), which has gained 6.9% over the past 52 weeks and marginally over the past six months. Therefore, Globe Life has been the clear outperformer over these periods.

Wall Street analysts are strongly bullish on Globe Life’s stock. The stock has a consensus rating of “Strong Buy” from the 13 analysts covering it. The mean price target of $167 indicates a 20.4% upside compared to current levels. The Street-high price target of $199 indicates a 43.4% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart