Mohawk Industries, Inc. (MHK), headquartered in Calhoun, Georgia, ranks as a premier global flooring manufacturer. The company excels in producing premium carpets, hardwood, laminate, tiles, and stone products tailored for residential and commercial spaces.

Renowned for its advanced technology and extensive production network, Mohawk delivers innovative designs and high-quality products to meet diverse market demands. The company has a market capitalization of $6.82 billion, which classifies it as a “mid-cap” stock.

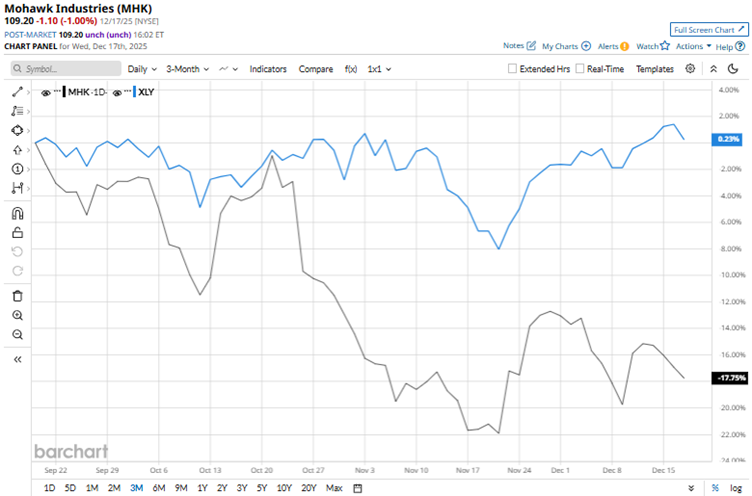

Mohawk’s shares had reached a 52-week high of $143.13 in September, but are down 23.7% from that level. Amid broader market pressures and lukewarm sentiment toward the company, the stock has declined 16.8% over the past three months. On the other hand, the State Street Consumer Discretionary Select Sector SPDR ETF (XLY) is down marginally over the same period. Therefore, the stock has underperformed its sector over this period.

Over a more extended period, this underperformance persists. Over the past 52 weeks, the stock has declined 12.4%, whereas over the past six months it has increased by 10.9%. By contrast, the Consumer Discretionary Select Sector ETF has increased marginally over the past 52 weeks and 14.6% over the past six months. The stock has been trading below its 200-day moving average since early December and below its 50-day moving average since late October.

On Oct. 23, Mohawk reported lacklustre third-quarter results. The company faced a challenging market backdrop, with economic conditions across its regions weakening more than Mohawk had expected compared to the prior quarter. Its net sales grew modestly 1.4% year over year (YOY) to $2.76 billion, exceeding the $2.73 billion that Wall Street analysts had expected.

The company’s EPS declined by 7.9% YOY to $2.67, missing the $2.68 figure that analysts had expected. The stock fell approximately 7% intraday on Oct. 24 following these results.

We compare Mohawk’s performance with that of another furnishings firm, Interface, Inc. (TILE), which has gained 10.2% over the past 52 weeks and 41% over the past six months. Therefore, Mohawk has been the clear underperformer over these periods.

Wall Street analysts are moderately bullish on Mohawk’s stock. The stock has a consensus rating of “Moderate Buy” from the 18 analysts covering it. The mean price target of $136.88 indicates a 25.3% upside compared to current levels. The Street-high price target of $155 indicates a 41.9% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart