CoreWeave (CRWV) stock has had a dramatic ride since its blockbuster debut on Wall Street. After launching its initial public offering (IPO) at $40 per share, CRWV stock surged to a peak of $187, reflecting significant demand for its cloud infrastructure that supports artificial intelligence (AI) technology.

But the euphoria has since cooled. CoreWeave shares have tumbled roughly 51% from their highs. This sharp pullback can be attributed to a combination of factors. The expiration of the company’s post-IPO lock-up period opened the door for insiders and early investors to sell shares, which pressured the stock. Moreover, CoreWeave tempered its near-term growth outlook during the Q3 conference call yesterday and signaled higher spending ahead. The guidance weighed on CRWV stock.

The company now expects 2025 revenue to come in between $5.05 billion and $5.15 billion, slightly lower than its previous forecast of $5.15 billion to $5.35 billion. Management cited delays in powered shell deliveries from a data center provider, which are expected to affect fourth-quarter results and, in turn, 2025 revenue.

Moreover, CoreWeave’s plans for massive capital expenditures didn’t sit well with the investors. The company expects to spend between $12 billion and $14 billion in 2025, and more than double that amount in 2026, as it continues to expand its AI cloud capacity.

While the underlying demand for AI infrastructure remains robust, CoreWeave’s higher spending, combined with growing market unease about a potential AI bubble, has weighed heavily on investor sentiment.

What’s Ahead for CoreWeave?

Despite short-term challenges, CoreWeave’s growth prospects remain solid. The delay in powered shell deliveries from a data center provider will impact fourth-quarter revenue, but this setback is expected to be temporary. The company’s aggressive capital spending has raised some eyebrows. However, these investments are strategically aimed at strengthening its infrastructure and enhancing its competitive positioning, thereby supporting its rapid growth trajectory. Moreover, these investments align with the soaring demand for CoreWeave’s AI-focused cloud services and a rapidly growing revenue backlog.

CoreWeave has also strengthened its long-term growth prospects through several strategic moves, including expanding its backlog, diversifying its customer base, forming partnerships, and securing new capital at lower costs.

CoreWeave added an impressive $25 billion in new backlog in the third quarter, bringing the total to over $55 billion and reaching $50 billion in remaining performance obligations. This provides a solid base for future revenue growth.

Moreover, the company continues to scale at a solid pace, expanding its active power footprint by 120 megawatts sequentially to 590 megawatts and increasing its contracted capacity to 2.9 gigawatts. With over 1 gigawatt of additional capacity expected to come online within the next 12 to 24 months, CoreWeave is well-positioned to deliver strong growth.

Strategically, it has deepened relationships with major clients such as Meta Platforms (META) and OpenAI while expanding ties with a leading hyperscaler. Notably, the majority of its largest customers now have multiple contracts with CoreWeave, reflecting strong retention and expanding partnerships. The company is also gaining traction among enterprise clients across diverse sectors, including software design and telecommunications.

The strong demand across industries and geographies augurs well for growth. Moreover, its focus on scaling infrastructure, securing long-term contracts, and broadening its customer base suggests that CoreWeave is likely to deliver strong growth in the coming quarters.

Is CoreWeave Stock a Buy?

The significant decline in CoreWeave stock reflects short-term pressure. Meanwhile, the company’s long-term outlook remains promising. CoreWeave continues to post strong revenue growth, is strengthening its partnerships, deepening client relationships, and expanding its backlog. These developments position it well to deliver significant long-term growth.

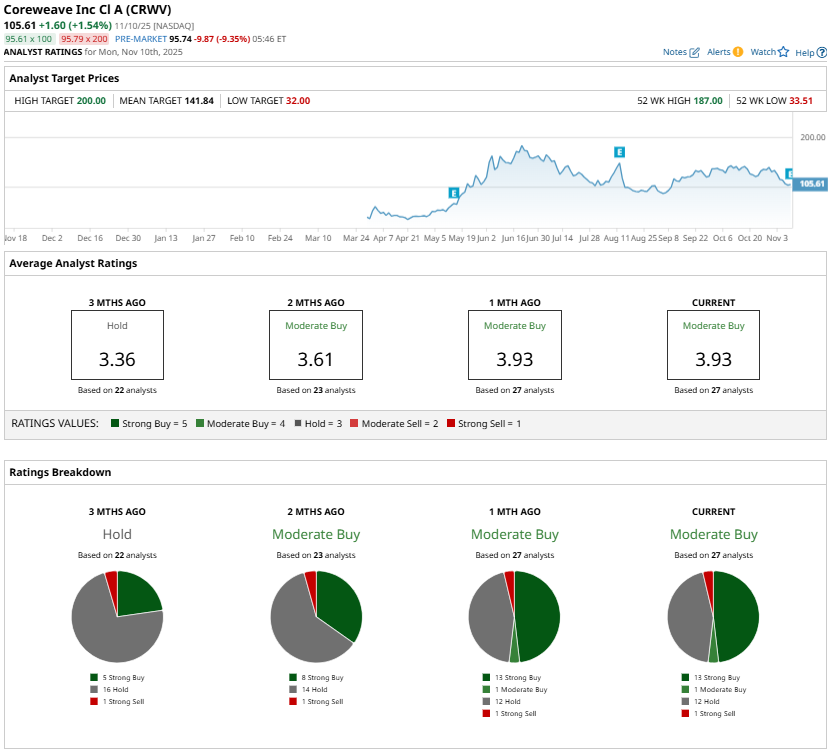

However, note that the company is still in a high-growth phase, investing heavily in expansion and not yet generating a profit. This means volatility is likely to persist in the near term. Analysts also maintain a “Moderate Buy” consensus on CoreWeave stock. For long-term investors, though, the recent sharp decline in CRWV shares presents a compelling opportunity to buy in and benefit from the increasing demand for AI infrastructure.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Alphabet Generates Strong FCF and If It Continues GOOGL Stock is 40% Undervalued

- Is Owens & Minor’s New Focus Enough to Lift Its Shares From the Bottom 100?

- SPY’s 50-Day Moving Average Streak is Going Strong. The Rest of the Market is Sending Up Flares.

- This ‘Strong Buy’ Tech Stock Just Inked a Deal with AWS. Should You Buy It Now?