Over the past six months, Jamf’s stock price fell to $14.70. Shareholders have lost 14.6% of their capital, which is disappointing considering the S&P 500 has climbed by 7%. This might have investors contemplating their next move.

Is there a buying opportunity in Jamf, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Even though the stock has become cheaper, we're swiping left on Jamf for now. Here are three reasons why we avoid JAMF and a stock we'd rather own.

Why Is Jamf Not Exciting?

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

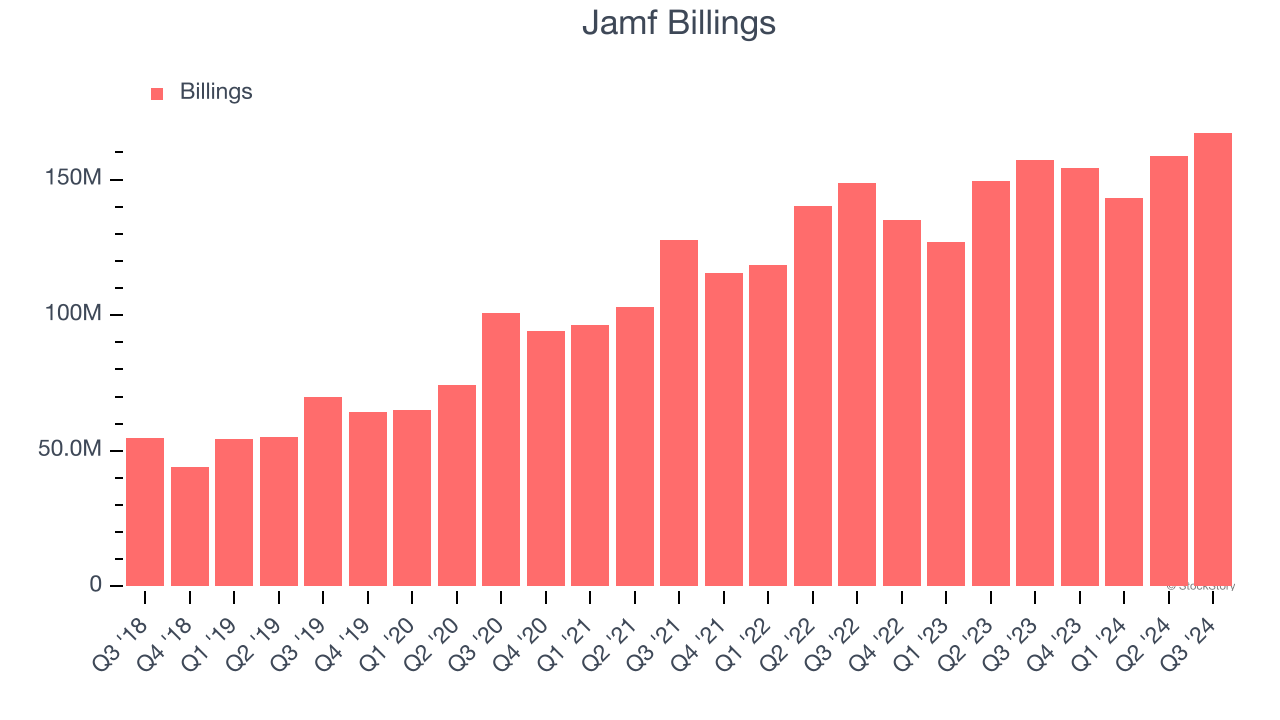

1. Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Jamf’s billings came in at $167.3 million in Q3, and over the last four quarters, its year-on-year growth averaged 9.9%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in acquiring/retaining customers.

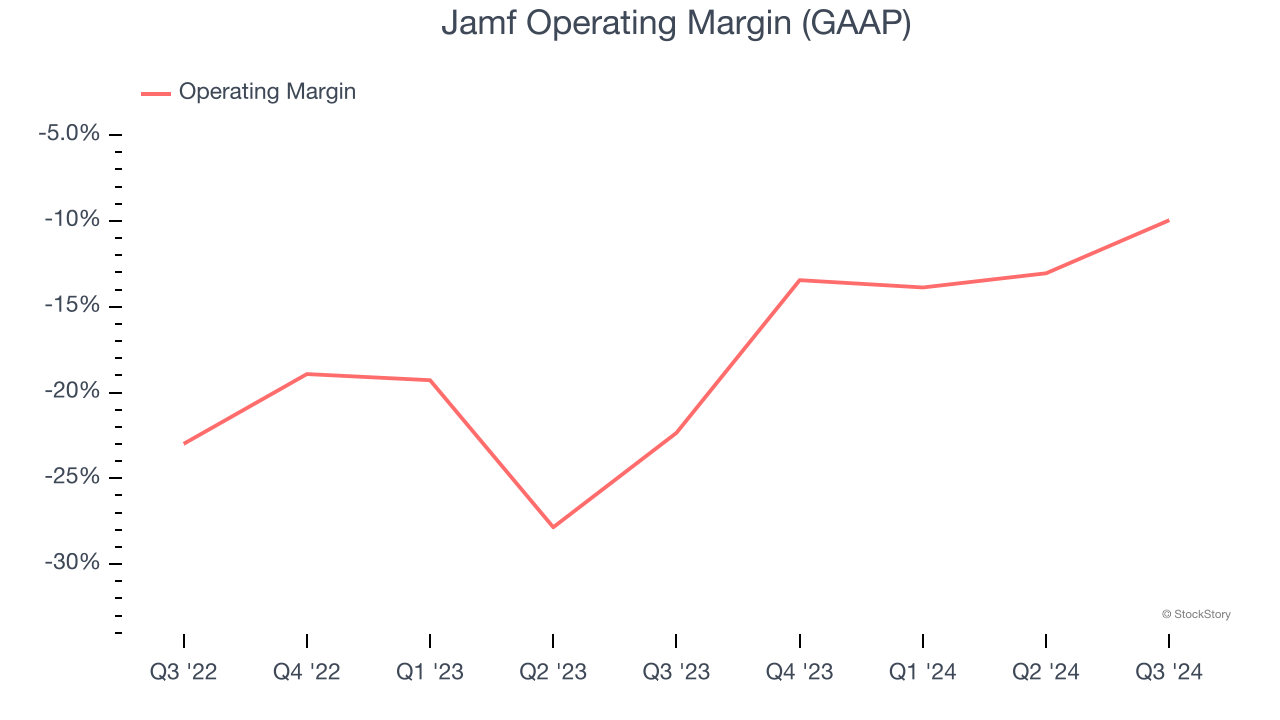

2. Operating Losses Sound the Alarms

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Jamf’s expensive cost structure has contributed to an average operating margin of negative 12.6% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Jamf reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

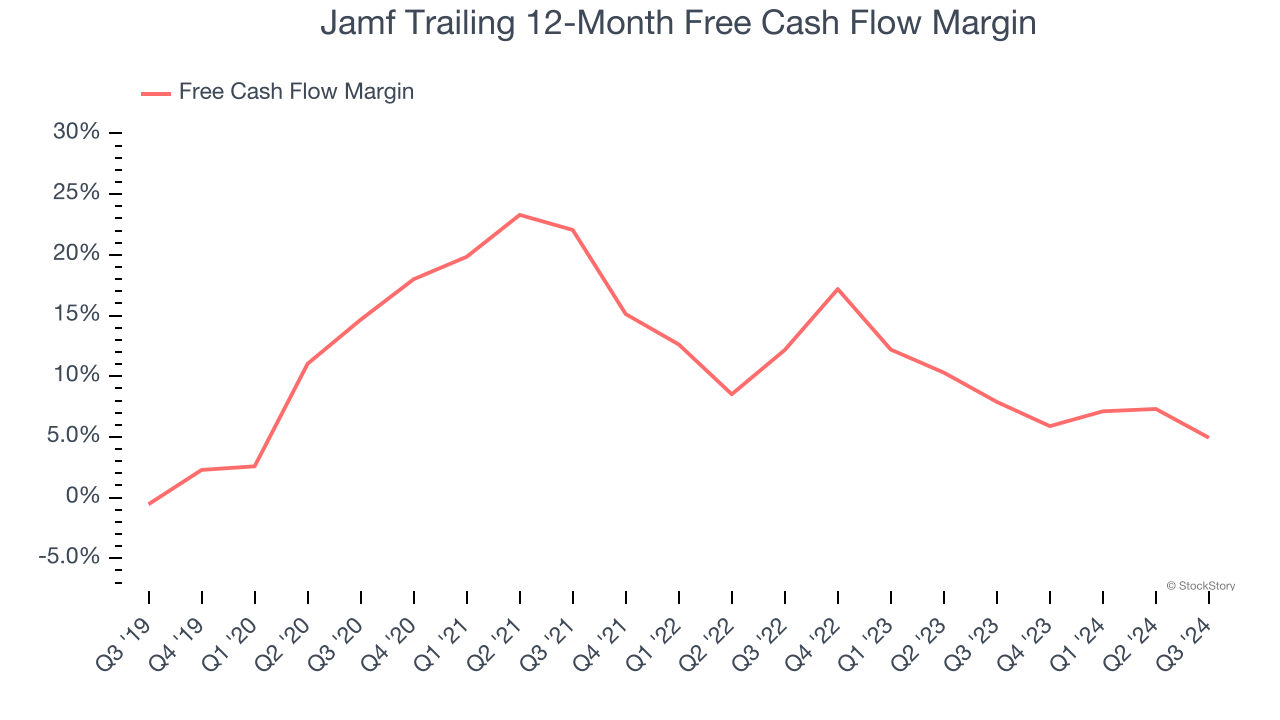

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Jamf has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.9%, subpar for a software business.

Final Judgment

Jamf isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 2.7× forward price-to-sales (or $14.70 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. Let us point you toward The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of Jamf

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.