Black Book Research-authors of the mid-2000s bestseller The Black Book of Outsourcing (Wiley Publishers) and the forthcoming The Black Book of Reshoring -reports indications of a decisive market reset as American hospitals move from managed RCM services to AI-powered, on-shore revenue cycle platforms. With one-third projecting the foregoing of at least one RCM outsourcing renewal, 62% prioritizing coding and CDI automation, and 78% demanding U.S. data residency, health systems are redefinin

DALLAS, TEXAS / ACCESS Newswire / October 29, 2025 / Black Book Research today announced new provider poll findings indicating a decisive shift by U.S. hospitals and health systems away from traditional offshore revenue cycle management (RCM) outsourcing and toward software-led, AI-enabled, and on-shore operating models accelerating into 2026.

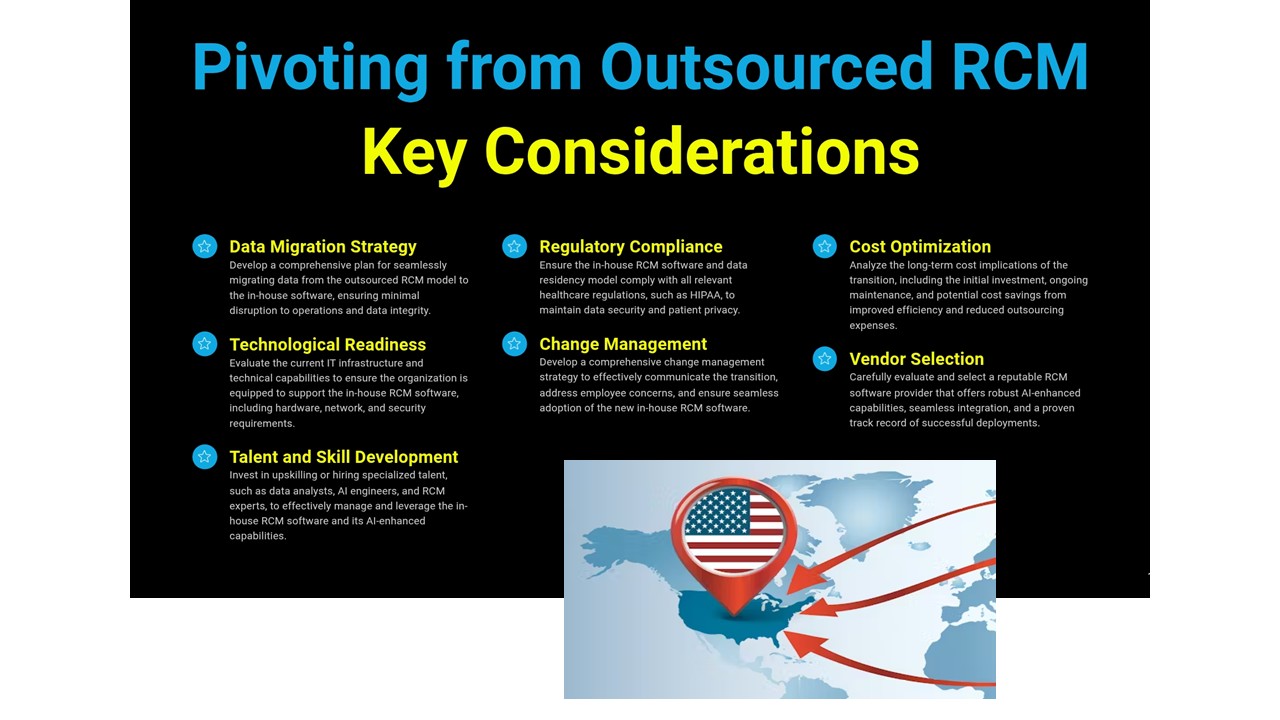

Drawing on Black Book's Q4 2025 RCM evaluation cycle and AI KPI framework, the survey captures how provider executives are planning to replace outsourced functions, especially in coding, clinical documentation improvement (CDI), and denials, with autonomous and human-in-the-loop AI, while tightening data residency and vendor risk controls.

Key Black Book Survey Findings

Renewals in retreat: 34% of health systems report they will not renew at least one legacy RCM outsourcing contract in the next 18 months, citing the availability of AI platforms and security concerns.

Automation first: 62% plan to automate coding/CDI as their top mid-cycle priority, and 64% expect AI to reduce external staffing needs by at least one quarter in those workstreams.

Data stays home: 88% say U.S. data residency and auditable AI pipelines are now "must-have" RFP requirements for RCM platforms and services.

Resilience mandate: 59% are adopting multi-clearinghouse or contingency workflows to reduce single-point-of-failure exposure, with RCM continuity written into vendor SLAs.

Proof over promises: Among organizations piloting AI, 76% report equal or better coder-level quality vs. human-only baselines, and 58% report cycle-time reductions of 15%+ in targeted service lines.

Market Context

Hospital and health system boards are prioritizing on-shore operations, tighter vendor governance, and AI-driven productivity following recent industry-wide disruptions and data-security events. At the same time, autonomous medical coding and AI-assisted denials management have reached adoption levels that make software-first operating models a credible alternative to labor-heavy outsourcing.

"RCM's unit economics have reset," said Douglas Brown, author of The Black Book of Outsourcing )2005, 2009) and the forthcoming The Black Book of Reshoring (Wiley, Q1 2026). "Where offshore labor arbitrage once underwrote cost‑to‑collect targets, AI‑first, U.S.-based architectures with autonomy where safe and human‑in‑the‑loop where required, are now outperforming on throughput, first‑pass yield, and auditability while de‑risking single points of failure. Our Q4 2025 findings show CFOs redeploying OPEX from people‑based outsourcing to platforms governed by verifiable KPIs: coder‑level precision, denials prevention, cycle‑time compression, and resilient multi‑rail claims continuity."

What Hospitals Are Doing Now

Targeting the mid-cycle: Coding and CDI are the leading entry points for AI substitution of outsourced hours, followed by denial prevention/management and claim-edit automation.

Hardening resilience: Providers are baking in multi-rail connectivity and fail-open playbooks across clearinghouses and payment channels.

Demanding verifiable ROI: Leaders are prioritizing vendors that disclose model governance, U.S. data residency, and coder-level quality metrics

About Black Book Research

Findings are based on Black Book's 2025 RCM & AI evaluation program utilizing 18 RCM‑specific KPIs and responses from 1,303 provider‑side stakeholders collected August-October 2025. Respondents included CFOs, VPs of revenue cycle, HIM/CDI leaders, IT leaders, and physician executives across hospitals and large medical groups. In addition to the KPI battery, the instrument included several ad hoc questions on buying trends and renewal intentions to capture near‑term market behavior. For a sample of this size (n=1,303), the maximum margin of error is ±2.7 percentage points at the 95% confidence level; margins are wider for subsegments. Independent auditing of the 2025 evaluation cycle preceded publication.

Black Book™ conducts crowdsourced, unbiased satisfaction and future-readiness surveys across healthcare IT, services, and capital equipment. Since 2009, over 3.5 million healthcare consumers, clinicians, and executives have contributed to Black Book rankings and buyer insights. Learn more at Black Book Market Research LLC. and to download numerous gratis industry insights to RCM stakeholders or contact research@blackbookmarketresearch.com

Contact Information

Press Office

research@blackbookmarketresearch.com

8008637590

SOURCE: Black Book Research

View the original press release on ACCESS Newswire