When a company earns a spot on the New York Stock Exchange, it's not simply switching floors – it's stepping onto the biggest stage in global finance. A NYSE listing signals prestige, maturity, momentum, and a level of credibility that draws sharper eyes and deeper pockets. This kind of shift can change a company’s entire orbit.

Centrus Energy (LEU) is making that leap. The stock will trade on the NYSE starting Dec. 4, right after its final day on the NYSE American on Dec. 3. For a company rebuilding America’s uranium enrichment muscle and pushing ahead in high-assay, low-enriched fuel, this move is another solid milestone – more visibility, more liquidity, more weight.

So, if nuclear-energy stocks are your thing, keep your schedule open. Dec. 3 is a date worth circling.

About Centrus Energy Stock

Headquartered in Bethesda, Maryland, Centrus Energy stands as a key force in the global nuclear landscape. With a market capitalization of $4.6 billion, the company operates through two core segments. Low-Enriched Uranium (LEU) supplies utilities with essential nuclear fuel and enrichment services, and Technical Solutions provides advanced engineering, manufacturing, and technical support to both government and commercial clients.

Since 1998, Centrus has delivered more than 1,850 reactor years of fuel, an output equal to over 7 billion tons of coal, cementing its reputation as a reliable American supplier of clean, carbon-free energy solutions. Backed by strong technical expertise, the company is driving efforts to rebuild U.S. enrichment capacity for future energy and national security needs.

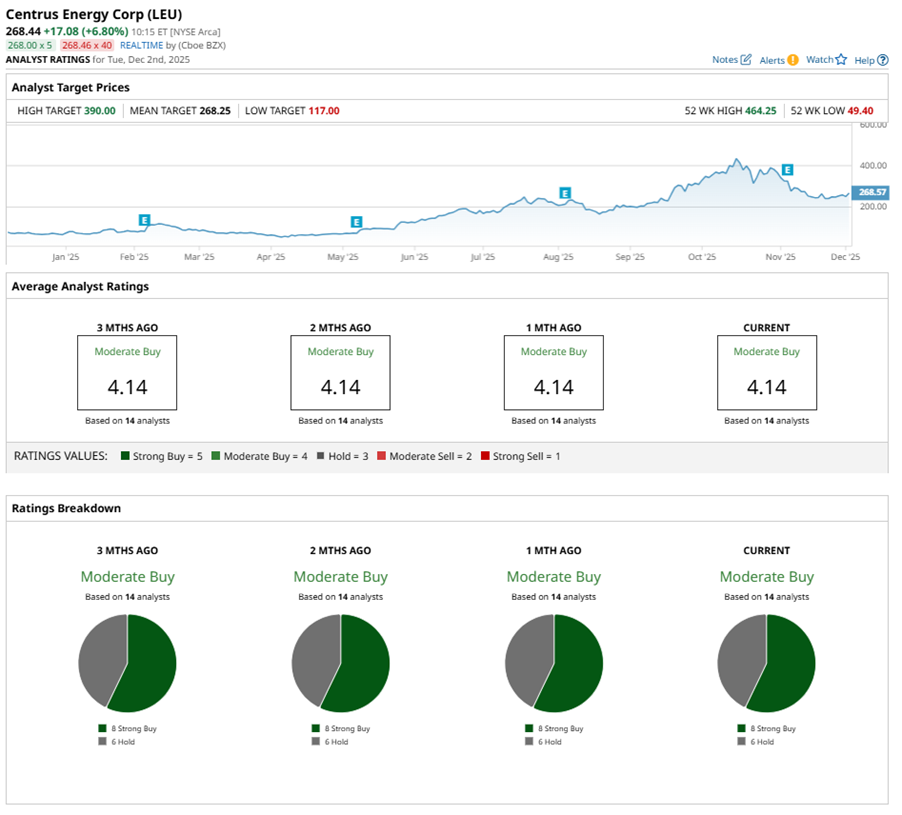

Centrus’ shares have experienced a notably dynamic and volatile year. After touching an eye-popping high of $464.25 in October, shares have cooled off and now sit about 48% below those peaks. Even so, the long-term picture remains impressive as LEU is still up 22% over the past 52 weeks, with an extraordinary 299% surge year-to-date (YTD), far outpacing the broader uranium space. For context, the Global X Uranium ETF (URA) has climbed 41.4% in the past year and 68.5% in 2025.

Momentum picked up again after news of the upcoming NYSE uplisting, helping to stabilize the stock’s recent pullback. On the technical side, the 14-day RSI has been ticking upward, now hovering near 45. More importantly, the MACD oscillator is showing early signs of a shift. The MACD line has crossed above the blue signal line, a classic bullish trigger. The histogram turning positive reinforces that momentum may be quietly rebuilding beneath the surface.

LEU stock is not cheap. Investors are clearly paying up for execution and the promise of what is ahead. The stock trades at 66 times forward earnings and 10.3 times forward sales, sitting well above the sector medians and its own five-year averages.

Centrus’ Mixed Q3 Earnings Report

Centrus’ Q3 2025 results, released on Nov. 5, offered a mixed but telling snapshot of the company's position in its long-term rebuild. The company delivered a clean earnings beat, even as revenue landed shy of forecasts. Still, the top line showed momentum, growing 30% year-over-year (YOY) to $74.9 million, while earnings swung sharply into the green at $0.19 per share – a meaningful turnaround from last year’s loss of -$0.30 per share.

Digging into the business lines, the LEU segment held its ground with $44.8 million in revenue, up 29% annually, driven largely by $34.1 million from uranium sales. On the other side of the house, the Technical Solutions division continued to cement its importance. With work tied to the Department of Energy’s (DOE) HALEU Operations Contract and a portfolio of technical and engineering services, the segment posted a 31% annual jump to $30 million, strengthened by a $7.3 million lift from HALEU-related activity and steady contributions from additional agreements.

Margins were the soft spot of the quarter. Centrus reported a gross loss of $4.3 million, a sharp departure from the $8.9 million profit recorded a year earlier, reflecting higher production and project-related costs. The company also posted an operating loss of $16.6 million. Yet, despite the pressures, Centrus still ended the quarter with $3.9 million in net income, thanks to a favorable tax benefit and rising investment income. With a sizable $3.9 billion backlog as of Sept. 30, locked in through 2040, Centrus maintains long-term visibility as it pushes to rebuild America’s nuclear-fuel capabilities at scale.

Centrus closed the quarter on a stronger footing, boosting its unrestricted cash to $1.6 billion through a heavily oversubscribed convertible notes deal and securing key U.S. government waivers for upcoming Russian deliveries. Also, the company sharpened its leadership bench with the appointment of Todd Tinelli as CFO and advanced strategic partnerships, including a potential investment from KHNP and POSCO International to support expansion in Piketon, Ohio.

As the Western world’s sole HALEU producer, Centrus is positioned for a fast-growing market projected to surge to $6.14 billion by 2035. Its expansion blueprint, adding thousands of centrifuges and scaling LEU output, aims to rebuild America’s enrichment capacity for a cleaner-energy future.

Analysts tracking the company project Q4 2025 EPS to dip 56.6% YOY to $1.39. Fiscal year 2025 EPS could also dip 12.1% annually to $3.93, and slip by another 5.9% annually to $3.70 in fiscal 2026.

What Do Analysts Expect for Centrus Stock?

Analysts tracking LEU are steady on their feet – confident, but not blind to the bumps. The stock has a “Moderate Buy” consensus rating overall. Of the 14 analysts tracking the stock, eight have a “Strong Buy,” while the remaining six have a “Hold” rating.

Meanwhile, the stock has been riding an intense wave of momentum following its NYSE uplisting announcement, holding the line with the average analyst target of $268.25. Even so, the most bullish view on the Street still leaves room to run – the Street-high target of $390 suggests roughly 47% upside from here, if Centrus’ momentum continues to build.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Nuclear Energy Stocks Fans, Mark Your Calendars for December 3

- Top 100 Stocks to Buy: Par Pacific Holdings Looks Tempting, But Should You Bite?

- Plug Power Just Kicked Off Its NASA Contract. Should You Buy PLUG Stock Here?

- Barchart- Commodity Roundup- November’s Top Performers and Underperformers