Tariffs on steel and aluminum have once again sparked tension across U.S. manufacturing throughout 2025. President Trump's 25% duties on metals and global imports have raised costs for equipment makers nationwide. Farm machinery manufacturers face some of the steepest exposure, with higher input prices squeezing margins.

The result is billions in added costs that are already flowing through to producers, dealers, and ultimately farmers. These policies have put intense pressure on industrial blue chips at a time when agricultural demand is soft and pricing power is limited.

Deere & Company (DE) sits squarely in the path of that storm. It just posted Q3 earnings of $3.93 per share on revenue of roughly $12.4 billion, beating sales expectations. Yet shares still dropped more than 5% after management flagged a $1.2 billion pre-tax tariff hit for fiscal 2026, nearly double this year's impact. Is this a quality name on sale or an early sign of deeper trouble ahead? Let's dive in.

Deere’s Financial Fundamentals

Deere & Company manufactures farm, construction, and forestry equipment and digital tools used by growers and contractors worldwide, with a market value near $125.6 billion. This dividend profile remains a key part of the long-term story, with an annual forward payout of $6.48 per share and a forward yield of about 1.33%. That income stream is anchored by DE’s dividend payout ratio of 32.95%.

The shares trade around $468, up roughly 10% year-to-date (YTD) and up about 1% over the past 52 weeks.

This valuation reflects investors paying roughly 24.18x forward earnings against a sector median closer to 20.33x.

The latest earnings release on Nov. 25 put those trade pressures in sharper focus. It showed fourth-quarter net income of about $1.065 billion, or $3.93 per share, versus $1.245 billion, or $4.55 per share, a year earlier, a modest miss versus the $3.96 consensus yet still healthy for this stage of the cycle.

The report detailed that worldwide net sales and revenues rose 11% to roughly $12.394 billion in the quarter, even though full-year revenues fell 12% to about $45.684 billion as large-ag demand cooled and tariffs squeezed margins.

That full-year snapshot included net sales of $10.579 billion in Q4 and $38.917 billion for fiscal 2025 against $9.275 billion and $44.759 billion in fiscal 2024, a combination that captures how pricing, mix, and cost controls are offsetting some tariff drag but not all of it. Deere’s 2025 bottom line ended at about $5.027 billion in net income, or $18.50 per share, down from $7.10 billion and $25.62 per share in 2024.

Growth Bets That Could Outlast Tariff Hit

Deere keeps getting punished for tariffs in the short term. The company is quietly stacking long-term growth levers that fit its core farm and energy customers. This year, the company joined Growth Energy, the nation’s largest biofuel trade association, as its newest member. That move underscores a deeper push into renewable fuels.

That membership aligns Deere with policy and industry efforts to advance ethanol and other renewable fuels. The shift could support higher equipment demand and service revenue as growers invest in efficient, fuel-compatible machinery over time.

Cathy Wood's ARK Innovation ETF (ARKK) has also backed that longer view with real capital. On Aug. 14, the fund bought 64,789 Deere shares worth about $33.3 million. This was its largest single purchase by dollar value that day, based on disclosed trading data. Those buys continued over the next three consecutive trading sessions. The result was a meaningfully larger ARK stake in Deere.

Wood’s team is signaling confidence in Deere’s technology, automation, and data platform. Tariffs may be compressing near-term margins and spooking traditional investors, but growth-focused capital is leaning in.

The internal innovation engine is pointing in the same direction. Deere recently announced six startups selected for its 2025 Startup Collaborator program, an initiative launched in 2019. This program is designed to deepen collaboration with early-stage technology firms that can add value for agriculture and construction customers. The new cohort includes Array Labs, Landscan, LIDWAVE, Presien, ReSim, and Witricity.

The broader farm economy backdrop is also turning more supportive. The United States Department of Agriculture (USDA) projects U.S. net farm income to climb about 30% year-over-year (YoY) to $180.1 billion in 2025. That increase is expected after two years of declines. The gain will mainly be driven by a $33.1 billion jump in direct government farm payments.

What Wall Street Is Willing to Pay

Deere just proved it can still beat on revenue while tariffs gnaw at margins, and the near-term numbers show exactly where analysts expect the pain to land. This current quarter ending January 2026 carries an average EPS estimate of $2.62, down from $3.19 a year earlier, which implies a YoY decline of about 17.87%.

For the year ending October 2026, Wall Street’s average earnings estimate sits at $19.34 per share, versus $18.50 earned in fiscal 2025. That shift translates into an expected EPS growth rate of roughly 4.54% YoY, a modest but meaningful uptick considering the heavier tariff drag management has flagged.

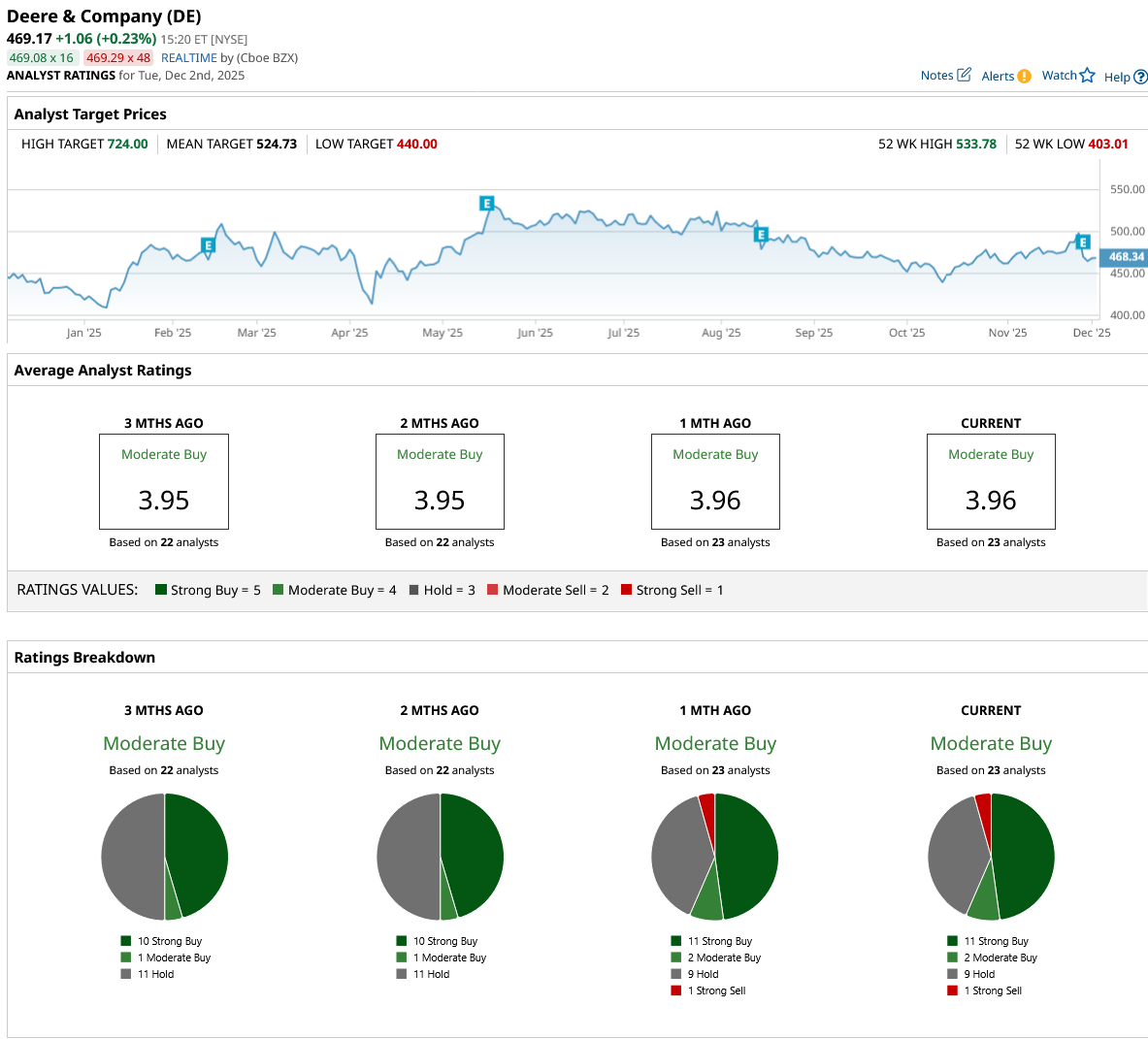

Analysts are very optimistic about DE’s future, and the 23 surveyed arrive at a consensus “Moderate Buy” rating. The average price target sits around $523.9, implying roughly 12.8% upside from here before any dividends.

Deere still looks like a buy-the-dip for long-term investors who can live with some tariff noise. Margins may stay under pressure near term, but the balance sheet, dividend, and growth bets in tech and renewables point in the right direction. Shares are more likely to drift higher toward the low $500s over the next year than collapse, though headlines could keep the ride bumpy. For patient investors, that risk–reward skews positive.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart