Electra Battery Materials Corporation (NASDAQ: ELBM; TSX-V: ELBM) (“Electra” or the “Company”) announces a new copper showing in proximity to its Iron Creek Project, and provides an update on its Idaho exploration activities.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240725529167/en/

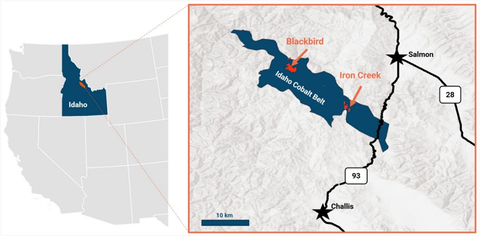

Figure 1. Location of the Iron Creek Property in east-central Idaho (Graphic: Business Wire)

Highlights

- Electra’s 2023 field program discovered a previously unknown copper surface showing, the Malachite Hill Copper Showing, on an unexplored boundary area of the Redcastle Agreement claims portion of the Idaho properties.

- Electra has signed an amendment to the Redcastle Property Agreement to extend its two main exploration expenditure commitments by two years, to 2026 and 2028 respectively.

“We are taking measured steps to maximize the value of our exploration assets in Idaho, which continue to demonstrate upside potential for copper and cobalt at Iron Creek, Ruby, CAS, and now Malachite Hill,” said Electra CEO, Trent Mell. “Under the leadership of Dr. William Stone, we have applied for a 10-year exploration permit, which will enable us to advance drilling activities on up to 91 specified drilling locations without unforeseen delays. While Electra’s primary focus is to complete the cobalt refinery project in Ontario, there is clear potential in the Idaho Cobalt Belt to be an important source of critical minerals to onshore the North American battery supply chain. We look forward to re-launching field exploration work and exploration drilling programs in due course.”

Ryan McDermott, CEO, Phoenix Copper Ltd., said, “We are pleased to be continuing our collaboration with Electra Battery Materials through the extension of this agreement. We believe Electra is well-positioned to further advance the Redcastle property’s potential, and we look forward to working with the Electra team as that potential is realized.”

The Idaho properties consist of mining patents and exploration claims over an area of 73.15 km2, including the Iron Creek Project, and cover the strike extent of strata hosting the cobalt-copper sulfide mineralization. Iron Creek is one of several cobalt-copper mineral resources and prospects within the Idaho Cobalt Belt, a prospective mineralized system that contains copper and the largest primary cobalt resources in the United States, according to the U.S. Geological Survey.

Historical underground development at Iron Creek includes 600 metres of drifting from three adits. A road connects Iron Creek to a state highway and the nearby towns of Challis and Salmon, and the Redcastle Property is located east adjacent to Electra’s Iron Creek Property.

The Malachite Copper Showing (“MHS”) was discovered in 2023 on the claims within the Redcastle Agreement area of interest, south adjacent to the core claims (Figure 2), in area not previously explored. Malachite occurs here in several outcrops of favourable, fine-grained meta-sedimentary rocks on a hillside. Assay results of outcrop grab samples indicate elevated copper (maximum = 2,660 parts per million copper), and low cobalt values. This finding demonstrates the presence of favourable host rocks at surface in this area of the Redcastle Property; however the extent of the surface mineralization exposure remains to be determined. Interestingly, the MHS appears to be located approximately two (2) kilometres along strike (southeast) of Electra's Ruby cobalt-copper target.

The Redcastle Property Agreement is an earn-in agreement, originally signed in May 2021 with Borah Resources Inc./Phoenix Copper Limited, which was subsequently amended to preserve future optionality for exploration work.

The Redcastle Property is made-up of 30 core claims owned by Borah and Phoenix, as well as an Area of Interest (“AOI”) for claims staked by Electra within a set radius of the core claims. In 2022, Electra staked additional claims in the AOI area, which therefore are included in the Agreement.

Investment commitments for Electra under the Agreement were a required investment of US$1.5M into any combination of exploration, development and related work by the third anniversary date of May 21, 2024, and an additional required investment of US$1.5M into any combination of the above works by the fifth anniversary date of May 21, 2026.

More recently, Electra has been strategically focused on completing the construction of North America’s first cobalt sulfate refinery at its property in Ontario and deferred any major exploration programs on the Redcastle Property. As a result, the Redcastle Agreement has been amended further such that the First Required Investment date has been reset to May 21, 2026, and the Second Required Investment date to May 21, 2028.

In follow-up to the very limited field work completed in 2023 at the MHS, a follow-up field mineral prospecting and geological mapping program has been proposed for the area. The area to be covered by the field program includes the MHS itself and the area between the MHS and the Ruby Deposit. The purpose of the proposed program is four-fold:

- Further confirm Electra's findings in 2023;

- Map and sample the extent and continuity of the mineralization on surface;

- Determine terrain suitability for follow-up geophysical surveys and/or drilling; and

- Trace indications of copper and cobalt mineralization along strike toward Ruby.

Execution of the Electra’s proposed field program will be subject to financing.

The Idaho Properties and Iron Creek

In March 2023, Electra released an updated Mineral Resources Estimate (“MRE”) for the Iron Creek Project. Highlights include:

- Indicated Mineral Resource of 4.5 million tonnes grading at 0.19% cobalt for 18.4 million pounds cobalt and grading at 0.73% copper for 71.5 million pounds of copper;

- Inferred Mineral Resource of 1.2 million tonnes grading at 0.08% cobalt for 2.1 million pounds of cobalt and grading at 1.34% copper for 36.5 million pounds of copper;

- As a result of infill and step-out drilling completed to date, Electra upgraded 54% of the Inferred classification of the 2019 MRE to the Indicated classification;

- The Mineral Resources of the Iron Creek Project extend approximately 1,100 metres along strike, 500 metres in thickness, and 500 metres to depth below surface.

- Within the Iron Creek Property boundary, there are seven reported occurrences of metallic mineralization exposed on surface or encountered in drilling. Iron Creek is the main mineralized body and Ruby is the second most important body (Figure 3);

- The 2023 MRE was prepared for a potential underground scenario with a US$87.00 net smelter return (NSR) cut-off grade; and

- Additional drilling was recommended to connect isolated intercepts within or along strike and at depth of the Mineral Resources, and advance Ruby to increase the Inferred Mineral Resources.

Table 1. Mineral Resource Estimate of the Iron Creek Cobalt-Copper Project

Classification |

Tonnes |

Cobalt (%) |

Copper (%) |

Cobalt (lbs) |

Copper (lbs) |

NSR Value/ Tonne (US$) |

Indicated |

4,451,000 |

0.19 |

0.73 |

18,364,000 |

71,535,000 |

123.65 |

Inferred |

1,231,000 |

0.08 |

1.34 |

2,068,000 |

36,485,000 |

118.48 |

Notes:

- The effective date of the 2023 MRE is January 27, 2023.

- The independent and qualified persons for the 2023 MRE are Martin Perron, P. Eng. and Marc R. Beauvais, P.Eng. all of InnovExplo Inc.

- The 2023 MRE follows the CIM Standards.

- These Mineral Resources are not Mineral Reserves, because they do not have demonstrated economic viability. The results are presented undiluted and are considered to have reasonable prospects of economic viability.

- The estimate encompasses one large, mineralized envelope using the grade of the adjacent material when assayed or a value of zero when not assayed. Dilution zones encompassing all mineralized zones were created as part of the mineralized domain to reflect the dilution within the constraining shapes.

- High-grade capping supported by statistical analysis was done on raw assay data before compositing and established on a per-metal basis, having a limiting value at 1% for cobalt and 10% for copper. Composites (1.5 m) were calculated within the zones using the grade of the adjacent material when assayed or a value of zero when not assayed.

- The MRE was completed using a sub-block model in Surpac 2022. A 4m x 4m x 4m parent block size was used.

- Grade interpolation was obtained by Inverse Distance Squared (ID2) using hard boundaries. Dynamic anisotropy was used for the interpolation of the mineralized domain.

- A density value of 2.78 g/cm3 was assigned to the mineralized domain.

- The MRE is classified as Indicated and Inferred. The Inferred classification is defined with a minimum of three drill holes within the areas where the drill spacing shows reasonable geological and grade continuity at the maximum range of the modelized semi-variogram. The Indicated classification is defined with a minimum of three drill holes within the areas where the drill spacing shows reasonable geological and grade continuity at half the range of the modelled semi-variogram.

- The 2023 MRE is locally constrained within Deswik Stope Optimizer shapes using a minimal mining width of 2.0m for a potential underground LH. An NSR-based cut-off grade was calculated using the following parameters: mining cost = US$55.00/t; processing cost = US$22.00/t; G&A = US$10.00/t. The cut-off grade should be re-evaluated in light of future prevailing market conditions (metal prices, mining costs, etc.).

- The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in pounds of in-situ metal rounded to the nearest hundred.

- The independent and qualified persons for the 2023 MRE are not aware of any known environmental, permitting, legal, political, title-related, taxation, socio-political, or marketing issues that could materially affect the MRE.

A copy of Electra’s 2023 updated MRE and Technical Report is available under the Company’s profile on www.sedarplus.ca.

Qualified Person Statement

The scientific technical content of this press release that relates to mineral exploration and the 2023 Mineral Resource Estimate has been reviewed and approved by Mr. George King, P.Geo. and Dr. William Stone, P.Geo., who are Qualified Persons as defined by National Instrument 43-101. Mr. King is employed as Senior Site Supervising Geologist by Idaho Cobalt. Dr. Stone is employed as Lead Geoscience Consultant by Electra.

About Electra Battery Materials

Electra is a processor of low-carbon, ethically-sourced battery materials. Currently focused on developing North America’s only cobalt sulfate refinery, Electra is executing a phased strategy to onshore the electric vehicle supply chain and provide a North American solution for EV battery materials refining. In addition to building North America’s only cobalt sulfate refinery, its strategy includes integrating black mass recycling, potential cobalt sulfate processing in Bécancour, Quebec, and exploring nickel sulfate production potential within North America. For more information, please visit www.ElectraBMC.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Estimates of Resources

Readers are cautioned that mineral resources are not economic mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. The estimate of mineral resources may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. The mineral resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum's (CIM) "2014 CIM Definition Standards on Mineral Resources and Mineral Reserves" incorporated by reference into NI 43-101. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for a Preliminary Economic Assessment as defined under NI 43-101. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically. An Inferred Mineral Resource as defined by the CIM Standing Committee is “that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling”. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. United States investors are cautioned that CIM and NI 43-101 standards for resource classification and public disclosure differ from the requirements of the U.S. Securities and Exchange Commission (SEC) and resource information contained in this news release may not be comparable to similar information disclosed by domestic United States companies subject to the SEC’s reporting and disclosure requirements.

Cautionary Note Regarding Forward-Looking Statements

This news release may contain forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects”, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved”. Forward-looking statements are based on certain assumptions, and involve risks, uncertainties and other factors that could cause actual results, performance, and opportunities to differ materially from those implied by such forward-looking statements. Among the bases for assumptions with respect to the potential for additional funding. Factors that could cause actual results to differ materially from these forward-looking statements are set forth in the management discussion and analysis and other disclosures of risk factors for Electra Battery Materials Corporation, filed on SEDAR+ at www.sedarplus.com and with on EDGAR at www.sec.gov. Other factors that could cause actual results to differ materially include changes with respect to government or investor expectations or actions as compared to communicated intentions, and general macroeconomic and other trends that can affect levels of government or private investment. Although the Company believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240725529167/en/

Contacts

Heather Smiles

Vice President, Investor Relations & Corporate Development

Electra Battery Materials

info@ElectraBMC.com

1.416.900.3891