Sends Stockholder Letter Highlighting Strategic Path Forward, Detailing Strength of Director Nominees, Countering Cruiser’s Untenable Claims and Questioning Cruiser’s Nominees Experience and Qualifications

Urges Stockholders to Vote “FOR ALL” the Company’s Highly Qualified and Experienced Director Nominees on the WHITE Proxy Card and Not to Let Cruiser Disrupt Company’s Growth Trajectory

American Vanguard Corporation (“American Vanguard” or “the Company”) (NYSE: AVD) today sent a letter to stockholders in connection with its Annual Meeting of Stockholders (the “2022 Annual Meeting”) that will convene on June 1, 2022. American Vanguard’s Board of Directors unanimously urges stockholders to vote “FOR ALL” the Company’s nine highly qualified director nominees on the WHITE proxy card and to disregard any proxy card received from Cruiser Capital Master Fund LP (“Cruiser”).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220516005902/en/

(Graphic: Business Wire)

The letter sent to stockholders highlights the following points:

- Under the leadership of your highly experienced Board and management team, the Company has delivered attractive returns and strong performance relative to agrochemical peers and outperformed the Russell 2000 over the last three- and one-year periods.

- Your Board and leadership team have executed key acquisitions and invested in innovative technologies that have positioned the Company for substantial earnings and long-term growth. Indeed, even Cruiser acknowledges that your Board has positioned the Company to benefit from “strong tailwinds.”

- Your Board has the right expertise and experience to drive incremental stockholder value.

- Alfred Ingulli, John Killmer and Esmail Zirakparvar are instrumental to the Company’s strategic direction and their experience far outweighs that of Cruiser’s director nominees.

- Cruiser and its nominees have misrepresented facts and its nominees have articulated no plan, lack any complementary expertise and, in some cases, lack the desire to serve as directors.

- Cruiser’s nominees lack the experience they claim is needed and two of the three candidates have never served as a director of a for-profit enterprise.

- Do not let Cruiser disrupt American Vanguard’s growth trajectory.

The letter references a comprehensive investor presentation American Vanguard filed with the Securities and Exchange Commission outlining performance and the Company’s strategic path forward and countering claims made by Cruiser. The presentation is available at https://www.sec.gov/Archives/edgar/data/0000005981/000119312522150194/d295746ddefa14a.htm.

The full text of the letter is as follows:

May 16, 2022

Dear American Vanguard Stockholders,

Our Annual Meeting of Stockholders, scheduled for June 1, 2022, is fast approaching. We are writing to encourage you to vote “FOR ALL” the Company’s nine highly qualified director nominees on the WHITE proxy card today. Your vote is critically important. Your Board of Directors is confident that reelecting the Company’s director nominees is the best way to continue American Vanguard’s progress.

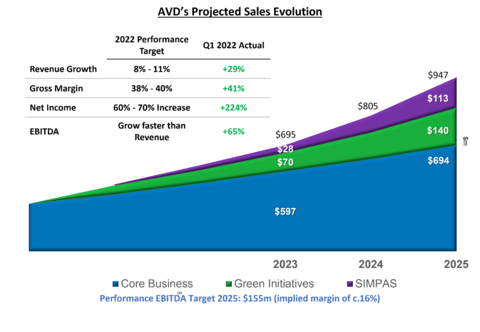

We recently publicized an investor presentation that details how your Board managed through a seven-year downcycle and successfully positioned American Vanguard to generate outsized returns. Fueled by the Company’s revolutionary Green Solutions portfolio and game-changing SIMPAS® prescriptive agriculture application platform, American Vanguard is positioned for significant growth amidst today’s favorable tailwinds.

Highlights of the presentation, which is available in our filing with the Securities and Exchange Commission, include:

AMERICAN VANGUARD IS POSITIONED FOR OUTSIZED RETURNS THROUGH 2025 – DON’T LET CRUISER DISRUPT THE COMPANY’S ROBUST GROWTH TRAJECTORY

-

Under the leadership of your highly experienced Board and management team, American Vanguard has performed well compared to the Russell 2000 and outperformed all other small-cap agricultural providers.

- We outperformed the Russell 2000 over the last one- and three-year periods and we had comparable performance in the last seven years despite unique sector-related headwinds.

-

As diligent stewards of the Company’s capital, the Board and management team have successfully positioned American Vanguard for near- and long-term outperformance in the current upcycle. This leadership team has:

- Delivered meaningful top-line growth and consistent dividend payments over the last decade despite a prolonged downcycle.

- Engaged in significant portfolio diversification and geographic expansion and development and implementation of innovative, game-changing technologies, such as SIMPAS® and Green Solutions.

- Prudently managed our balance sheet and capital allocation with ample headroom to pursue additional accretive M&A.

- Overseen acquisitions that have led to $222 million in sales, $33 million in EBITDA and an EBITDA margin of 15%.

-

As a result of your Board’s strategies, first quarter earnings for 2022 exceeded targets, and earnings momentum is expected to continue, with mid-double-digit growth anticipated in 2022.

- In fact, American Vanguard’s sales growth has beaten consensus for the last five quarters.

-

Your Board has the right experience and expertise to lead AVD and capitalize on large opportunities that exist in the strategic plan developed by the Board and management team.

- Our team has an excellent track record, has positioned American Vanguard for the current upcycle and possesses the skills needed to lead the Company forward.

- We have recently refreshed the Board by adding two new directors in the past three years and are actively planning additional director refreshment and to continue to identify and develop future leaders.

- We interviewed Cruiser’s nominees extensively and your Board concluded that they do not have relevant industry experience, expertise and in some instances, desire to serve.

ALFRED INGULLI, JOHN KILLMER AND ESMAIL ZIRAKPARVAR ARE LARGE PART OF AVD’S BRAIN TRUST AND INSTRUMENTAL TO THE BOARD AND THE COMPANY’S STRATEGIC DIRECTION

- As chair of the finance committee, Alfred Ingulli has enabled us to be the most proficient deal company in our space and has led the Company and the Board in completing 16 transactions in the last seven years, all of them accretive. He has over 33 years of experience in the agricultural chemical business with additional expertise in chemical engineering, business finance and operational management. He spent 41 years at the Crompton Corporation (later Chemtura Corporation, previously named U.S. Rubber Co., Uniroyal Inc., Uniroyal Chemical, and CK Witco), a specialty chemical company, where for his last 15 years he served as Executive Vice President responsible for the company’s global agricultural chemical business, including managing the company’s specialty chemical business in Europe, Africa and Latin America. He also served as a member of the executive committee and helped to manage the company’s $3 billion P&L, $2 billion of which was under his direct purview. Mr. Ingulli’s board experience includes serving on the board of directors of PBI/Gordon, Inc., a marketer of specialty chemicals in turf and ornamental, lawn and garden and animal health markets and Gustafson LLC, a manufacturer of seed treatment products and application equipment. He also served as chairman of CropLife America, a nationwide not-for-profit trade organization representing member companies that produce, sell, and distribute most of the active compounds used in crop protection products registered for use in the United States. He has a master’s degree in Business and completed the Executive Management Program at Harvard Business School.

- In his role as Lead Independent Director, John Killmer guides American Vanguard’s business strategy, which has positioned us for significant outperformance in the current upcycle. He has over 40 years of experience in marketing and product management. Previously Dr. Killmer was responsible for Global Marketing, Product and Supply Chain Management for Arysta LifeSciences Corporation, a large privately held crop protection and life science company where he managed their nearly $1 billion P&L. Prior to that, Dr. Killmer served in various roles with Monsanto Company, including some 15 years in Asia and three years as President of Monsanto China. Dr. Killmer also served as CEO and member of the board of directors of RNAgri, Inc., a privately held corporation involved in the development of RNAi technology. Dr. Killmer possesses a combination of considerable technical expertise and business acumen. A trained scientist, he began his professional career focusing on technology and ascended the corporate ladder with increasing profit responsibility. He has a PhD in Agronomy with a focus on plant science and crop physiology from the University of Illiniois, and has completed the Executive Management Program at Harvard Business School.

- As chair of the Corporate Governance and Nominating Committee, Esmail Zirakparvar has taken the lead role in directing efforts to diversify and refresh the Board. He also oversees our governance and ESG practices to ensure they align with best practices and gives the Board a global sense of perspective and strategic direction. Dr. Zirakparvar has over 35 years of experience in product development, project management and agricultural chemical businesses. He previously served in executive positions at Bayer CropScience AG where he managed a $1 billion P&L, and held roles including Chief Operating Officer and member of the Bayer CropScience AG’s Board of Management in Germany; Head of Region of Americas, President and CEO of Bayer CropScience LP USA; and Member of the Bayer CropScience AG Executive Committee. Prior to that, Dr. Zirakparvar served in various executive positions at Rhone-Poulenc Agrochimie and Aventis CropScience, ultimately as Head of Portfolio Management and member of the Global Executive Committee in Lyon, France for these companies. Dr. Zirakparvar holds a MS and Ph.D. degrees on Plant Pathology/Nematology from Iowa State University.

CRUISER IS MISREPRESENTING THE FACTS, DOES NOT HAVE A PLAN AND ITS NOMINEES WOULD NOT BE ADDITIVE TO OUR BOARD: DON’T LET THEM DISRUPT AMERICAN VANGUARD’S MOMENTUM

Cruiser’s director nominees do not understand our business and have no plan, lack any expertise that would be additive to your Board and, in some cases, lack the desire to serve as directors. Cruiser’s recent statements have contained a number of mischaracterizations of our performance, governance practices and the value of our investments. We would like to set the record straight.

-

Cruiser’s benchmarking of American Vanguard’s total shareholder return (“TSR”) against Specialty Chemicals demonstrates confusion and a lack of understanding of our fundamental attributes and business drivers as we are more comparable to small-cap agricultural inputs companies.

- Cruiser portrays a story of TSR underperformance when American Vanguard outperformed several of its Small-Cap Agricultural Inputs peers over the same period.

-

Cruiser’s suggestion of implied “core EBITDA contraction” is based on a shallow and faulty comparison. Comparison of EBITDA across a decade neglects inherent earnings volatility and agricultural market headwinds since 2011.

- Even Cruiser acknowledges that AVD is well positioned for the upcycle that materialized in 2022 – which is only possible through the strategic initiatives they questioned.

- Cruiser contends that AVD can be “a $55 to $60 stock” in the foreseeable future. Without intending to make promises or commit to guidance on this topic, we call shareholders’ attention to the fact that the strategy and analysis they use to derive that projection is the very same strategy that was developed and implemented by the existing Board and management team! The very board Cruiser claims is underperforming and that requires “change”! It’s not just that they have no strategy – they’re affirmatively promoting the Board’s while contending that your Board cannot succeed without Cruiser’s help.

- Over the years, we have been able to attract an extraordinarily qualified Board while advancing racial and gender diversity. Cruiser fails to recognize the core capabilities and expertise of our Board, and Cruiser’s nominees lack the required competencies and seem less than enthusiastic to join our Board.

- American Vanguard’s average Board compensation and average executive stock-based compensation for FY-21 are 7% and 47% lower than its proxy peers, respectively.

-

Cruiser’s proxy background misrepresents basic facts. Our engagement with Cruiser has been constructive, robust and fair since the beginning, included meetings with our Chairman and CEO and a thorough, in-person interview process of their nominees.

- Even though we allotted them the time and opportunity, we learned that, while filled with critiques, the presentation lacked substance and was devoid of constructive suggestions as to how Cruiser would improve our performance.

- Cruiser’s nominees have given misleading and inconsistent depictions of their ownership and investment stake in American Vanguard, which led the Board to question their commitment to our culture of integrity, transparency and commitment.

DON’T BE FOOLED: CRUISER’S NOMINEES LACK THE EXPERIENCE THEY CLAIM IS NEEDED

A majority of Cruiser’s nominees, in fact, have either no recent operational experience or no such experience at all. Likewise, two of the three candidates have never served as a director of a for-profit enterprise.

Throughout their campaign, which appears to have begun before Cruiser owned more than 10,000 shares of AVD stock, Cruiser has called for “change” and “improvements” at American Vanguard.

Mr. Rosenbloom contends that Cruiser’s nominees will improve American Vanguard’s operational and financial performance, and he touts his own financial expertise as critical to the enhancements he alleges your company needs. This contention is dramatically at odds with Mr. Rosenbloom’s and Cruiser’s actual history.

- Mr. Rosenbloom has never held an executive or management-level position in any operating company, nor has he ever served on the board of directors of a for-profit enterprise.

- Instead, he manages a hedge fund that we believe to be comprised largely of his own family’s wealth — and based on TipRanks.com, Cruiser exemplifies abysmal financial performance, ranking in the bottom quintile of the 390 hedge funds reviewed by TipRanks.1*

- While Mr. Rosenbloom and Cruiser are highly critical of American Vanguard’s performance, a bit of introspection on their part would lead to the inescapable conclusion that Cruiser’s performance is far, far worse. In fact, Cruiser, with Mr. Rosenbloom at the helm, has recorded a lifetime portfolio loss of 28.7%, a three-year average portfolio loss of 6.58%, and a 5.91% portfolio loss over the last 12 months.

- Cruiser — under Mr. Rosenbloom’s leadership — has grossly underperformed both the Average Hedge Fund Portfolio Index (which gained 23.32% over the five years ended March 31, 2022) and the S&P 500 (which gained 60.41% over that same period). By comparison over that same period, Cruiser lost 28.6% of its invested capital.

- Your Board is skeptical that sophisticated, unrelated investors would entrust their fortunes to Mr. Rosenbloom’s performance, and firmly believes that he lacks the financial management skills to assess or improve American Vanguard’s performance.

- In any event, after an extensive interview and more than nine months of previous engagement with Cruiser, your Board found Mr. Rosenbloom completely lacking in managerial, operational, financial or leadership traits. Mr. Rosenbloom met repeatedly with management over the nine months preceding the launch of Cruiser’s proxy contest. Having had extensive opportunities to learn about your Company, he promised to provide a detailed and constructive presentation to the Board during his two-day audience in mid-April. In reality, his presentation was replete with generalized and often unsupported conclusions, completely lacking in constructive recommendations.

- While your Board values input from all shareholders and recognizes that activists can often bring value to an organization, Mr. Rosenbloom’s pattern of conduct suggests a level of opportunism that, at best, will work to the detriment of stockholders’ interest in long-term value creation.

- For example, when Mr. Rosenbloom initially demanded a meeting with management, Cruiser beneficially owned fewer than 10,000 shares, representing 0.03% (3/100 of 1%) of our common stock.

- When Cruiser nominated its candidates, it owned 0.19% of our common stock. In other words, Mr. Rosenbloom appears willing to gamble on your company’s future without having demonstrated any significant long-term commitment to AVD. Even his later and modestly more significant investment only came at a time when he expected to benefit from the public announcement of a proxy contest — and, fortunately for Cruiser, it happened to coincide with our best quarterly performance in recent years.

Mr. Gottschalk has a more accomplished resume, but your Board was troubled by three serious defects in his candidacy.

-

First, Mr. Gottschalk has not been employed since leaving Dow Chemical Company in 2016, apparently in connection with a reorganization that rendered his position superfluous. In one article published by McKinsey & Co, Mr. Gottschalk's former employer noted that the reorganization focused substantially on improving efficiencies.23

- Your American Vanguard Board believes that this experience suggests Mr. Gottschalk was neither involved in nor essential to the cost control measures that Cruiser touts as being instrumental in his service as a director of American Vanguard.

-

Second, Mr. Gottschalk’s only known board experience is on that of a Canadian public company, Superior Plus Corporation, where he has served since late 2017. During Mr. Gottschalk’s tenure, Superior’s performance has been lackluster at best, with total shareholder return less impressive than AVD’s.

- Similarly, in contrast with Cruiser’s misleading characterization of American Vanguard’s director compensation policies, Mr. Gottschalk’s average annual compensation of approximately US$172,000 is considerably higher than that of any American Vanguard outside directors whose compensation Cruiser criticizes.

- Third, on more than one occasion during Mr. Gottschalk’s two-hour interview with your Board, he indicated an ambivalence toward serving as a director, indicating that he did not necessarily view himself as an ideal candidate.

- Cruiser and Mr. Gottschalk have provided conflicting information about Mr. Gottschalk’s personal investment in AVD common stock, with Mr. Gottschalk initially indicating that he owns more than 50,000 shares, and with Cruiser repeating this contention in a recent letter. These assertions directly contradict Cruiser’s proxy statement disclosure, which indicates that he bought 1,012 shares on February 18, 2022, and, as of May 9, 2022, he had no other investment.

- He has previously been nominated twice in unsuccessful proxy fights mounted by Cruiser, and indicated a lack of familiarity with American Vanguard’s business that might otherwise allow him to identify specific improvements he would make, how he would make those improvements, or what mistakes he considers your Board to have made in the past.

Mr. Bassett impressed the Board with a cooperative and inquisitive approach and unquestionably has quality experience in the chemical industry. However, he has never served as a director of a public company, and your Board is concerned about some apparent discrepancies in his supposed ownership of AVD common stock.

- Specifically, Mr. Bassett contended during his interview that he owns 27,000 shares of AVD common stock. Cruiser repeated this assertion in its public letter dated May 10, 2022. However, this assertion is inconsistent with Cruiser’s definitive proxy statement dated May 9, 2022, the disclosure requirements for which include the nominees’ beneficial ownership of common stock, as well as the dates of acquisition and the source of funds used to acquire the shares.

- During his interview with American Vanguard’s Board, Mr. Basset indicated he had “never heard of” American Vanguard “until a couple of months ago” and he only purchased shares and accepted to be a nominee at the request of Mr. Rosenbloom. If elected, he will bring zero knowledge, know-how and experience in the fields of agriculture and crop protection business to your Board.

- Further, even more specifically than Mr. Gottschalk, Mr. Bassett expressed a lack of enthusiasm for serving on American Vanguard’s Board, indicating that any of the value he could add for our stockholders could be conveyed with equal or better effect if he were retained as a consultant.

YOUR VOTE IS VERY IMPORTANT!

PROTECT THE VALUE OF YOUR INVESTMENT! VOTE THE WHITE PROXY CARD TODAY FOR ALL NINE OF AMERICAN VANGUARD’S HIGHLY QUALIFIED DIRECTORS.

We strongly urge you to use the enclosed WHITE proxy card to vote today “FOR ALL” nine of American Vanguard’s highly qualified nominees: Marisol Angelini, Scott D. Baskin, Debra F. Edwards, Morton D. Erlich, Emer Gunter, Alfred F. Ingulli, John L. Killmer, Eric G. Wintemute and M. Esmail Zirakparvar. Simply follow the easy instructions to vote by telephone, by Internet, or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided.

Please DO NOT vote using any proxy card you may receive from Cruiser — even as a "protest vote." Any vote on the proxy card from Cruiser will revoke your prior vote on a WHITE proxy card, and only your latest-dated proxy will count towards the election of your highly qualified and experienced Board of Directors.

Once you complete and return this official WHITE proxy card, no further action is required, and you should ignore additional notifications — and DISCARD any other proxy cards you receive.

Your vote "FOR ALL" of our director nominees will help ensure that you, as an American Vanguard investor, have a Board focused on sustaining our positive momentum and creating lasting value for ALL stockholders.

We appreciate your continued support.

Sincerely,

Eric G. Wintemute, Chairman and Chief Executive Officer

John L. Killmer, Lead Independent Director

If you have any questions or need assistance in

voting your shares please call:

Mackenzie Partners, Inc.

1407 Broadway, 27th Floor

New York, New York 10018

(212) 929-5500 (Call Collect)

or

Call Toll-Free (800) 322-2885

Email: proxy@mackenziepartners.com

Important Additional Information and Where to Find It

American Vanguard has filed a definitive proxy statement on Schedule 14A, and an accompanying WHITE proxy card, with the Securities and Exchange Commission (“SEC”) in connection with the solicitation of proxies for its 2022 Annual Meeting of Stockholders. STOCKHOLDERS ARE STRONGLY ADVISED TO READ THE COMPANY’S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY AND ALL OTHER DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain a free copy of the proxy statement and accompanying WHITE proxy card, any amendments or supplements to the proxy statement, and other documents that the Company files with the SEC, from the Company’s website, https://www.american-vanguard.com, or from the SEC's website at http://www.sec.gov. These will be available as soon as reasonably practicable after such materials are electronically filed with or furnished to the SEC.

Certain Information Regarding Participants to the Solicitation

The Company and its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the business to be conducted at the Annual Meeting. Stockholders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers included in or incorporated by reference into the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, which was filed with the SEC on March 14, 2022, or from the Company’s definitive proxy statement filed with the SEC on April 29, 2022. To the extent the holdings of the Company’s securities by the Company’s directors and executive officers have changed since the numbers set forth in the Company’s definitive proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

Forward-Looking Statements

Certain information set forth in this release and the accompanying letter may constitute “forward looking statements” within the meaning of federal and applicable state securities laws. All statements herein that are not statements of historical fact are forward looking statements. These statements include statements regarding management’s expectations for future performance, as well as descriptions of plans and strategies and the expected results thereof. Without limiting the generality of the foregoing, statements about our expected ability to continue benefiting from the strategies developed and implemented by the Board and management, and statements about the anticipated outcomes of these strategies, are forward looking in nature and should be interpreted accordingly. Statements about our projected stock price and the strategies that may lead to those prices are likewise forward-looking. These statements reflect the current expectations of American Vanguard’s management based on currently known facts and circumstances, and should not be construed as assurances of performance or as guaranties of the actual outcomes. Without limiting the generality of the foregoing, forward looking statements include expectations about expected revenues, product margins, and net income, as well as factors relating to the effects on the Company’s earnings of the contested proxy solicitation currently underway. Actual results may differ from those expressed in forward looking statements, and those differences may be material and adverse. Factors that could cause actual results to differ from expectations include the ongoing effects of the COVID-19 pandemic and government responses and economic conditions resulting therefrom; the effect of international exchange rates and other local, national and foreign economic conditions; weather and climate conditions; changes in regulatory policy and in specific regulations and permitting processes that affect our products, and other risks as detailed from time-to-time in the Company’s SEC reports and filings. The Company’s Quarterly Report on Form 10-Q for the fiscal Quarter ended March 31, 2022, filed with the SEC on May 4, 2022, contains a list of risk factors that may cause results to differ from expectations. These risk factors will be updated from time to time in accordance with the requirements of the Securities Exchange Act of 1934, as amended, and the regulations thereunder (“Exchange Act”), or otherwise in our Exchange Act filings. The statements in this release speak only as of the date hereof, and the Company undertakes no duty to update such statements to reflect future events or developments.

About American Vanguard

American Vanguard Corporation is a diversified specialty and agricultural products company that develops and markets products for crop protection and management, turf and ornamentals management and public and animal health. American Vanguard is included on the Russell 2000® and Russell 3000® Indexes and the Standard & Poor’s Small Cap 600 Index. To learn more about American Vanguard, please reference the Company’s web site at www.american-vanguard.com.

1 https://www.tipranks.com/experts/hedge-funds/keith-m.-rosenbloom

2 https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-making-of-a-megadeal-howard-ungerleider-on-the-merger-of-dow-and-dupont

3 Permission to cite the identified sources has been neither sought nor obtained.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220516005902/en/

Contacts

Reevemark

Paul Caminiti/Nicholas Leasure

(212) 433-4600

Paul.Caminiti@reevemark.com

Nicholas.Leasure@reevemark.com

MacKenzie Partners, Inc.

Bob Marese

(212) 929-5500

bmarese@mackenziepartners.com