NATP survey finds most tax pros faced issues with accurate reporting of stimulus payments, client issues and late/lack of IRS guidance

APPLETON, Wis. - Aug. 16, 2021 - PRLog -- Tax preparers faced unprecedented challenges in the 2021 tax season, including last-minute tax law changes that needed to be incorporated into returns that may have already been filed and accepted by the IRS. The National Association of Tax Professionals (NATP) sent a survey to more than 20,000 tax preparers, both before and after tax season, comparing their expectations of the upcoming season with how it actually went.

According to the survey findings, the most critical issues tax pros faced this past tax season were related to tax law changes. But, overall, tax professionals reported they felt confident in their knowledge level when it came to completing accurate returns this season – specifically related to new or revised deductions and credits, and tax law changes or updates.

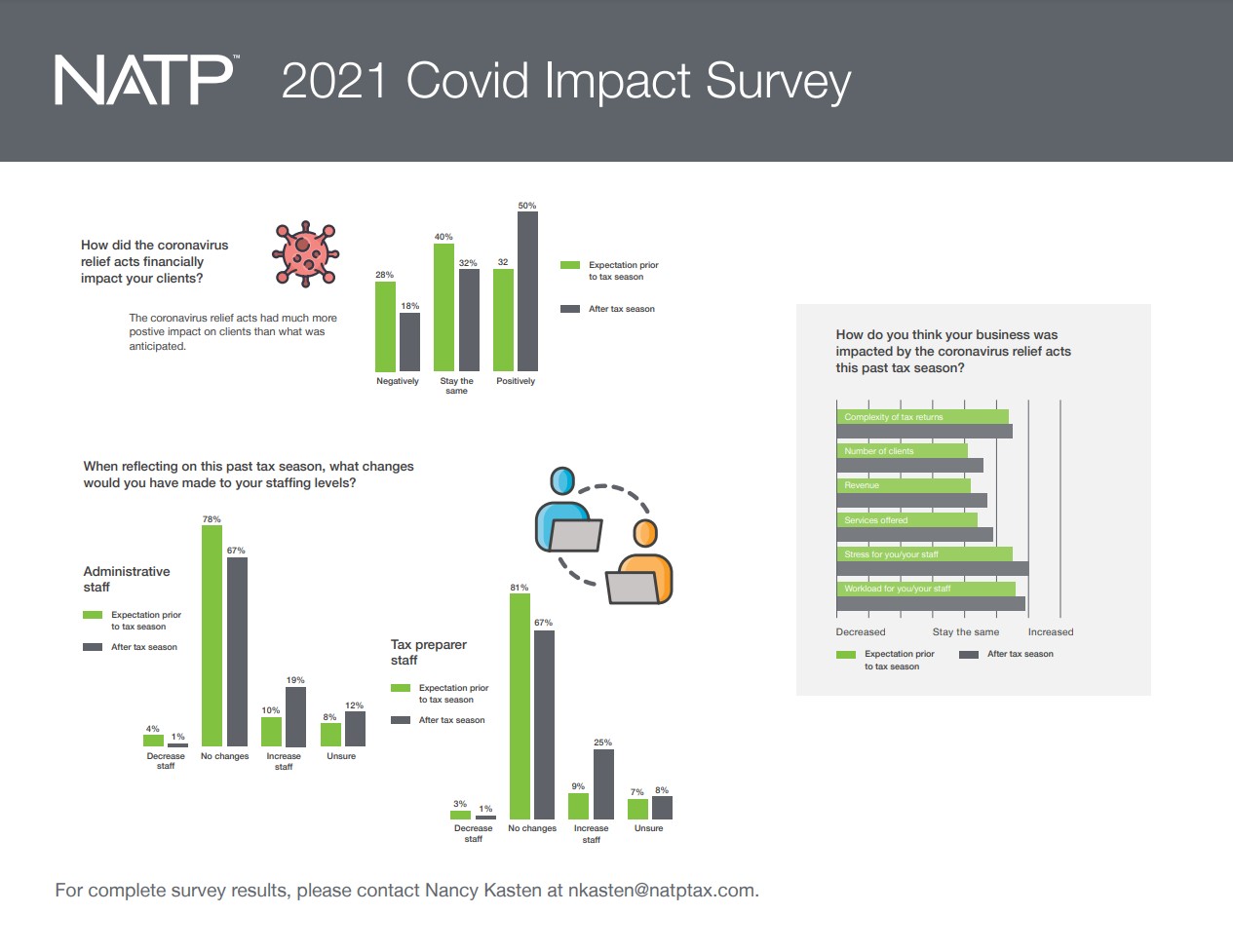

Additionally, the coronavirus relief acts did not have as negative of an impact on their clients as expected. One complicated issue preparers faced with the coronavirus relief acts was their clients' recordkeeping and accurate reporting to reconcile the third stimulus payment. The change in business operations due to pandemic safety protocols was also a burden to some firms, according to the survey.

"This data, while not surprising, is important to collect because it helps us develop the resources our members need to provide outstanding service to their clients during tax season and beyond," said NATP Executive Director Scott Artman. "This tax season was another one for the books, and we're not expecting the changes to stop as the year progresses. I'm proud that NATP was able to keep tax pros informed and equipped to handle these changes as they were announced."

Even though tax preparers saw an increase in the number of returns they prepared this season compared to last, the Tax Day extension to May 17 had little impact on the number of returns prepared – both for business and individual clients. The overall impact on tax professional's business was greater than expected, and reflecting on the past season, more tax professionals indicated they would have increased staffing levels compared to what they expected prior to the tax season. They also think the increased impact will carry into next year's filing season.

Tax pros reported the biggest ways coronavirus relief acts impacted their business in the 2021 tax season were in stress levels and workload, as well as the complexity of returns, which was expected among industry professionals. At the center of it all, though, was the need for further clarification and guidance from the IRS on issues related to coronavirus relief acts. Many preparers reported getting in contact with the IRS to be a burden on their workload this season.

Other key findings include:

- The majority of firm owners (67%) made no changes to their staffing levels in response to the coronavirus relief acts, but in hindsight, many tax professionals would have hired more staff if they had known the complexities associated with this tax season

- Tax professionals, in general, filed about the same number of extensions as last year

- About a quarter of the extensions filed were due to effects from the coronavirus relief acts

- Tax professionals mostly conducted client interviews virtually or over the phone

- 25% of firm owners plan to increase their staff for next year, up from 9% when asked prior to tax season

To view the full report, or to speak with someone on its findings, please contact Nancy Kasten, NATP marketing director, at nkasten@natptax.com.

###

About NATP: The National Association of Tax Professionals (NATP) is the largest association dedicated to equipping tax professionals with the resources, connections and education they need to provide the highest level of service to their clients. 23,000 members rely on NATP to deliver professional connections, content expertise and advocacy that provides them with the support they need to best serve their clients. The NATP headquarters is located in Appleton, WI. To learn more, visit www.natptax.com.

Looking for a tax expert? Rhonda Collins, EA, CPA, MBA, is the director of tax content and government relations at the National Association of Tax Professionals (NATP). Collins has a diverse background of over 25 years in the industry. As a licensed CPA and EA, Collins can represent clients before the IRS. She is available for phone or video interviews to discuss federal tax topics including tax law change and its implications, taxpayer issues, tax preparer regulation and more. To schedule an interview with Collins, contact nkasten@natptax.com.

Contact

Nancy Kasten, marketing and communications director

***@natptax.com

Photos: (Click photo to enlarge)

Read Full Story - Tax pros weigh in on 2021 tax season, COVID-19 relief acts and future business practices | More news from this source

Press release distribution by PRLog