The past six months have been a windfall for Pangaea’s shareholders. The company’s stock price has jumped 55.1%, setting a new 52-week high of $7.20 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Pangaea, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Pangaea Not Exciting?

We’re happy investors have made money, but we're cautious about Pangaea. Here are three reasons you should be careful with PANL and a stock we'd rather own.

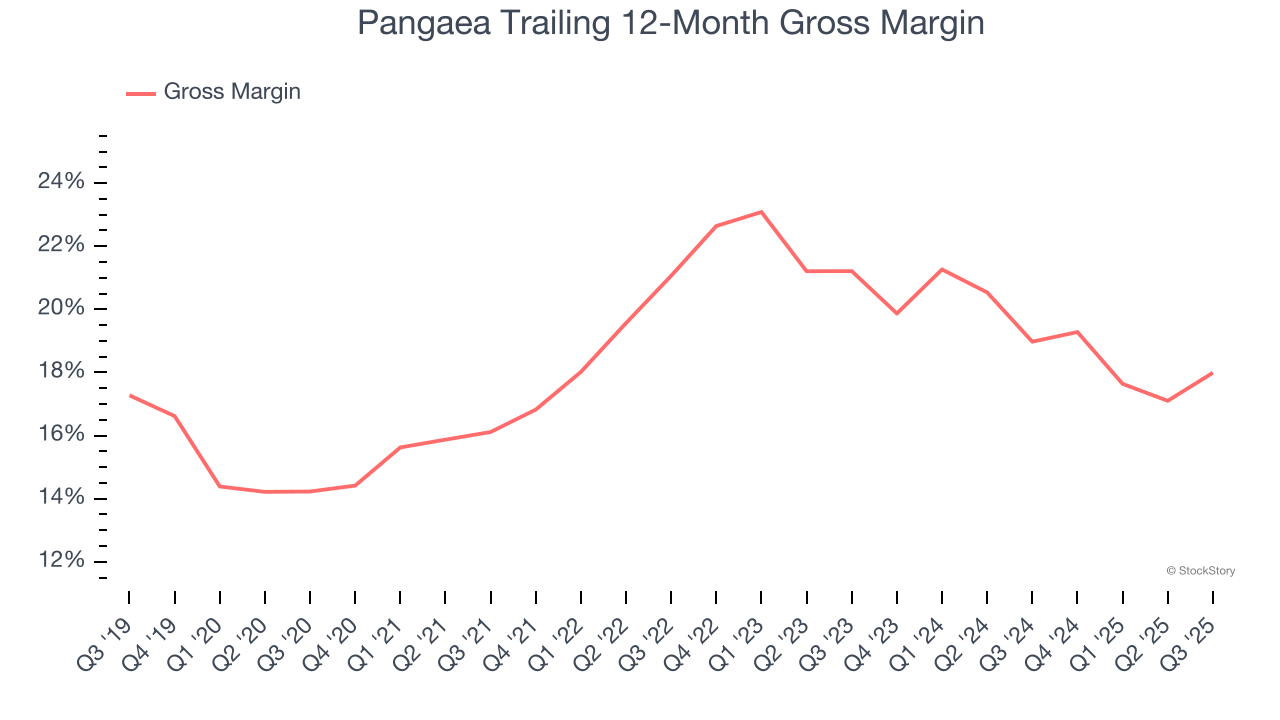

1. Low Gross Margin Reveals Weak Structural Profitability

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Pangaea has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 19.1% gross margin over the last five years. Said differently, Pangaea had to pay a chunky $80.86 to its suppliers for every $100 in revenue.

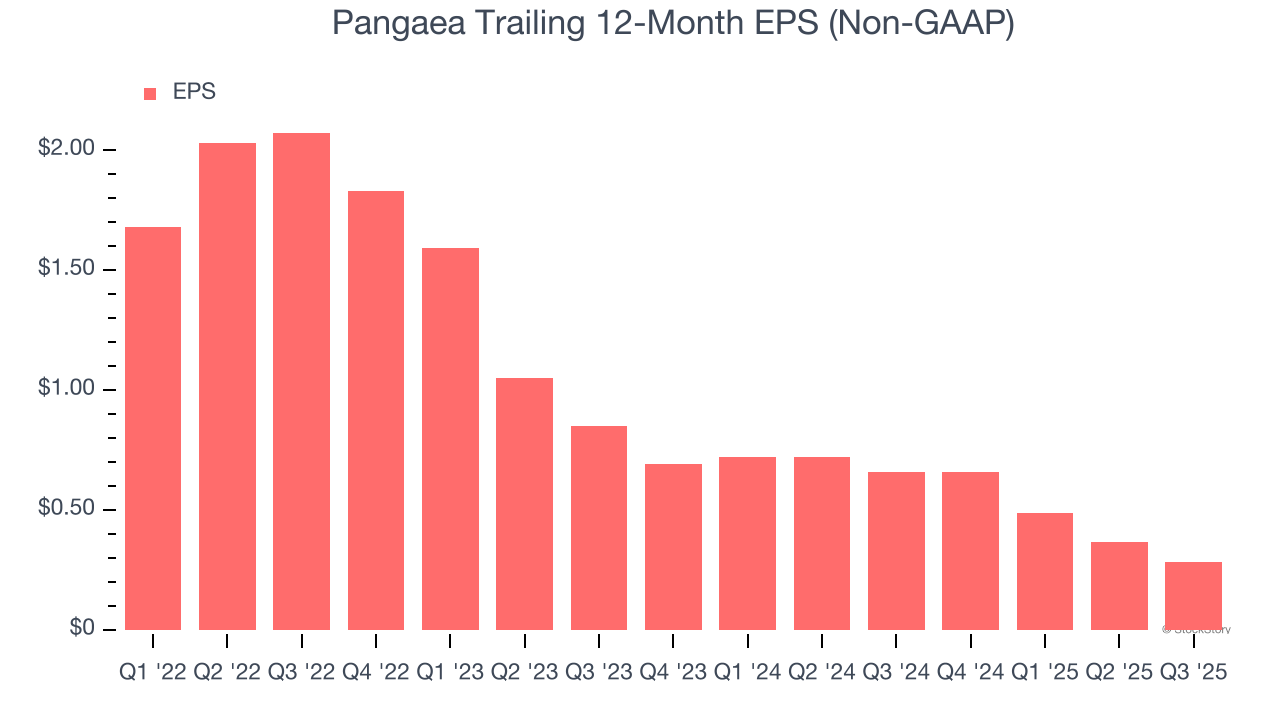

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Pangaea’s full-year EPS dropped 218%, or 33.6% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Pangaea’s low margin of safety could leave its stock price susceptible to large downswings.

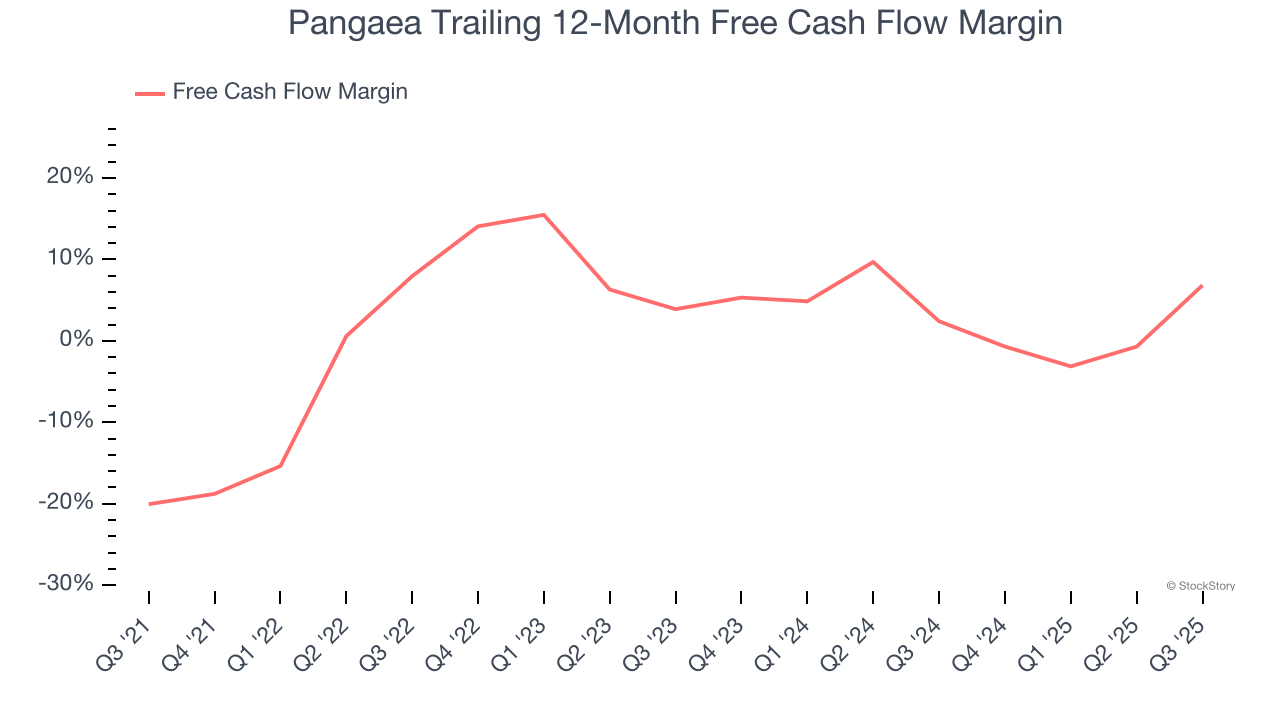

3. Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Pangaea broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders. The divergence from its good operating margin stems from its capital-intensive business model, which requires Pangaea to make large cash investments in working capital and capital expenditures.

Final Judgment

Pangaea isn’t a terrible business, but it isn’t one of our picks. Following the recent rally, the stock trades at 6.7× forward P/E (or $7.20 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Pangaea

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.