Lam Research Corporation (LRCX) is a leading semiconductor-equipment company that specializes in designing, manufacturing, and servicing wafer-processing systems for integrated circuit fabrication. Headquartered in Fremont, California, it provides crucial tools used in deposition, etching, cleaning, and other front- and back-end wafer-processing steps. Lam Research’s market capitalization is around $187.6 billion, making it one of the most valuable players in the semiconductor-equipment space.

Shares of the semiconductor giant have surged past the broader market. Over the past 52 weeks, LRCX stock has rallied 112.1%, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, on a year-to-date (YTD) basis, the stock is up 106%, compared to SPX’s 12.9% return.

Zooming in further, LRCX’s outperformance is also apparent compared to the First Trust Nasdaq Semiconductor ETF’s (FTXL) 35% uptick over the past 52 weeks and 34.8% YTD rise.

Lam Research’s shares have been rising strongly in 2025, driven by surging demand for artificial intelligence (AI)-centric and data center chips. As more companies invest in high-performance computing, the need for advanced wafer-fabrication tools like those Lam produces for deposition and etching has shot up. On top of that, favorable macro tailwinds such as proposed tax credits to boost U.S. chip manufacturing are further strengthening their growth outlook.

For fiscal 2026, ending in June, analysts expect Lam Research’s EPS to grow 15.7% year over year to $4.79. The company’s earnings surprise history is promising. It surpassed the consensus estimates in each of the last four quarters.

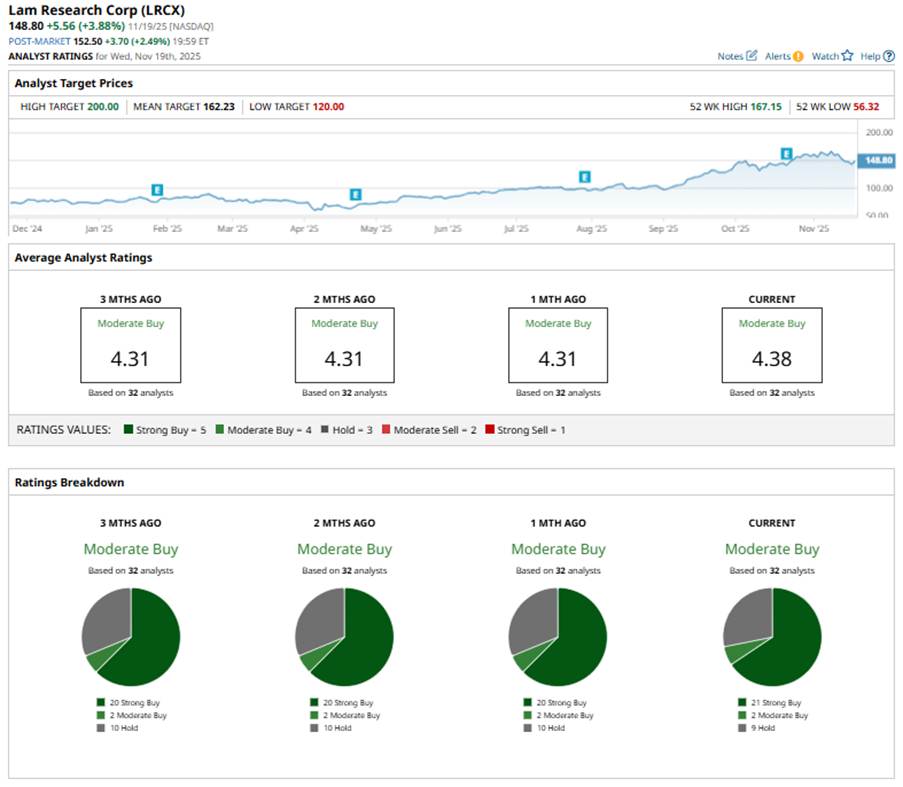

Among the 32 analysts covering the stock, the consensus rating is a “Moderate Buy,” and that is based on 21 “Strong Buy” recommendations, two “Moderate Buys,” and nine “Hold” ratings.

This configuration is slightly more bullish than one month ago, when there were 20 “Strong Buy” ratings.

Last month, TD Cowen raised LRCX’s price target to $170 from $145 while keeping a “Buy” rating, highlighting the company’s strong September quarter, driven by robust Chinese demand for front-end and logic equipment. TD Cowen remains optimistic, expecting Lam to benefit from NAND upgrades, rising HBM demand, and leading-edge logic strength, setting up a stronger market heading into 2027.

The mean price target of $162.23 represents an upside potential of 9%, while the Street-high price target of $200 suggests the stock could rally as much as 34.4% from Wednesday’s close.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Pfizer Is Giving Up on BioNTech. Should You Ditch BNTX Stock Now Too?

- This Silver Stock Just Raised Its Dividend 16%. Should You Buy Shares Now?

- Is GOOGL Stock a Buy, Sell, or Hold as Google Launches Gemini 3?

- Elliott Management Is Betting Big on This Dividend-Paying Gold Stock. Should You Buy Shares Now?