Shareholders of Hamilton Lane would probably like to forget the past six months even happened. The stock dropped 21.1% and now trades at $118.78. This may have investors wondering how to approach the situation.

Given the weaker price action, is now a good time to buy HLNE? Find out in our full research report, it’s free for active Edge members.

Why Is HLNE a Good Business?

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ: HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

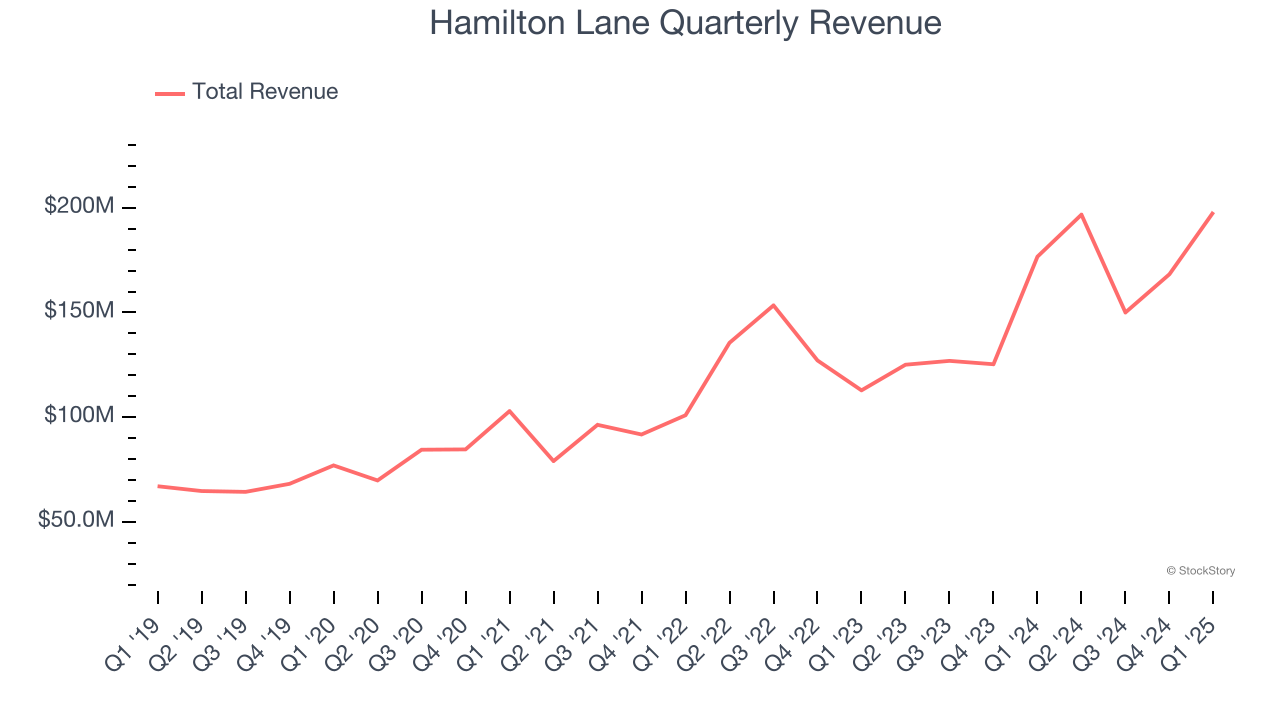

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Luckily, Hamilton Lane’s revenue grew at an excellent 21.1% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers.

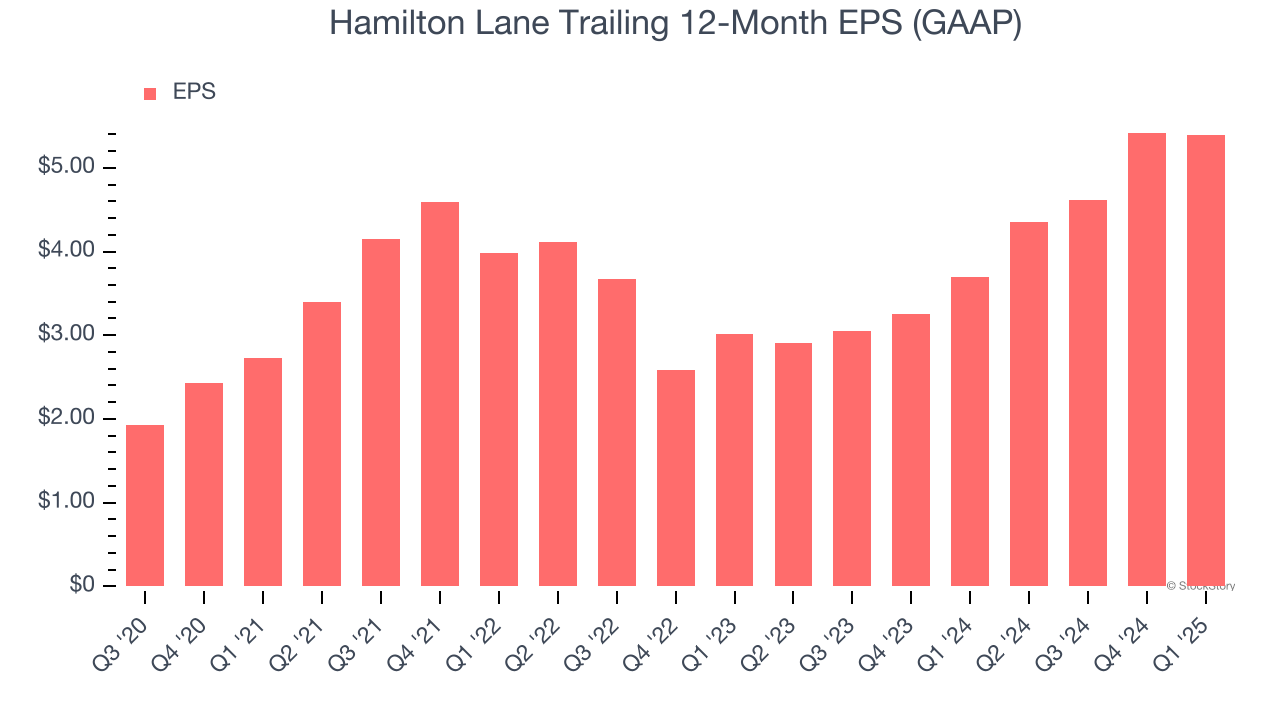

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Hamilton Lane’s EPS grew at a remarkable 17.1% compounded annual growth rate over the last five years. This performance was better than most financials businesses.

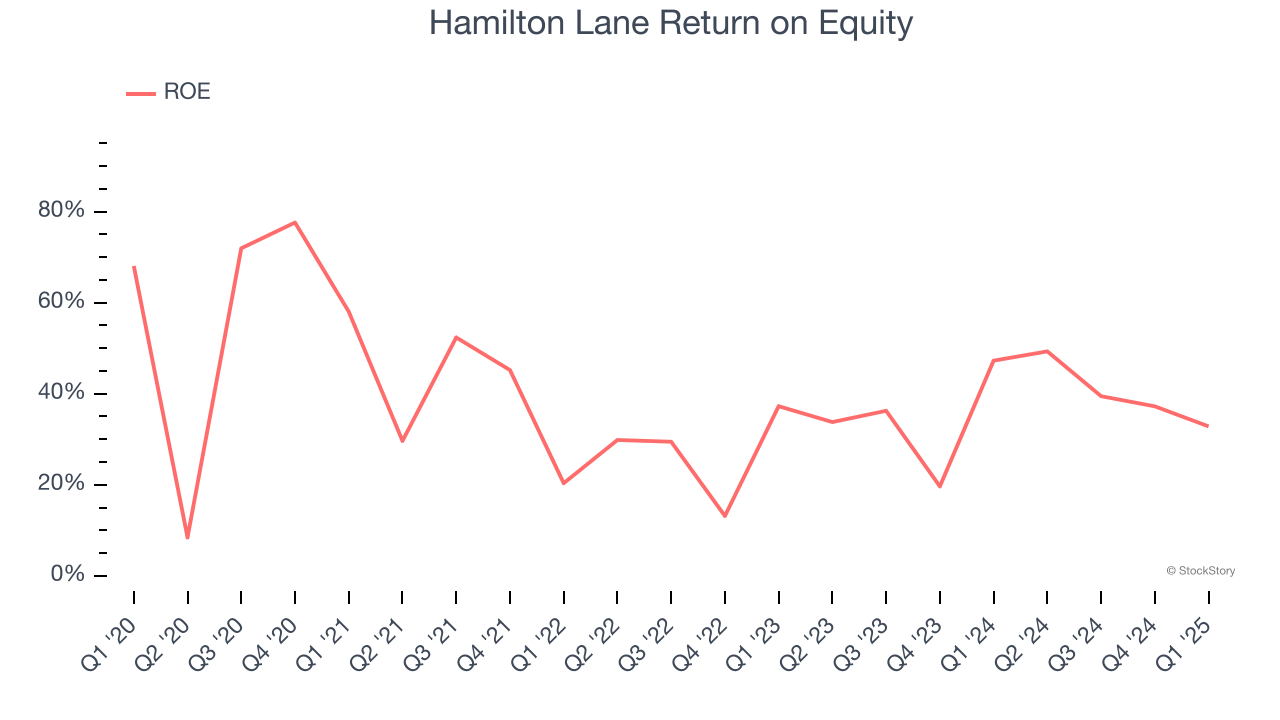

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Hamilton Lane has averaged an ROE of 38.5%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Hamilton Lane has a strong competitive moat.

Final Judgment

These are just a few reasons why Hamilton Lane is one of the best financials companies out there. After the recent drawdown, the stock trades at 25.6× forward P/E (or $118.78 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Hamilton Lane

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.