Financial News

Options Volume in Banco Bradesco Soars, Fueling Breakout Buzz for Brazilian Bank

Wednesday’s total options volume was 56.46 million, slightly less than its 30-day average. In other words, nothing to write home about.

Obviously, Banco Bradesco (BBD) options traders didn’t get the memo. Investors blew the roof off the bank’s overall options volume and unusual options activity.

The former was 273,027, almost 21 times its average 30-day volume. In fact, its volume was the highest single-day number in the past two years. The next closest daily volume was 60,007 on May 7, 2024.

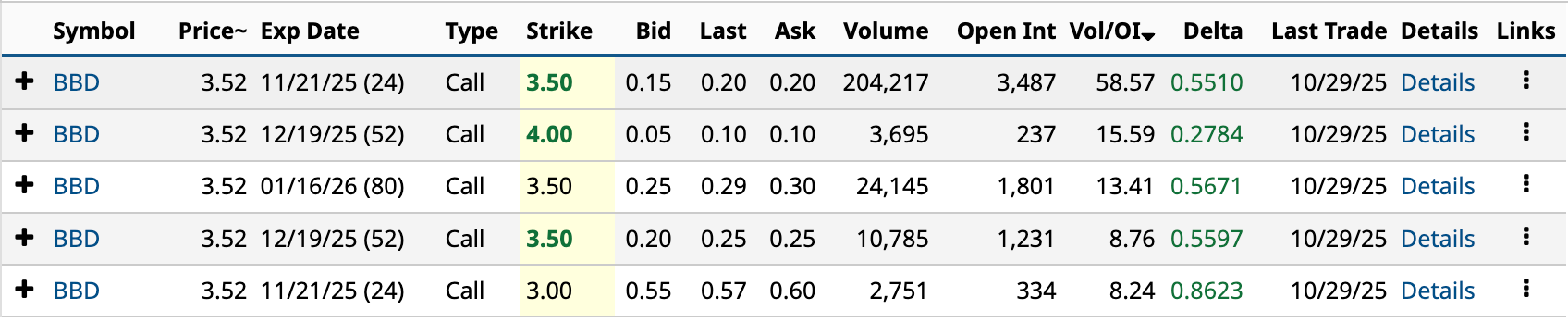

The Brazilian bank’s unusual options activity was, for lack of a better word, unusual. It had five unusually active options yesterday -- all of them calls.

Of the five calls, the Nov. 21 $3.50 call stands out because of its Vol/OI (volume-to-open-interest) ratio of 58.57. Of the options expiring in seven days or more with Vol/OI ratios of 1.24 or higher, Banco Bradesco’s Nov. 21 $3.50 call was the sixth-highest on the day.

Of the five calls, the Nov. 21 $3.50 call stands out because of its Vol/OI (volume-to-open-interest) ratio of 58.57. Of the options expiring in seven days or more with Vol/OI ratios of 1.24 or higher, Banco Bradesco’s Nov. 21 $3.50 call was the sixth-highest on the day.

While BBD stock is up 84% in 2025, there’s reason to believe there could be more gas in the tank for this low-priced emerging market stock.

Is it time to buy? It could be. Here’s why.

Understanding Wednesday’s Activity

As I said in the introduction, the stock’s options volume on the day was the highest in the past two years, nearly five times the second-highest daily volume.

The first thing I noticed about yesterday’s activity is that there wasn’t any put volume. None. Since the beginning of 2025, there have been only eight days when this happened—and none of those days had volume anywhere near 273,027.

It’s fair to say yesterday was special. Now on to the unusual options activity, generally, and the Nov. 21 $3.50 call, specifically.

The call volume of 204,217 was 75% of Banco Bradesco’s total volume. The stock’s share price ranged between $3.44 and $3.55, so the $3.50 strike was both ITM (in the money) and OTM (out of the money). Closing ITM by two cents at $3.52.

There were 20 trades of 1,000 or more contracts on the $3.50 call yesterday. They accounted for 42% of the total volume on the call, 204,217. The most significant single trade was 32,400, accounting for 16% of the call’s volume.

The 32,400 trade was at $0.15. It cost the buyer $486,000, or 4.3% of the $3.52 closing share price. That’s more than reasonable.

The expected move by Nov. 21 is 8.45% or $0.30. With a delta of 0.5510, you can double your money by selling before expiration if the shares rise by 27 cents, within the 30-cent expected move.

Whoever made the 32,400 trade will roll over the call to a later expiration date at some point before the Nov. 21 expiry.

Why the Enthusiasm for Banco Bradesco Stock?

Banco Bradesco reported its Q3 2025 results yesterday. They were better-than-expected.

On the top line, revenue was $6.39 billion, $160 million higher than the Wall Street estimate. On the bottom line, it earned $0.11 a share, slightly higher than the $0.109 estimate.

In February 2024, the company announced a strategic transformation of the bank that included investing in its technology, using AI to improve efficiency, doubling its MSME (micro, small and medium-sized enterprises) customer base, and delivering higher profitability and risk-adjusted returns on its lending.

How’s it doing?

Banco Bradesco finished the third quarter with a loan portfolio of 1.034 trillion Brazilian real ($192.2 billion). Of that, 44% were individual loans, and 56% were corporate loans. Of the 582.67 billion Brazilian real ($110.71 billion) in corporate loans, 41% were with MSME customers. That’s up from 35.3% a year earlier. Overall, MSME loans have increased as a percentage of their total loan portfolio by 280 basis points to 23.3%, on the back of a 24.8% year-over-year increase in the MSME loan portfolio.

The delinquency ratio (non-performing loans over 90 days as a percentage of the total portfolio) was 4.1%, down slightly from 4.2% a year ago. The MSME delinquency ratio was 3.7%, down 140 basis points from 5.1% in September 2024.

The bank’s NIL (net interest income) in the quarter was 18.71 billion Brazilian real ($3.55 billion), 16.9% higher than in Q3 2024, and 3.7% higher than in Q2 2025. NIL is the difference between what it earns on its interest-bearing assets and what it pays out on deposits and other interest-bearing liabilities.

Banco Bradesco’s fee and commission income in the third quarter was 10.59 billion Brazilian real ($2.01 billion), 6.9% higher year-over-year, and 2.8% sequentially. Its three largest revenue generators were card income (44% of fee and commission income), checking accounts (16%), and asset management (10%).

Due to a 9.6% increase in the size of the bank’s loan portfolio, its LLP (loan loss provision) expenses increased by 21.1% to 8.6 billion Brazilian real ($1.63 billion). As a percentage of the loan portfolio, its LLP expenses were 3.3%, up 30 basis points from a year ago, and 10 basis points from Q2 2025. Not a big deal.

Lastly, the company’s insurance business, Bradesco Saguros, generated net income of 7.3 billion Brazilian real ($1.39 billion) in the nine months ended Sept. 30, 11.4% higher than Q3 2024, on 54.33 billion Brazilian real ($10.32 billion) in premiums and other related revenue.

I’d say that’s a success.

The Bottom Line on BBD Stock

In January 2023, I included Banco Bradesco stock and its Jan. 19/2024 $4 call in a group of three unusually active options to double your money. At the time, BBD was trading around $2.80. It needed to rise to $3.36 over the next year for investors to double their money by selling the call before its expiration.

The share price reached $3.58 in July 2023 before falling to $1.84 by the beginning of 2025. BBD stock is nearly back to where it was two years ago. Since listing its ADRs (American Depositary Receipts) in March 2004, the stock’s highest price was $11.97 on May 1, 2008.

I don’t know if BBD can crack the single digits, but I like its chances of moving out of penny-stock territory ($5 or less) in the next 12 months.

Wishful thinking? Perhaps, given the volatility of Brazil’s economy. However, as yesterday’s unusual options activity showed, there’s plenty of interest in Banco Bradesco from investors, retail and institutional. Use them to make a leveraged bet on one of Brazil’s best banks.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Options Volume in Banco Bradesco Soars, Fueling Breakout Buzz for Brazilian Bank

- Ashes to Alpha: Adobe’s (ADBE) Implosion Offers an Opportunity for a Rebound

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move

- Huge, Unusual Options Activity in Nokia After Nvidia Takes $1 Billion Stake

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.