Financial News

A $135 Billion Reason to Buy Microsoft Stock Now

Tech earnings season is just getting started, and we are seeing quite strong revenue trends, but heavy AI spending is starting to weigh on results. Microsoft (MSFT) also reported earnings, yet its shares plunged on concerns about elevated AI-related capex and a recent Azure outage.

Still, beneath the headline noise lies a foundational strategic shift that could justify a buy-the-dip mindset. Microsoft’s landmark agreement to take roughly a 27% stake in OpenAI, a position valued at about $135 billion, pairs exclusive cloud and IP rights with multi-year Azure commitments and ongoing revenue sharing. That deal effectively locks OpenAI’s scale to Azure while giving Microsoft direct exposure to the commercial upside of leading AI models.

For investors seeking large-cap AI exposure with robust cash flow, buybacks, and analyst backing, MSFT’s newfound tie to OpenAI may be the catalytic reason to own the stock now.

About MSFT Stock

Founded in 1975, Microsoft is a diversified technology giant offering Windows OS, Office productivity software, Azure cloud services, and consumer devices. The company is organized into three main segments: Productivity & Business Processes, Intelligent Cloud, and More Personal Computing, each driving strong revenue growth. Microsoft is among the world’s most valuable companies, with a market cap of nearly $4 trillion. It has steadily expanded from software into cloud computing and AI, and today competes across enterprise tech and consumer markets.

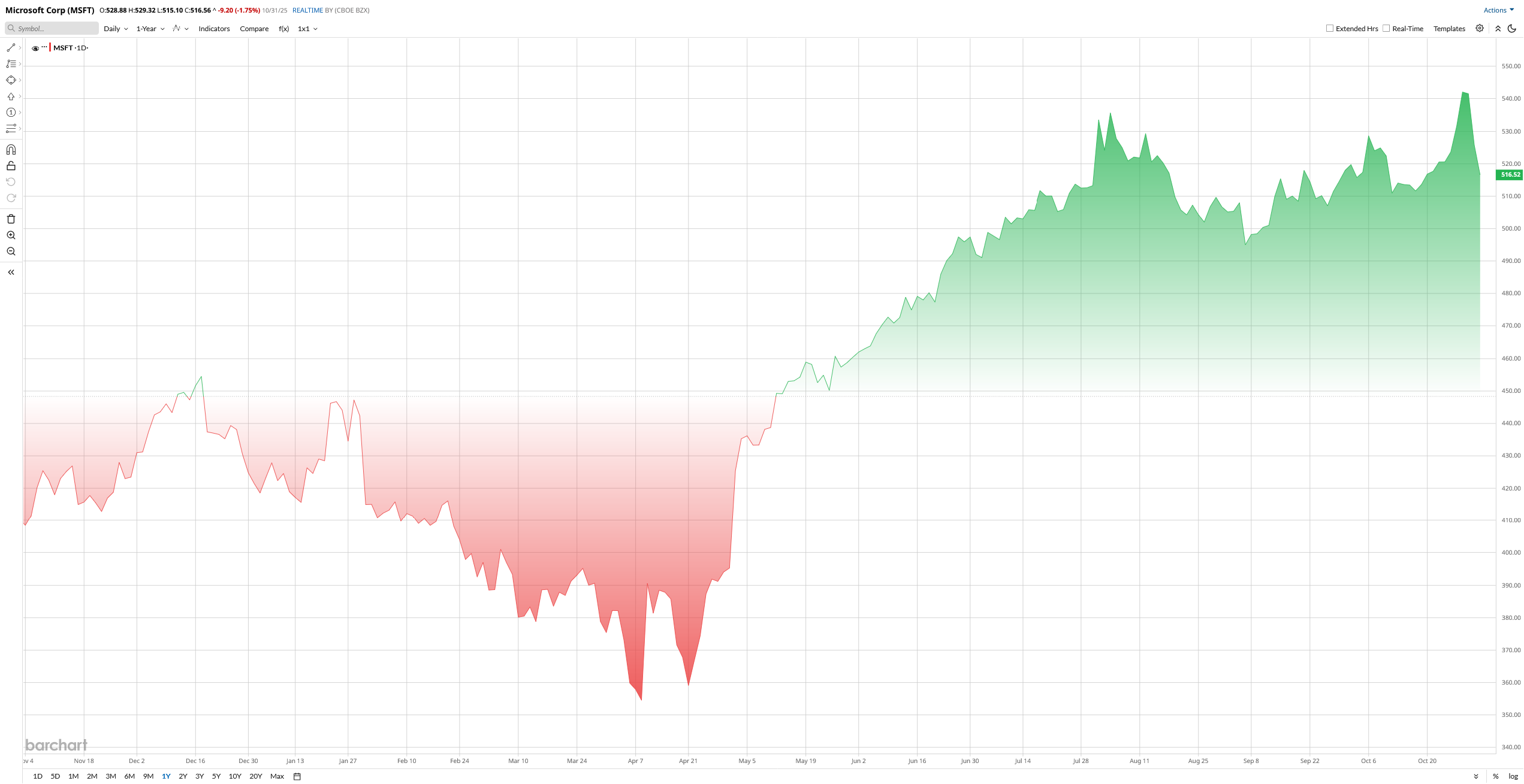

Microsoft shares have outperformed this year. Through late October 2025, MSFT is up roughly 23% year-to-date (YTD), far outpacing the S&P 500 ($SPX), which gained 15% in the same time frame. MSFT stock surged as massive AI-driven cloud growth and bullish investor enthusiasm around Azure fueled a rally.

Despite a bullish run, Microsoft's valuation looks reasonable. Its trailing P/E is about 37x, far below the software industry average of 81x, suggesting a relative discount. Its EV/EBITDA is roughly 26x, close to the sector median of 28x. In Morgan Stanley’s view, MSFT trades under 26x forward EPS (2027 estimates), effectively “underpriced” given its growth outlook.

Microsoft Locks In Multi-Billion Dollar Deal With New OpenAI Deal

Microsoft announced earlier this week a landmark expansion of its OpenAI partnership. Under the new structure, Microsoft will own roughly a 27% stake in OpenAI, valued at $135 billion, as the AI pioneer transitions into a public-benefit corporation, paving the way for fresh outside funding and a potential future IPO. In return, Microsoft secures exclusive cloud and IP rights to OpenAI’s models through at least 2032, while OpenAI commits to about $250 billion in Azure purchases and will keep sharing close to 20% of its revenue with Microsoft. Analysts say the deal removes a major constraint on OpenAI’s growth and significantly strengthens Microsoft’s long-term AI and cloud advantage, giving investors a compelling new reason to stay bullish on MSFT stock.

MSFT Beats Q1 Earnings Estimate

Microsoft kicked off its fiscal year with another strong quarter. Revenue jumped 18% year-over-year (YoY) to $77.7 billion, with growth coming from all major segments.

The real powerhouse, once again, was Azure. Cloud revenue surged around 40%, lifting the Intelligent Cloud segment to nearly $31 billion, a clear sign that enterprise demand for AI and data services is still booming.

Profitability stayed solid as well, with operating income climbing 24%, net income improving 12%, and EPS rising 13%. Microsoft also generated more than $45 billion in operating cash flow, leaving plenty of room to fund AI-driven expansion even after heavy data center spending.

Looking ahead, management issued cautious guidance for Q2, not because growth is slowing, but because the company is focused on disciplined investment. Both Satya Nadella and CFO Amy Hood emphasized profitable growth and smart capital allocation. Analysts still expect double-digit revenue and earnings gains for the full year, signaling confidence in Microsoft’s cloud and AI momentum.

Analysts Opinions

Wall Street remains broadly bullish. Morgan Stanley recently made MSFT its “Top Pick” in software and raised the 12-month price target to $625, citing diversified AI/cloud drivers. Goldman Sachs reiterated its $630 target and pointed out that extended API rights protect Microsoft’s long-term value.

Recently, Evercore ISI raised its Microsoft price target to $640 from $625 and reiterated an “Outperform” rating, citing an “impressive” quarter led by 39% Azure growth and surging commercial bookings. The firm says booming cloud demand and the strengthened OpenAI partnership boost long-term revenue visibility, despite near-term selling pressure.

On the other hand, Stifel cut its price target to $640 from $650, citing near-term margin pressure from sharply higher AI-driven Azure capex. Despite persistent capacity constraints weighing on guidance, the firm called Microsoft’s fiscal Q1 “solid” and reiterated a “Buy” rating, expecting aggressive infrastructure investments to support long-term cloud growth.

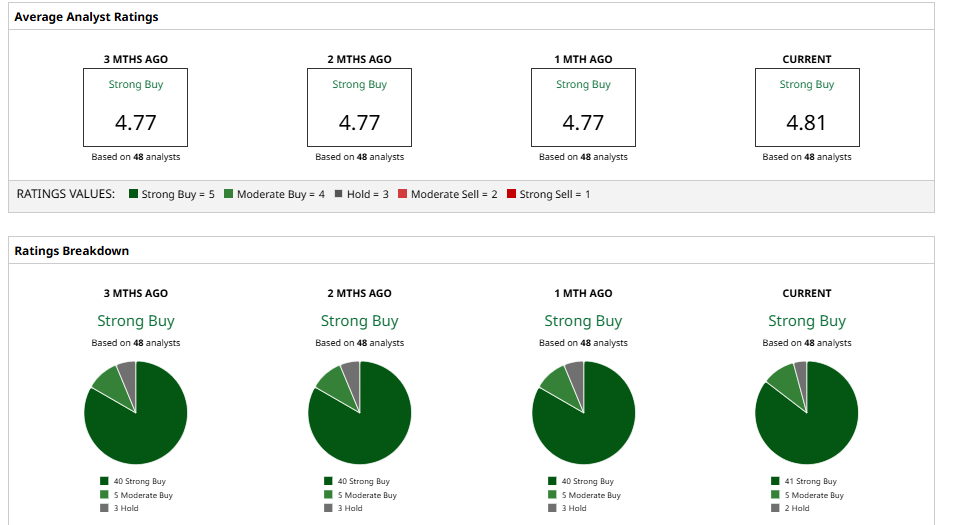

Nevertheless, Barchart notes that 48 analysts rate MSFT a consensus “Strong Buy,” with an average target around $630. The forecast implies a healthy upside of around 22% from current levels.

In short, analysts still see Microsoft as a top player in AI and cloud. Even with rising competition and higher spending, most believe the growth in Azure and Copilot is worth it.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia CEO Jensen Huang Says You Can ‘Tokenize Anything’ But You’ll Need ‘Thousands of Chips.’ That’s Good News for NVDA Stock.

- This Analyst Just Slashed His Fiserv Stock Price Target by 55%. Should You Jump Ship Now?

- 'Aggressive' Spending Spooks Meta Platforms Investors. Should You Buy the Dip in META Stock?

- A $135 Billion Reason to Buy Microsoft Stock Now

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.