Financial News

Should You Buy Monolithic Power Stock Before Dec. 22?

Inclusion of a company's stock in a reputable index is always seen as a positive indicator for the stock. Not only does it result in the tangible benefits of passive flows from the funds tracking that index and enhanced liquidity for the stock, but it also boosts the surrounding narrative. That is what is set to happen to Monolithic Power (MPWR).

About Monolithic Power

Founded in 1997, Monolithic Power is a U.S. semiconductor firm focusing on efficient power management integrated circuits (PMICs) and related products serving diversified technology end markets worldwide. A public company since 2004, over the following decades, the company expanded its product lines to include power converters, controllers, motor drivers, battery management, and more, reaching thousands of SKUs (stock keeping units) deployed globally.

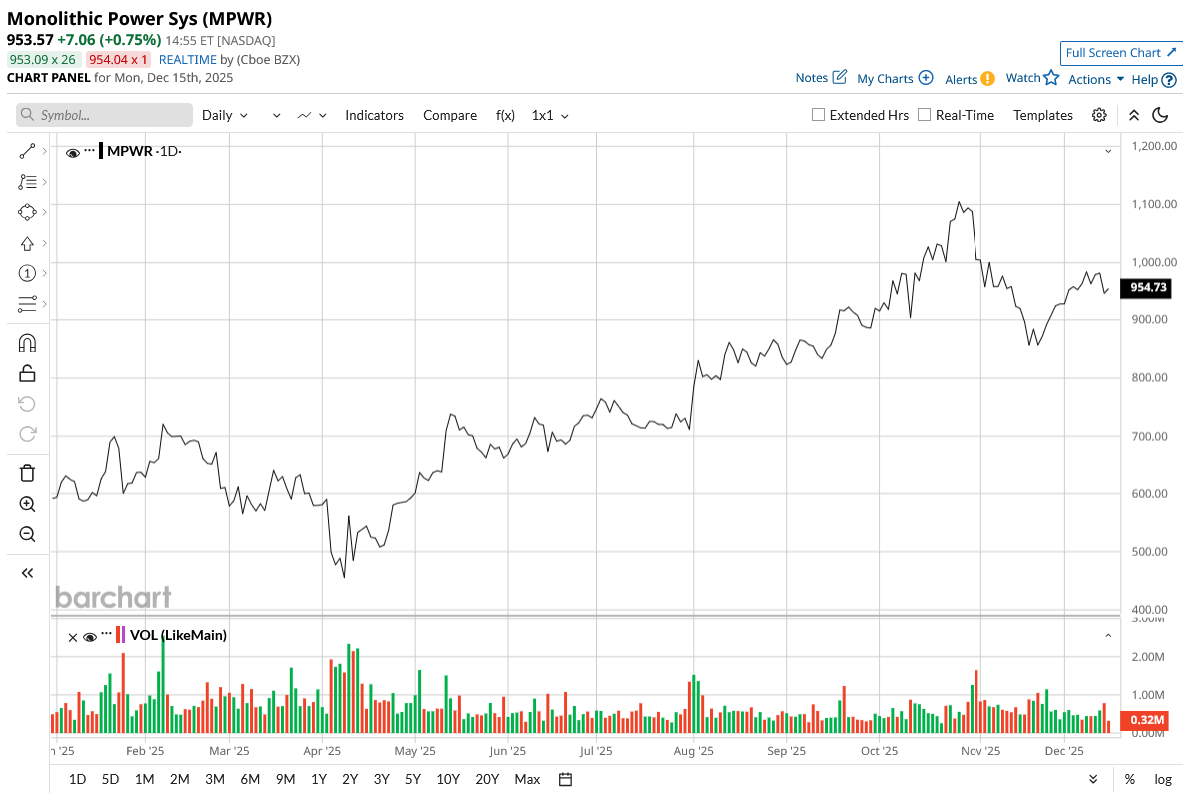

Included in the S&P 500 ($SPX) in 2021, the company currently commands a market cap of $45.3 billion and is up 60% on a year-to-date (YTD) basis. Now, MPWR stock is all set to become a part of the Nasdaq-100 on Dec. 22. What this means is that the company is poised to receive massive passive flows from Nasdaq-100-focused ETFs such as the Invesco QQQ Trust (QQQ) (AUM of $385 billion).

So, with momentum and sentiment by its side, can the MPWR stock be considered for addition to an investor's portfolio? Let's find out.

Steady Financials Marked by Growth (With a Valuation Bogey)

Monolithic Power has surely benefited from the AI megatrend, but growth has been a feature of its operations for a while. Over the last 10 years, the company's revenue and earnings have grown at impressive CAGRs of 23.52% and 49.53%, respectively, with the company also displaying consistent quarterly earnings beats for more than a couple of years.

The results for the most recent quarter were powerful as well, with both revenue and earnings surpassing estimates. In Q3 2025, Monolithic's revenues were at $737.2 million, up 18.9% from the previous year. Encouragingly, all the key segments witnessed yearly growth, with the largest Enterprise Data segment rising by 3.8% on a year-over-year (YoY) basis and the Storage and Computing segment seeing an even sharper growth rate of 29.6% in the same period to $186.6 million.

Shifting focus towards earnings, the EPS for the quarter came in at $4.73. Not only was this higher, 16.5% from the prior year, but it also came in ahead of the consensus estimate of $4.64. Further, apart from being the ninth consecutive quarter of earnings beat from the company, this was also the sixth straight quarter of yearly rise in earnings from the company.

Monolithic remained a reliable cash generator as well, with net cash from operating activities coming in at $733.3 million, higher than the corresponding period's figure of $620.7 million last year. Overall, the company closed the quarter with a cash balance of $1.1 billion, with no short-term debt on its books.

For Q4 2025, the company expects revenue to be in the range of $730 million to $750 million. The midpoint of which would denote a YoY growth of 19%.

However, the stock's strong upmove has come at the expense of it trading at heady valuations. Its forward P/E, P/S, and P/CF of 53.48, 16.31, and 47.35 are all much higher than the sector medians of 24.51, 3.45, and 20.35, respectively. Yet, the Street remains convinced about MPWR's growth prospects, with forward revenue and earnings growth rates pegged at 21.36% and 21.93%, compared to the sector medians of 8.06% and 10.75%, respectively.

What Can Drive This Growth?

Analysts' optimistic growth projections are not misplaced, as Monolithic has a number of things going for it to continue on this trajectory.

This is because Monolithic Power Systems thrives by focusing on segments where its specialized technology delivers unmistakable edges, translating into outsized profitability. Moreover, the management takes a patient view, favoring long-term growth over chasing quarterly swings or Wall Street sentiment, which has supported steady, compounding expansion.

Notably, at its core, the MPS's offerings stand out through sophisticated analog circuit design, dense on-chip integration, and superior power efficiency. A robust cash position and a capital-light fabless approach further enable aggressive reinvestment in new capabilities, while ongoing product breakthroughs, tighter collaboration with key accounts, and moves into bigger-ticket applications have sustained the growth engine.

Delving into its competitive advantages further, what truly differentiates MPS from analog peers is a portfolio of proprietary power-management topologies, protected process nodes, and packaging intellectual property. Close-knit engineering ties with customers, often spanning years, create high switching costs and give MPS early visibility into next-generation platforms. Finally, the fabless structure keeps overhead low, provides agility in scaling production, and frees up capital for research, all of which bolster margin sustainability and fuel faster innovation loops.

That said, even with broadening exposure, MPWR retains meaningful ties to cyclical pockets like servers, factory automation, and vehicle electrification. A marked pullback in data center spending, slower EV rollout, or industrial capex cuts could weigh against the company. Though MPWR has historically gained share coming out of low periods, occasional earnings variability tends to cap multiples during softer patches.

Additionally, heavy reliance on marquee names in cloud infrastructure, artificial intelligence hardware, and automotive platforms drives much of the upside, yet introduces concentration risks. These tier-one clients wield considerable bargaining power and could gradually bring in alternative suppliers, hurting Monolithic's revenues. Shifts in design allocations or sustained pricing concessions from major accounts would carry real potential to erode growth rates and compress operating margins, especially as power semiconductors grow more central to system performance and attract fiercer rivalry.

Analyst Opinion on MPWR Stock

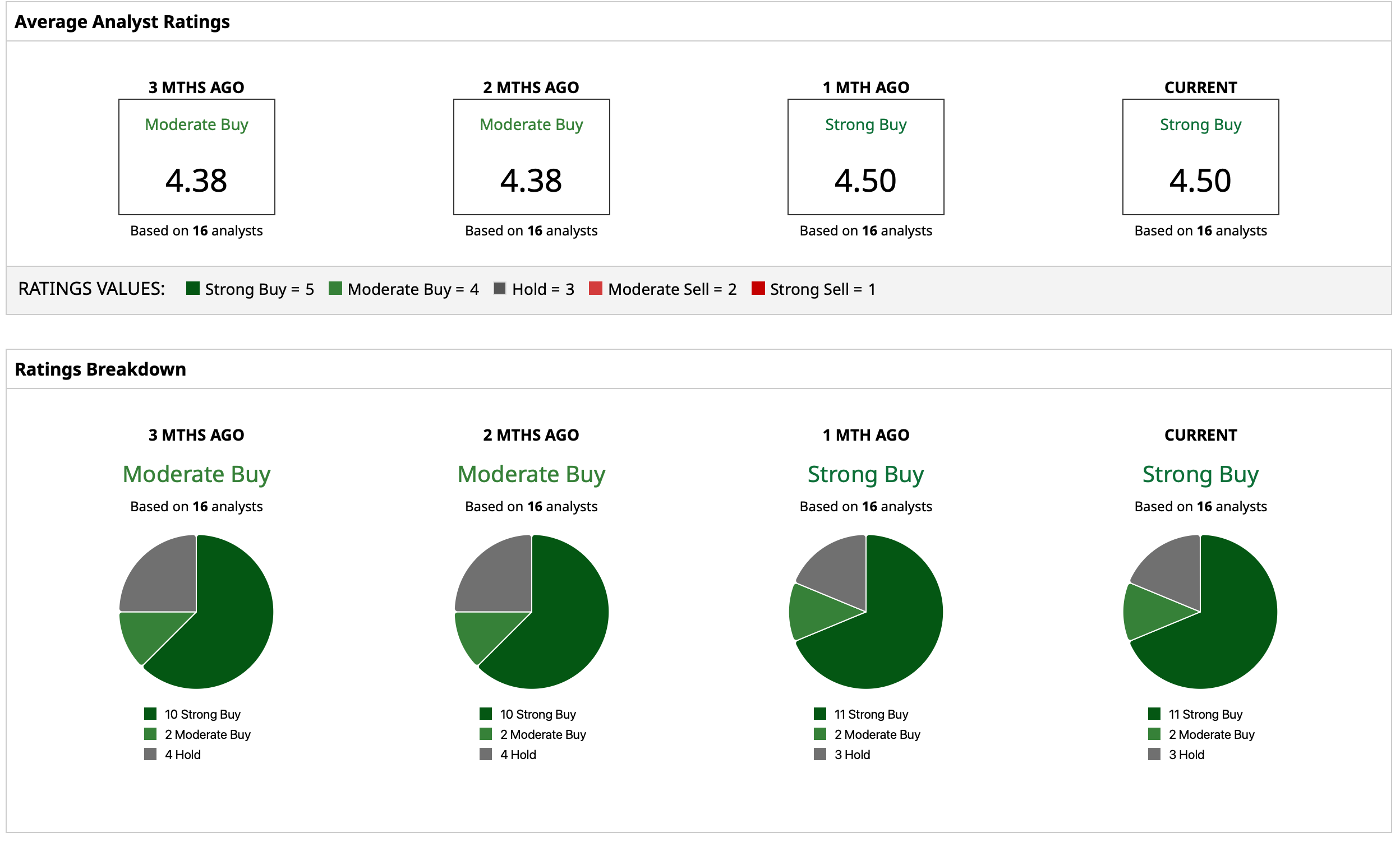

Thus, analysts have attributed to the MPWR stock an overall rating of “Strong Buy.” The mean target price of $1,201 indicates an upside potential of about 26% from current levels. Out of 16 analysts covering the stock, 11 have a “Strong Buy” rating, two have a “Moderate Buy” rating, and three have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy Monolithic Power Stock Before Dec. 22?

- 4 Quotable Investing Lessons in Honor of the Late Rob Reiner

- Should You Buy the Dip in Oracle Stock and Hold for 2026?

- Can Nextdoor Stock Hit $4 Before the End of 2025?

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.