Financial News

More News

View More

Why Taiwan Semiconductor's 6.5% Dip Could Be a Smart Buy ↗

Today 18:39 EST

RTX Surges to Record Highs as Defense Orders Explode ↗

Today 17:42 EST

Smart Money Is Buying Auto Suppliers, Not Car Brands ↗

Today 16:49 EST

Higher Beef Prices Are Here: Best Steakhouse Stocks for 2026 ↗

Today 15:07 EST

AI Runs on Power—And Constellation Energy Controls the Switch ↗

Today 14:16 EST

Recent Quotes

View More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

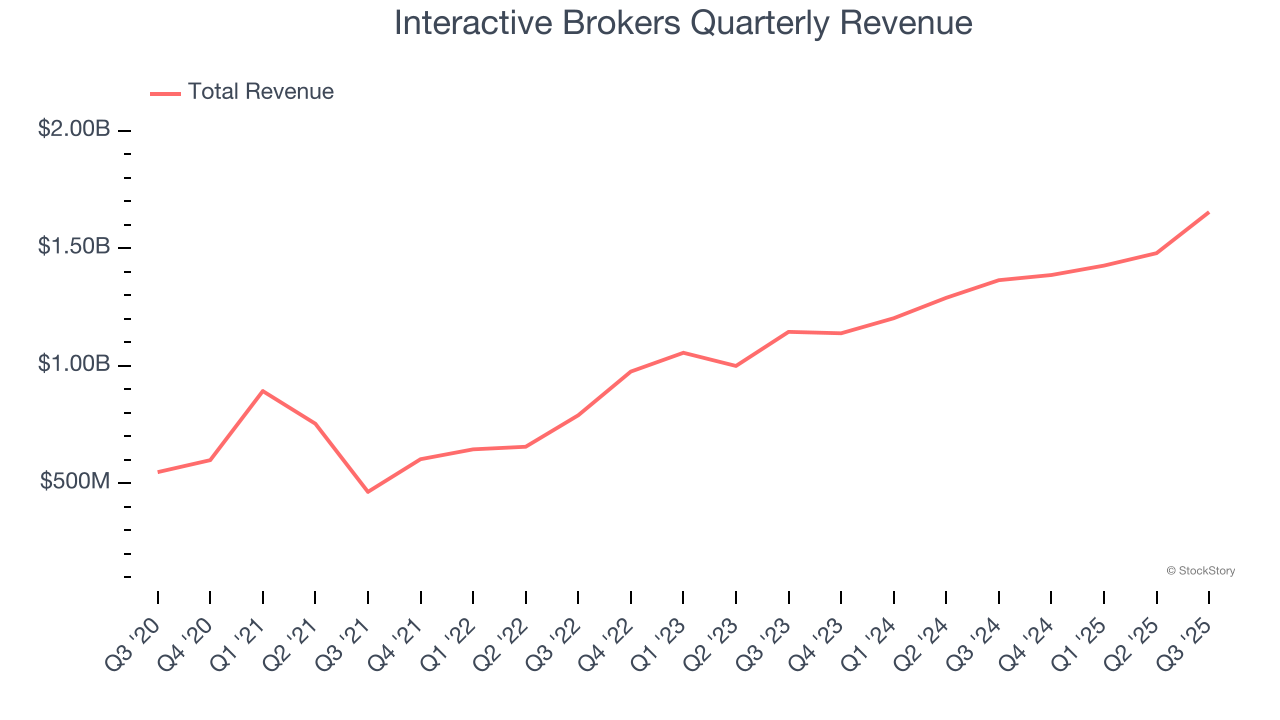

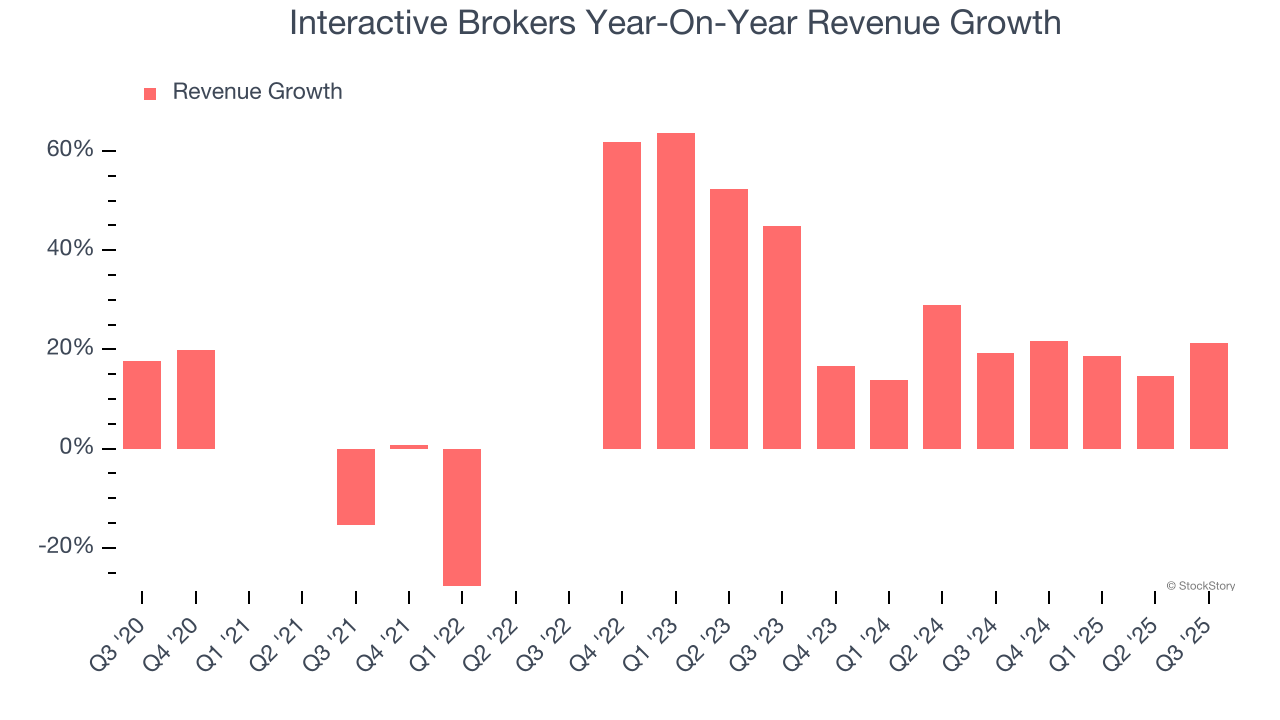

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.