Financial News

Boeing (NYSE:BA) Reports Sales Below Analyst Estimates In Q1 Earnings

Aerospace and defense company Boeing (NYSE: BA) fell short of the market’s revenue expectations in Q1 CY2025, but sales rose 17.7% year on year to $19.5 billion. Its non-GAAP loss of $0.49 per share was 62.4% above analysts’ consensus estimates.

Is now the time to buy Boeing? Find out by accessing our full research report, it’s free.

Boeing (BA) Q1 CY2025 Highlights:

- Revenue: $19.5 billion vs analyst estimates of $19.66 billion (17.7% year-on-year growth, 0.8% miss)

- Adjusted EPS: -$0.49 vs analyst estimates of -$1.30 (62.4% beat)

- Adjusted EBITDA: $1.06 billion vs analyst estimates of $594.9 million (5.4% margin, 78.5% beat)

- Operating Margin: 2.4%, up from -0.5% in the same quarter last year

- Free Cash Flow was -$2.29 billion compared to -$3.93 billion in the same quarter last year

- Backlog: $544.7 billion at quarter end

- Sales Volumes rose 56.6% year on year (-36.2% in the same quarter last year)

- Market Capitalization: $122.3 billion

"Our company is moving in the right direction as we start to see improved operational performance across our businesses from our ongoing focus on safety and quality," said Kelly Ortberg, Boeing president and chief executive officer.

Company Overview

One of the companies that forms a duopoly in the commercial aircraft market, Boeing (NYSE: BA) develops, manufactures, and services commercial airplanes, defense products, and space systems.

Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Sales Growth

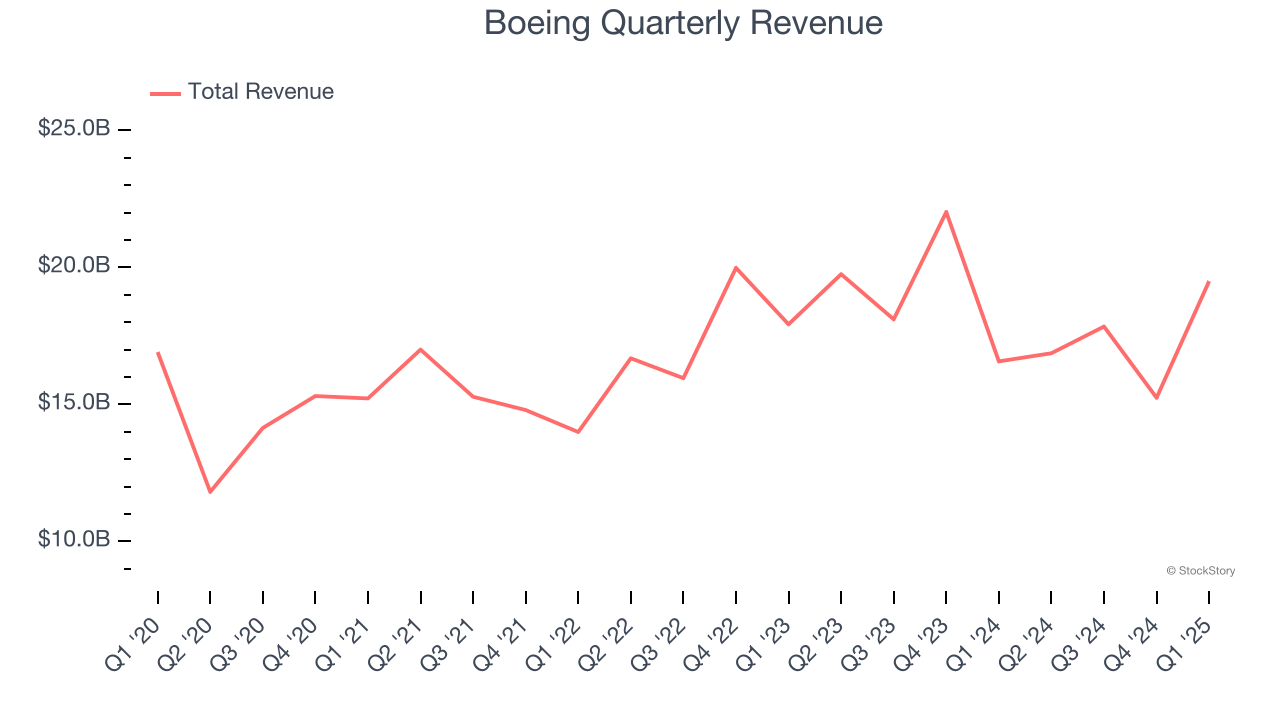

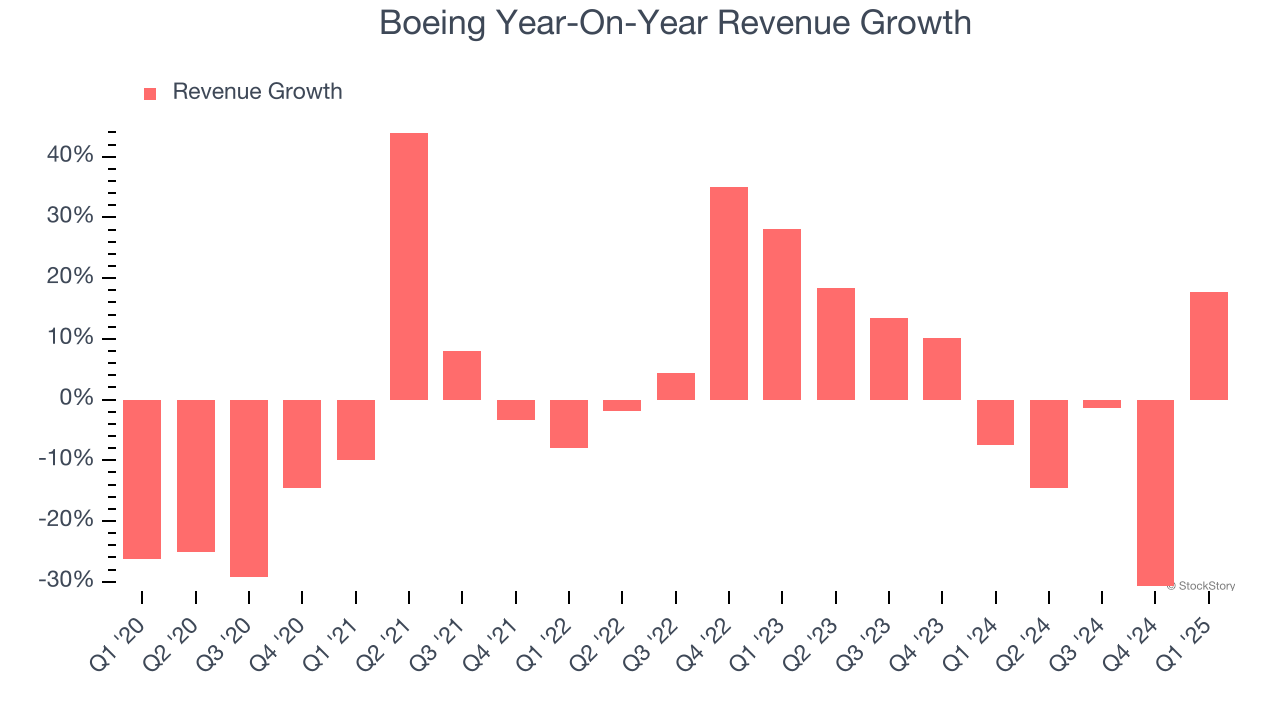

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Boeing struggled to consistently increase demand as its $69.44 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Just like its five-year trend, Boeing’s revenue over the last two years was flat, suggesting it is in a slump.

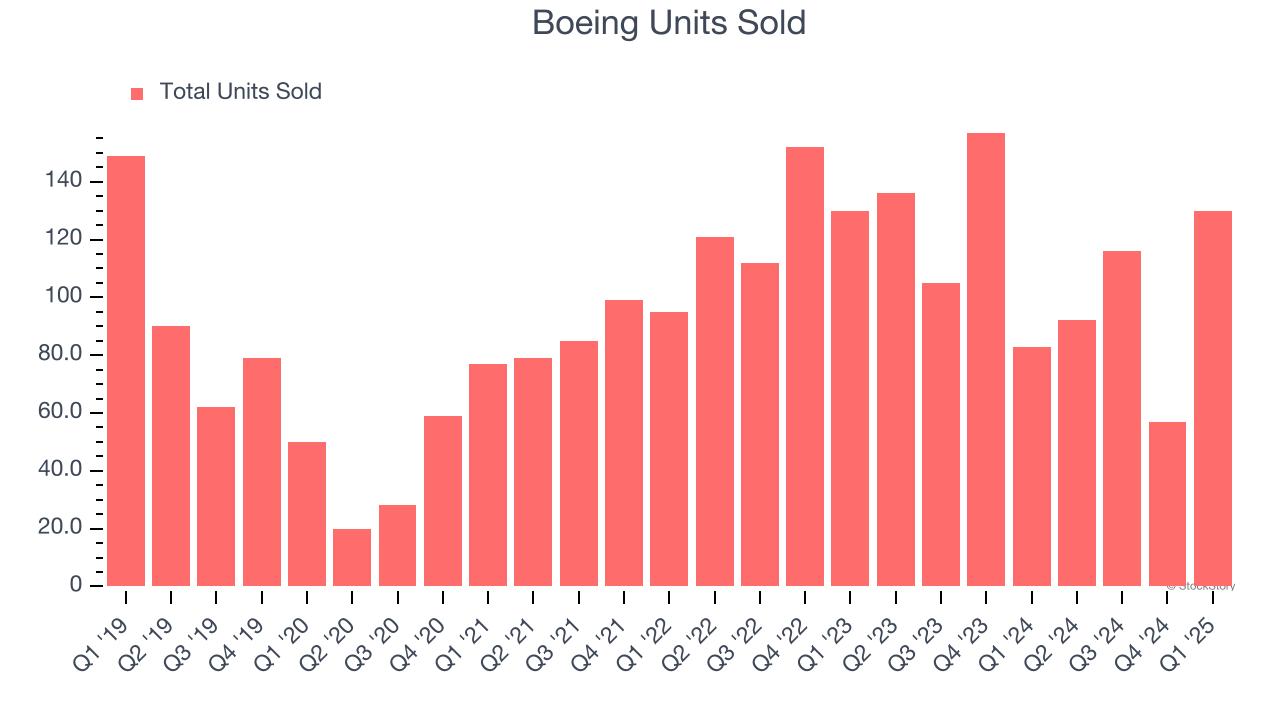

We can better understand the company’s revenue dynamics by analyzing its number of units sold, which reached 130 in the latest quarter. Over the last two years, Boeing’s units sold averaged 7% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Boeing’s revenue grew by 17.7% year on year to $19.5 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 26.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping for a company of its scale and suggests its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

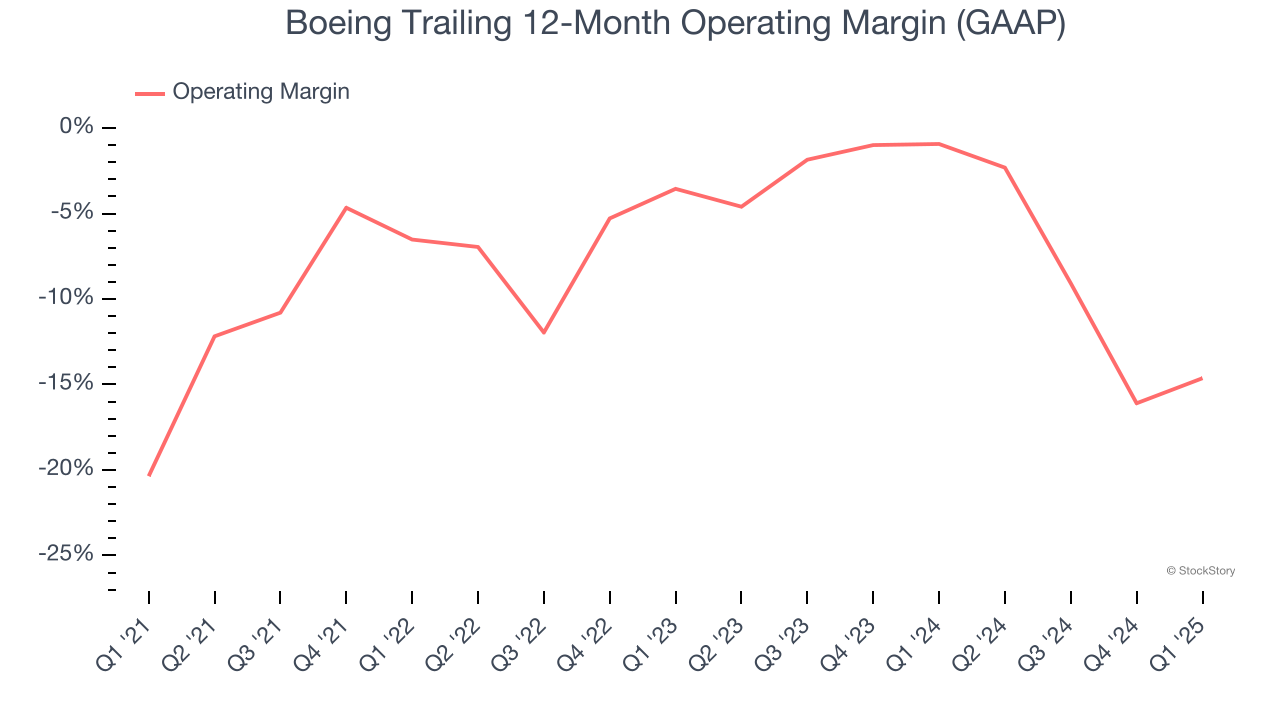

Although Boeing was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 8.6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Boeing’s operating margin rose by 5.7 percentage points over the last five years. Still, it will take much more for the company to show consistent profitability.

This quarter, Boeing generated an operating profit margin of 2.4%, up 2.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

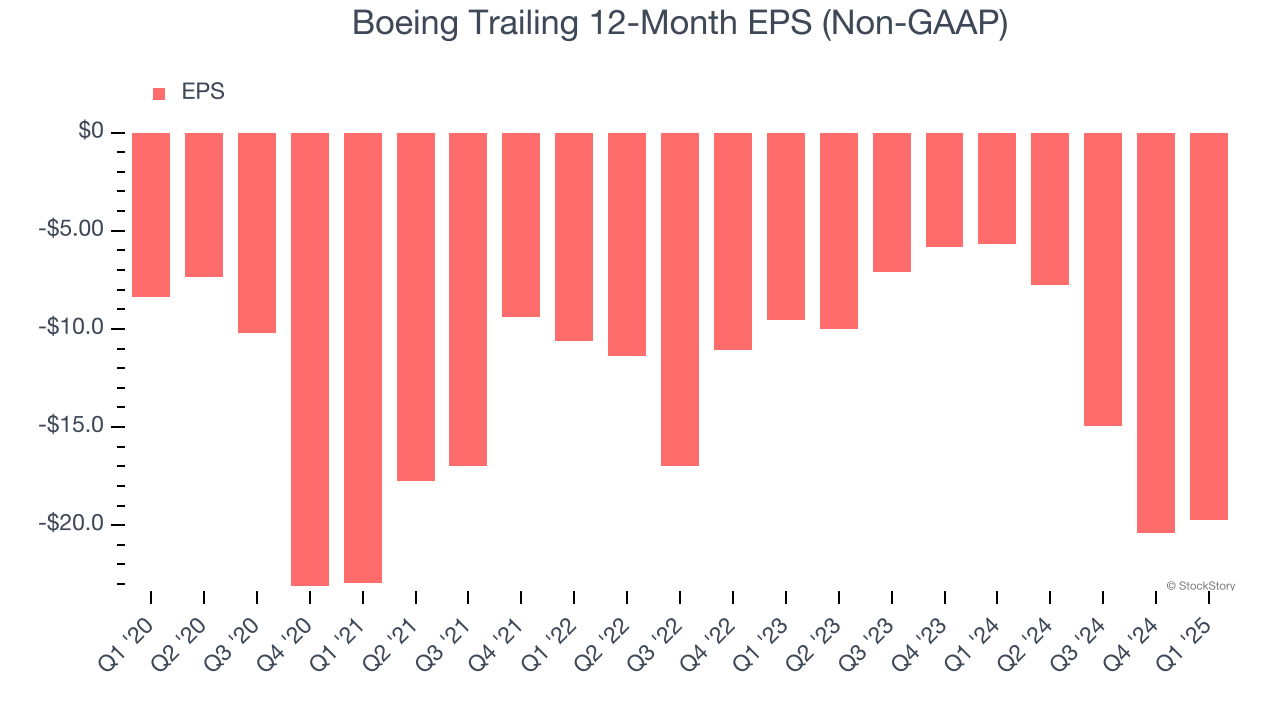

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Boeing’s earnings losses deepened over the last five years as its EPS dropped 18.6% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Boeing’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Boeing, its two-year annual EPS declines of 43.6% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q1, Boeing reported EPS at negative $0.49, up from negative $1.13 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Boeing’s full-year EPS of negative $19.74 will reach break even.

Key Takeaways from Boeing’s Q1 Results

We were impressed by how significantly Boeing blew past analysts’ EBITDA and EPS expectations this quarter, signaling improved profitability. On the other hand, its revenue slightly missed. Still production of the company's signature 737 planes remains on schedule. Overall, we think this was a solid quarter with some key areas of upside amidst low expectations. The stock traded up 3.5% to $168.08 immediately following the results.

Boeing had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.