Financial News

Hims & Hers Health’s (NYSE:HIMS) Q1: Beats On Revenue, Full-Year Outlook Slightly Exceeds Expectations

Telehealth company Hims & Hers Health (NYSE: HIMS) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 111% year on year to $586 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $540 million was less impressive, coming in 4.3% below expectations. Its GAAP profit of $0.20 per share was 66.4% above analysts’ consensus estimates.

Is now the time to buy Hims & Hers Health? Find out by accessing our full research report, it’s free.

Hims & Hers Health (HIMS) Q1 CY2025 Highlights:

- Revenue: $586 million vs analyst estimates of $541.3 million (111% year-on-year growth, 8.3% beat)

- EPS (GAAP): $0.20 vs analyst estimates of $0.12 (66.4% beat)

- Adjusted EBITDA: $91.06 million vs analyst estimates of $61.78 million (15.5% margin, 47.4% beat)

- The company reconfirmed its revenue guidance for the full year of $2.35 billion at the midpoint

- EBITDA guidance for the full year is $315 million at the midpoint, above analyst estimates of $296.5 million

- Operating Margin: 9.9%, up from 3.6% in the same quarter last year

- Free Cash Flow Margin: 8.5%, up from 4.3% in the same quarter last year

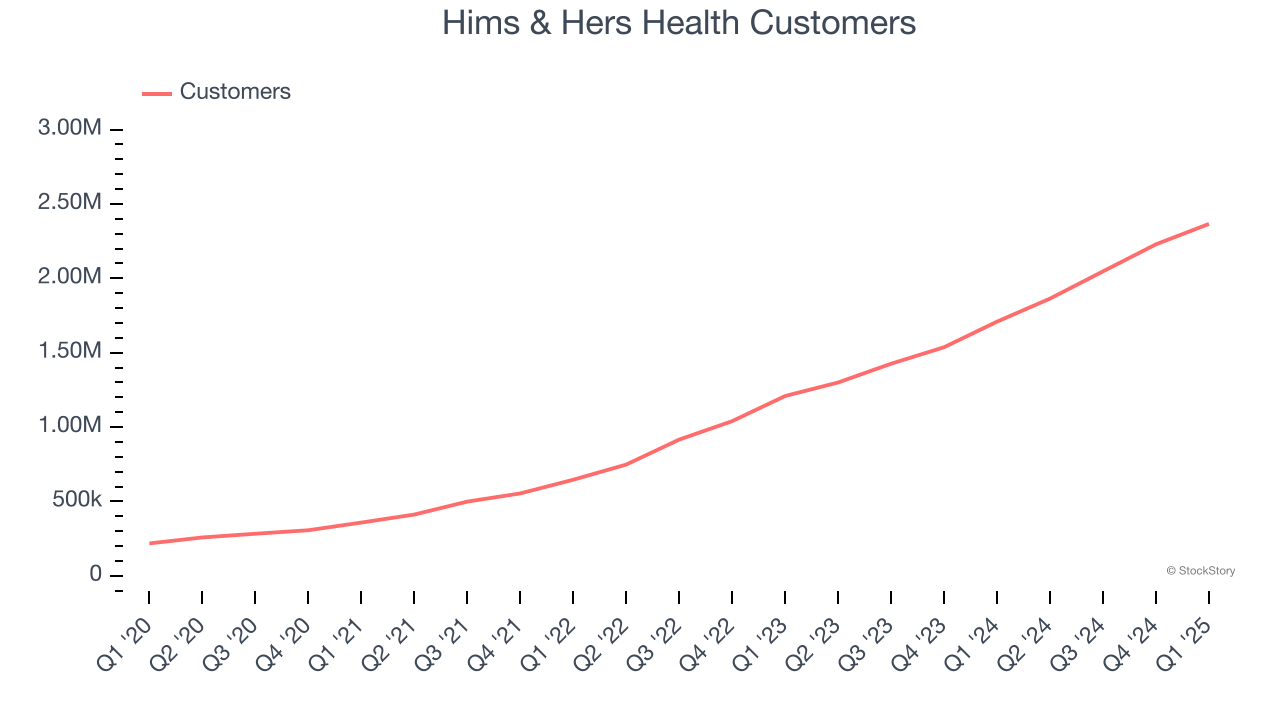

- Customers: 2.37 million, up from 2.23 million in the previous quarter

- Market Capitalization: $9.13 billion

“We’re starting 2025 with incredible momentum. Millions of people are turning to us for access to care that is personal, affordable, and has the potential to drive better outcomes,” said Andrew Dudum, co-founder and CEO.

Company Overview

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE: HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

Sales Growth

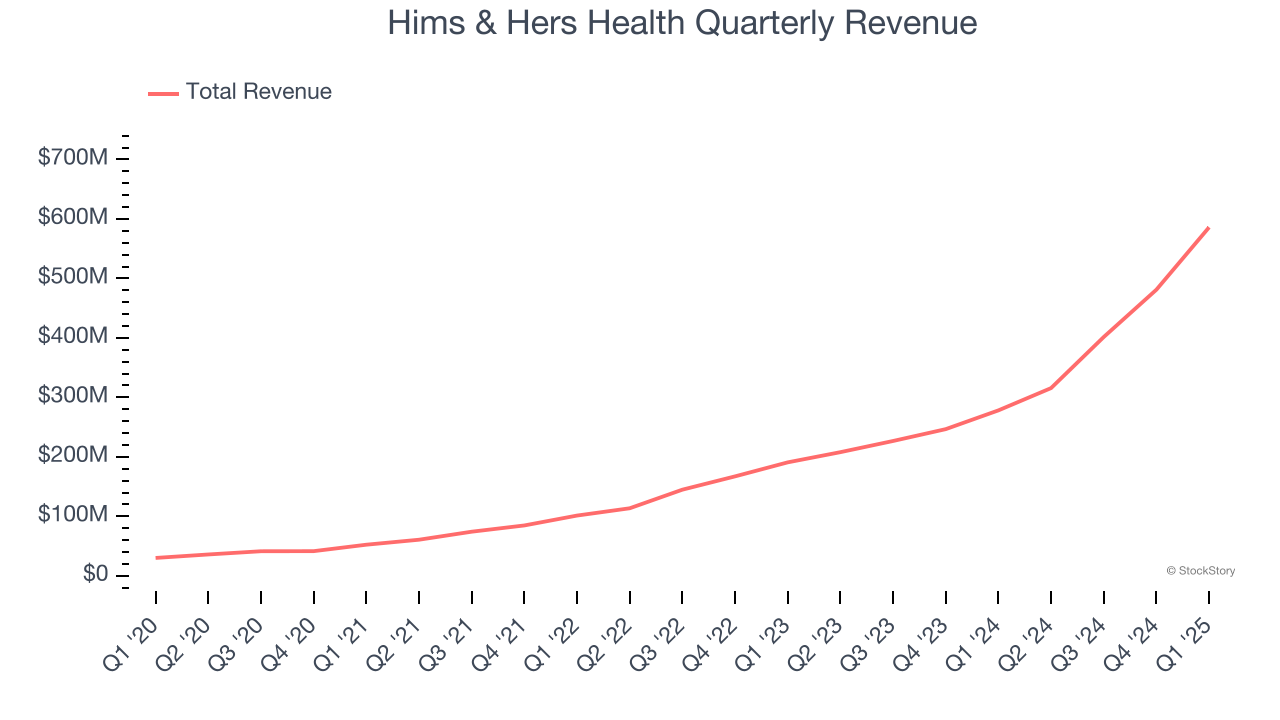

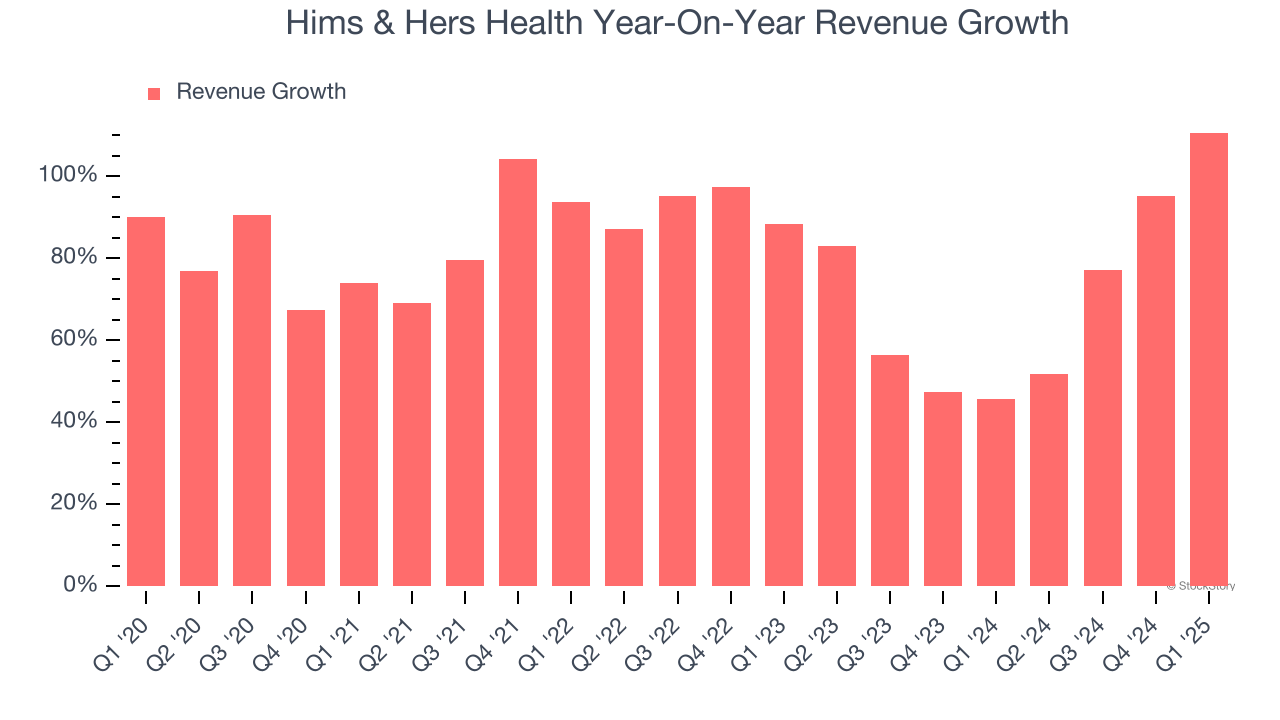

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Hims & Hers Health’s sales grew at an incredible 79.1% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Hims & Hers Health’s annualized revenue growth of 70.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can dig further into the company’s revenue dynamics by analyzing its number of customers, which reached 2.37 million in the latest quarter. Over the last two years, Hims & Hers Health’s customer base averaged 48.6% year-on-year growth. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Hims & Hers Health reported magnificent year-on-year revenue growth of 111%, and its $586 million of revenue beat Wall Street’s estimates by 8.3%. Company management is currently guiding for a 71.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 36.5% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and indicates the market is forecasting success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

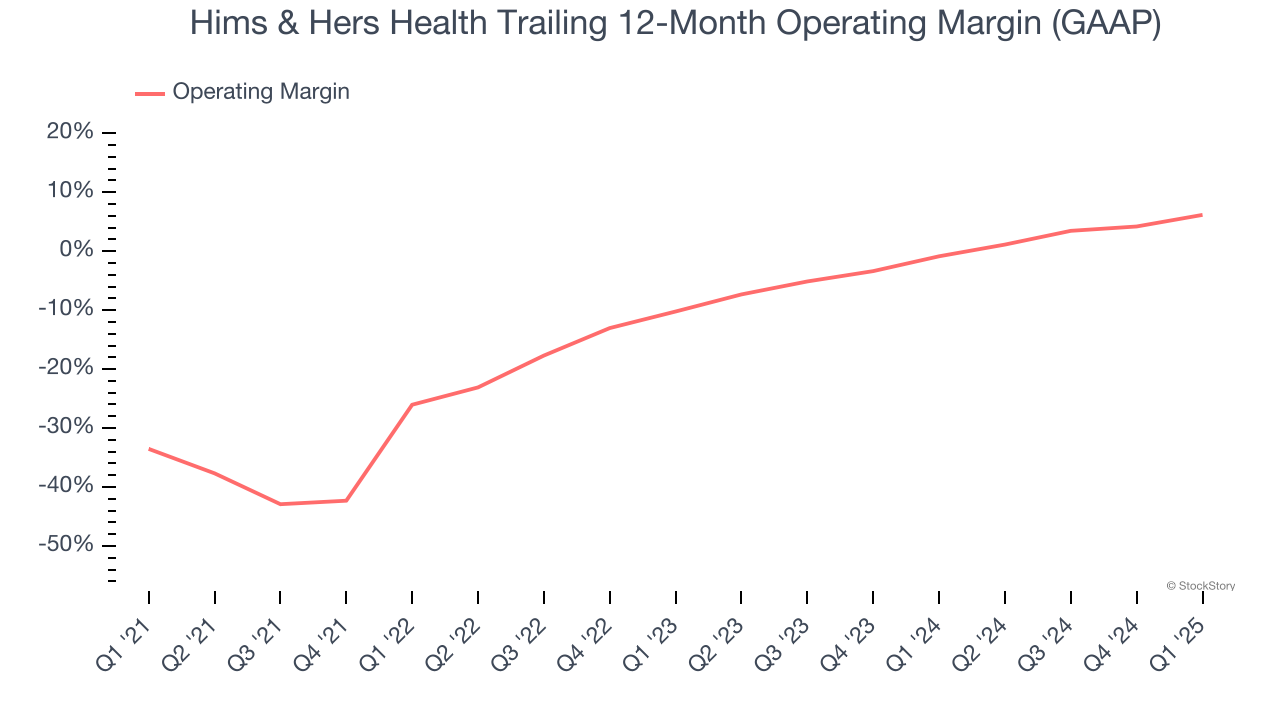

Although Hims & Hers Health was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.7% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Hims & Hers Health’s operating margin rose by 39.7 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 16.4 percentage points on a two-year basis. These data points are very encouraging and shows momentum is on its side.

In Q1, Hims & Hers Health generated an operating profit margin of 9.9%, up 6.3 percentage points year on year. This increase was a welcome development and shows it was more efficient.

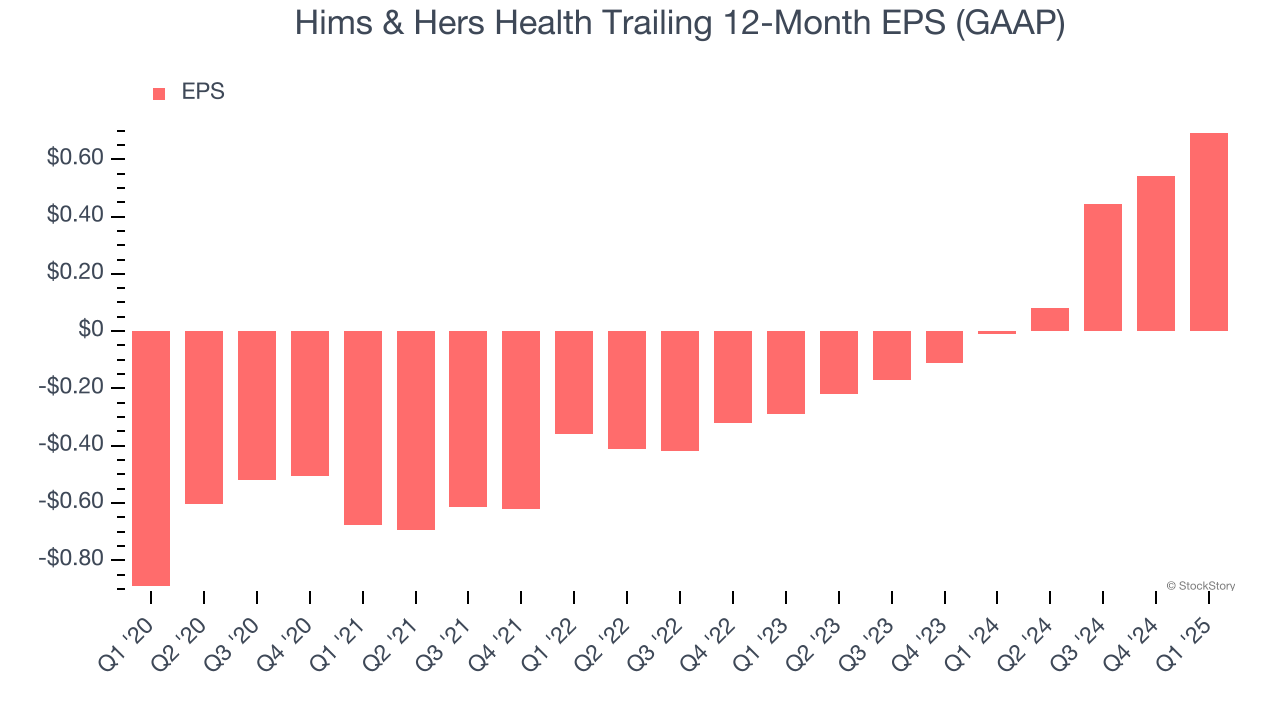

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Hims & Hers Health’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q1, Hims & Hers Health reported EPS at $0.20, up from $0.05 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Hims & Hers Health’s full-year EPS of $0.69 to grow 7.6%.

Key Takeaways from Hims & Hers Health’s Q1 Results

We were impressed by how significantly Hims & Hers Health blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, its customer additions fell short of Wall Street’s estimates and its revenue guidance was softer than anticipated. Overall, we still think this was a decent quarter. The market seemed to be hoping for more, and the stock traded down 1.4% to $41.37 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.