Financial News

2 Reasons We’re Fans of SoFi (SOFI)

What a time it’s been for SoFi. In the past six months alone, the company’s stock price has increased by a massive 113%, reaching $29.16 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is SOFI a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is SOFI a Good Business?

Starting as a student loan refinancing company founded by Stanford business school students in 2011, SoFi Technologies (NASDAQ: SOFI) operates a digital financial platform offering lending, banking, investing, and other financial services to help members borrow, save, spend, invest, and protect their money.

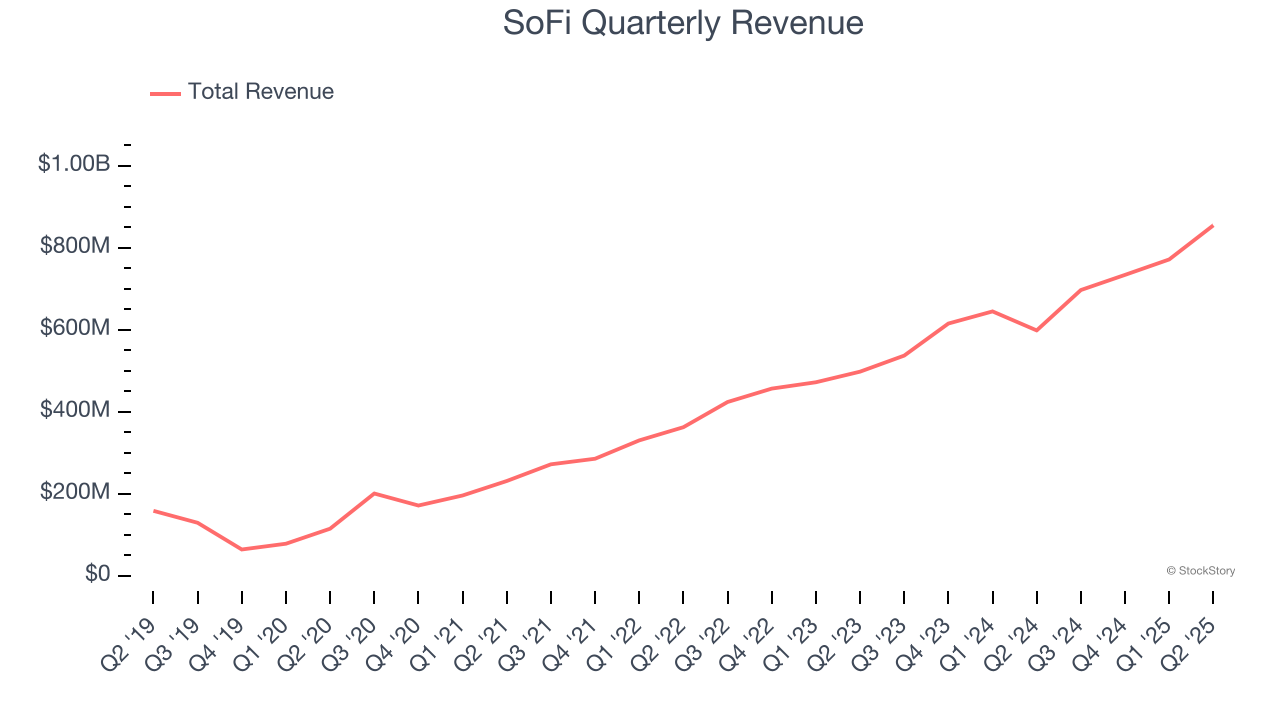

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

Luckily, SoFi’s revenue grew at an incredible 51.2% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers.

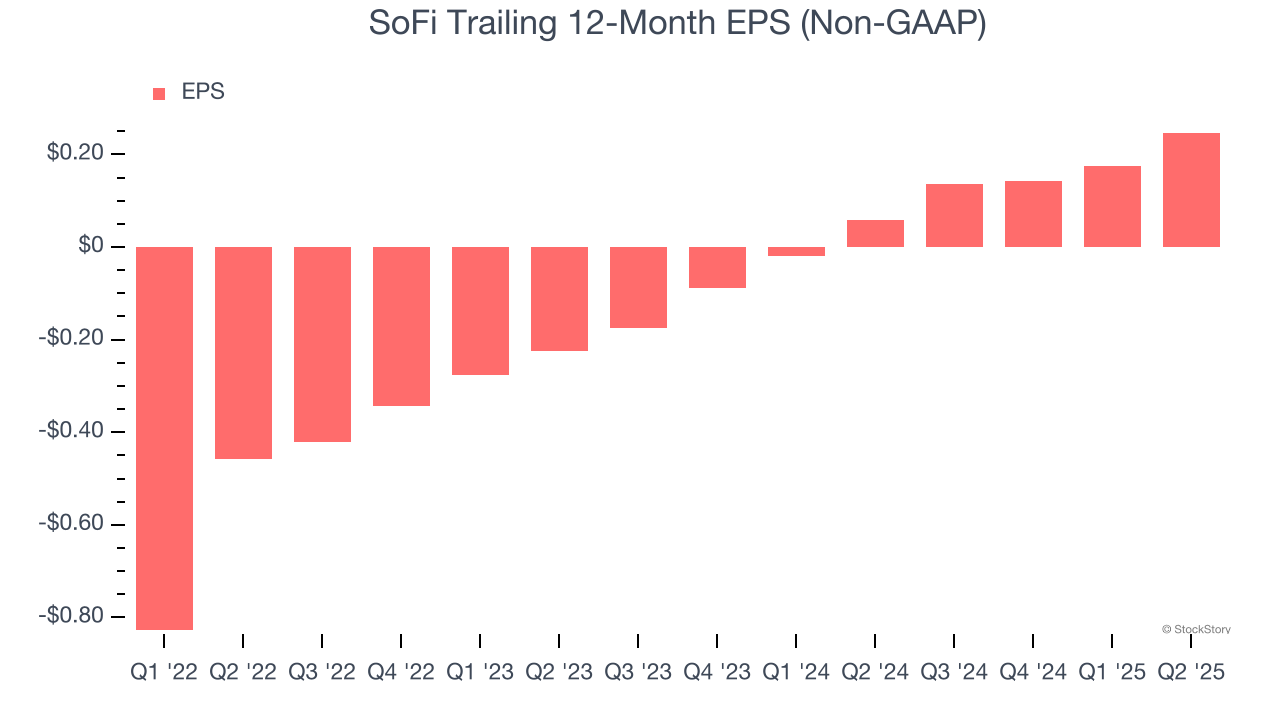

2. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

SoFi’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons SoFi is a high-quality business worth owning, and with the recent rally, the stock trades at 78.3× forward P/E (or $29.16 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.