With all eyes on Tesla CEO Elon Musk’s social media banter, LiveWire Group, Inc. (NYSE: LVWR) is quietly scheming an electric vehicle (EV) revolution of its own — two wheels at a time.

The Milwaukee-based company is leading motorcycling’s electric transformation by following through on a commitment to produce tech-driven electric bikes for a growing cadre of motorcycle enthusiasts. Already on its second generation e-motorcycle, LiveWire has a multi-year head start over traditional automakers like BMW, Honda and Ducati, which have been quick to tout their electric motorcycle capabilities but slow to manufacture at scale.

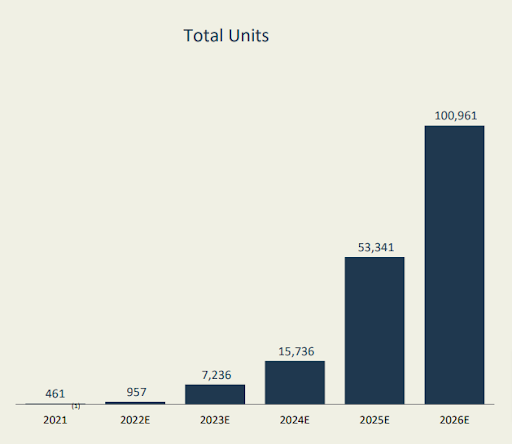

A little over a year removed from its spin-off from Harley Davidson, LiveWire is on pace to sell as many as 1,000 electric motorcycles this year, as management recently confirmed in its third-quarter update. While this pales in comparison to the estimated 14 million electric cars and trucks that will be sold this year, it’s the growth that matters most to investors.

LiveWire predicts that it will be selling over 100,000 units annually by 2026. This is projected to equate to $1.5 billion in revenue, more than 30x the amount of revenue it generated in the 12-month period ended September 30, 2023. Can the company really sell 100x more electric motorcycles than it's currently selling in just a few years?

Research group Prescient & Strategic Intelligence forecasts that the North American electric motorcycles and scooters market will grow 18% annually for the rest of the decade. The growth is expected to be driven by government subsidies, tax rebates and the adoption of sustainable urban mobility infrastructure. If LiveWire can capitalize on its head start and ride this growth wave over the next few years, its lofty sales target could very well be met (if not exceeded).

Electric motorcycles, mopeds and scooters are already in widespread use in China, India and other parts of Asia. There they are relied upon for delivery, daily commutes, and to alleviate traffic congestion — not to mention relieve the environment of harmful carbon emissions. The U.S. has been slower to adopt the idea that less is more in city transportation — which brings us to a key point.

The industry’s push into the electrification of two-wheeled transportation is just getting started. While Ford, GM and other American automakers are ramping up EV production to adhere to government mandates (and compete with Tesla), the uptake in the motorcycle industry has been much slower. This is nothing new.

Motorcycle technological innovation has historically lagged behind that of cars. Electric cars and trucks have been growing fast for years, but the application of EV powertrains to motorcycles and scooters is still a new concept.

The good news for investors — e-motorcycles appear to be in the early stages of rapid growth. As EV infrastructure and affordability improve, a rising fleet of cleaner, quieter two-wheelers for urban communities and last-mile deliveries is likely to hit U.S. roads.

LiveWire vehicles are getting more economical

LiveWire’s first electric motorcycle, LiveWire ONE, captured the imaginations of weekend joyriders, professional riders and other early adopters. It's been praised for its fast-charge, range and advanced rider aids like Bluetooth connectivity — but not so much its price.

LiveWire ONEs currently start at $22,799 — a price that has already been slashed. Especially in a high auto loan rate, and high insurance premium environment, this is too expensive — even for the biggest of motorcycle lovers.

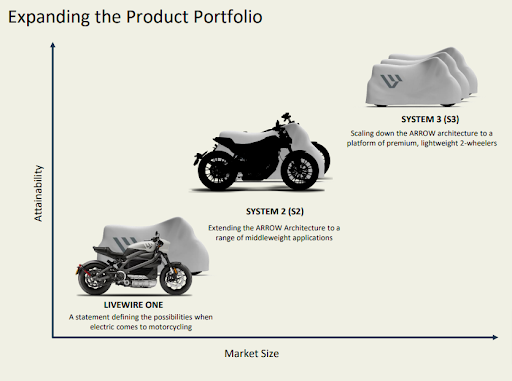

Going forward, the company is targeting a much broader set of customers who are equally adventurous and economical. This includes both seasoned and first-time riders across all age groups. LiveWire is aiming to appeal to more of the mass market with the System 2 (S2) Del Mar, which starts at $15,499. Built on its new ARROW architecture designed to eliminate unnecessary material, weight and cost, the S2 Del Mar can be reserved for $100 down. Compared to the bulkier LiveWire ONE, it is a more practical solution for urban transportation.

LiveWire shipped its first S2 Del Mar last quarter and is ramping production in North America and Europe in anticipation of consumers liking the 32% lower price point. It is also building out its distribution network in anticipation of developing more models on the S2 platform. The company ended the third quarter with 126 global retail partners, which gives it a valuable brick-and-mortar presence in addition to its digital sales channel.

A lot is riding on the success of the S2 models. Yet, with deliveries just underway and the macroeconomic environment less than supportive, the flashy new Del Mars has yet to translate to flashy financial results.

On October 26th, LiveWire announced that third quarter sales fell 45% year-over-year to $8.1 million. The performance would have been worse had it not been for $6.8 million in revenue generated from the company’s STACYC business, which makes high-end electric bicycles for kids. Like LiveWire ONEs, $2,000 to $3,000 e-bikes didn’t make the budget for most American families as sales were down 30% from last year. With LiveWire also selling fewer motorcycles, the Q3 results were far from riveting — but there are some positives.

Despite the 45% revenue drop, a $14.6 quarterly net loss marked a significant improvement from the prior year period. This shows that the company is reining in its cost structure as targeted and should be better positioned to deliver profits as S2 deliveries ramp. With its focus now firmly on the S2 buildout, management glazed over the fact that it sold only 50 electric motorcycles in Q3 in favor of expressing excitement towards the Del Mar.

Looking further down the road, LiveWire plans to unveil even lighter-weight System 3 (S3) two-wheelers which could be even cheaper than the S2’s. More importantly, the vehicles could expand its market into courier, food and last-mile package delivery — as it continues to take pages out of the China playbook.

New head honcho at the wheel

As LiveWire enters a critical chapter in its quest for electric motorcycle dominance, it has a new head rider. In June 2023, the company named Karim Donnez as CEO. Mr. Donnez replaced former CEO Jochen Zeitz, who served in the capacity for an agreed-upon period and has retained his role as Board Chairman. He inherits a company that has yet to prove itself from a financial standpoint but has a long, promising road ahead.

One thing that LiveWire has going for it that the market doesn’t fully appreciate is a lack of competition. While the electric car and truck space includes a growing number of old-school automakers and startups, the electric motorcycle market has relatively few players.

Traditional OEMs like BMW and Honda will no doubt make inroads in the market, but motorcycles are likely to remain a small portion of their businesses. Upstarts like Zero, Lightning and Energica have shown promise but lack the brand recognition and manufacturing support that majority shareholder Harley-Davidson provides. This makes LiveWire a unique pure play with a singular focus on electric motorcycles, mopeds and scooters.

Second chance IPO sale

When Harley-Davidson spun off LiveWire through a special purpose acquisition company (SPAC) merger, it aimed to retain 74% of the stock. However, when most SPAC investors opted to cash out their interest in LiveWire, Harley-Davidson was forced to provide $100 million in capital, which gave it a much larger stake of approximately 90%.

This means that LiveWire is an extremely low float stock. Less than 10 million of the 202.4 million shares outstanding are publicly available to trade. For prospective retail investors, this means two things: 1) the stock is always at the mercy of a heavy-handed Harley-Davidson, which could sell large chunks at any moment if it needs cash or wants to capitalize on a run, and 2) day-to-day stock movements can be volatile as investors jockey over the 5% of LiveWire that isn’t owned by insiders.

It’s not surprising, then, that LiveWire has been on a wild ride since its September 2022 standalone debut. During the initial day one buzz, the stock surged as high as $11.63, only to dip as low as $4.20 in December 2022. It then caught a second wind and climbed as high as $12.50 in July of this year, with the market in ‘risk-on’ mode. On Friday, LVWR closed at $9.19, not far from where the IPO ride began.

This means that bullish investors have a second opportunity to grab shares at sub-$10 SPAC prices. LiveWire’s long-term growth prospects have only improved in the past 14 months with the launch of the more economical S2 platform and expanded global retail presence. The fact that the pullback from $12.50 has been in low trading volume makes it easier to like the current entry point.

Bottom Line

LiveWire is an early mover in the motorcycle industry that is in the early stages of shifting to electric. It is ramping up production of its lower-cost, next-gen electric two-wheelers in anticipation of growing demand for gas-powered bike alternatives from city dwellers, delivery contractors and enthusiasts alike. The growth story will likely take a few years to play out — but at around $9 a share, LVWR may be worth taking for a spin.