Egg and butter company Vital Farms (NASDAQ:VITL) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 22.2% year on year to $166 million. The company’s full-year revenue guidance of $740 million at the midpoint came in 4.7% above analysts’ estimates. Its GAAP profit of $0.23 per share was 40% above analysts’ consensus estimates.

Is now the time to buy Vital Farms? Find out by accessing our full research report, it’s free.

Vital Farms (VITL) Q4 CY2024 Highlights:

- Revenue: $166 million vs analyst estimates of $159.9 million (22.2% year-on-year growth, 3.8% beat)

- EPS (GAAP): $0.23 vs analyst estimates of $0.16 (40% beat)

- Adjusted EBITDA: $19.09 million vs analyst estimates of $14.96 million (11.5% margin, 27.5% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $740 million at the midpoint, beating analyst estimates by 4.7% and implying 22.1% growth (vs 29% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $100 million at the midpoint, above analyst estimates of $93.61 million

- Operating Margin: 7.8%, up from 6.7% in the same quarter last year

- Free Cash Flow was -$3.38 million, down from $21.33 million in the same quarter last year

- Market Capitalization: $1.48 billion

“2024 was an outstanding year for Vital Farms. We exceeded $600 million in net revenue, keeping us well on track to deliver our $1 billion sales target by 2027. We also added approximately 125 new family farms, and our farm network at the end of 2024 totaled more than 425, with more on the way. We accomplished these milestones while investing in the Vital Farms brand and expanding our supply chain capabilities to ensure future growth. We could not have done this without our great stakeholders, including our crew members, our farmers, and our customers, and I’d like to thank them for their dedication to bringing ethical food to the table. Industry supply will remain under pressure to start the year due to the impact of HPAI on poultry flocks across the United States. We have experienced supply constraints to start the year. However, as the year progresses, we believe the supply chain investments we made in 2024 and into 2025 will begin bearing fruit. We expect our business to accelerate in the second half of the year as we add to our supply, helping drive us toward our ambitious net revenue and adjusted EBITDA guidance for 2025 and beyond,” said Russell Diez-Canseco, Vital Farms’ President and CEO.

Company Overview

With an emphasis on ethically produced products, Vital Farms (NASDAQ:VITL) specializes in pasture-raised eggs and butter.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $606.3 million in revenue over the past 12 months, Vital Farms is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

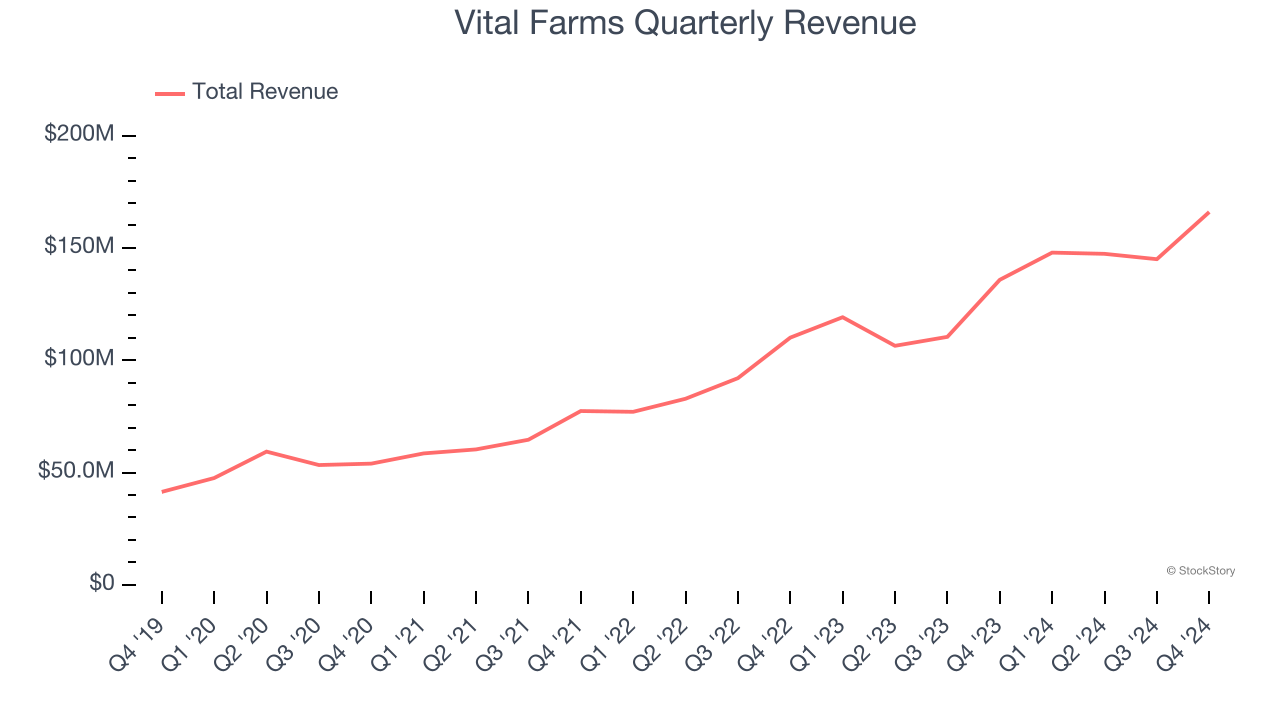

As you can see below, Vital Farms’s sales grew at an incredible 32.5% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Vital Farms reported robust year-on-year revenue growth of 22.2%, and its $166 million of revenue topped Wall Street estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to grow 16.5% over the next 12 months, a deceleration versus the last three years. Still, this projection is admirable and indicates the market sees success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

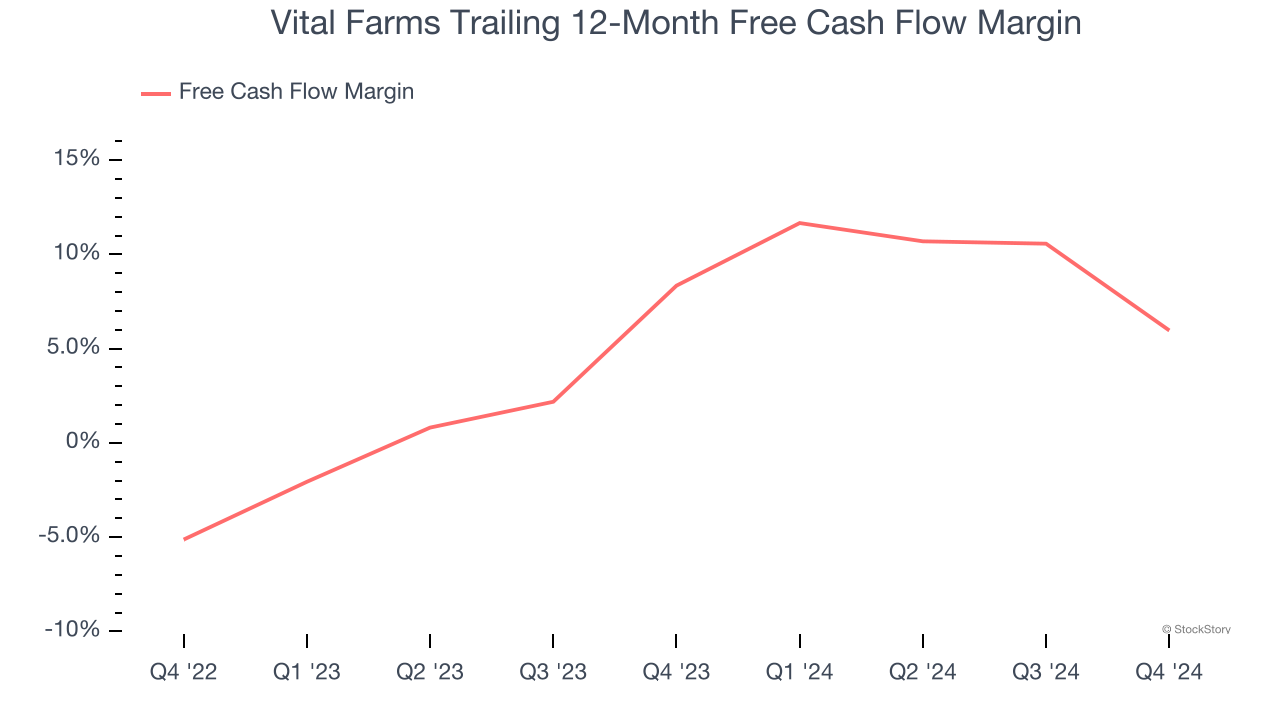

Vital Farms has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7% over the last two years, better than the broader consumer staples sector.

Taking a step back, we can see that Vital Farms’s margin dropped by 2.4 percentage points over the last year. If its declines continue, it could signal higher capital intensity.

Vital Farms burned through $3.38 million of cash in Q4, equivalent to a negative 2% margin. The company’s cash flow turned negative after being positive in the same quarter last year, which isn’t ideal considering its longer-term trend.

Key Takeaways from Vital Farms’s Q4 Results

We were impressed by how significantly Vital Farms blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad its full-year revenue and EBITDA guidance trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 6.3% to $36 immediately following the results.

Sure, Vital Farms had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.