Broadcom Inc. (AVGO), headquartered in Palo Alto, California, is a global technology leader that designs, develops, and supplies various semiconductor devices, with a focus on complex digital and mixed-signal complementary metal-oxide-semiconductor-based devices and analog III-V-based products. With a market cap of $1.7 trillion, the company offers storage adapters, controllers, networking processors, motion control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the most complex hybrid environments.

Shares of this semiconductor giant have considerably outperformed the broader market over the past year. AVGO has gained 90.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.7%. In 2025, AVGO stock is up 50.7%, surpassing the SPX’s 14.4% rise on a YTD basis.

Zooming in further, AVGO’s outperformance is also apparent compared to the SPDR S&P Semiconductor ETF (XSD). The exchange-traded fund has gained 30.9% over the past year. Moreover, AVGO’s gains on a YTD basis outshine the ETF’s 31.5% returns over the same time frame.

Broadcom's shares are up due to its successful pivot into AI infrastructure, becoming a key player in the AI boom. Its collaboration with OpenAI to develop custom AI accelerators is a major win, solidifying its role in the growing AI market. The deal's expected to drive substantial revenue, with rollout starting in 2026.

On Sep. 4, AVGO shares closed up more than 2% after reporting its Q3 results. Its adjusted EPS of $1.69 topped Wall Street expectations of $1.66. The company’s revenue was $16 billion, beating Wall Street forecasts of $15.8 billion. For Q4, AVGO expects revenue to be $17.4 billion.

For the current fiscal year, ended in October, analysts expect AVGO’s EPS to grow 45.8% to $5.41 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

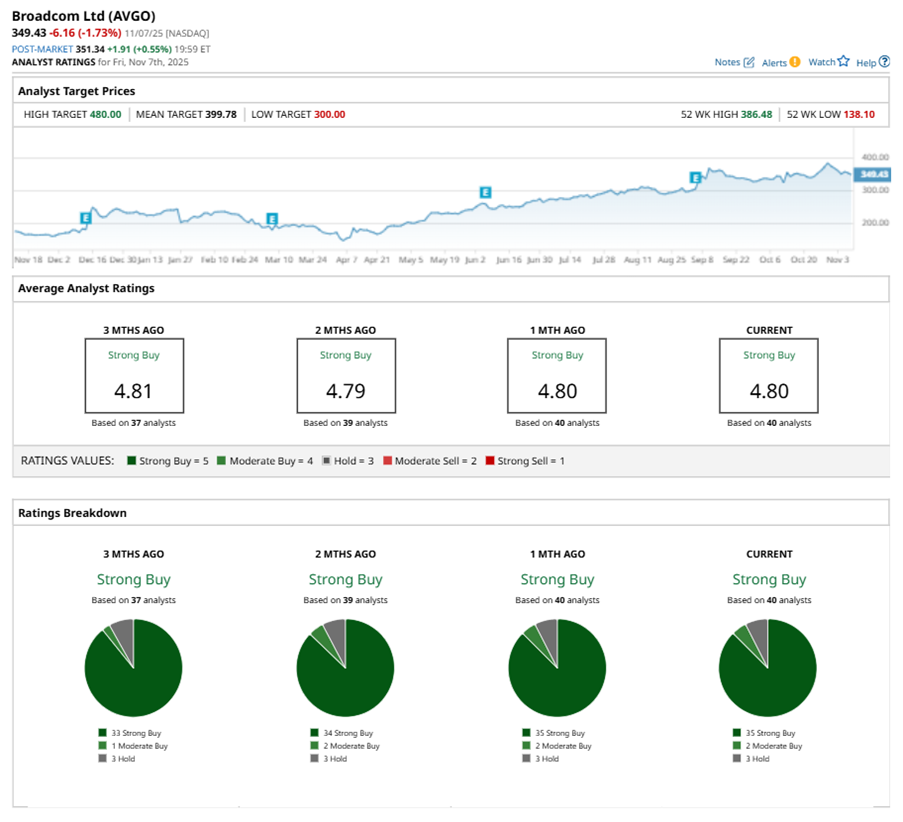

Among the 40 analysts covering AVGO stock, the consensus is a “Strong Buy.” That’s based on 35 “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.”

This configuration is more bullish than two months ago, with 34 analysts suggesting a “Strong Buy.”

On Oct. 26, Vijay Rakesh from Mizuho Financial Group, Inc. (MFG) maintained a “Buy” rating on AVGO with a price target of $435, implying a potential upside of 24.5% from current levels.

The mean price target of $399.78 represents a 14.4% premium to AVGO’s current price levels. The Street-high price target of $480 suggests an ambitious upside potential of 37.4%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart