Datadog, Inc. (DDOG), headquartered in New York City, is a cloud-monitoring and analytics software company that delivers a unified SaaS platform for infrastructure, application performance, log management, network monitoring, security and observability across cloud-native, hybrid and on-premise environments. Its market cap is around $70 billion.

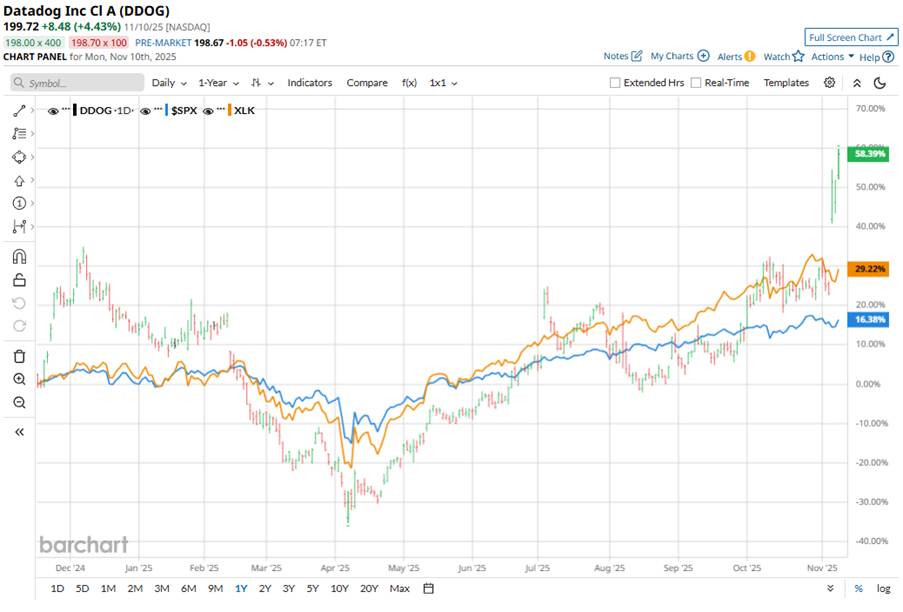

Shares of Datadog have significantly outperformed the broader market. Over the past year, DDOG stock has surged 60.5% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 14% surge during the same time frame. Moreover, on a year-to-date (YTD) basis, DDOG has gained 40%, compared to the SPX’s 16.2% rally in 2025.

Zooming in further, DDOG has also outpaced the Technology Select Sector SPDR Fund’s (XLK) 24.6% rise over the past year and 27.1% surge on a YTD basis.

DDOG stock is rising in 2025 primarily because the company is seeing accelerating demand for its cloud observability and security tools, driven by AI and cloud-migration trends. Combined with the rising large-customer adoption and strong product expansion, these factors have boosted investor confidence and pushed the stock higher.

For the current fiscal year ending in December 2025, analysts project DDOG’s EPS to decline 36.2% year-over-year to $0.30 per share. The company has surpassed or met the consensus earnings estimates in each of the past four quarters.

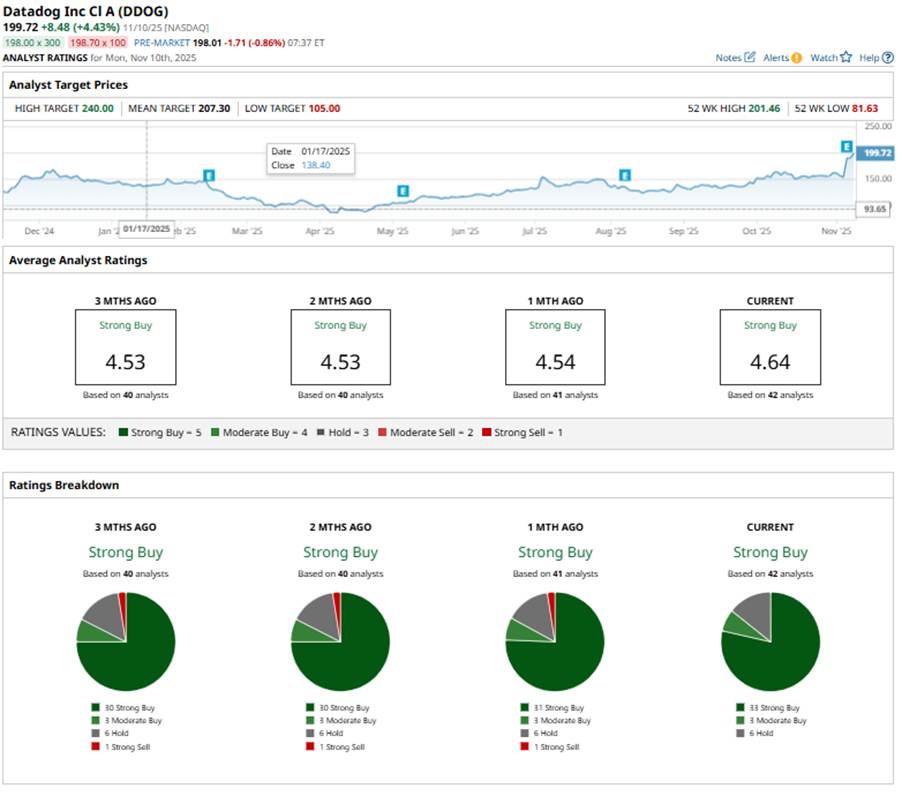

Among the 42 analysts covering the DDOG stock, the consensus rating is a “Strong Buy.” That’s based on 33 “Strong Buys,” three “Moderate Buys,” and six “Holds.”

This configuration is slightly more bullish than a month ago, when there were 31 “Strong Buys” and one “Strong Sell” rating.

Recently, KeyBanc upgraded Datadog to “Overweight” with a $230 price target, citing accelerating revenue growth beyond OpenAI and renewed spending commitments from the AI leader.

Its mean price target of $207.30 represents a 3.8% premium to current price levels, and its Street-high target of $240 indicates a 20.2% upside potential.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart