All News about DB US Dollar Index Bearish -1X Fund Invesco

FX Daily: US Prices And Activity In The Spotlight

August 12, 2024

Via Talk Markets

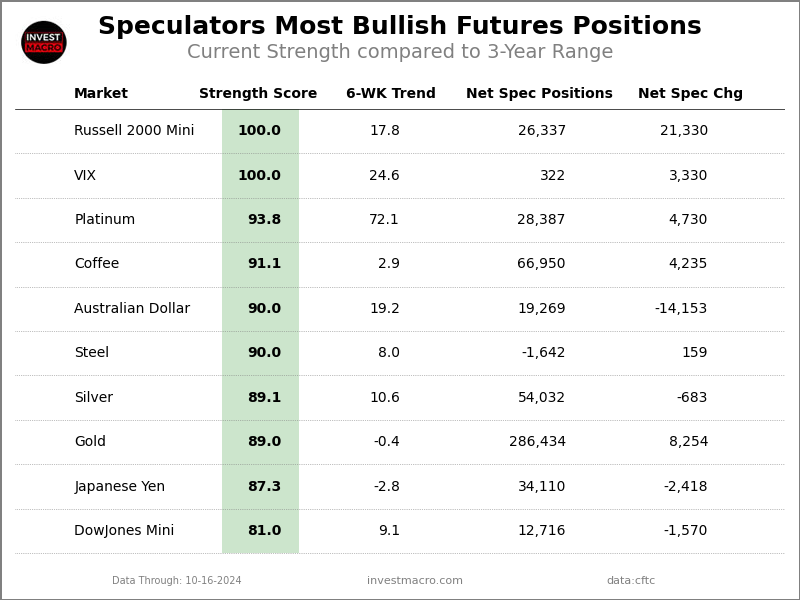

Speculator Extremes: Russell 2000, VIX, USD Index & 5-Year Bonds Lead Bullish & Bearish Positions

October 20, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

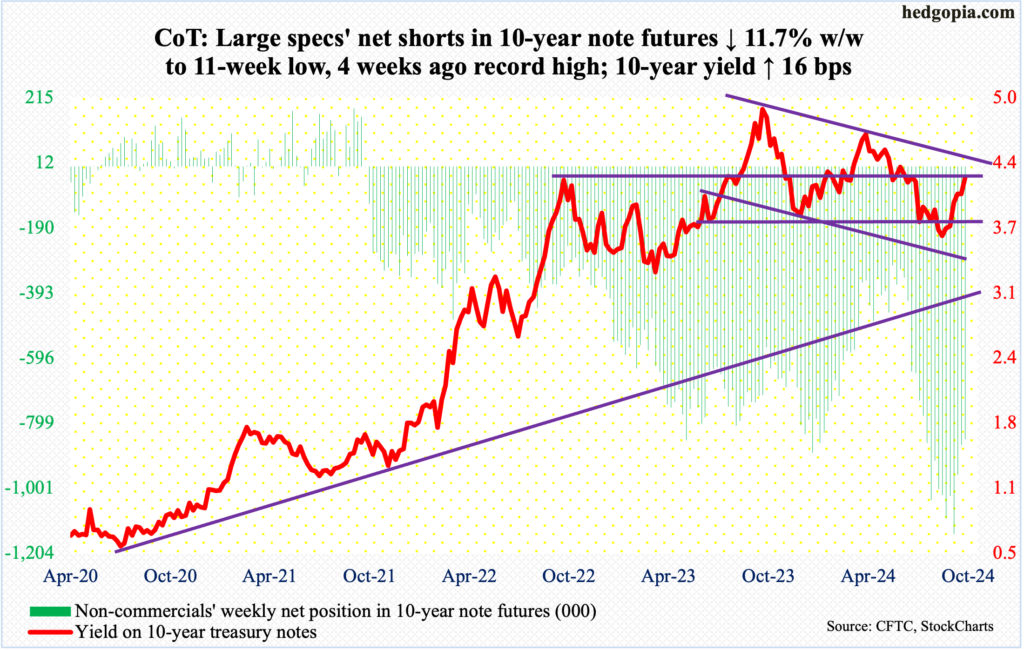

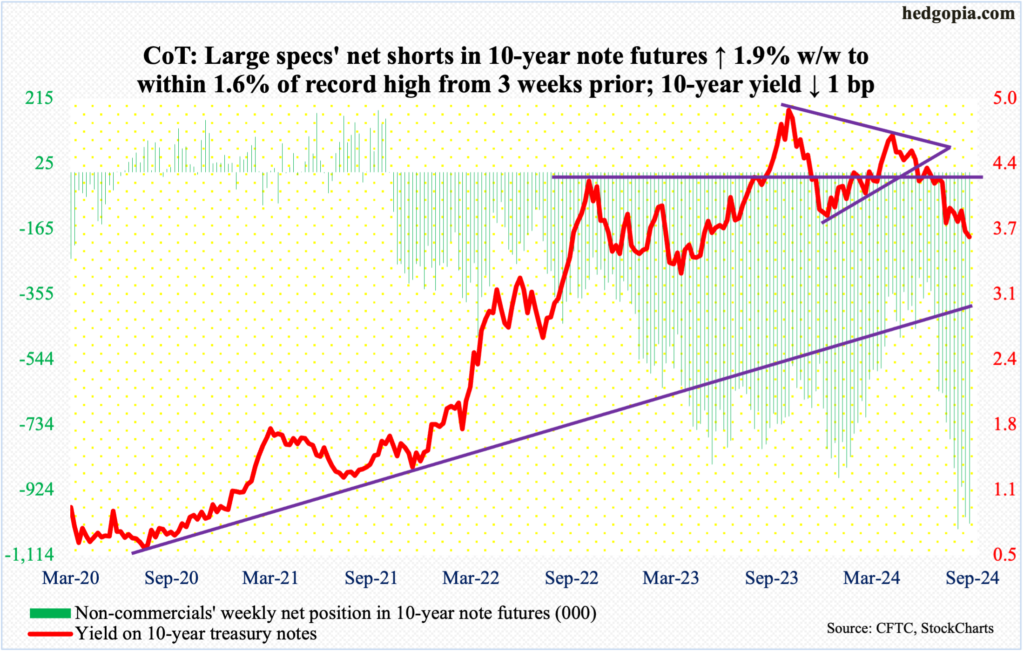

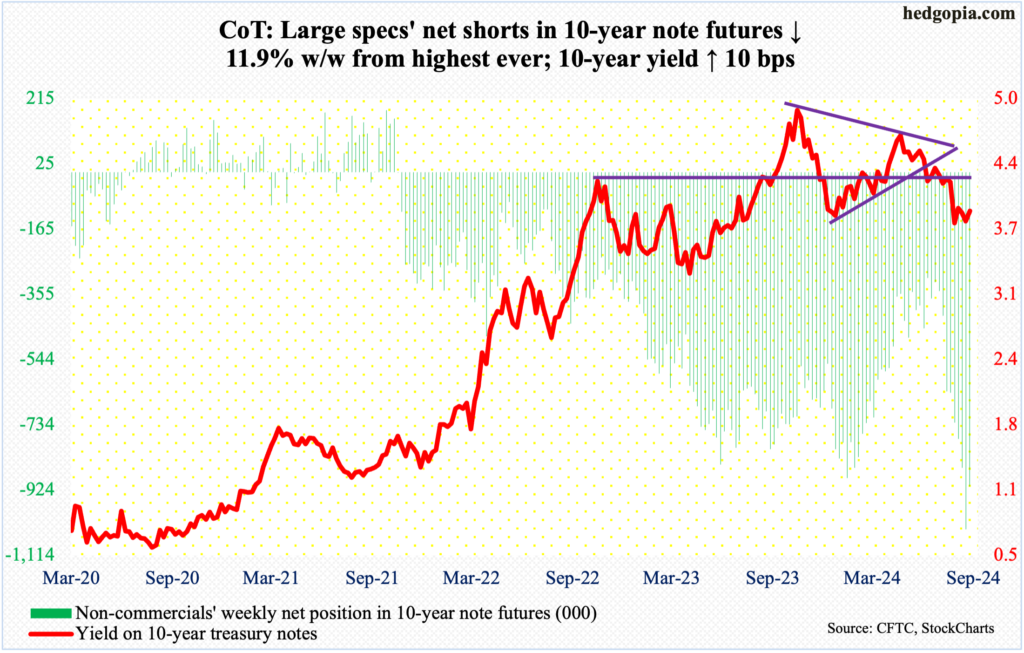

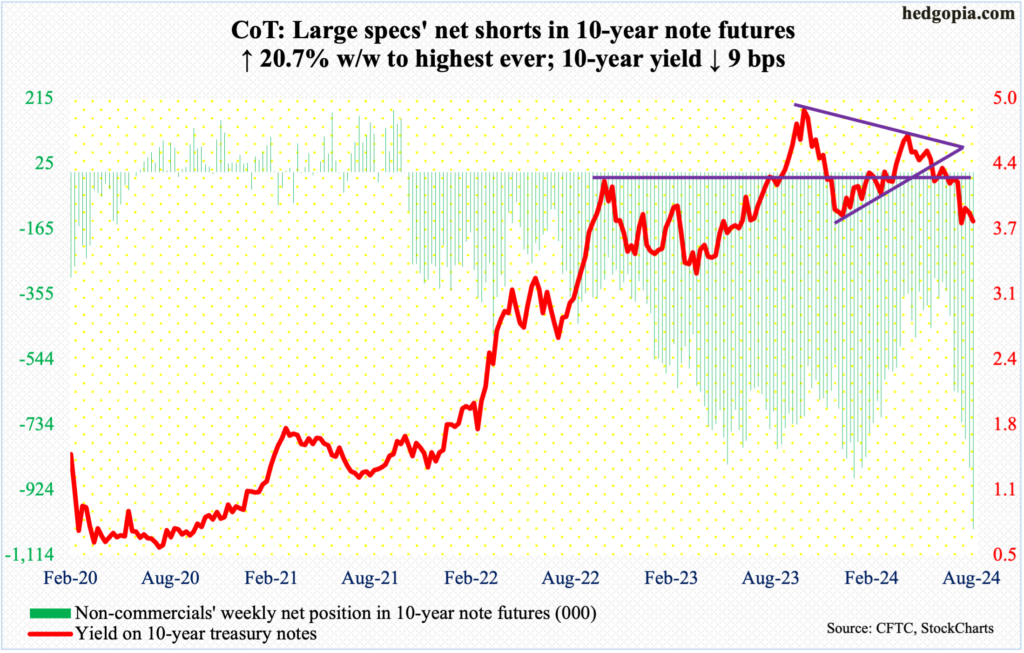

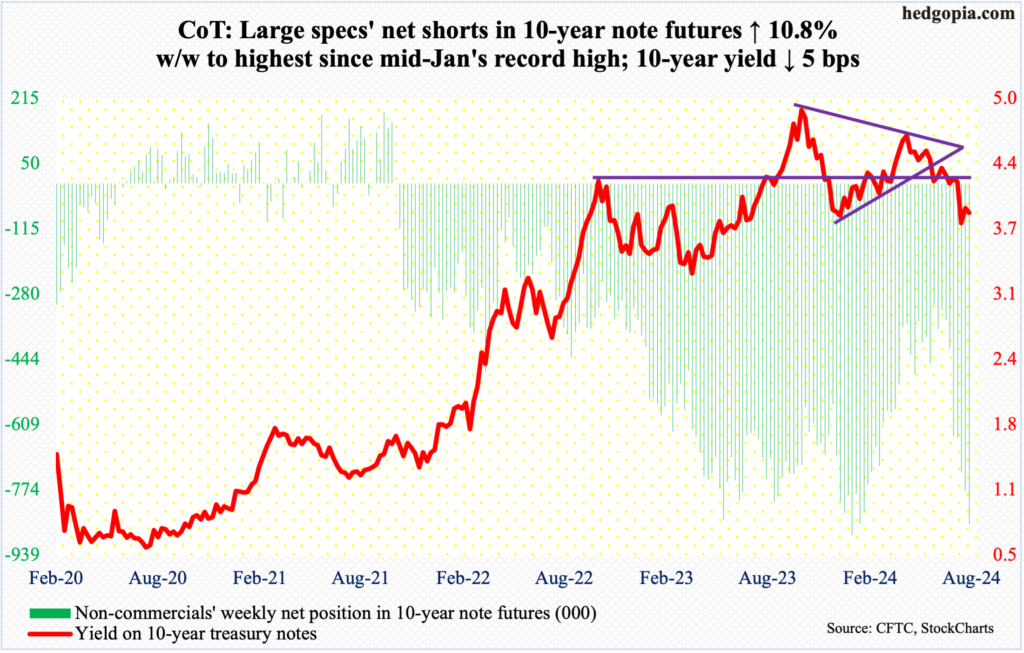

CoT On The Future Through Futures, Hedge Funds Positioning

September 15, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Dollar Consolidates As Stocks Melt

September 04, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Daily Market Outlook, Wednesday, September 4

September 04, 2024

Via Talk Markets

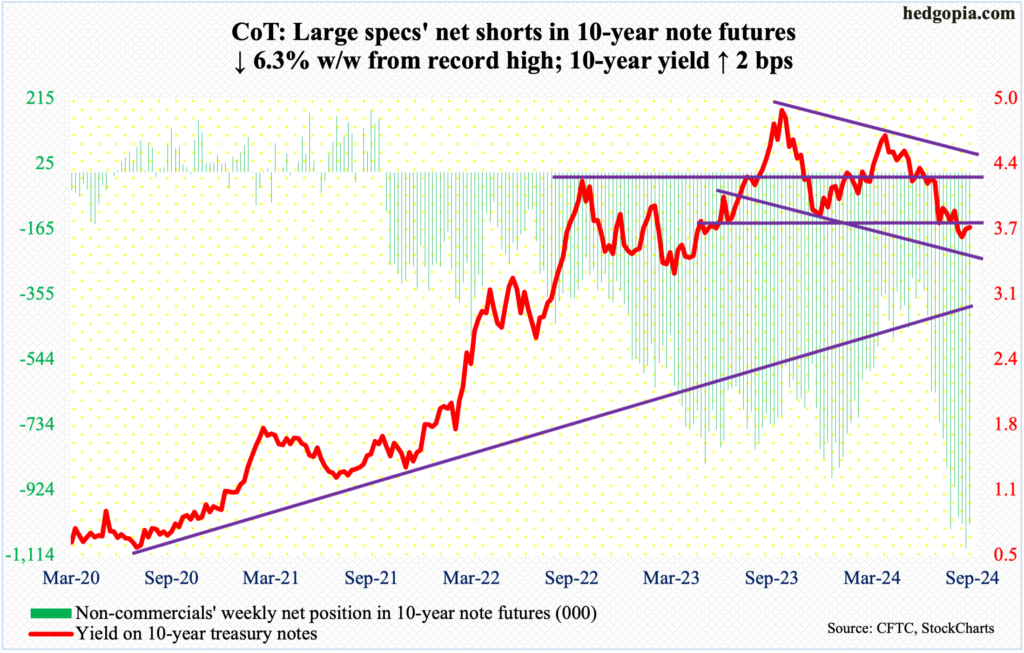

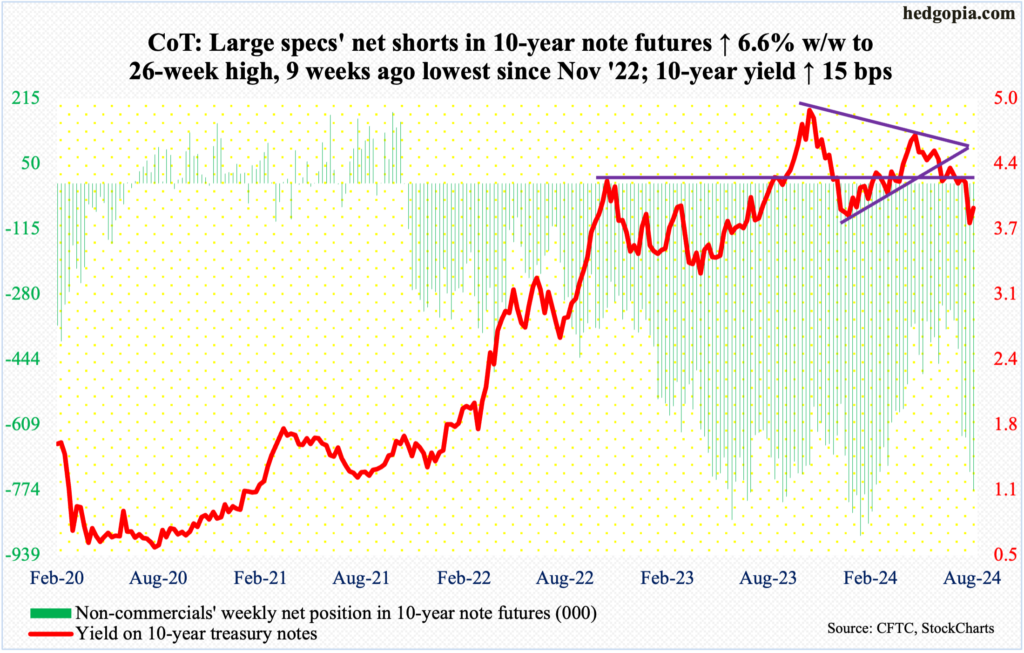

Hedge Funds Positions, Noncommercial Buying - How CoT Peeks Into The Future

September 01, 2024

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

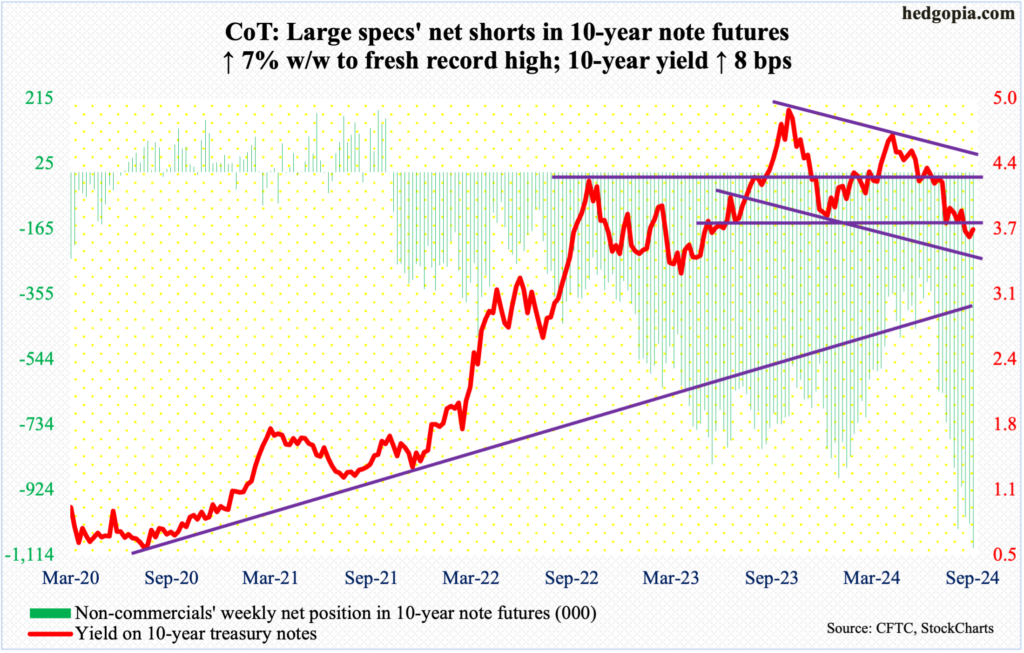

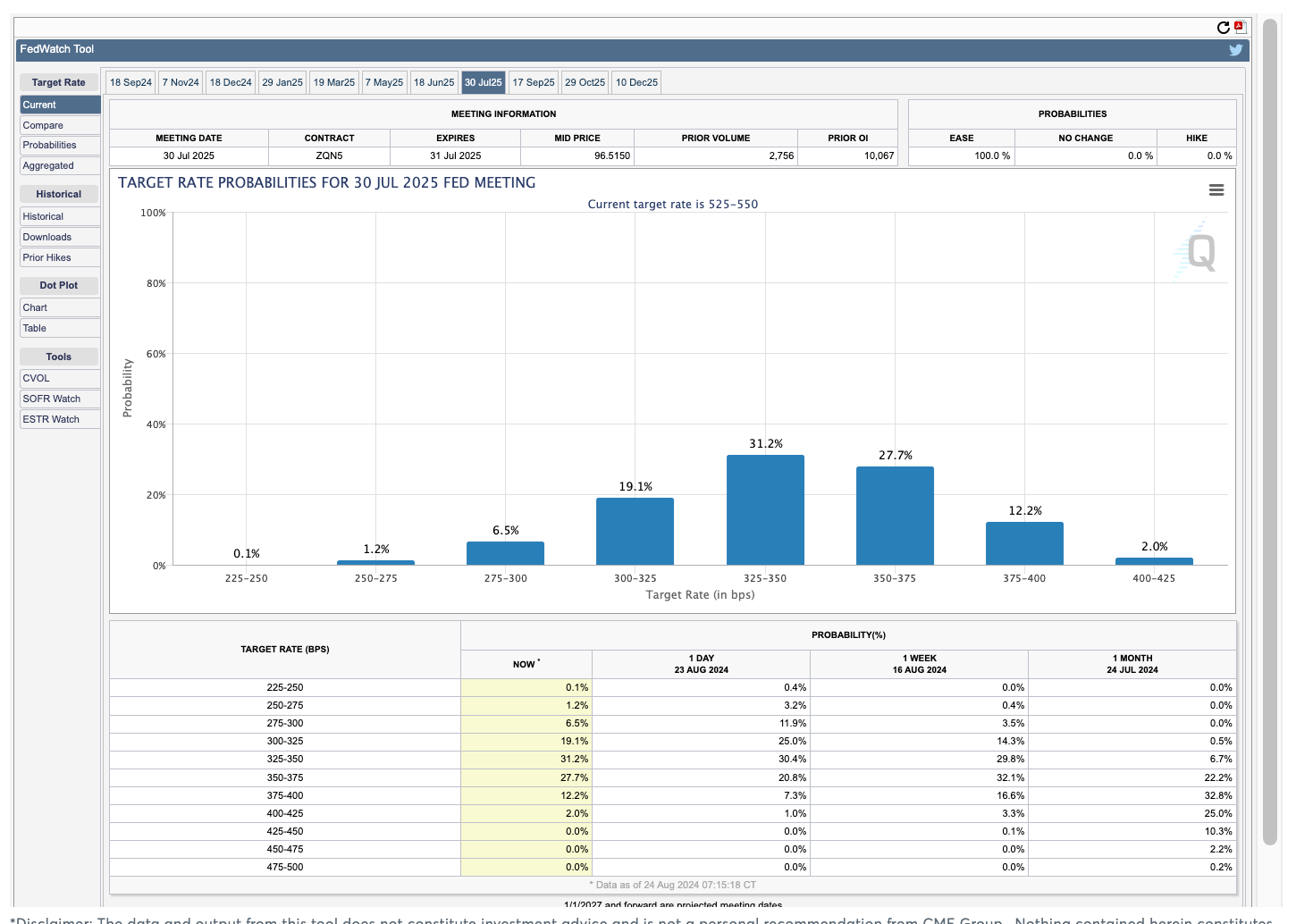

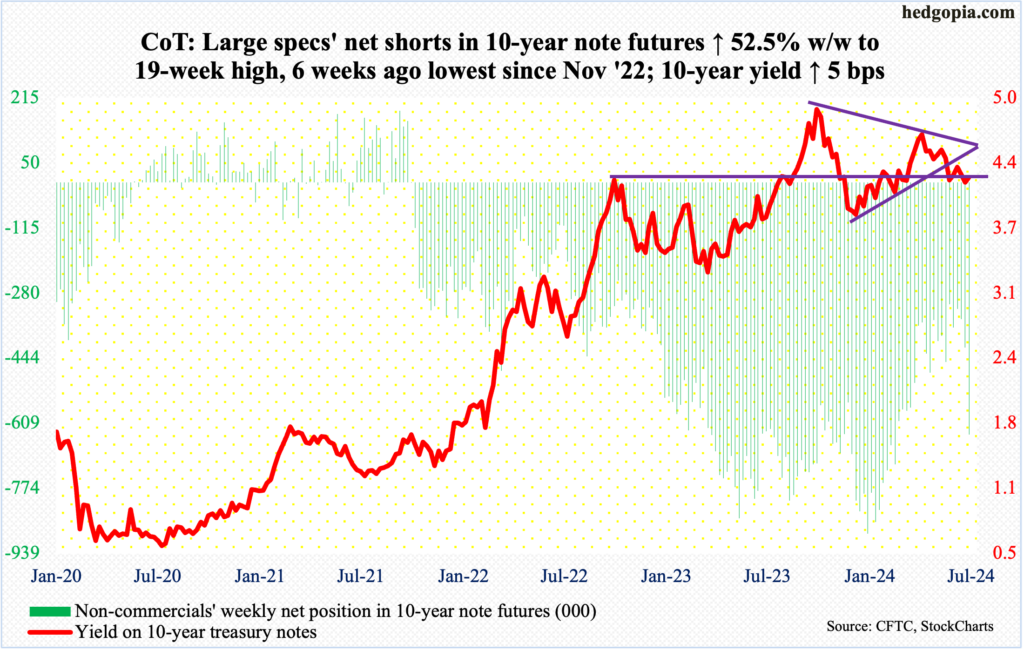

Focus Returns To The Fed's Terminal Rate

August 25, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Is The US CPI Anti-Climactic?

August 14, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

.thumb.png.0b184e166c914405e402a1a18a298164.png)

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.