Gaming and hospitality company Boyd Gaming (NYSE: BYD) will be reporting results this Thursday after the bell. Here’s what to expect.

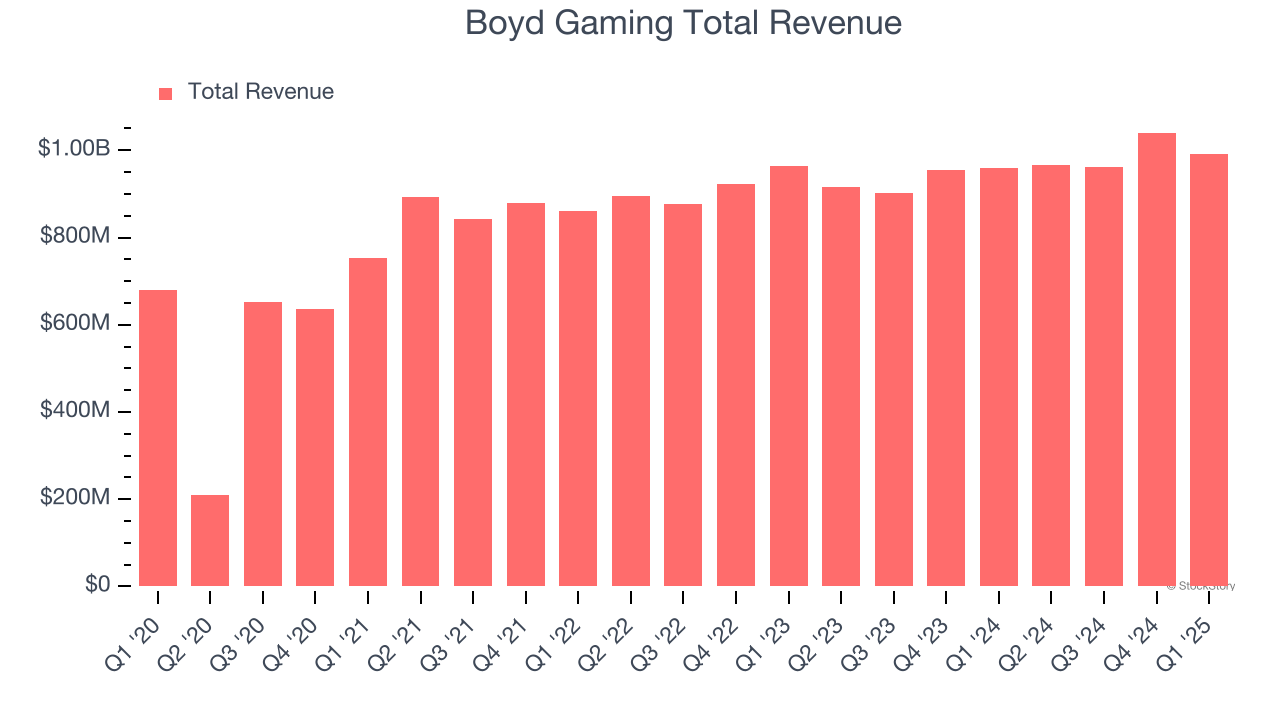

Boyd Gaming beat analysts’ revenue expectations by 2.1% last quarter, reporting revenues of $991.6 million, up 3.2% year on year. It was a mixed quarter for the company, with a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

Is Boyd Gaming a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Boyd Gaming’s revenue to grow 1.4% year on year to $980.9 million, slowing from the 5.5% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $1.67 per share.

Heading into earnings, analysts covering the company have grown increasingly bearish with revenue estimates seeing 8 downward revisions over the last 30 days (we track 11 analysts). Boyd Gaming has only missed Wall Street’s revenue estimates once over the last two years, exceeding top-line expectations by 3% on average.

Looking at Boyd Gaming’s peers in the consumer discretionary segment, some have already reported their Q2 results, giving us a hint as to what we can expect. Monarch delivered year-on-year revenue growth of 6.8%, beating analysts’ expectations by 5.4%, and Levi's reported revenues up 6.4%, topping estimates by 5.8%. Monarch traded up 20.4% following the results while Levi's was also up 11.1%.

Read our full analysis of Monarch’s results here and Levi’s results here.

There has been positive sentiment among investors in the consumer discretionary segment, with share prices up 13.9% on average over the last month. Boyd Gaming is up 7.7% during the same time and is heading into earnings with an average analyst price target of $86.85 (compared to the current share price of $82.94).

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.