All News about DB Agriculture Fund Invesco

Via Talk Markets

Unstoppable: What Does The Fed Know That We Don't?

September 22, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Speculator Extremes: Yen, VIX, Cotton & WTI Crude Oil Top Bullish & Bearish Positions

September 15, 2024

Via Talk Markets

Topics

Stocks

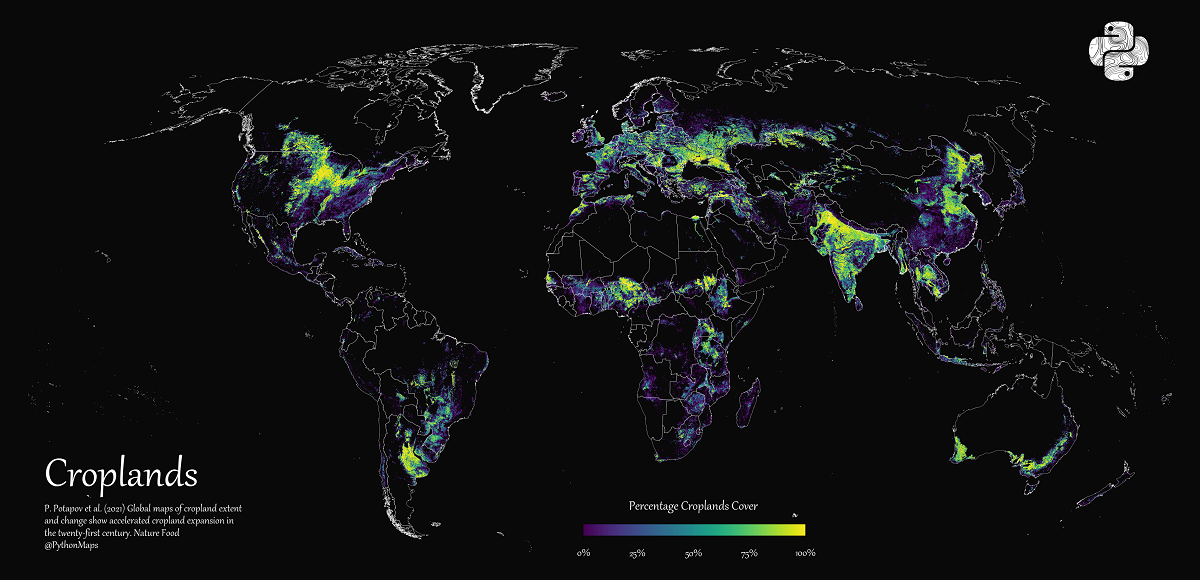

The Cost Of Grain That Feeds The World Hits New 15-Year High

December 27, 2023

Via Talk Markets

Speculator Extremes: Yen, Gold, 5-Year, 10-Year & Cotton Lead Bullish & Bearish Positions

August 25, 2024

Via Talk Markets

Exposures

Textiles

Via Talk Markets

Via Talk Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.