Valued at $24.2 billion by market cap, Birmingham, Alabama-based Regions Financial Corporation (RF) operates as a financial holding company, providing banking and financial services to individuals and corporations. Regions operates through Corporate Bank, Consumer Bank, and Wealth Management segments.

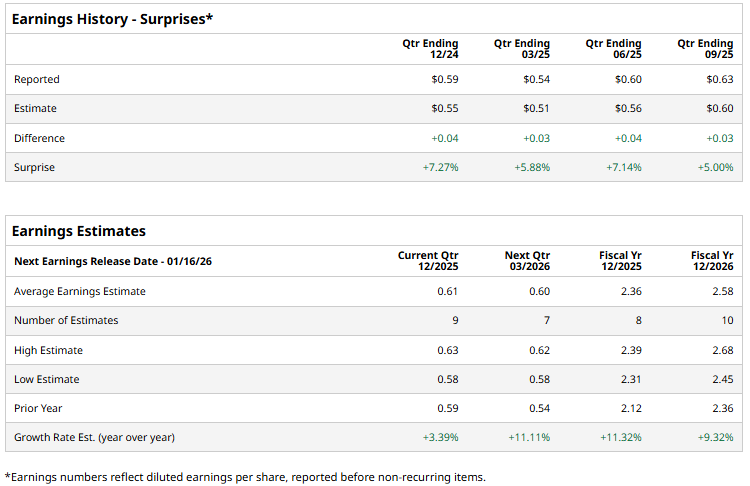

The banking major is set to unveil its fourth-quarter results before the markets open on Friday, Jan. 16. Ahead of the event, analysts expect RF to deliver an adjusted profit of $0.61 per share, up 3.4% from $0.59 per share reported in the year-ago quarter. On a more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, RF is expected to deliver an adjusted EPS of $2.36, up 11.3% from $2.12 reported in 2024. In fiscal 2026, its earnings are expected to grow by 9.3% year-over-year to $2.58 per share.

RF stock prices have soared 18% over the past 52 weeks, notably outpacing the S&P 500 Index’s ($SPX) 15.4% surge and the Financial Services Select Sector SPDR Fund’s (XLF) 14.5% returns during the same time frame.

Regions Financial’s stock prices gained nearly 1% in the trading session following the release of its impressive Q3 results on Oct. 17. While the company observed a slight decline in interest income, it also observed a notable drop in interest expenses and provision for credit losses. RF’s net interest income for the quarter grew 4.3% year-over-year to $1.2 billion. Further, driven by growth in service charges, fee incomes, and other non-interest income, Regions’ total non-interest income soared 15.2% year-over-year to $659 million. Overall, the company’s topline increased 8% year-over-year to $1.8 billion, coming mostly in line with the Street’s expectations. Moreover, RF’s adjusted EPS increased 10.5% year-over-year to $0.63, beating the consensus estimates by 5%.

The consensus opinion on RF stock is cautiously optimistic with an overall “Moderate Buy” rating. Out of the 25 analysts covering the stock, seven recommend “Strong Buy,” two advise “Moderate Buy,” 15 suggest “Hold,” and one advocates a “Strong Sell” rating. Regions’ mean price target of $28.92 represents a modest 5.2% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Mizuho Says This 1 Agentic AI Company Is the Top Software Stock to Buy in 2026

- Broadcom Stock Just Raised Its Dividend by 10%. Should You Buy AVGO Stock Now?

- Weight Watchers Is Going All In on GLP-1 Drugs. Should You Buy WW Stock Here?

- This Analyst Just Raised Their Micron Stock Price Target by 50%. Should You Buy Shares Here?