Buffalo, New York-based M&T Bank Corporation (MTB) operates as a bank holding company, which engages in the provision of retail and commercial banking, trust, wealth management, and investment services. With a market cap of $27.9 billion, M&T Bank operates through Commercial Bank, Retail Bank, and Institutional Services and Wealth Management segments.

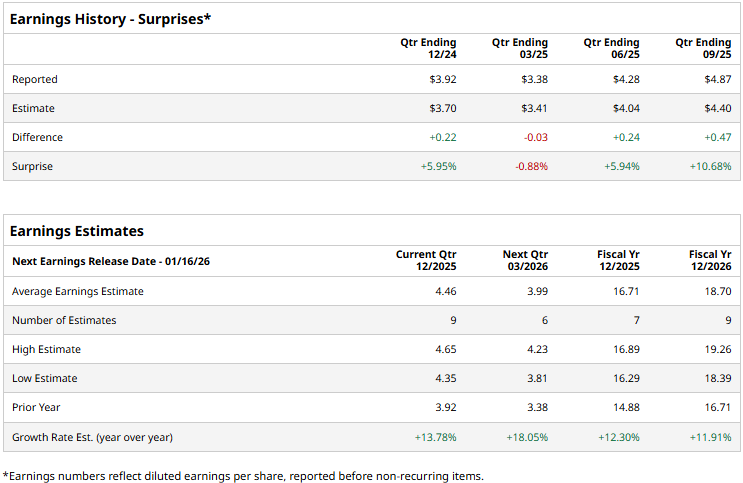

MTB is set to announce its Q4 results before the markets open on Friday, Jan. 16. Ahead of the event, analysts expected MTB to deliver an EPS of $4.46, up 13.8% from $3.92 reported in the year-ago quarter. While the company has surpassed the Street’s bottom-line estimates thrice over the past four quarters, it has missed the projections on one other occasion.

For the full fiscal 2025, MTB is expected to deliver an EPS of $16.71, up 12.3% from $14.88 reported in fiscal 2024. Meanwhile, in fiscal 2026, its earnings are expected to further grow by 11.9% year-over-year to $18.70 per share.

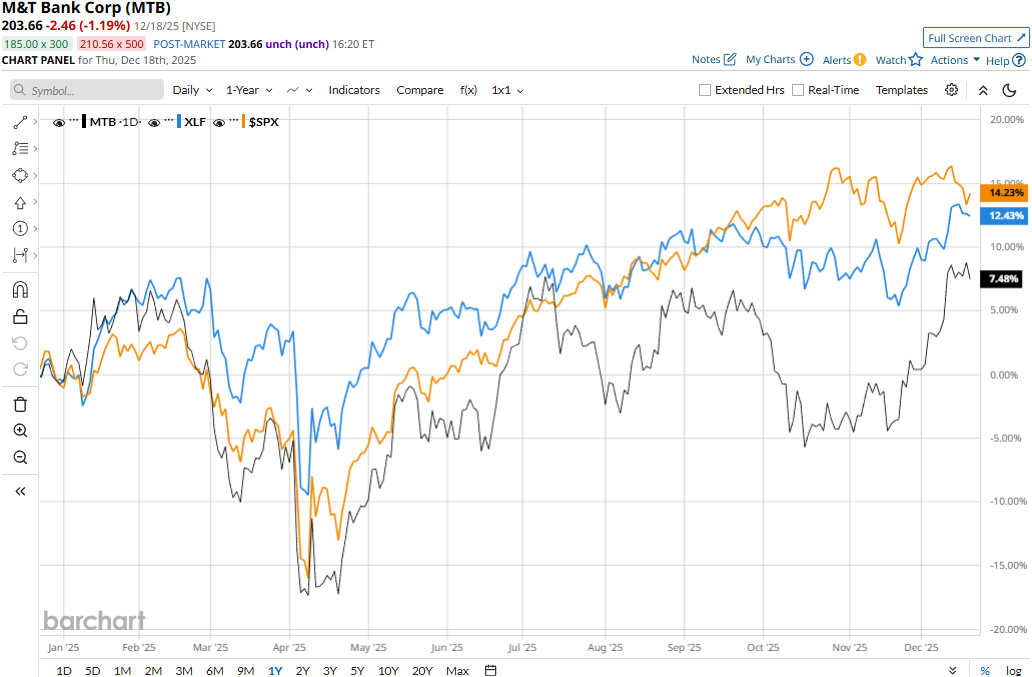

MTB stock prices have gained 9.4% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 15.4% surge and the Financial Services Select Sector SPDR Fund’s (XLF) 14.5% returns during the same time frame.

M&T Bank’s stock prices declined 3.5% in the trading session following the release of its mixed Q3 results on Oct. 16. Although the company observed a 4% decline in interest income compared to the year-ago quarter, it observed an even steeper 13% drop in interest expenses, leading to a notable 2% growth in net interest income (NII) reaching $1.6 billion. Further, MTB’s other non-interest income surged 24.1% year-over-year to $752 million. Overall, the company’s topline came in at $2.4 billion, up 8% year-over-year, missing the consensus estimates by a thin margin.

Meanwhile, MTB’s earnings increased by an impressive 19.4% year-over-year to $4.87, beating the consensus estimates by 10.7%. Following the initial dip, MTB stock prices maintained a positive momentum for two subsequent trading sessions.

Analysts remain optimistic on the stock’s prospects. MTB holds a consensus “Moderate Buy” rating among the 23 analysts covering the stock. That’s based on 11 “Strong Buys,” one “Moderate Buy,” 10 “Holds,” and one “Strong Sell.” Its mean price target of $220.48 suggests an 8.3% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Dividend Kings Delivering Generational Income & Market-Beating Returns

- Mizuho Says This 1 Agentic AI Company Is the Top Software Stock to Buy in 2026

- Broadcom Stock Just Raised Its Dividend by 10%. Should You Buy AVGO Stock Now?

- Weight Watchers Is Going All In on GLP-1 Drugs. Should You Buy WW Stock Here?