Apple’s (AAPL) latest quarterly report gave investors plenty to cheer about. The tech giant’s fiscal fourth-quarter financials surpassed Wall Street expectations, driven by strong demand for its devices and the continued growth in its high-margin services business. While it is trading close to record highs, a strong finish to the fiscal year and its optimistic forecast for the upcoming holiday quarter may keep the momentum alive for AAPL stock.

According to management, Apple is entering the December quarter with exceptional strength across its hardware and services divisions. Management expects revenue to reach the company’s highest level ever, driven by what’s projected to be record-breaking iPhone sales.

Apple Sees Double-Digit Top Line Growth

Apple is heading into its best holiday season yet, driven by strong demand for its flagship products and the strength of its services business. The iPhone maker reported fourth-quarter revenue of $102.5 billion, representing an 8% increase from the same period last year and a new record for the September quarter. The momentum doesn’t appear to be slowing down as Apple projects that its December quarter will deliver 10% to 12% year-over-year revenue growth, setting the stage for what could be the strongest quarter in Apple’s history.

Driving this optimism is an impressive lineup of new products. The iPhone 17 series, AirPods Pro 3, and new Apple Watch lineup are leading the charge. Moreover, MacBook Pro and iPad Pro models powered by the M5 chip enhance Apple’s offerings. With this refreshed portfolio, the company enters the holiday period with perhaps its most compelling range of devices ever.

The iPhone remains Apple’s key growth engine, and its performance continues to impress. In the September quarter, iPhone revenue reached a record $49 billion, representing a 6% year-over-year increase. Strong demand for the iPhone 16 and 17 models pushed the active installed base to an all-time high. Management anticipates double-digit growth in iPhone revenue for the holiday quarter, positioning it to achieve its best iPhone performance to date.

Apple’s Mac segment also delivered a robust performance, with revenue climbing 13% year-over-year to $8.7 billion, driven primarily by the popularity of the MacBook Air. However, growth is expected to moderate in the coming quarter as the company faces a tough comparison against last year’s launches of the M4 MacBook Pro, Mac Mini, and iMac. Even so, the continued strength of iPhone and Services revenue is expected to more than compensate for this decline.

Meanwhile, Apple’s Services division continues to shine as a key catalyst for growth. The segment generated an all-time record $28.8 billion in revenue during the quarter, up 15% year-over-year with double-digit growth across developed and emerging markets. The company saw new highs across its advertising, App Store, cloud, Music, payments, and video offerings. Looking ahead, Apple expects Services revenue to maintain its growth trajectory and grow at a mid-teens rate.

Is AAPL Stock a Buy Now?

With momentum building across hardware and services, Apple’s growth will likely accelerate. The strong product lineup and demand, expanding base of active devices, and the seasonal holiday boost position the company for another blockbuster quarter.

Besides a growing base of active devices, Apple’s services business is likely to benefit from higher customer engagement, with both transactional and paid accounts showing strength. The company continues to enhance the quality and accessibility of its services portfolio, strengthening its ecosystem and deepening customer loyalty. Additionally, Apple’s presence in the enterprise sector is gaining traction as more businesses adopt Apple's hardware and software solutions across various industries.

However, despite these positives, Apple’s valuation is a concern. Shares currently trade at roughly 34.3 times forward earnings, a premium multiple considering the company’s moderate earnings growth forecast. Analysts expect earnings to grow by 5.5% in fiscal 2026 and 9.3% in 2027, suggesting that much of the positives are priced into AAPL stock.

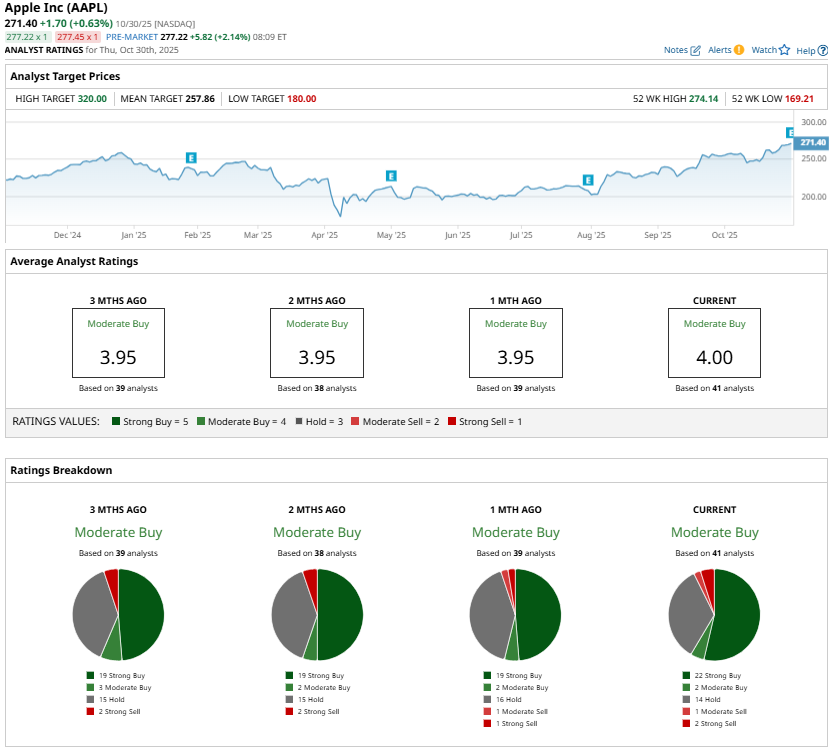

Wall Street maintains a “Moderate Buy” consensus on Apple post its fourth-quarter earnings report. While the company’s fundamentals and brand strength remain solid, investors may want to exercise caution. The stock’s rich valuation could limit near-term upside potential.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla’s New Focus Isn’t on Cars, But on ‘Sustainable Abundance.’ What Does That Mean for TSLA Stock and Buy-and-Hold Investors?

- Amazon's Revenue Beat Surprises Analysts and Its Cash Flow Surges (Not FCF) - AMZN Stock Could Still Be Undervalued

- As Apple Turns the Corner With the iPhone 17, Should You Buy AAPL Stock for 2026?

- This Stock Lets You Profit from Building the Power Grid