Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Varonis Systems (NASDAQ: VRNS) and its peers.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.1% on average since the latest earnings results.

Best Q2: Varonis Systems (NASDAQ: VRNS)

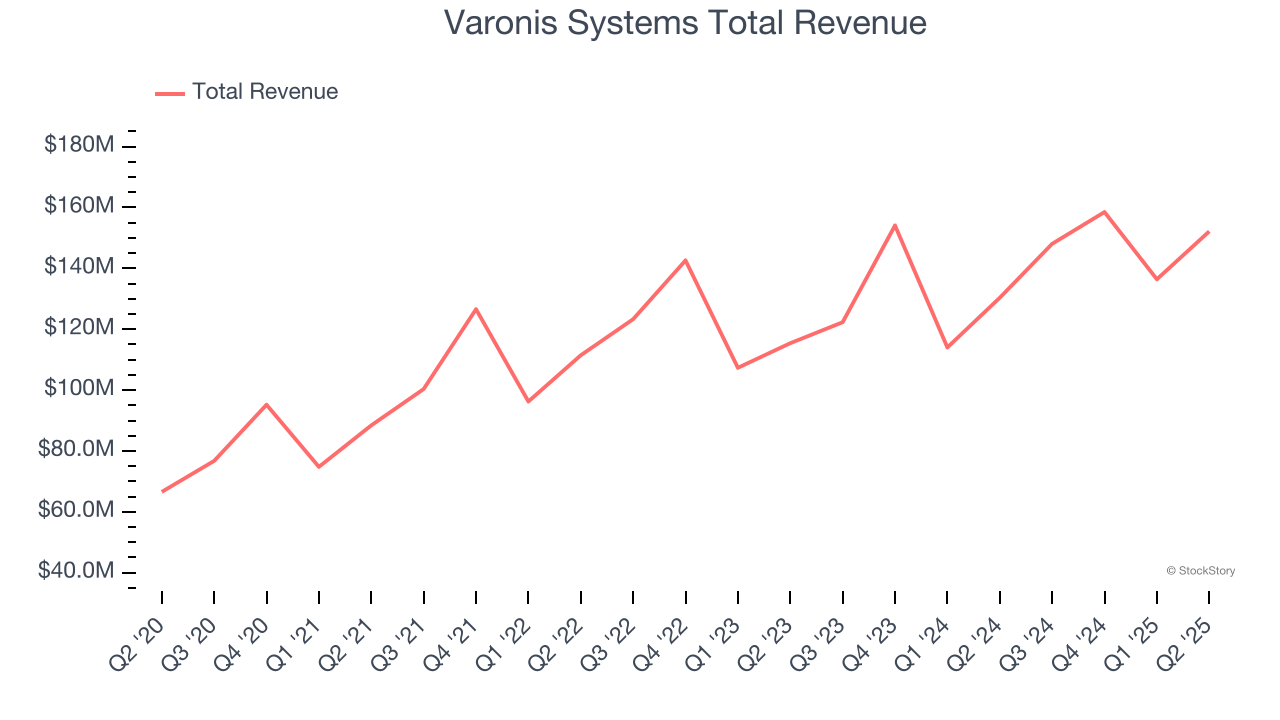

Beginning with protecting Windows file shares in 2005 and evolving into a comprehensive security platform, Varonis Systems (NASDAQ: VRNS) provides data security software that helps organizations protect sensitive information, detect threats, and comply with privacy regulations.

Varonis Systems reported revenues of $152.2 million, up 16.7% year on year. This print exceeded analysts’ expectations by 2.8%. Overall, it was a very strong quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Yaki Faitelson, Varonis CEO, said, "We are excited by the many tailwinds we are seeing in our business. The simplicity and automated outcomes of our SaaS platform and MDDR, the adoption of AI and the growing awareness for data-centric cloud and SaaS security are continuing to drive momentum in our business, and we look forward to executing on this massive and growing market opportunity.”

Varonis Systems pulled off the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 9.7% since reporting and currently trades at $59.54.

Is now the time to buy Varonis Systems? Access our full analysis of the earnings results here, it’s free.

CrowdStrike (NASDAQ: CRWD)

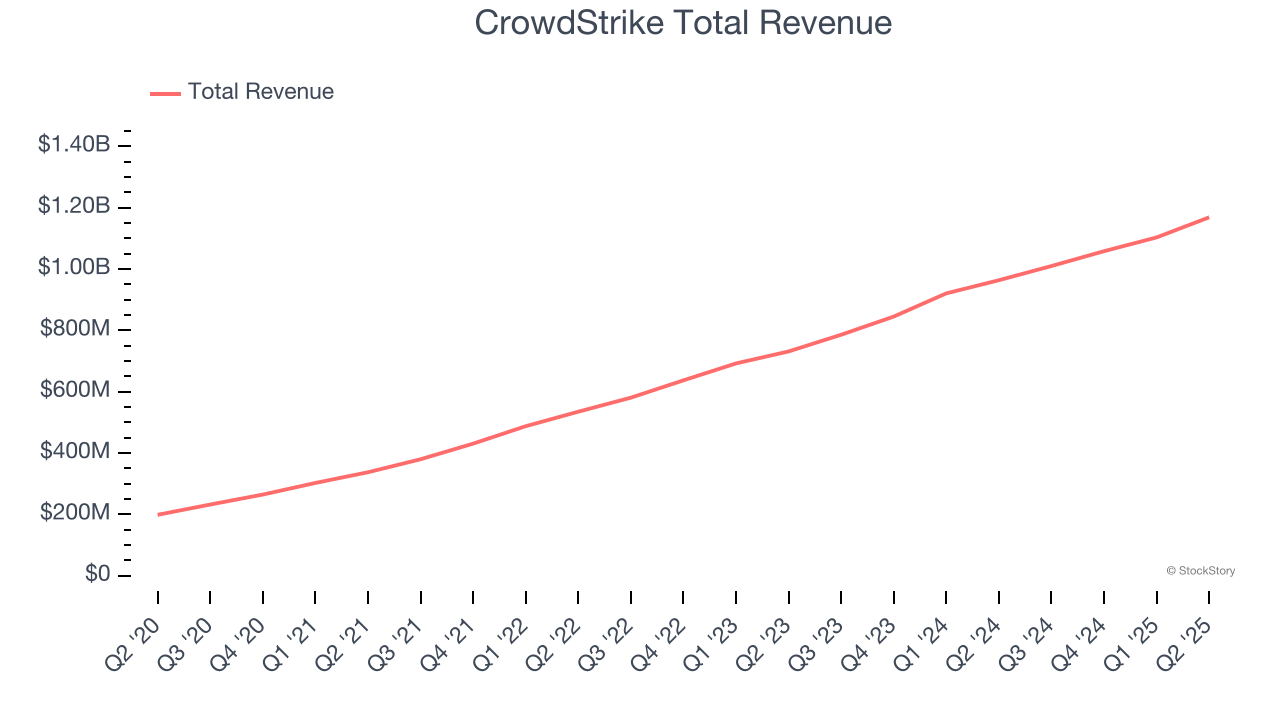

Known for detecting the massive SolarWinds hack in 2020 that compromised numerous government agencies, CrowdStrike (NASDAQ: CRWD) provides cloud-based cybersecurity solutions that protect endpoints, cloud workloads, identity, and data through its Falcon platform.

CrowdStrike reported revenues of $1.17 billion, up 21.3% year on year, outperforming analysts’ expectations by 1.7%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 14.1% since reporting. It currently trades at $481.97.

Is now the time to buy CrowdStrike? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Tenable (NASDAQ: TENB)

Starting with the widely-used Nessus vulnerability scanner first released in 1998, Tenable (NASDAQ: TENB) provides exposure management solutions that help organizations identify, assess, and prioritize cybersecurity vulnerabilities across their IT infrastructure and cloud environments.

Tenable reported revenues of $247.3 million, up 11.8% year on year, exceeding analysts’ expectations by 2.2%. Still, it was a slower quarter as it posted EPS guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ annual recurring revenue estimates.

As expected, the stock is down 7% since the results and currently trades at $29.97.

Read our full analysis of Tenable’s results here.

Palo Alto Networks (NASDAQ: PANW)

Founded in 2005 by security visionary Nir Zuk who sought to reimagine firewall technology, Palo Alto Networks (NASDAQ: PANW) provides AI-powered cybersecurity platforms that protect organizations' networks, clouds, and endpoints from sophisticated threats.

Palo Alto Networks reported revenues of $2.54 billion, up 15.8% year on year. This result surpassed analysts’ expectations by 1.4%. Overall, it was a strong quarter as it also put up full-year EPS guidance exceeding analysts’ expectations.

The stock is up 14.7% since reporting and currently trades at $202.36.

Read our full, actionable report on Palo Alto Networks here, it’s free.

Zscaler (NASDAQ: ZS)

Pioneering the "zero trust" approach that has fundamentally changed enterprise network security, Zscaler (NASDAQ: ZS) provides a cloud-based security platform that connects users, devices, and applications securely without traditional network-based security hardware.

Zscaler reported revenues of $719.2 million, up 21.3% year on year. This number topped analysts’ expectations by 1.6%. It was a strong quarter as it also logged an impressive beat of analysts’ billings estimates and full-year guidance of robust revenue growth.

Zscaler achieved the highest full-year guidance raise among its peers. The stock is up 7.5% since reporting and currently trades at $295.12.

Read our full, actionable report on Zscaler here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.